Join every day information updates from CleanTechnica on e-mail. Or observe us on Google Information!

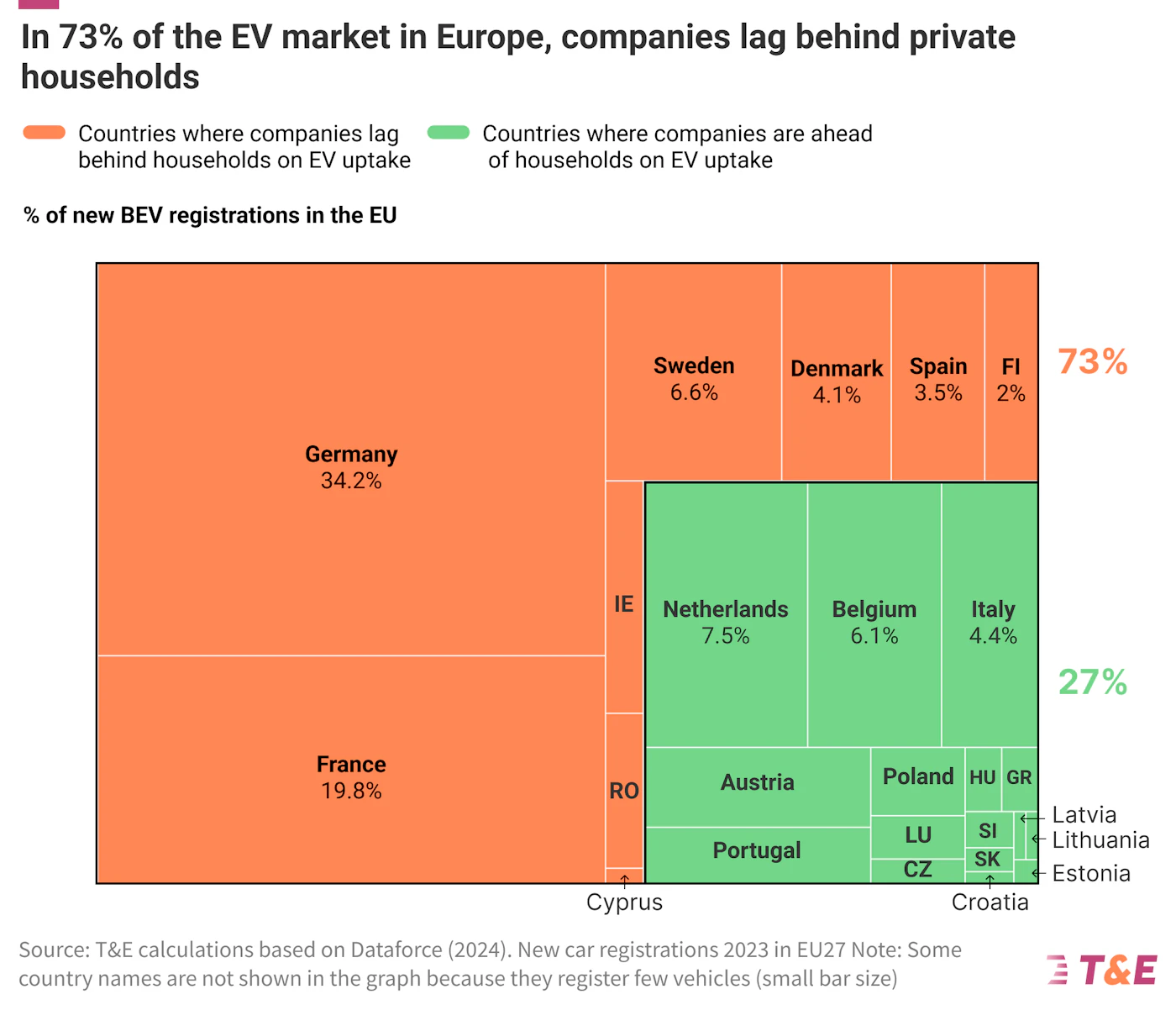

Electrification within the firm automotive market lags behind — significantly in Europe’s largest automotive markets France and Germany, a brand new report by inexperienced group Transport & Surroundings (T&E) finds.

The corporate automotive market lagged behind on electrification once more final yr with battery electrical autos accounting for 14.1% of company gross sales, while the non-public market was at 15.6%, a brand new report finds. For the third yr in a row, corporations are falling behind, regardless of having the monetary assets to make the swap to EVs and likewise benefiting from beneficiant tax cuts. Within the EU, six out of 10 new registrations are firm automobiles. As a result of they drive twice as many kilometers as non-public autos, they account for 74% of all new automotive emissions.

Germany and France, which mixed account for over half of latest BEV registrations within the EU, present the most important disparities between the company channel and personal households. In Germany, company BEV uptake is at 16.3%, considerably beneath the non-public sector’s 25.6%. In France, the uptakes are 12% and 22.1% respectively. These disparities are solely exceeded by Denmark, the place company BEV uptake is lagging the non-public market by a large 27 share factors (26.1% in comparison with 53.1%).

Firms registered twice as many giant automobiles (automobiles of segments D, E, F and G) as non-public households final yr (12% of latest registrations versus 5%), the research additionally finds. This phenomenon is especially accentuated in Germany: as Europe’s largest automotive market, Germany accounted for 40% of all heavy automobiles registered throughout the EU.

Firms are additionally driving the uptake of plug-in hybrid automobiles in Europe – automobiles which have been confirmed again and again to be equally as polluting as petrol automobiles. In 2023, 77% of all new PHEVs registered have been within the company channel.

“Firms have greater buying energy, so they need to be main on the EV transition. As an alternative they lag behind households on electrification and register twice as many massive automobiles. In the meantime governments are subsidising firm automobiles with beneficiant tax exemptions. The market is just not delivering and present nationwide incentives aren’t robust sufficient to show the corporate automotive market into the inexperienced chief it’s purported to be. That is why EU motion is just not solely justified but in addition a lot wanted.” explains Stef Cornelis, director of the electrical fleets programme at T&E.

Company automobiles may emerge as a serious driver in supporting the inexperienced industrial transition of European carmakers, the research finds. The company automotive market is answerable for the overwhelming majority of automotive gross sales of 5 of Europe’s predominant automotive producers (Volvo, Volkswagen, BMW, Stellantis and Mercedes-Benz). 70% of VW’s automotive gross sales within the EU are firm automobiles. On common, solely 49% of gross sales of non-European automotive makers go to the company phase.

Firm automotive drivers even have a better tendency over non-public households to purchase European electrical automobiles, the info exhibits. 76% of zero-emission automobiles within the company market are offered by European producers, in comparison with 65% within the non-public market. Accelerating the electrification of company fleets might be extra useful for European carmakers than their rivals, T&E explains.

“The European Fee must design the proper framework to make Europe a world chief in electrification. That is the place EV targets for company fleets come into play. This demand instrument will create predictability and supply certainty for European carmakers to proceed to ramp up investments in EV and battery manufacturing. As European carmakers have a better presence within the company market, they are going to profit extra from this measure than their non-EU rivals.” concludes Stef Cornelis.

Europe has a serious legislative alternative to rectify the imbalance in EV uptake within the company channel, with the opening of the public session on greening company fleets. T&E calls upon the brand new European Fee to make a proposal for a Company Fleets Regulation in 2025 that units 100% electrification targets for giant fleets and leasing corporations by 2030. Member states must also reform company automotive taxation, incentivising the uptake of EVs by growing the tax burden on polluting diesel, petrol and plug-in automobiles.

Associated Publication: Unveiling Europe’s company automotive downside

Article from Transport & Surroundings. Featured picture by CleanTechnica.

Have a tip for CleanTechnica? Wish to promote? Wish to recommend a visitor for our CleanTech Speak podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.