COP28 was fascinating. For the primary time it referred to as for the world to maneuver away from all fossil fuels, and in the identical breath gave a nod to pure gasoline as a transition gas.

The juxtaposition of these two statements is each jarring and contradictory. Whereas there was controversy round this, the transition gas narrative has been distinguished for the reason that early 2000s. The truth that it wanted some type of recognition at a worldwide local weather occasion appears curious.

Fuel is portrayed as a cleaner fossil gas as a result of, when combusted, it emits half as muchcarbon than coal or oil. It is a fixed narrative, not solely espoused by business but additionally used as justification in pro-gas policymaking and funding choices.

Nevertheless, the inconvenient fact normally omitted is that pure gasoline additionally emits methane—a extra potent greenhouse gasoline that has a warming impact a minimum of 80 occasions worse than carbon within the brief time period. Recognising gasoline as a transition gas appears counterintuitive for a world that’s chasing a 1.5C international warming restrict by 2050.

As such, it seems like COP28 has missed the fantastic print and basically turned a blind eye to some essential information about gasoline. Why might this be?

Specialists discredit gasoline

The worldwide electrification push is chief amongst the drivers for declining oil and gasoline demand. This isn’t only a push by local weather consultants; monetary establishments are additionally advocating for it. COP28 resulted in a brand new international goal to triple renewable power era and double power effectivity by 2030. The summit additionally witnessed an oil and gasoline pledge to speed up local weather motion, which incorporates investing in renewable power, low-carbon fuels and damaging emissions applied sciences, enhancing transparency in greenhouse gasoline emissions and their discount. A few of these dynamics have seen traders beginning to view oil and gasoline as a sundown business.

In anticipation of waning investor curiosity, it begins to make sense that the business would search methods to lengthen its lifespan. If international automobile gross sales – the motive force of major oil consumption – is any indicator, then the boat could have sailed for the oil sector specifically.

Fuel should see itself as having an opportunity. Nevertheless, a 2022 paper printed by the worldwide authority on power evaluation and coverage suggestions, the Worldwide Vitality Company (IEA), brazenly discredited the credentials of gasoline as a transition gas, for the primary time. It discovered that when gasoline is at its highest use, based mostly on said insurance policies, international demand for the gas would rise by lower than 5 per cent between 2021 and 2030 after which plateau via to 2050.

The IEA’s 2023 outlook was no higher. It discovered that international demand for coal, oil and gasoline would peak earlier than 2030—lower than six years from right now. That’s a lot earlier than what the gasoline majors had been projecting.

Different essential datapoints, coupled with the IEA’s unenthusiastic gasoline demand projections, sign the gasoline business’s declining entry to inexpensive future capital and explains their obsession with the “transition” label.

Inexperienced finance offers, of which 58 per cent had been earmarked for renewable energty, overtook oil, gasoline and coal-related financing within the first half of 2023. This adopted the US$1.1 trillion of inexperienced funding in 2022, which roughly equalled the quantity of coal, oil and gasoline investments mixed.

Additionally within the first half of 2023, sustainability-themed bonds globally crossed the US$4 trillion mark and their volumes have been climbing year-on-year. Fuel initiatives weren’t broadly backed by these bonds.

As debate continues about whether or not sustainable or inexperienced bond devices supply any borrowing value benefit over standard debt, a examine discovered that they will – by as much as 8 foundation factors, in reality. Overwhelming investor curiosity has persistently dwarfed the availability of inexperienced bonds, additionally resulting in decrease financing prices for inexperienced initiatives.

Nevertheless, there are geographical nuances round value financial savings from early 2000 to 2021. For instance, in China, the price of debt for oil and gasoline manufacturing is mostly greater than that of renewable. The identical might be noticed in Europe. In North America, nevertheless, oil and gasoline manufacturing has a decrease value of debt in comparison with reneable, which isn’t any shock provided that up till the Inflation Discount Act was authorised within the US in August 2022, the coverage panorama was a lot friendlier in the direction of the oil and gasoline sector.

These indicators of rising international curiosity in financing clear power initiatives, an increasing sustainable finance market, and a declining value of finance for renewable power, could have spooked gasoline builders about their place in international power programs.

No place in Asia’s sustainable finance taxonomies

The facility sector globally is a key gasoline shopper. Asian markets seem extra enticing to gasoline producers because the area will want some gasoline to fulfill its quick and burgeoning power calls for, amid pressures to transition away from coal. Nevertheless, whereas there may very well be a job for gasoline to play of their net-zero methods, the logic as to why gasoline ought to have a spot in sustainable finance taxonomies and profit from doubtlessly decrease financing prices doesn’t maintain.

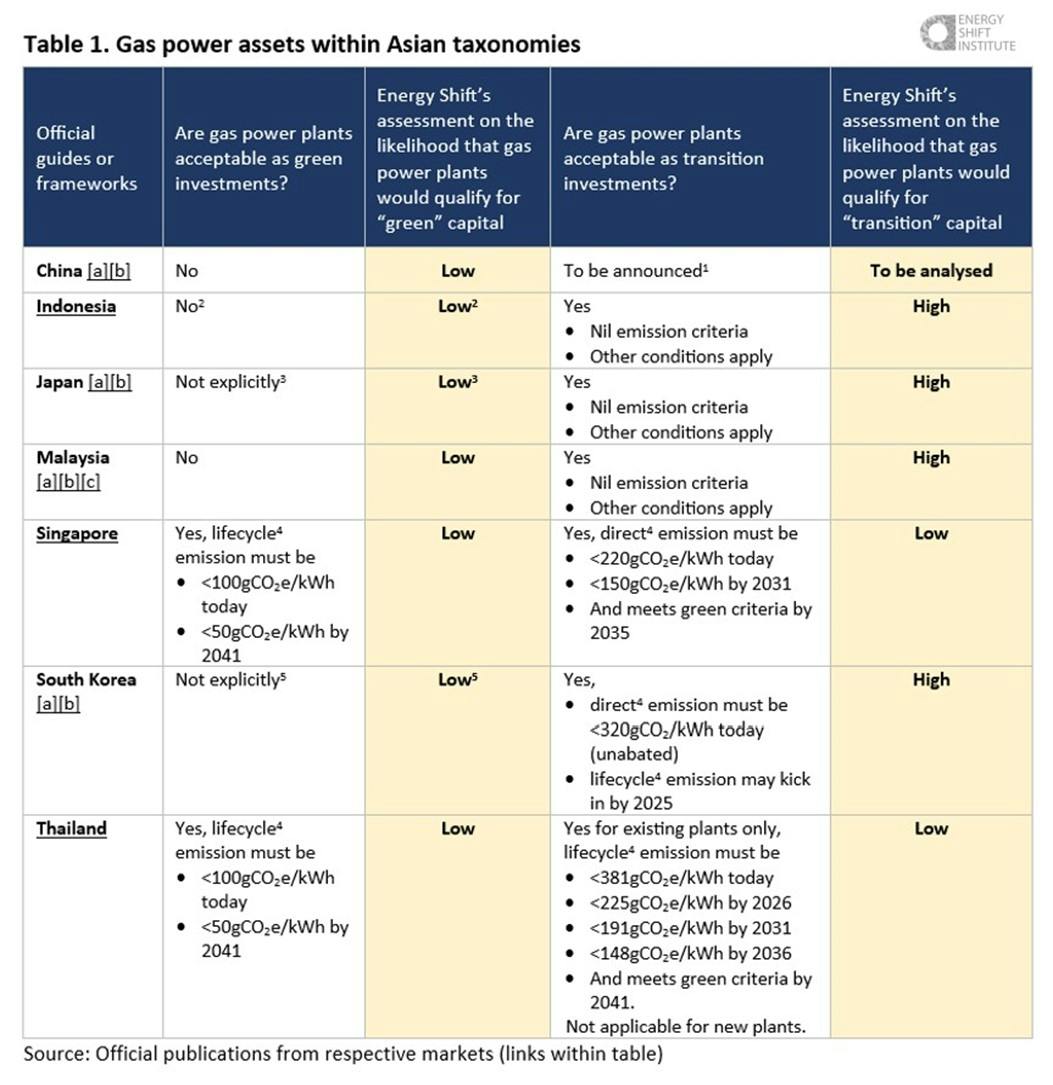

Desk 1 reveals the specs at which gasoline energy vegetation are handled as inexperienced or transition investments in Asia.

Amongst Asian international locations, Singapore and Thailand have sustainable financing taxonomies that supply a extra balanced methods to cope with emissions from the gasoline sector, stated Christina Ng, managing director on the Vitality Shift Institute. Picture: Vitality Shift Institute

Whereas not many markets label gasoline as “inexperienced”, most are blissful to discover gas-powered era as a “transition” funding, though Singapore and Thailand do that to a lesser extent. Assembly the taxonomy’s definition of “transition” permits capital to be raised for brand new or present gasoline vegetation by way of transition bonds or loans, together with these branded “sustainability-linked”. As such, emissions-conscious traders would should be on greater alert to transition-themed finance, which the funding group is in any other case excited about.

Just like the EU, Singapore and Thailand have gone down an fascinating route. Their taxonomies recognise that it will be laborious to fulfill strict thresholds, but when there’s a solution to produce zero or low-emission gas-fired power, then it’s welcomed beneath the inexperienced or transition labels. This seems to be a extra balanced solution to cope with gasoline lobbyists, each producers and customers, and places the onus again on corporations to search out an “emissions-free” model of their product.

In different phrases, if gasoline gamers wish to keep away from paying a premium for financing, then they need to begin investing extra closely in actual technological development, notably within the areas of carbon seize and storage (CCS). At time of writing, we’re not conscious of any working CCS for gas-powered era in Asia.

It’s notable that each Japan and South Korea have a looser stance on gasoline, which is disappointing provided that their greater improvement standing inside Asia ought to in any other case see them show regional management on this space.

Specifically, Japan’s energy sector transition roadmap emphasises the discount of carbon as a precedence – putting methane on the again burner – and doesn’t supply an emissions guideline, a backward transfer that continues to be in lock-step with rising market counterparts, not like Singapore and Thailand. The federal government’s assist for gas-fired vegetation as a transition funding has facilitated the issuance of transition bonds and loans amounting to over 170 billion Japense Yen (US$1.13 billion) by utility corporations,similar to JERA, Kyushu Electrical Energy and Osaka Fuel. A lot of the proceeds had been allotted to refinancing present or constructing new gasoline energy vegetation, in accordance with respective official firm paperwork.

South Korea additionally focusses on carbon discount. Whereas it has a cap on carbon emissions, it recognises unabated gasoline vegetation as green-transition investments till 2025 (until prolonged). It is a decrease customary as in comparison with, for instance, Singapore and Thailand, which require all greenhouse gases to be measured, necessitating an emission abatement know-how like CCS at gasoline energy vegetation.

When markets like Japan and South Korea are already reliant on gasoline energy, it’s questionable what these economies are actually transitioning to. Would extra unabated gasoline investments make sense as a transitionary step to decreasing emissions?

Quick-term environmental value

In precept it is smart that gasoline is a transition gas for some markets. Nevertheless, embedding this narrative at COP28 appears to be legitimising the place of gasoline in monetary markets and permitting it entry to extra plentiful and cheaper capital than it in any other case might acquire.

The affordability of gas-powered electrical energy has been a persistent challenge for a lot of Asian rising markets, particularly these counting on imported liquefied pure gasoline, so this could problem the transition gas notion. Those that can afford to pay for gasoline ought to proceed with it in the event that they actually need it, however within the absence of regulation that limits new gasoline investments, it needs to be left to the ability of market forces to find out its financing, with out the assistance of a inexperienced or transition label.

Embracing gasoline in taxonomies is a regarding experiment in encouraging the gasoline business to evolve or change its behaviour – the current u-turn in renewable power funding pledges has demonstrated a nasty observe document of following via. A extra life like end result is that it dangers locking rising markets right into a high-emissions future as a result of any gas-powered challenge invested in right now may have a 20 to 40 12 months lifespan.

Investing in additional gasoline services comes at a price to the surroundings or local weather within the brief time period. It is smart that gasoline builders and energy operators needs to be discovering it more and more troublesome and costlier to supply capital. This justifies the externalities gasoline creates.

Christina Ng is managing director of the Vitality Shift Institute, an unbiased non-profit power finance think-tank driving context, readability and credibility for Asia’s power transition pathways.

This op-ed was first printed on Vitality Shift Institute.