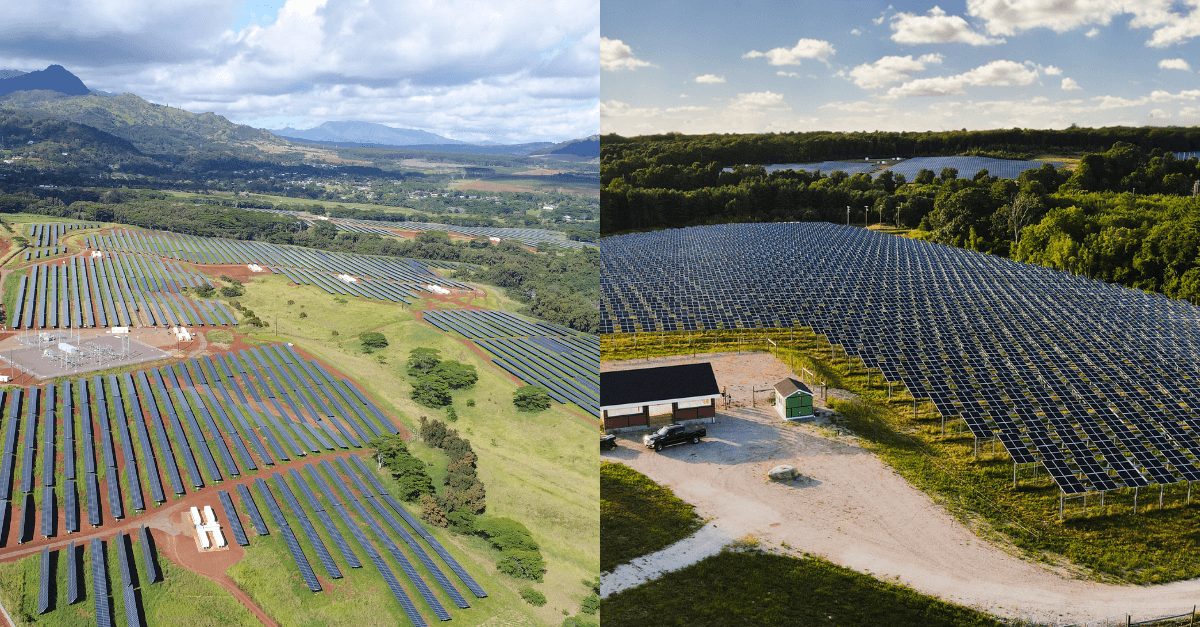

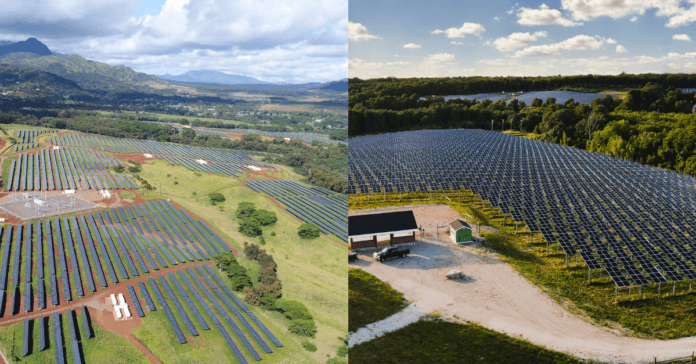

HASI has invested in a portfolio of vitality belongings developed, owned and operated by AES, consisting of greater than 200 operational renewable initiatives.

Per the settlement, which reached monetary shut in December, HASI will make a structured fairness funding within the roughly 605 MW portfolio of photo voltaic and solar-plus-storage belongings spanning seven energy markets and 11 states: Arizona, California, Colorado, Connecticut, Georgia, Hawaii, Illinois, Massachusetts, New York, Rhode Island and Vermont.

The corporate says the portfolio consists primarily of neighborhood photo voltaic and industrial plus industrial photo voltaic belongings, with greater than a 3rd of the overall capability paired with battery vitality storage. AES will proceed to personal and function the belongings.

“HASI is immensely proud to advance our partnership with AES with this newest transaction,” says Susan Nickey, Chief Consumer Officer of HASI. “Collectively, we share an unwavering dedication to accelerating the vitality transition. AES’ distinctive management in carefully aligning renewable vitality provide with demand is exactly the main focus our business wants for the following section of progress. This funding not solely considerably expands our programmatic funding partnership but in addition presents diversification and scale to our stability sheet.”