The income stack for utility-scale battery storage is evolving in the UK. Adjustments to the best way Nice Britain’s electrical energy system operator (ESO) Nationwide Grid ESO operates – mixed with growing put in capability – are reshaping the panorama. It’s a market in transition, as the primary built-in nationwide grid on the planet navigates a number of the greatest adjustments in its 89-year historical past.

Proof of that transition may be present in latest capacity-market public sale outcomes. In Nice Britain, there are two sorts of capability market public sale. The “T-1” procurement workout routines award one-year contracts for the next electrical supply yr, and the “T-4” auctions have a multi-year horizon. The auctions assist guarantee there may be sufficient future grid capability whereas on the identical time offering mission builders with proof of future income – the type that may be instrumental to securing finance. An analogous system is in place on the island of Eire, the place Northern Eire and the Republic of Eire share an built-in wholesale electrical energy market.

In February 2023, the success of battery power storage techniques (BESS’) in Nationwide Grid ESO’s capability market auctions demonstrated the demand for BESS’ as a part of Nice Britain’s power combine. The T-1 capability public sale for 2023-2024 awarded contracts to 627 MW of battery storage initiatives, up from 385 MW awarded in 2022. Within the T-4 public sale, battery storage was awarded 1.29 GW price of contracts for 2026-27.

“There’s a elementary want for storage, we’ve seen that with storage profitable contracts within the capability market and we’ll see that with continued volatility within the balancing mechanism,” mentioned George Hilton, a senior analyst at S&P World Commodity Insights, referring to funds made by the ESO for turbines to ramp or cut back output in keeping with demand. “That’s going to drive continued set up, continued development available in the market, and it’s going to imply builders are nonetheless constructing initiatives.”

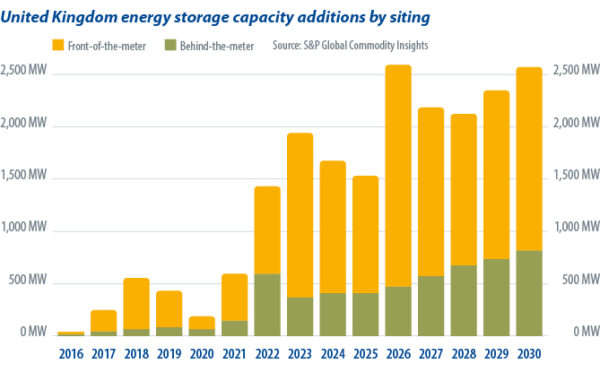

The pipeline for utility-side, “front-of-the-meter” (FTM) battery storage additions has swelled in the UK, (see chart under) regardless of annualized revenues for BESS belongings tumbling from the highs of 2022. Again then, the battery storage fleet achieved annualized income of GBP 156,000 ($197,000)/MW, based on Modo Power’s GB BESS Index. The UK-based battery analytics platform’s 2023 market evaluation additionally revealed annualized battery power storage revenues fell 65% in 2023, to a complete of GBP 53,000/MW. A big growth, however not a shocking one.

Frequency response

Till not too long ago, frequency response companies had been the principle income supply for Nice Britain’s FTM battery fleet. Protecting the electrical energy grid inside 1% of fifty Hz was profitable for FTM battery belongings throughout the storage market’s infancy. When Nationwide Grid ESO launched its dynamic containment (DC) frequency response service, on Sept. 30, 2020, six tenders had been obtained and two battery storage models had been accepted within the first spherical, to supply 90 MW of quick response companies over 24 hours. That heralded the beginning of a DC income increase for batteries in Nice Britain. When BESS belongings had been having fun with document revenues in 2022, 63% derived from DC companies whereas 25% of income got here from the ESO’s month-to-month agency frequency response (FFR) funds, based on Modo Power information. Immediately, issues have modified. In January 2024, balancing mechanism (BM) revenues eclipsed frequency response companies for the primary time on the Modo Power GB BESS index.

It was virtually inevitable – the grid solely wants a lot frequency response and battery storage capability additions have led to heightened competitors. In right this moment’s market, builders have to strategy battery power storage from a extra rational place than earlier than, based on S&P World’s Hilton.

“You’re not going to have the [return on investment] that you simply had beforehand, so it’s attracting, I suppose, a unique sort of investor and a unique sort of developer, which are extra in it for the long run,” mentioned the power storage analyst.

Juggling act

Lengthy-term buyers will undoubtedly hope to boost income from the BM, in addition to by way of power arbitrage – shopping for and promoting again electrical energy to the grid at optimum tariffs. There’s a whole lot of income up for grabs – balancing Nice Britain’s electrical energy grid doesn’t come low-cost. Nationwide Grid ESO’s most up-to-date Balancing Providers Use of System forecast, printed in February 2024, predicted the system operator will spend greater than GBP 2 billion on balancing the grid in 2024.

Securing income from the BM just isn’t as easy as merely approaching the ESO with the bottom bid, nevertheless. If it was, there’s a robust argument that battery storage would already get pleasure from a larger share of BM income. Legacy know-how points are at play. Till not too long ago, employees at Nationwide Grid ESO solely had entry to 15-minute discharge information from Nice Britain’s fleet of BM-registered batteries. That put battery storage out of the working for BM trades with an extended dispatch period. Issues are enhancing. As pv journal went to press, Nationwide Grid ESO was set to increase its 15-minute rule for battery storage, to half-hour, from March 1, 2024. The change means battery operators will inform the ESO of the utmost energy they’ll provide for a 30-minute window – opening a brand new set of income alternatives. That is only one approach the ESO is tackling the phenomenon known as “skipping,” when a battery asset just isn’t chosen by the ESO regardless of being the extra cost-efficient choice. There are some reputable explanation why the ESO won’t go for essentially the most cost-efficient generator within the BM, corresponding to geographical calls for, however growing older guidelines and procedures have left battery storage at a drawback.

Additional power system upgrades are coming. Nationwide Grid ESO is within the means of rolling out a brand new Open Balancing Platform, a program of upgrades which it guarantees will “revolutionize” the BM. Issues kicked off in December 2023, when the ESO added a brand new device which allows control-room engineers to ship a whole bunch of directions to smaller BM-registered models and battery storage models, on the press of a single button. That could be a change that can allow battery storage to play a extra energetic position in balancing the community, based on Nationwide Grid ESO. By 2027, it’s anticipated the total Open Balancing Platform could have grown to interchange each the prevailing BM and the ESO’s Ancillary Providers Dispatch Platform – the system used to acquire operational-reserve and contingency assets.

Improved entry to BM alternatives may put battery storage on a greater footing, in income phrases. Wendel Hortop, market lead at Modo Power, highlighted additional adjustments slated for 2024 that ought to present much more alternatives for FTM storage.

“On the companies aspect, we’ve received two new markets popping out this yr,” mentioned Hortop. “There’s the balancing reserve market, which is because of be launched in March, and the short reserve in direction of the top of the yr. Primarily, what that might do is simply deepen the pool of markets that storage can take part in. I don’t suppose it’s going to make a drastic distinction due to the hyper competitiveness [in the market].”

Future know-how

Nick Smailes, head of commercialization at United Kingdom storage analysis physique The Faraday Establishment, is aware of a factor or two about competitors. Tasked with working alongside lecturers and mission managers to determine business alternatives for battery know-how, Smailes mentioned the institute’s evaluation suggests 50% of the balancing market may be out there to batteries.

“It’s fairly bewildering, the variety of alternatives and enterprise instances which are on the market,” mentioned Smailes, including that electrical car (EV) batteries and fast-charging installations may additionally play an growing position in balancing Britain’s grid.

The UK’s demand for EV battery manufacturing capability is projected to succeed in greater than 100 GWh each year in 2030, based on The Faraday Establishment. Precisely what the longer term income stack will seem like for EV batteries and charging infrastructure stays to be seen, with vehicle-to-grid and vehicle-to-home know-how presenting completely different potentialities.

On the one hand, by the top of the last decade there will probably be important grid balancing capability within the garages and repair stations of Nice Britain. On the opposite, there are open questions on how collaborating in power markets could have an effect on battery degradation.

“There’s much more analysis to do by way of how vehicle-to-grid protocols may have an effect on battery degradation, as a result of this may increasingly make the most of and stress batteries in a really completely different approach which additionally wants new financial issues, corresponding to stacked income fashions,” mentioned Smailes. “There are analysis questions for us there.”

Additional shake-ups may come if and when sodium ion battery storage turns into commercially viable and that could be a analysis space which the Faraday Establishment is closely concerned in. The entity’s Nexgenna mission, based mostly on the College of St Andrews, in Scotland, is backed by GBP 15.9 million of funding. The mission is tasked with growing the following technology of sodium ion batteries, a subject wherein Smailes mentioned the UK might be “very succesful.”

“The Faraday Establishment has an enormous sodium program and with firms corresponding to Faradion, who’ve a big quantity of the world’s [intellectual property] on sodium, so the following technology of batteries might be very attention-grabbing and so they’re not very distant,” added Smailes.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and want to reuse a few of our content material, please contact: editors@pv-magazine.com.