Within the first week of November, wind vitality manufacturing reached a weekly report in Italy and in Portugal it was the second highest in historical past. As well as, virtually all markets registered a rise in manufacturing utilizing this expertise. This, along with decrease demand and decrease fuel costs, contributed to a downward development in European electrical energy market costs. From October 26 to November 6, the MIBEL market had the bottom costs, excluding the 31st.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind vitality manufacturing

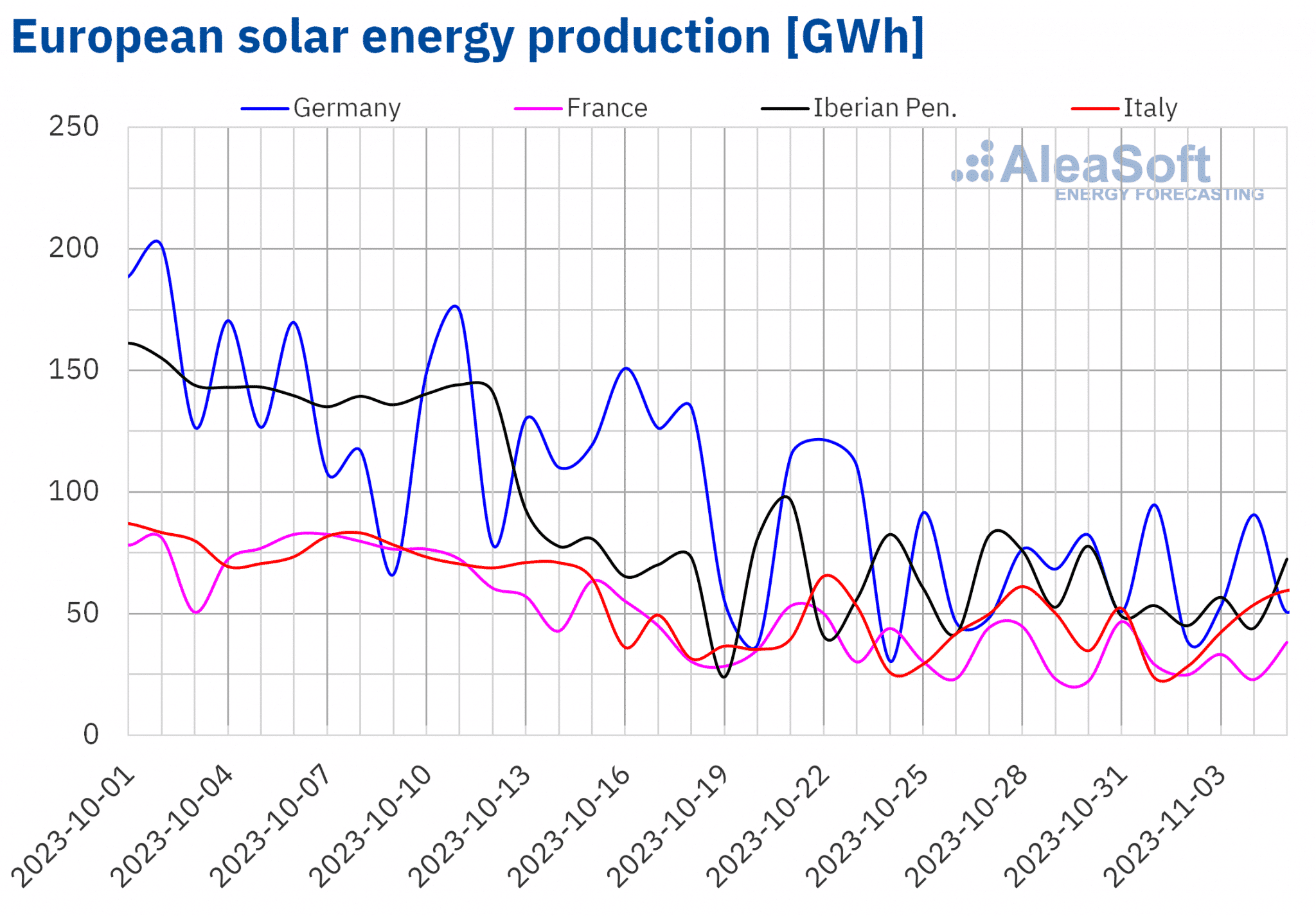

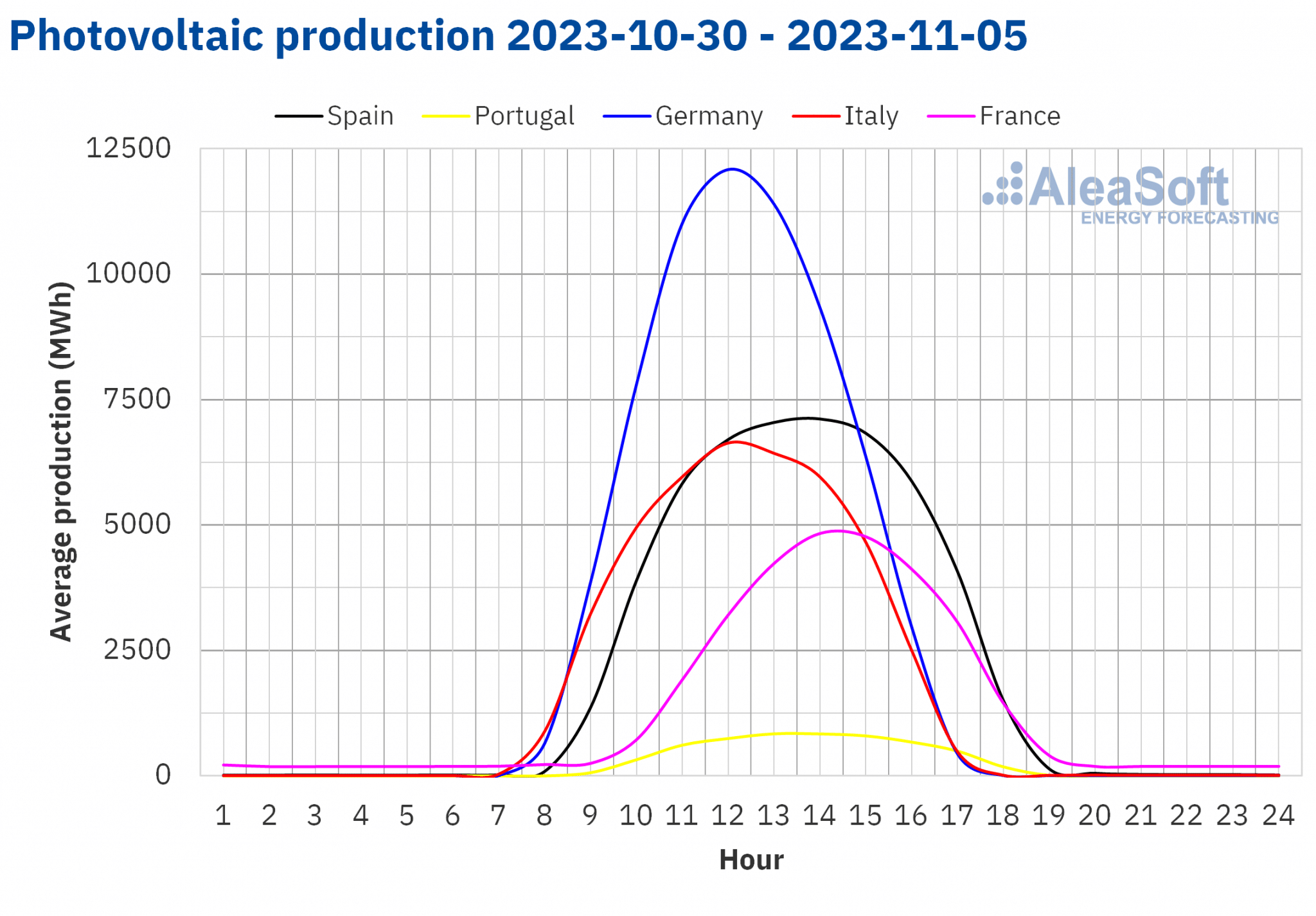

Within the week of October 30, most main European markets registered a lower in photo voltaic vitality manufacturing from the earlier week. This isn’t shocking as the autumn progresses and the times get shorter. Within the Spanish market, photo voltaic vitality manufacturing had the most important drop, 14%. Within the German market, manufacturing utilizing this renewable expertise registered the smallest decline, 2.4%. As within the earlier week, the exception was the Portuguese market, the place photo voltaic vitality manufacturing elevated by 8.6%. In response to forecasts of AleaSoft Power Forecasting, photo voltaic vitality manufacturing will enhance in Germany, Spain and Italy within the week of November 6.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

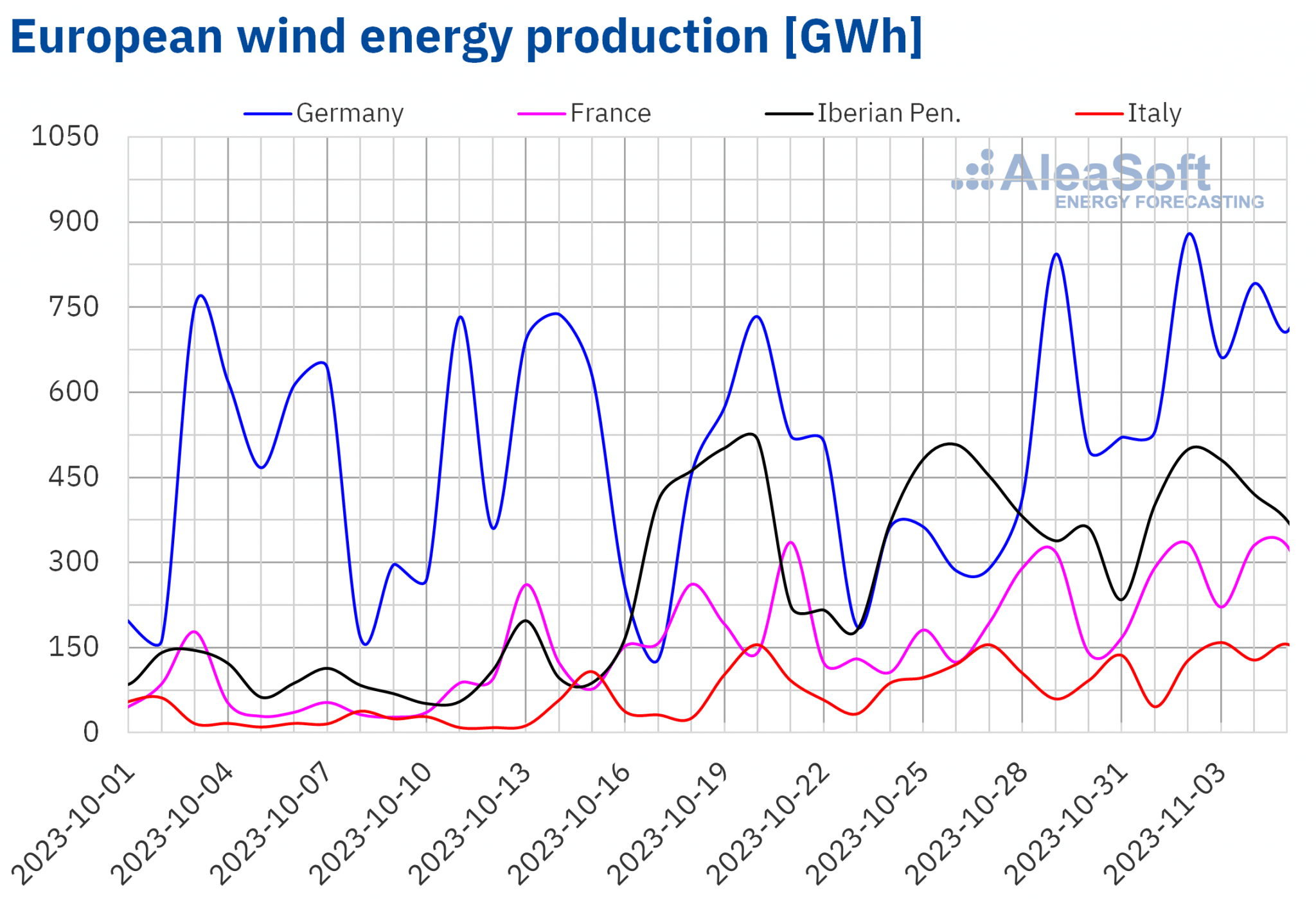

Wind vitality manufacturing offset the drop in photo voltaic vitality manufacturing. The week of October 30 introduced a rise in wind vitality era in comparison with the earlier week in all main European markets. The exception was Spain, the place wind vitality manufacturing was excessive, though there was nearly no change within the weekly whole in comparison with the earlier week. Within the German market, wind vitality era registered the most important enhance, which was 67%. The Portuguese market had the smallest enhance, 12%. The Italian market set an all?time report for weekly wind vitality manufacturing by producing 846 GWh utilizing this expertise throughout the first week of November. The Portuguese market ended the week with a wind vitality era of 567 GWh, being the second highest worth after the report manufacturing within the week of February 8, 2016, which was 587 GWh.

In response to AleaSoft Power Forecasting’s wind vitality manufacturing forecasts, wind vitality manufacturing will lower in all analyzed markets within the week of November 6.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Electrical energy demand

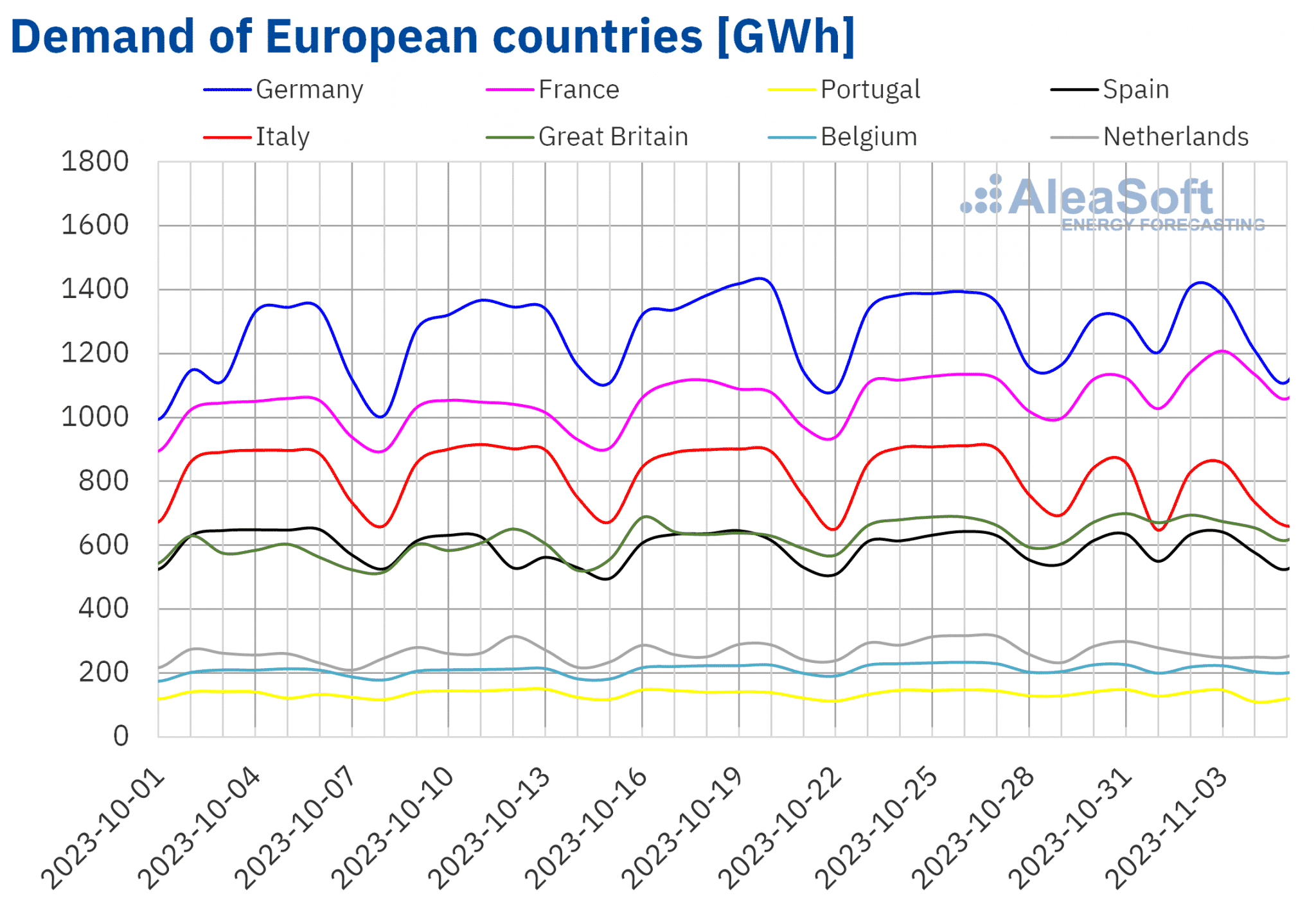

Within the week of October 30, most main European markets registered a lower in electrical energy demand in comparison with the earlier week. The celebration of All Saints’ Day, on November 1, in most of Europe contributed to those declines. The Italian market registered the most important drop, 8.5%. The Spanish market noticed the smallest decline, 1.2%. Solely France and Nice Britain registered a rise in electrical energy demand, 2.5% and a pair of.2%, respectively. Nice Britain didn’t rejoice All Saints’ Day.

Throughout the identical interval, common temperatures decreased in all analyzed markets, besides within the Netherlands. The decreases ranged from 2.0 °C in France to 0.5 °C in Belgium.

In response to AleaSoft Power Forecasting’s demand forecasts, demand will enhance in all analyzed markets within the week of November 6 in comparison with the earlier week.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

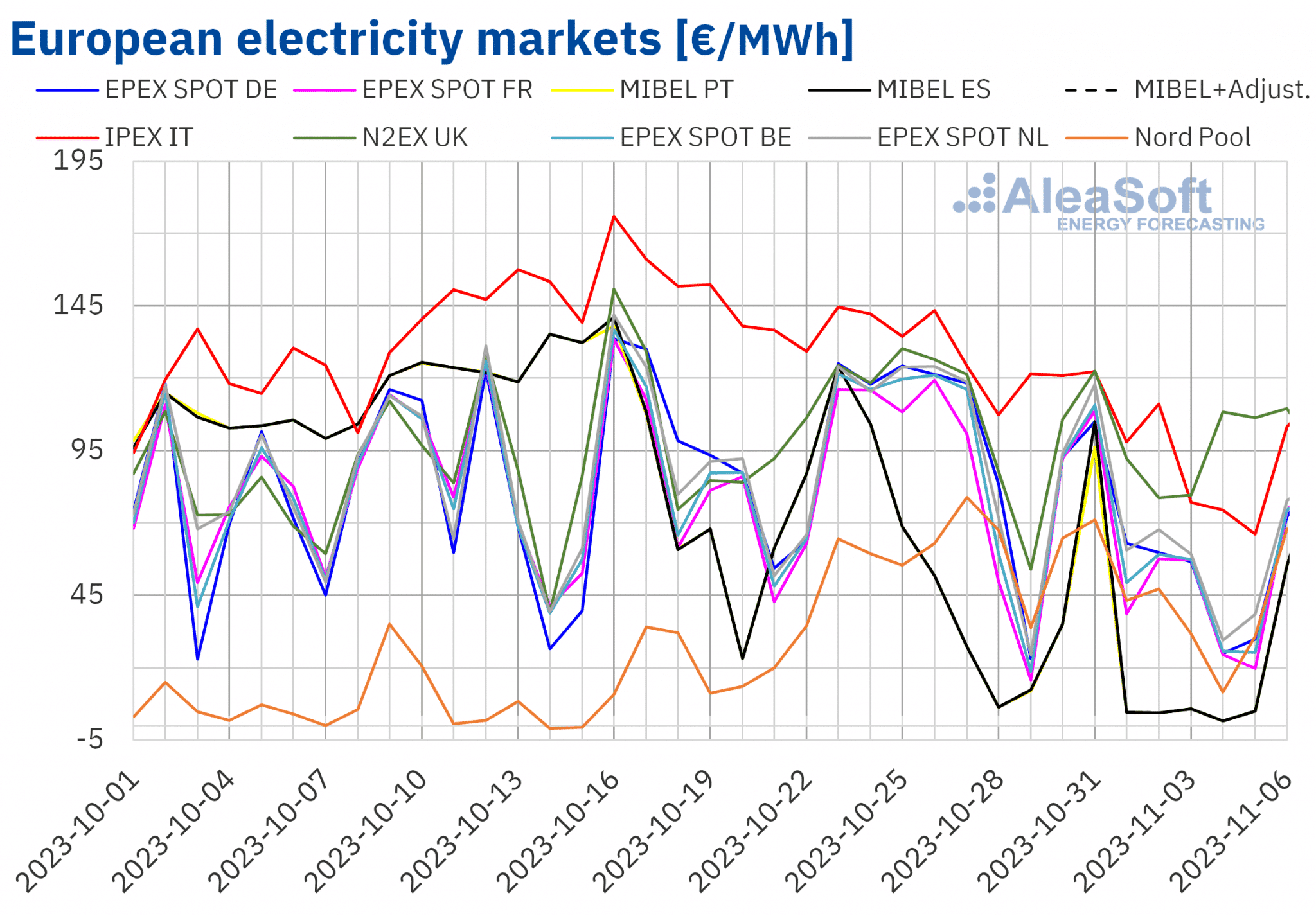

European electrical energy markets

Within the week of October 30, the principle European electrical energy markets registered a downward development in costs in comparison with the earlier week. The MIBEL market of Spain and Portugal reached the most important worth declines, 59% and 61%, respectively. In distinction, the N2EX market of the UK registered the smallest drop, 9.1%. Within the different markets, costs falls ranged from 27% within the IPEX market of Italy to 39% within the EPEX SPOT market of Germany.

Within the first week of November, most analyzed European electrical energy markets had weekly averages beneath €70/MWh. The exceptions have been the Italian and British markets, the place costs averaged €95.72/MWh and €99.08/MWh, respectively. In distinction, the Portuguese and Spanish markets registered the bottom common costs, €21.77/MWh and €23.02/MWh, respectively. In the remainder of analyzed markets, costs ranged from €42.87/MWh within the Nord Pool market of the Nordic international locations to €66.77/MWh within the Dutch market.

Within the first week of November, the MIBEL market reached the bottom hourly costs. From November 3 to five, this market registered nineteen hours with a worth of €0.00/MWh. The Italian market registered a minimal hourly worth of €2.46/MWh. This worth, registered on November 5 from 14:00 to fifteen:00, was the bottom since Could in Italy. Then again, on Monday, November 6, from 18:00 to 19:00, the Nordic market reached the very best worth since April, €142.69/MWh.

Then again, from October 26 to November 6, the MIBEL market had the bottom each day costs among the many most important European markets, excluding October 31.

In the course of the week of October 30, the autumn within the common worth of fuel and CO2 emission rights, the decline in demand in most markets and the rise in wind vitality manufacturing led to decrease costs in European electrical energy markets. Within the case of the Portuguese market, photo voltaic vitality manufacturing additionally elevated. This contributed to Portugal registering the bottom weekly common. In response to AleaSoft Power Forecasting’s worth forecasts, within the second week of November costs will enhance in most European electrical energy markets analyzed. The rise in demand and the lower in wind vitality manufacturing will affect this conduct.

Supply: Ready by AleaSoft Power Forecasting utilizing information from OMIE, EPEX SPOT, Nord Pool and GME.

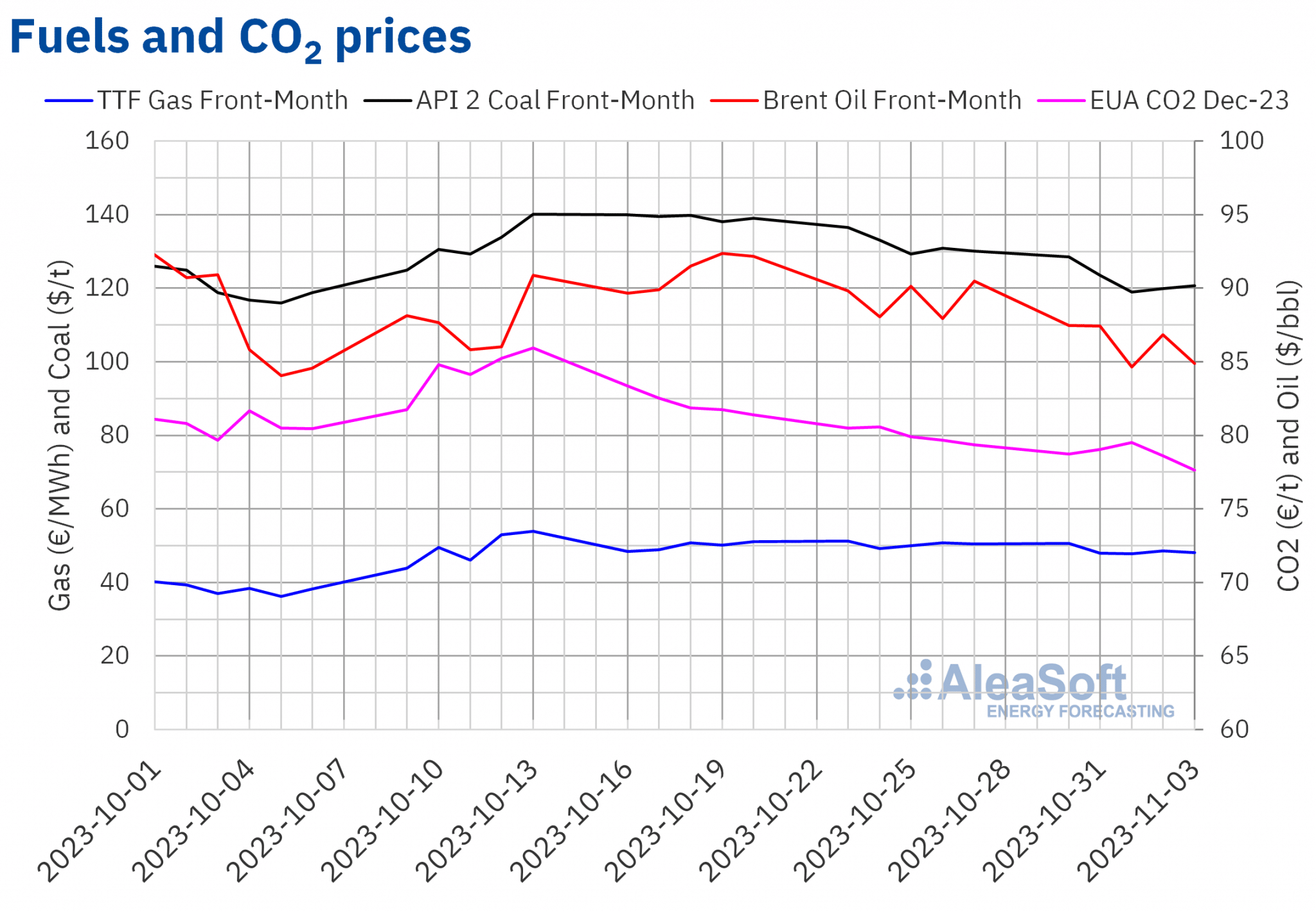

Brent, fuels and CO2

On Monday, October 30, within the ICE market, Brent oil futures for the Entrance?Month registered their weekly most settlement worth, $87.45/bbl, though this worth was 2.6% decrease than the earlier Monday. Then again, on Wednesday, November 1, they registered their weekly minimal settlement worth, at $84.63/bbl. This worth was 6.1% decrease than the earlier Wednesday. Regardless of recovering barely on Thursday, within the final session of the primary week of November, the settlement worth fell beneath $85/bbl once more, reaching $84.89/bbl. This worth was 6.2% decrease than the earlier Friday.

In the course of the first week of November, diminishing fears that the battle within the Center East would have an effect on provide helped costs to fall. Firstly of the second week of November, affirmation that Russia and Saudi Arabia will keep their deliberate manufacturing cuts till the top of 2023 influenced Brent oil futures costs upwards.

As for TTF fuel futures within the ICE marketplace for the Entrance?Month, on Monday, October 30, settlement costs reached their weekly most, reaching €50.55/MWh. For the remainder of the week, settlement costs remained beneath €50/MWh. On November 1, settlement costs reached their weekly minimal, €47.76/MWh. This worth was 4.3% decrease than the earlier Wednesday.

Increased than traditional temperatures for the season and excessive ranges of European reserves saved costs beneath €50/MWh within the first week of November. As well as, Israel resumed its fuel exports to Egypt, which additionally exerted a downward affect on costs. Settlement costs of CO2 emission rights futures within the EEX market for the reference contract of December 2023 remained beneath €80/t throughout the first week of November. On Wednesday, November 1, these futures reached their weekly most settlement worth, reaching €79.51/t. Nonetheless, costs declined on Thursday and Friday. In consequence, the settlement worth on Friday, November 3, reached the weekly minimal, €77.65/t. This worth was 2.1% decrease than the identical day of the earlier week and the bottom since mid?January.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ICE and EEX.

AleaSoft Power Forecasting’s evaluation on the prospects for vitality markets in Europe and the vitality transtion

AleaSoft Power Forecasting and AleaGreen are organizing the subsequent webinar of their month-to-month webinar sequence for Thursday, November 16. Luis Marquina de Soto, President of AEPIBAL, the Enterprise Affiliation of Batteries and Power Storage, would be the visitor speaker at this webinar. The primary subjects to be mentioned within the webinar embrace the prospects for European vitality markets for the winter 2023?2024 and the imaginative and prescient of the longer term for batteries and vitality storage.