Within the second week of November, electrical energy market costs recovered from the earlier week. For the third consecutive week, MIBEL was the market with the bottom weekly common. The rise in demand and the autumn in wind vitality manufacturing after the excessive ranges on the finish of October and the start of November favored the rise in costs. Even so, on November 6, the German market reached the best wind vitality manufacturing since mid?March.

Concentrated Photo voltaic Energy, photovoltaic and wind vitality manufacturing

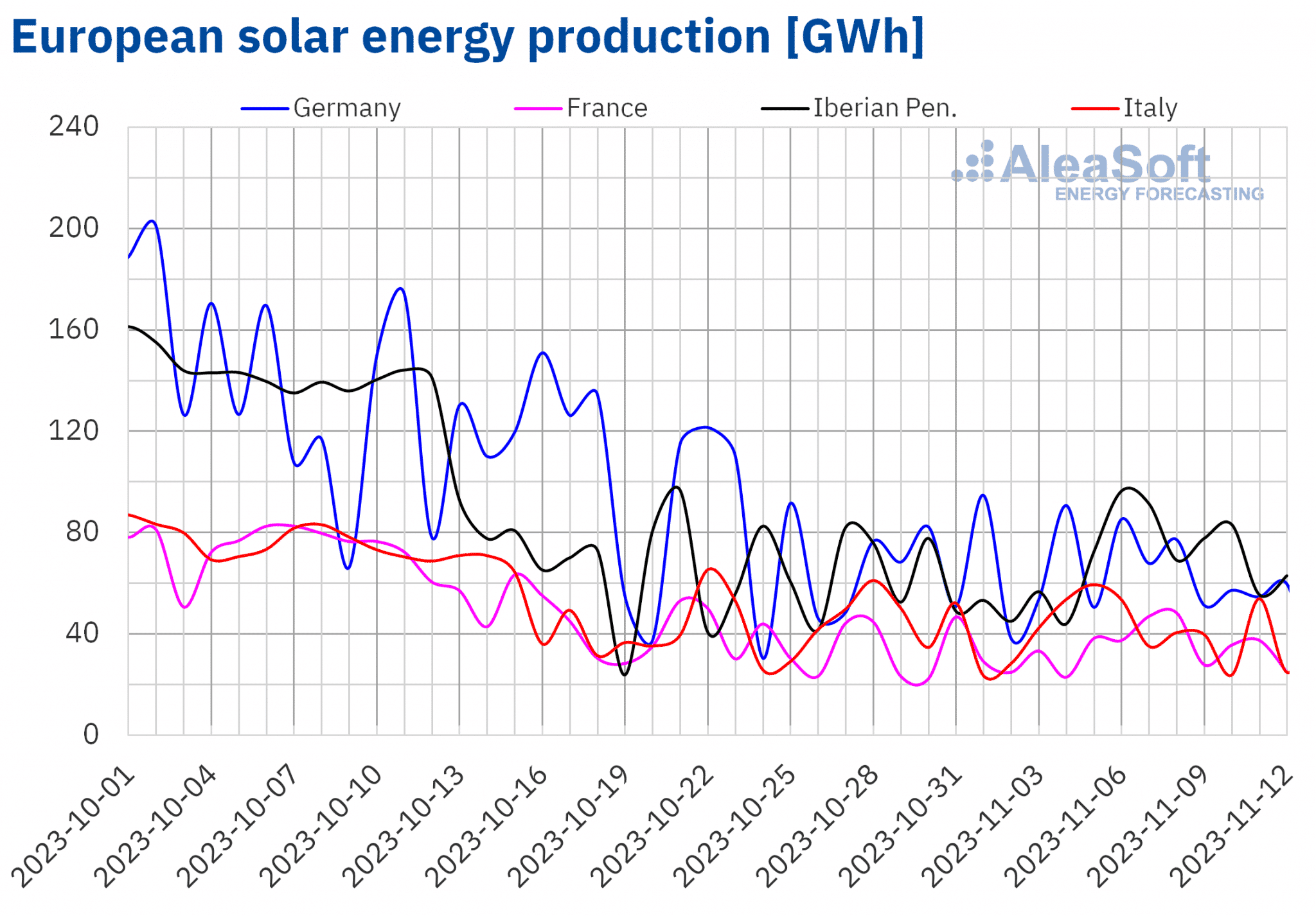

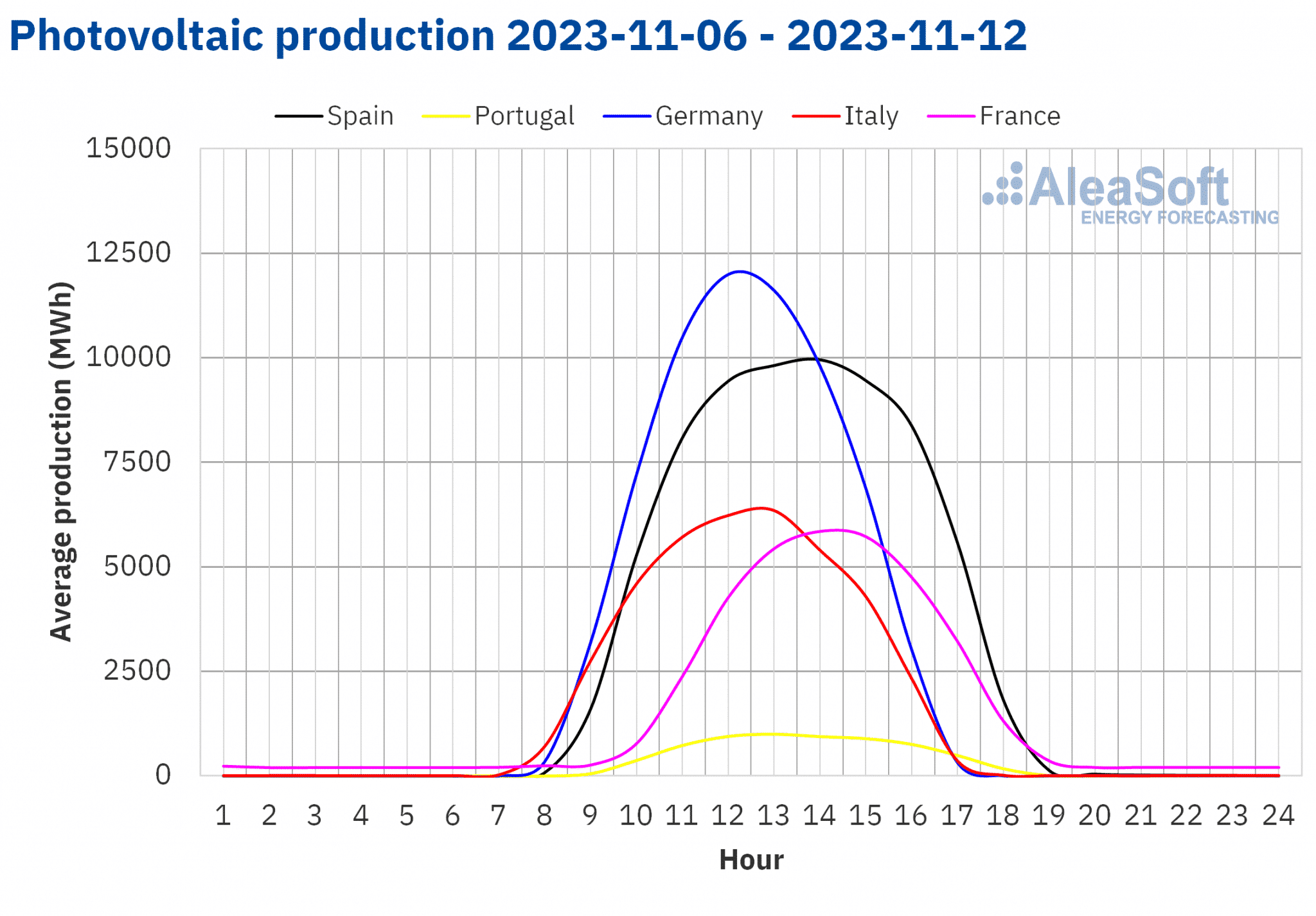

Within the week of November 6, variations in photo voltaic vitality manufacturing in the principle European electrical energy markets didn’t present a homogeneous pattern in comparison with the earlier week. Photo voltaic vitality manufacturing elevated by 37% in Spain, 19% in France and 12% in Portugal. The Italian and German markets registered the other conduct, photo voltaic vitality manufacturing fell by 7.7% and 1.7%, respectively. For the week of November 13, in line with AleaSoft Power Forecasting’s photo voltaic vitality manufacturing forecasts, photo voltaic vitality manufacturing will improve in Spain and Italy.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

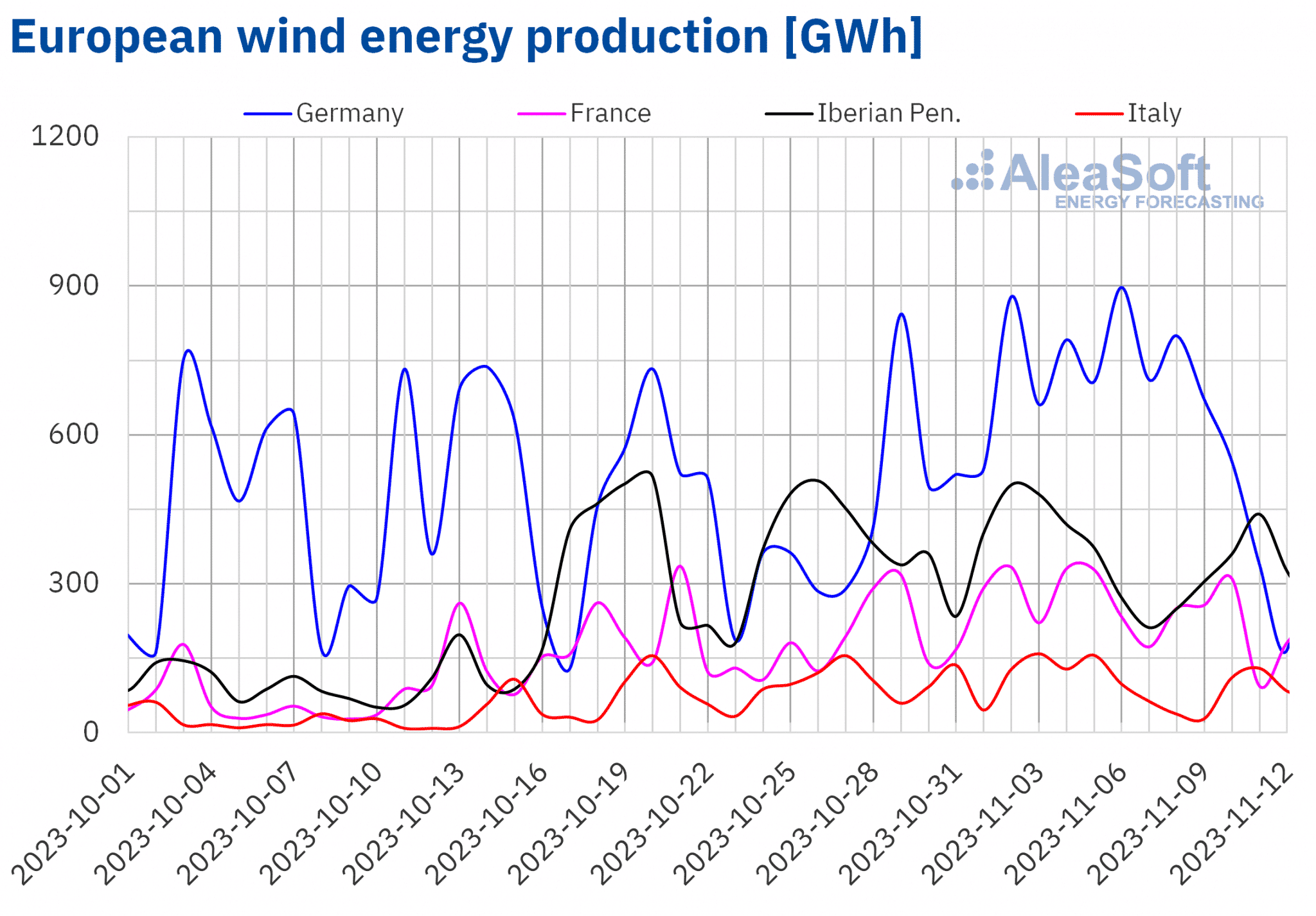

In the course of the week of November 6, wind vitality manufacturing in the principle European electrical energy markets decreased week?on?week after reaching very excessive ranges on the finish of October and the start of November. The Italian market registered the biggest drop, 35%, adopted by the Portuguese market the place the decline was 34%. The German market registered the smallest decline, 9.9%. Nonetheless, regardless of the decline in weekly manufacturing, wind vitality generated 897 GWh within the German market on November 6, the best worth since mid?March.

For the week of November 13, AleaSoft Power Forecasting’s wind vitality manufacturing forecasts point out that wind vitality manufacturing will proceed to say no in a lot of the analyzed markets apart from Italy.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Electrical energy demand

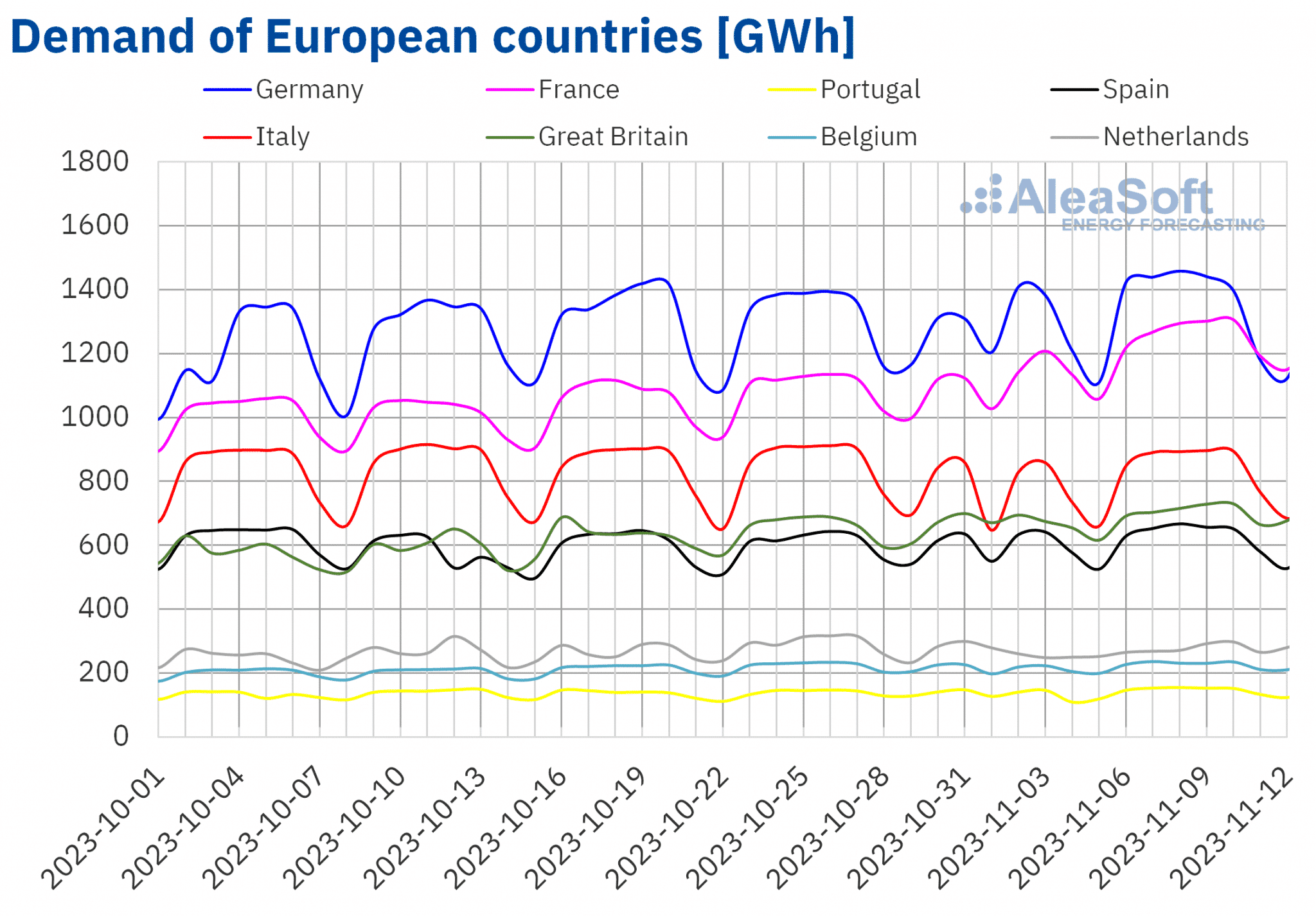

Within the week of November 6, electrical energy demand elevated in the principle European electrical energy markets in comparison with the earlier week. Partly, this rise was as a consequence of demand recovering after the earlier week’s falls, associated to the celebration of All Saints’ Day in most of Europe, besides Nice Britain. Will increase ranged from 3.6% within the Dutch market to 12% within the French market.

Throughout the identical interval, common temperatures decreased in all analyzed markets in comparison with the earlier week. The decreases ranged from 3.1 °C in Italy to 1.0 °C in Portugal.

Based on AleaSoft Power Forecasting’s demand forecasts, within the week of November 13, electrical energy demand will improve in a lot of the analyzed markets. Solely the French, German and Spanish markets will register decrease demand.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

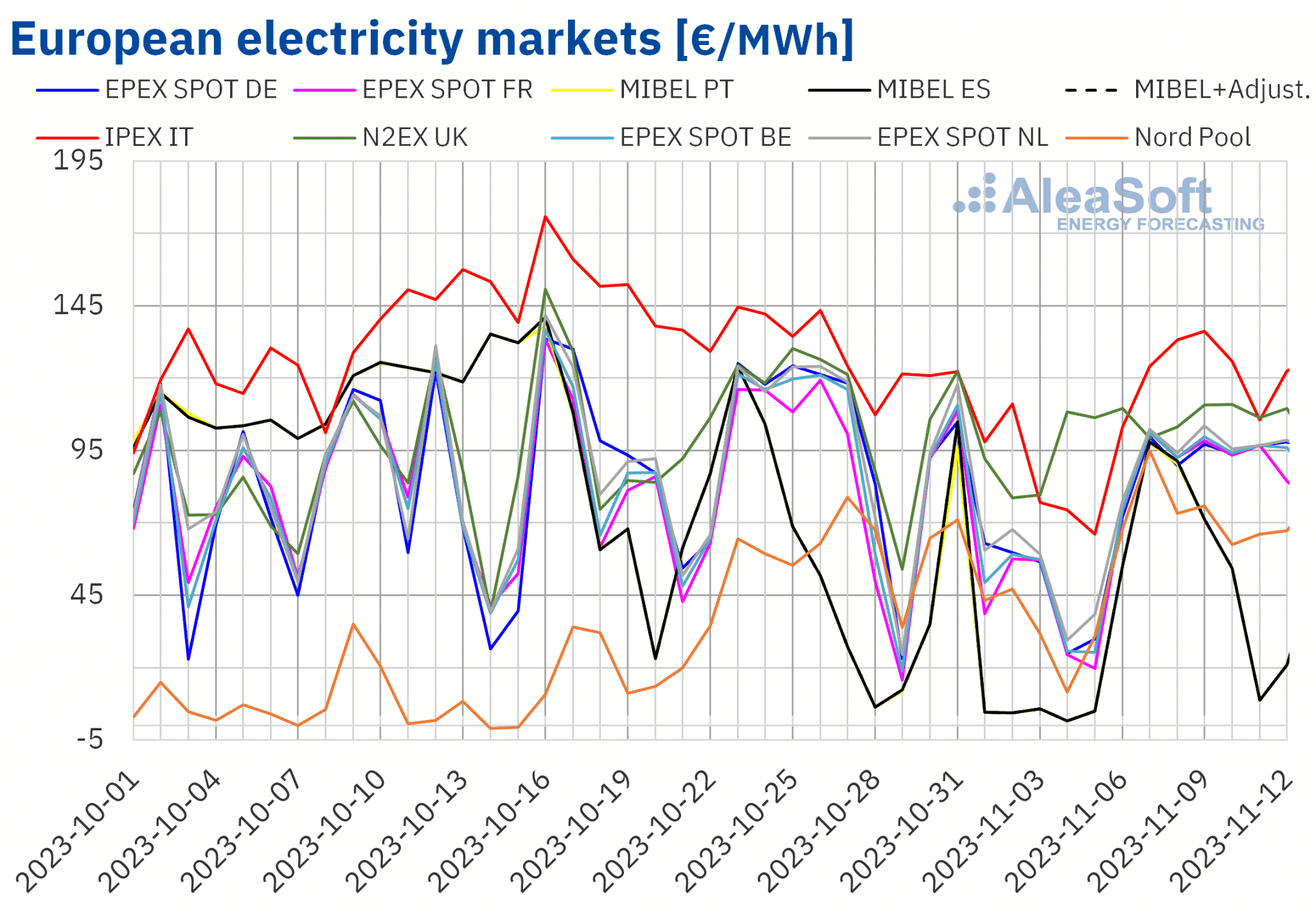

European electrical energy markets

Within the week of November 6, costs in the principle European electrical energy markets confirmed an upward pattern in comparison with the earlier week. The MIBEL market of Spain and Portugal reached the best value rises, 148% and 161%, respectively. In distinction, the N2EX market of the UK registered the smallest improve, 8.1%. Elsewhere, costs rose between 27% within the IPEX market of Italy and 69% within the Nord Pool market of the Nordic nations.

Within the second week of November, weekly averages had been beneath €100/MWh in a lot of the European electrical energy markets analyzed at AleaSoft Power Forecasting. The exceptions had been the British and Italian markets, the place the averages had been €107.11/MWh and €121.54/MWh, respectively. For the third consecutive week, the Portuguese and Spanish markets registered the bottom common costs, €56.90/MWh and €57.11/MWh, respectively. In the remainder of the analyzed markets, costs ranged from €72.56/MWh within the Nordic market to €95.54/MWh within the EPEX SPOT market of the Netherlands.

Regardless of the rise within the weekly common within the second week of November, the MIBEL market registered thirty?six hours with costs beneath €10/MWh on November 6, 11 and 12. Then again, on Tuesday, November 7, from 18:00 to 19:00, the Nordic market reached the best value because the starting of April, €149.86/MWh.

In the course of the week of November 6, the rise in demand and the autumn in wind vitality manufacturing in Europe induced electrical energy market costs to rise.

AleaSoft Power Forecasting’s value forecasts point out that within the third week of November costs in most European electrical energy markets may proceed to rise. Declining wind vitality manufacturing will contribute to this conduct.

Supply: Ready by AleaSoft Power Forecasting utilizing information from OMIE, EPEX SPOT, Nord Pool and GME.

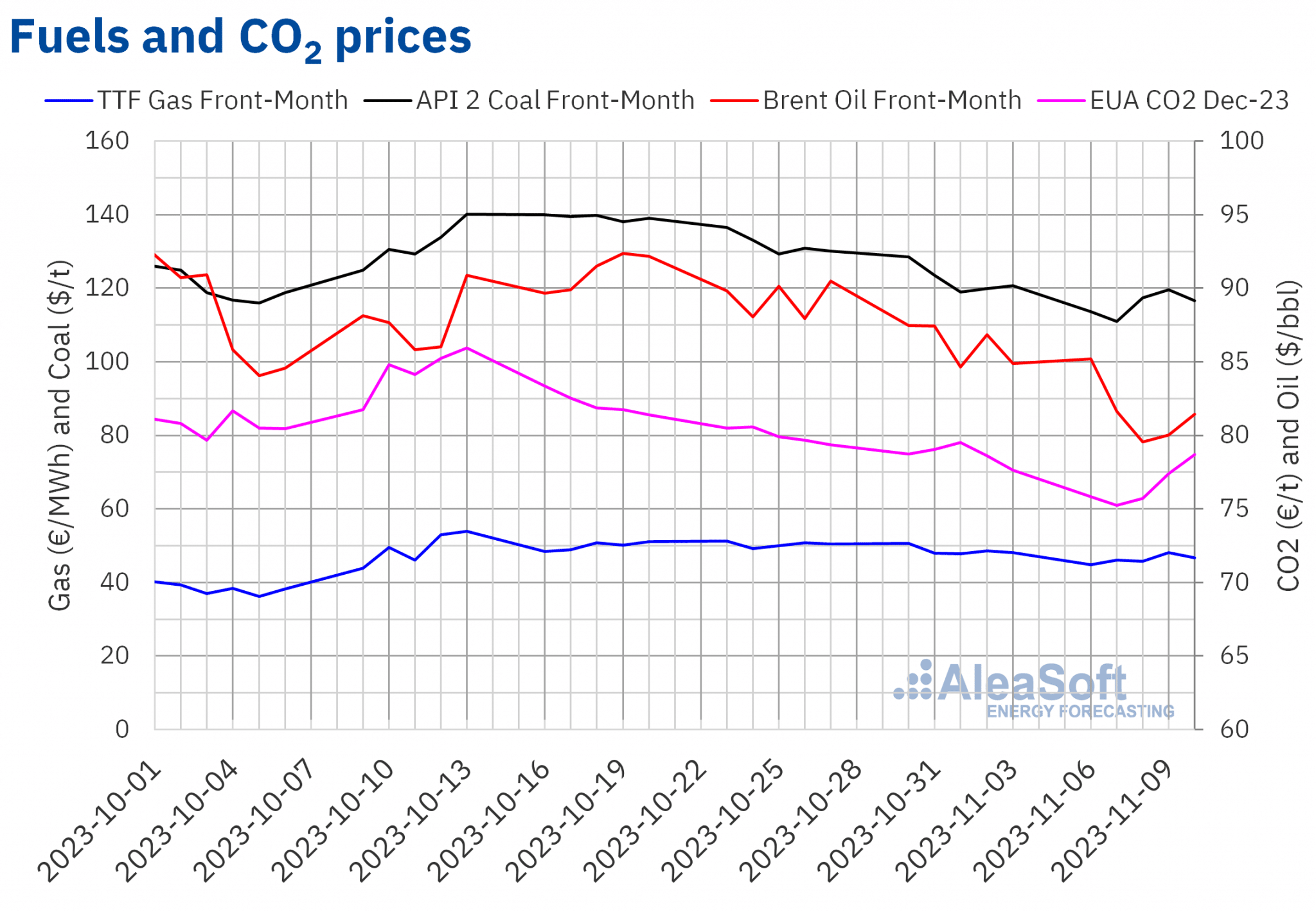

Brent, fuels and CO2

On Monday, November 6, Brent oil futures for the Entrance?Month within the ICE market registered their weekly most settlement value, $85.18/bbl. This value was already 2.6% decrease than the earlier Monday. Costs declined on Tuesday and Wednesday to succeed in the weekly minimal settlement value, $79.54/bbl, on Wednesday, November 8. This value was 6.0% decrease than the earlier Wednesday and the bottom since July. Within the final classes of the week, costs elevated once more. The settlement value on Friday, November 10 was $81.43/bbl. This was 4.1% decrease than the earlier Friday.

Considerations about demand evolution in the USA and China exerted their downward affect on Brent oil futures costs within the second week of November. As well as, fears of provide issues associated to instability within the Center East diminished, lowering their upward affect on costs. However, Iraq’s assist for OPEC+ manufacturing cuts pushed costs larger on the finish of the second week of November.

Based on information analyzed at AleaSoft Power Forecasting, settlement costs of TTF fuel futures within the ICE marketplace for the Entrance?Month had been beneath €50/MWh within the second week of November. On Monday, November 6, they registered the weekly minimal settlement value, €44.83/MWh. This value was 11% decrease than the earlier Monday. Then again, on Thursday, November 9, they reached the weekly most settlement value, €48.13 /MWh. This value was nonetheless 0.9% decrease than the earlier Thursday.

In the course of the second week of November, excessive ranges of European reserves and plentiful provides of liquefied pure fuel saved costs beneath €50/MWh. As well as, Israel ordered the reopening of the Tamar area and provides to Egypt from this nation elevated. Then again, Bulgaria’s new tax on Russian fuel may exert its affect on value evolution within the coming days.

As for the settlement costs of CO2 emission rights futures within the EEX market for the reference contract of December 2023, at the start of the second week of November they continued the declines that started on the finish of the earlier week. Because of this, the settlement value on Tuesday, November 7, €75.25/t, was the weekly minimal. This value was 4.8% decrease than the one on the identical day of the earlier week. It was additionally the bottom because the settlement costs of some November 2022 classes for the reference contract of December 2022. However, within the final three classes of the week, costs elevated. On Friday, November 10, these futures reached their weekly most settlement value, €78.70/t. This value was 1.4% larger than the one on the identical day of the earlier week.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ICE and EEX.

AleaSoft Power Forecasting’s evaluation on the prospects for vitality markets in Europe and the vitality storage

This Thursday, November 16, AleaSoft Power Forecasting and AleaGreen will maintain the subsequent webinar of their month-to-month webinar collection. The webinar will handle the prospects for European vitality markets for the winter 2023?2024 and the imaginative and prescient of the longer term for batteries and vitality storage. Luis Marquina de Soto, President of AEPIBAL, the Enterprise Affiliation of Batteries and Power Storage, would be the visitor speaker on this event.

Then again, AleaSoft Power Forecasting, within the means of increasing into new markets, is deciding on skilled companions within the vitality sector. Power consultants, renewable vitality sponsors and vitality market specialists can apply to the corporate’s Partnership Program.