Join each day information updates from CleanTechnica on e-mail. Or comply with us on Google Information!

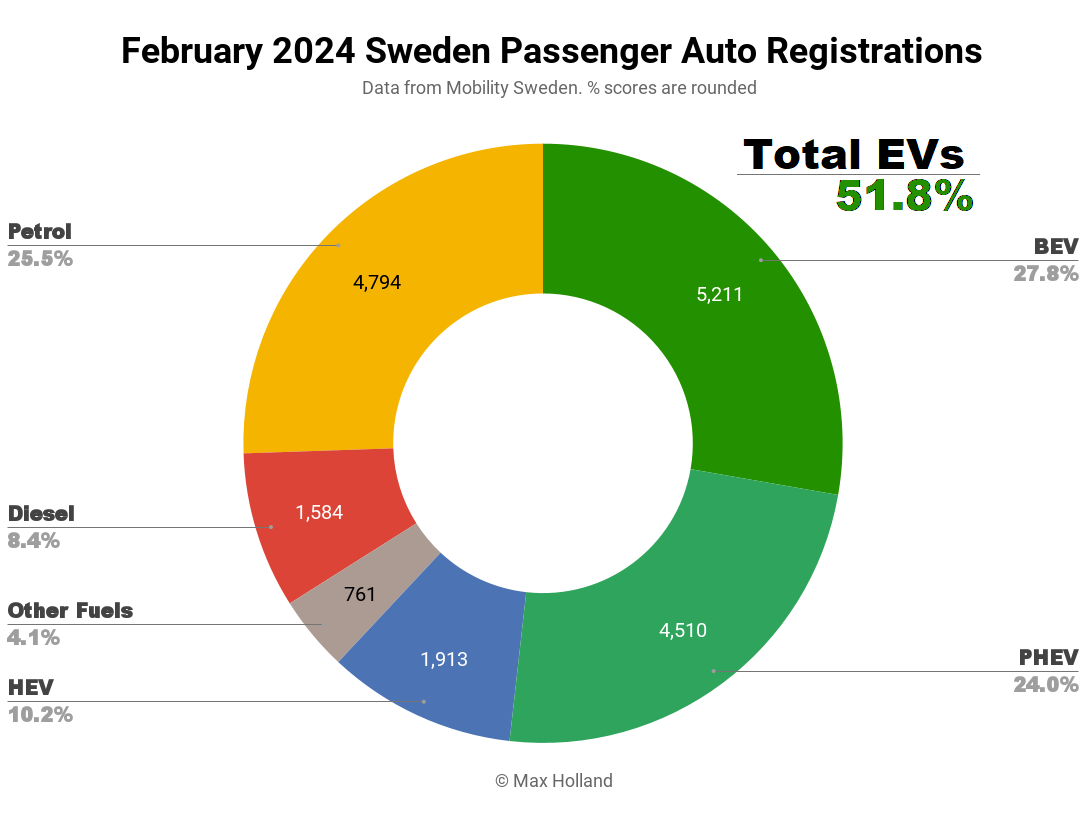

February’s market noticed plugin EVs take 51.8% share in Sweden, down YoY from 54.0%. Plugin volumes had been down YoY for BEVs, however up for PHEVs. February’s total auto quantity was 18,773 models, up some 2% YoY. The Tesla Mannequin Y was the month’s bestselling BEV.

February noticed mixed EVs take 51.8% share in Sweden, with full battery electrics (BEVs) at 27.8% and plugin hybrids (PHEVs) at 24.0%. These figures examine with 54.0% mixed in February 2023, 33.2% BEV and 20.8% PHEV.

By way of volumes, BEVs had been down some 15% YoY, to 5,211 models, some 900 models brief YoY.

Contributing most to the quantity shortfall, Volkswagen Group manufacturers had been down by some 39% in quantity YoY, leaving the market some 650 models brief. Stellantis manufacturers had been virtually fully absent, down some 90% (and 310 models). These two European heavyweights collectively accounted for the YoY quantity drop.

However others had been failing to tug their (lighter) weight additionally. BMW Group was additionally down by round 39%, and 200 models brief. MG Motor was far down (-80%) and a few 360 models brief. Hyundai Motor Group was reasonably down (~30%) and a few 250 models brief. Mercedes Group was solely barely down (~12%, 25 models brief).

With all these producers considerably down in YoY BEV volumes, which manufacturers had been up? Tesla was up by over 100% YoY (+ 1030 models), and Volvo/Polestar was up by round 25% (and up some 300 models). Toyota Group was up by virtually 400% (although, given the low baseline, nonetheless just some 80 models up).

Are Volkswagen Group and Stellantis manufacturers extra subsidy-dependent than others? Maybe, however how about BMW? Are we taking a look at short-term allocation/logistics shortfalls? Please talk about. Little question we are going to get a clearer image within the months forward.

In the meantime, diesel share continued to slip, from 10.9% a 12 months in the past to only 8.4% (and 1584 models).

Finest Sellers

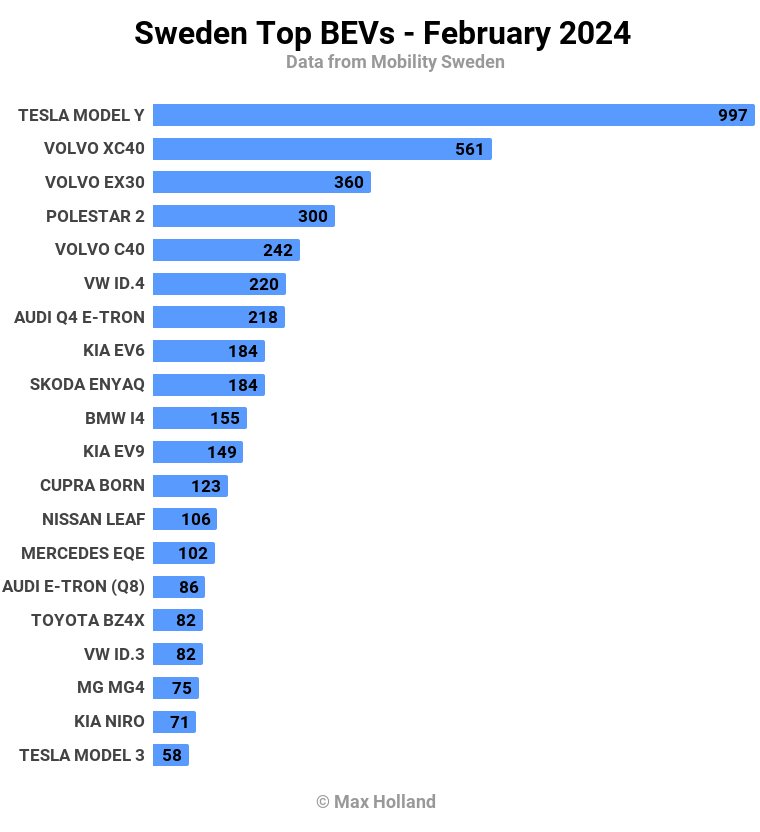

The Tesla Mannequin Y was as soon as once more the most effective promoting BEV in February, with 997 models registered. The Volvo XC40 was the runner up, with 561 models, and the brand new Volvo EX30 rose to 3rd, with 360 models.

Third is a good consequence for the brand new Volvo EX30, which solely debuted in December! The compact SUV is taken into account to be one of many higher worth BEVs at the moment accessible in Sweden.

Realistically, a beginning worth of €38,400 can’t precisely be known as cheap on an absolute scale, when you should buy, for instance, a Dacia Sandero (albeit 3% smaller) for €16,000 in Sweden. Even an entry MG4 will be purchased for €33,000. However, relative to most different BEV costs in Europe, the EX30 is “extra reasonably priced.” Doubtlessly, it might prime Sweden’s charts someday quickly, a minimum of in Tesla’s low-ebb months, assuming that Volvo can construct sufficient models.

Discover additionally that the home-grown Volvo and Polestar fashions took each rank from #2 to #5, a formidable feat.

There have been few notable adjustments within the prime 20 ranks in February. There have been, nevertheless, two new BEV fashions launched onto the Swedish market.

Essentially the most attention-grabbing newcomer, with a 52 unit debut, was the Zeekr 001. It is a massive, 4955 mm size sedan/coupe with 620 km WLTP vary from its 94 kWh (usable) battery. It’s able to 31 minute 10–80% charging. The beginning worth for these specs is SEK 677,000 (€60,200), however different variants can be found with AWD and extra energy for extra money.

Then there’s the Peugeot e-308, which arrived with 7 models. In order for you extra element on this compact hatchback with 410 km WLTP vary, priced from SEK 479,900 (€43,000), check out Zach’s overview from final 12 months. Stellantis has not been promoting a lot quantity in Sweden not too long ago, as mentioned earlier, so we are able to’t count on a lot market affect from this mannequin for now (nor maybe a lot demand, a minimum of at this “formidable” worth level).

Now let’s flip to the trailing quarter rankings:

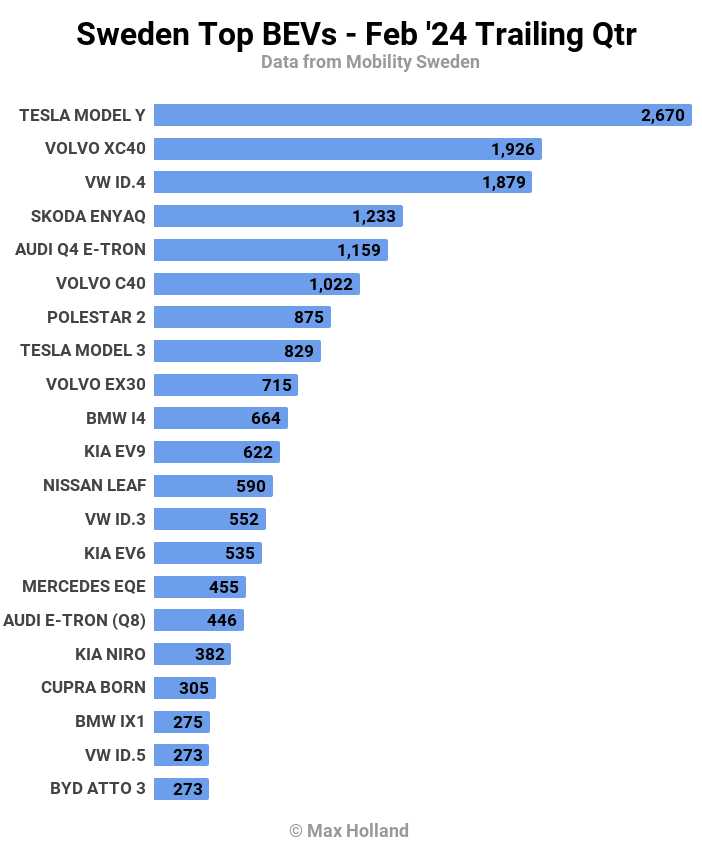

As traditional, the Tesla Mannequin Y is dominant, a major step forward of the Volvo XC40 and Volkswagen ID.4.

These identical three fashions have been the long-term leaders in Sweden, generally shuffling locations, since mid-2022. Already, the Volvo EX30 has joined the highest 10 within the 3-month chart, following its December debut. Can the EX30 problem the stasis of the highest 3 ranks? It appears doubtless to take action, given its evident reputation.

Additional again within the eleventh spot, the brand new Kia EV9 is doing nicely, particularly given the excessive beginning worth (SEK 807,900, €72,000). Its nearest competitor, the Volkswagen ID. Buzz, is languishing down within the thirtieth spot, the place it has been for some time.

Let’s keep watch over the Volvo EX30’s ascent within the coming few months.

Fleet Evolution

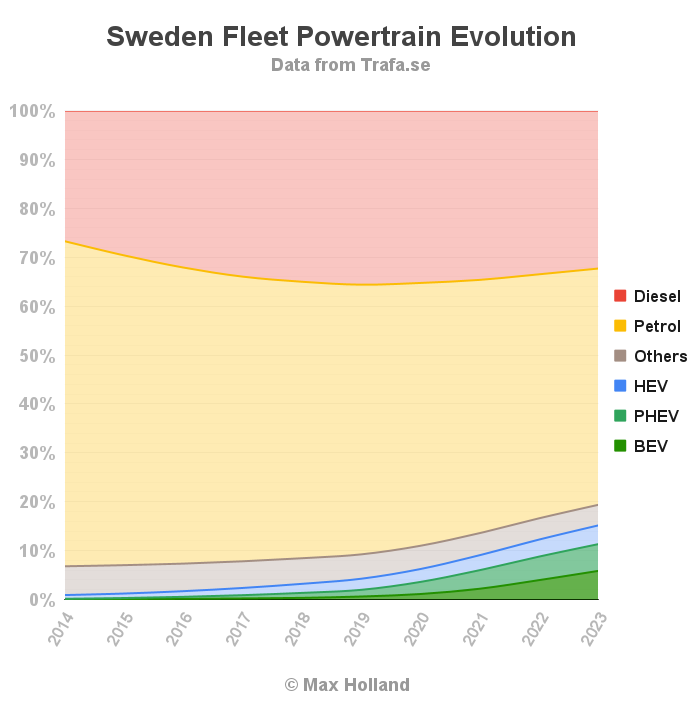

The statistics company publishes fleet updates annually, so let’s check out Sweden’s progress:

The speed of change over the previous 4 years appears frustratingly gradual. On the finish of 2019, mixed plugin share was 1.98% (with 0.62% BEV). 4 years later, on the finish of 2023, plugin share was 11.33% (5.86% BEV). PEV fleet enhance truly slowed from 2022’s 2.77% to only 2.55% in 2023.

On the fee seen in 2023, it could take one other 35 years (until 2059) to realize a totally plugin fleet. This underscores why we’d like extra reasonably priced BEVs to be made accessible on the market in Europe. A latest JATO report discovered that European carmakers have truly elevated their BEV costs and their income, are attempting to money in on high-end fashions, and are refusing to supply reasonably priced BEVs.

They’re doing this even while LFP cell costs have not too long ago achieved report lows of 340 RMB (€44, $48) per kWh. This is able to put the price of a forty five kWh pack in an environment friendly small automotive (for 320+ km vary) at round €2,500. So, why are most European OEM’s BEVs nonetheless priced a minimum of €10,000 greater than an ICE equal? The JATO report factors to legacy OEM profiteering. Is worth collusion happening additionally? I wouldn’t guess towards it.

Outlook

Sweden’s economic system remains to be weak, with newest information (This autumn 2023) displaying YoY development of -0.2% GDP, the third consecutive damaging quarter. Inflation has worsened, to five.4% in January (newest information) from 4.4% in December. Rates of interest are flat at 4%. The manufacturing PMI rating, nevertheless, did enhance in February to 49 factors, from 47.1 in January.

Sweden’s auto business physique, Mobility Sweden, had this to say: “It’s clear that the non-public marketplace for passenger automobiles normally and electrical automobiles particularly remains to be weak. To reverse this damaging pattern, focused efforts from the federal government are required to stimulate demand for electrical automobiles amongst non-public people. It’s essential that electrification doesn’t go backwards.”

What are your ideas on Sweden’s EV transition? Please be a part of within the dialogue under.

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Discuss podcast? Contact us right here.

Newest CleanTechnica TV Video

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.