Marking the completion of its spin-off from GE, GE Vernova started buying and selling on the New York Inventory Change on April 2 as an impartial firm “singularly centered” on accelerating the power transition.

The measure, accredited by GE’s Board on Feb. 29, successfully establishes GE Vernova as a large purpose-built agency that can leverage its know-how and options to empower electrification and decarbonization. The corporate embarks on its company path housed at its new headquarters in Cambridge, Massachusetts, with greater than 80,000 staff throughout greater than 100 nations—and an enormous buyer base that features most of the world’s main utilities, builders, governments, and enormous industrial customers.

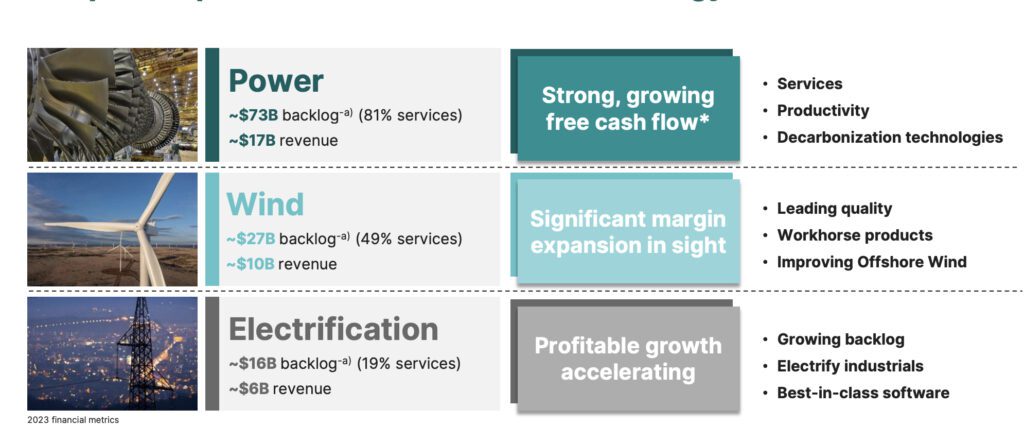

The brand new agency is comprised of three key segments: Energy (composed of its Fuel, Steam, Hydro, and Nuclear divisions); Wind (which incorporates Onshore Wind, Offshore Wind, and LM Wind Energy); and Electrification (comprising Grid Options, Energy Conversion, Photo voltaic & Storage Options, and Electrification Software program).

As firm executives underscored throughout GE Vernova’s inaugural Investor Day on March 6, the corporate’s mission might be formed by three core values: sustainability, innovation, and lean. Nevertheless, the corporate will proceed its concerted deal with its clients, together with “to speed up the trail to extra dependable, inexpensive, and sustainable power whereas serving to its clients’ energy economies and ship the electrical energy that’s important to well being, security, safety, and improved high quality of life.”

A Transformational Alternative

For Scott Strazik, GE Vernova’s CEO, the corporate’s mission and outlook characterize a behemoth alternative. The marketplace for GE Vernova’s key choices has ripened, pushed by international tendencies towards electrification and decarbonization, Strazik urged. In the present day, the power sector, already on a progress trajectory for transformation, is grappling equally with a surge in new energy demand—together with from knowledge facilities and synthetic intelligence—and a push for sustainable power options, he mentioned.

“Within the U.S., the load demand from knowledge facilities in 2020 was about 2% of the overall load demand. Many individuals venture that to be nearer to eight% by 2030—substantial progress,” he famous. “Our U.S. clients in my 25 years with the corporate haven’t seen this dynamic of load progress, extremely pushed by issues like knowledge facilities and synthetic intelligence.”

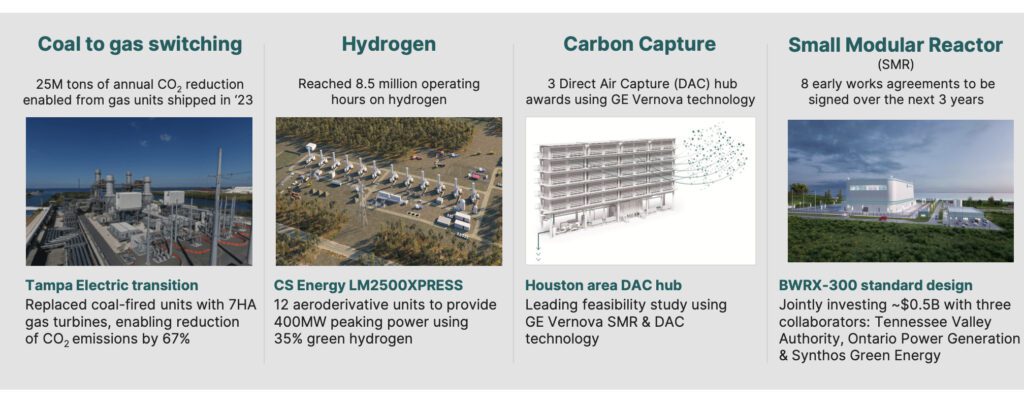

The corporate’s put in fleet of gasoline generators has, in the meantime, grown to 7,000, and 70% of Fuel Energy’s companies is targeted on providers, he famous. Enthusiasm for brand spanking new nuclear, pushed by decarbonization, has on the identical time opened up alternatives for GE Hitachi’s BWRX-300 small modular reactor. Progress in wind energy, grid options, and electrification additionally current “actual demand and actual alternatives,” he mentioned.

“We see these market dynamics which might be driving a transparent trajectory of multi-decade progress. And so they’re occurring at the very same time we’re working these companies higher. Foundationally, sustainability is the place it begins,” Strazik mentioned in the course of the Investor Day in March. “Persevering with to put money into innovation with a lean working system that permits our groups to prioritize the important KPIs most vital to our clients, whereas concurrently discovering house and oxygen to put money into long-term breakthroughs. And that’s very a lot the journey we’ve been on in Fuel Energy for over 5 years. We’re seeing outcomes. We’re accelerating that journey with every of our companies.”

When all that is coupled collectively—“the markets, working these companies higher”—it offers GE Vernova a “excessive diploma of confidence within the financials for GE Vernova going ahead and our means to create substantial worth for the corporate from right here,” he mentioned.

GE Vernova: A Daring New Chapter in a Prolonged Historical pastGE Vernova’s independence from GE marks a notable new route, significantly given the context of GE’s lengthy historical past. GE has been a flagship title within the energy producing enterprise since 1896, when it turned one of many first firms listed on the newly shaped Dow Jones Industrial Common. By 1901, GE had efficiently developed a 500-kW Curtis turbine generator, and in 1948, it put in a pioneering heavy-duty gasoline turbine for energy era on the Belle Isle Station in Oklahoma. Then, in 1957, the corporate linked the primary nuclear reactor to a industrial electrical energy grid. GE’s contributions to energy era know-how have continued in a gentle stream over the a long time. In 2010, nonetheless, to take care of monetary stability in the course of the international monetary disaster, GE’s energy companies had been grouped below GE Power, a division headquartered in Atlanta—and the corporate was finally break up into three companies. These included GE Power Companies, which included grid-related companies, energy providers, industrial options, and components and restore; GE Energy & Water, which included its full array of energy era and supply applied sciences, together with its gasoline and steam generators, renewable power, and nuclear power (GE Hitachi Nuclear Power, a three way partnership with Hitachi); and GE Oil & Fuel, which housed its segments catering to the oil and gasoline manufacturing trade. In 2015, the corporate marked one other main enterprise milestone as it took over competitor Alstom in a $10.1 billion deal, and built-in the enormous international tools agency’s services and products into its portfolio. And the yr earlier than, it launched the HA heavy-duty gasoline turbine, a brand new gasoline turbine know-how that GE’s engineers leveraged to realize a 62.22% mixed cycle internet effectivity (at EDF’s Bouchain plant in 2016 with a 9HA.01 unit) and 63.08% combined-cycle gross effectivity (at Chubu Electrical Energy’s Nishi Nagoya plant in 2018 with a 7HA.01 unit). Within the backdrop, to spice up revenues and cement the corporate’s future, it moved to speculate $4 billion over half a decade to rework the agency right into a “digital industrial” firm. See a timeline of GE Vernova’s gasoline turbine milestones right here: “A Transient Historical past of GE Fuel Generators.“ In 2018, weeks after GE Chairman and CEO H. Lawrence Culp Jr. was appointed to interchange John Flannery, GE introduced it deliberate to divide GE Energy into two models: GE Fuel Energy, composed of Fuel Energy Techniques and Energy Companies, and GE Energy Portfolio, comprising Steam Energy Techniques, Grid Options, GE Hitachi Nuclear, and Energy Conversion. Grid Options was later transferred to GE Renewable Power. In December 2020, GE took one other flip to handle quickly shifting market fundamentals, publishing a wide-ranging white paper that formalized its “all-in” stance to fight local weather change. The white paper argues that decarbonization of the ability sector—which it defines as “the discount of carbon emissions on a kilogram per MWh foundation”—and electrification of power use sectors is “mired in defining and debating a perfect future state and the timeline by which society would obtain that end-state.” Practically a yr later, in November 2021, GE introduced a plan to break up the historic conglomerate into three separate investment-grade firms centered on healthcare, power, and aviation. The trouble, which centered on debt discount, successfully kicked off the event of a stand-alone power enterprise that mixed its GE Energy, GE Renewable Power, and GE Digital enterprise segments. The transfer “aligns with buyer choices to decarbonize, and asset-balancing choices can finest be solved with [an] built-in top-of-the-house strategy,” the corporate mentioned. The brand new firm was finally branded “GE Vernova.” “Vernova” signifies the “mixture of ‘ver,’ derived from ‘verde’ and ‘verdant,’ to sign the greens and blues of Earth, and ‘nova,’ from the Latin ‘novus,’ or ‘new,’ reflecting a brand new and modern period of lower-carbon power that GE Vernova will assist ship,” as Chief Communications Officer Kristin Carvell has defined. |

A Promising Energy Market

In the course of the Investor Day, GE Vernova’s enterprise phase heads additionally pointed to optimistic market tendencies that might doubtlessly drive progress.

Maví Zingoni, GE Vernova’s new CEO of Energy, urged the corporate’s gasoline turbine legacy will proceed to thrive. “To date, gasoline has proved to be the most effective know-how on the subject of giving a solution to the power transition trilemma. And that’s the explanation why our clients are investing not solely in upgrades within the present put in base however they’re additionally investing in new models,” she mentioned.

“Should you check out the market, 5 years in the past, the marketplace for heavy-duty new models was 32 GW. Final yr, it was 42 GW. The subsequent yr, we predict that’s going to be within the 40 GW space,” she added. “We’re seeing that demand for our largest and most effective unit, the H-class. Once we began to fee the primary one seven years in the past, and thus far, we’ve greater than 100 models working and working, greater than 2.3 million hours of expertise of operations in our rising put in base. However on high of that, this can be a unit that’s being constructed to run at very excessive capability elements. So you may have a rising put in base and excessive capability utilization. It drives providers,” she mentioned.

GE Vernova’s huge 800-GW gas-fired put in base has continued to be a really resilient, Zingoni famous. “Regardless of the impacts of COVID or the geopolitical tensions that we’re going by and likewise the gasoline value volatility, the utilization of those fleets within the final yr has been going up low single-digits on common yearly. Prospects want this gasoline energy,” she mentioned. “And that’s the explanation why they carry on investing in it. They put money into upgrades, upgrades to extend output, to enhance effectivity, to have higher flexibility, to have sooner ramp-ups or extra environment friendly turndowns in case that there’s a peak in demand and the grid must be stabilized.”

Vic Abate, CEO of Wind at GE Vernova, shared related optimism about GE Vernova’s wind choices. The outlook is brilliant, he urged. “You’ll see wind going from 7% of the electrical energy to the grid right this moment to the place 25% of the ability era globally will come from wind. Simply pause for a second and digest that time,” he mentioned. “Consider an power system the place 1 out of 4 electrons comes from wind as a result of this can be a completely different world. And for this reason we consider there’s a premium to be gained from reliability, high quality, and uptime as a result of that is high-tech infrastructure that’s being deployed at an unprecedented scale.”

Nevertheless, Abate famous GE Vernova’s Wind phase deliberate to cut back the variety of its product variants in compliance with the corporate’s “lean” technique. “We centered our learnings on our fleet of 55,000 wind generators, leveraging the 4 billion working hours of perception and data. And, we’ve picked merchandise that win in markets that we care about,” he mentioned. These “workhorse” merchandise will embody GE Vernova’s 3.6-MW 154-meter rotor wind turbine for megawatt-constrained functions, its 6.1-MW 158-meter turbine for land-constrained functions, and its 250-meter rotor Haliade-X for offshore functions.

“We talked quite a bit about lean, and the way we had been going to drive structural productiveness and remodel the Onshore enterprise utilizing lean and listed below are a number of the outcomes,” Abate mentioned. “First, we’ve lowered layers, successfully bringing our groups nearer to our clients. We’ve simplified and centered our R&D spend with the three workhorse merchandise that we talked about. We’re consolidating our footprint to create stronger, extra succesful communities of apply. And eventually, we’ve repositioned our manufacturing assets nearer to strategic markets.”

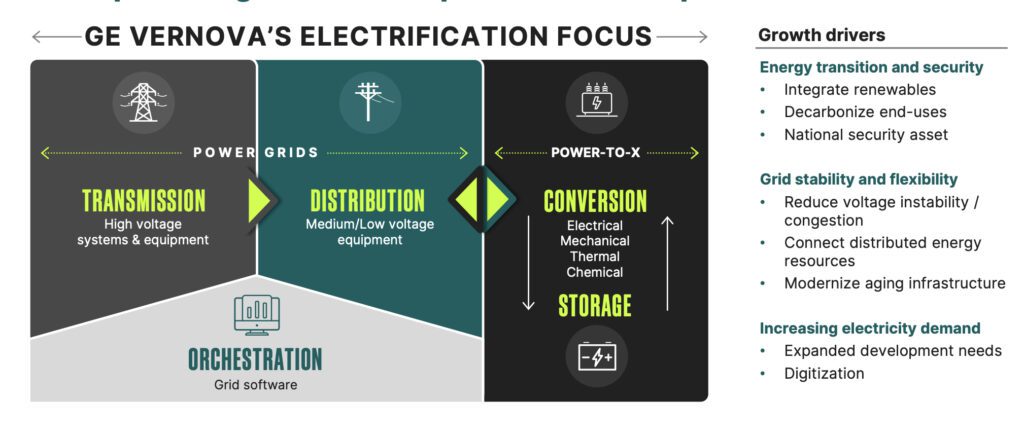

Philippe Piron GE Vernova, CEO of Electrification Techniques, was as optimistic. “General, electrification is the spine of the power transition in the direction of this net-zero power system, and for this reason we’re benefiting from this implausible progress. From $75 billion in 2022, we anticipate the addressable market by GE Vernova to greater than double in 2030. GE Vernova is masking the complete worth chain of electrification from the purpose of era to the purpose of consumption,” he mentioned.

“I have to admit we’ve a singular positioning right here. Our tools evacuates the electrical energy from typical energy crops or renewables transmitted on the worldwide or nationwide degree with high-voltage direct present or different present transmission techniques, and it flows afterward to the distribution grid on the regional or native degree, to lastly being transformed into one other sort of power vital for every end-use,” he added.

“As an illustration, mechanical power with electrical motors, thermal power with electrical furnaces, chemical power with battery storage or electrolyzer. On energy grids, orchestration permits to watch and to conduct the complete infrastructure. We’re sturdy on grid transmission and first distribution, however we’re forefront on grid orchestration and digitization to oversee electrical networks, which have gotten increasingly more complicated.”

The way forward for energy will hinge on imperatives, Piron urged. These embody “the crucial of power transition with the rise of the low carbon depth power for positive, however as nicely power safety,” he mentioned. The second large progress driver will embody the necessity for grid stability and adaptability, he predicted.

Lastly, the obvious progress driver pertains to rising demand. “The worldwide growing demand for electrical energy [accounted] for 20% of world power consumption in 2022,” he famous. “Electrical energy would want to succeed in 50% in 2050 to succeed in the online zero targets. To seize effectively this worthwhile progress, GE Vernova is dedicated to develop top-notch applied sciences that permit us to safe a modern positioning,” he mentioned.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).