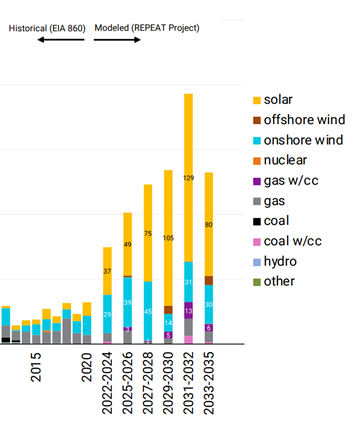

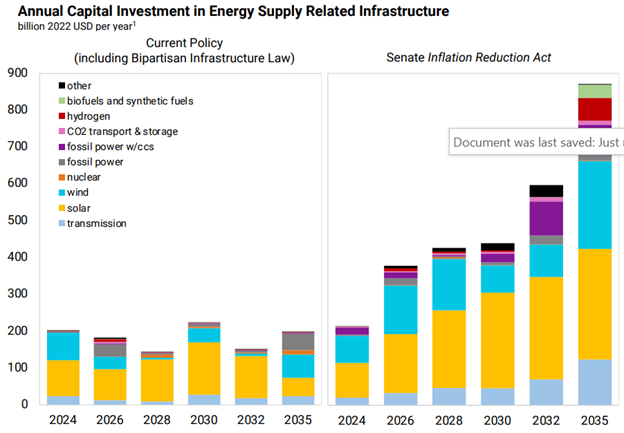

A brand new era of unpolluted power begins in america. Because the Inflation Discount Act of 2022 (IRA) turns into regulation, we embark on new and historic alternatives for builders, buyers, and renewable power consumers. Quite a few analyses show the clear power and local weather provisions of the IRA will spur economy-wide greenhouse gasoline emission reductions of 40 p.c whereas starting to reshore vital manufacturing provide chains. This can permit company leaders to speed up clear power investments and to make extra impactful power procurement selections because the IRA begins the method of addressing historic power inequities in communities throughout America.

Moreover, the IRA will spur new technological development which can result in new clear power sources and elevated undertaking availability for power consumers throughout the US. Vitality Innovation additionally discovered that the IRA might create as much as 1.5 million jobs by 2030. Underpinning the success of the IRA is the necessity to scale the renewable power sector. Wooden Mackenzie estimates that, at a minimal, the IRA will result in 67% extra photo voltaic.

What’s in a Title?

In our final CEO letter, we highlighted the menace that inflation poses to the renewable power trade whereas noting the deflationary potential of unpolluted power. The aptly named Inflation Discount Act’s monumental investments in clear power ought to have a long-term deflationary influence.

What’s within the Legislation?

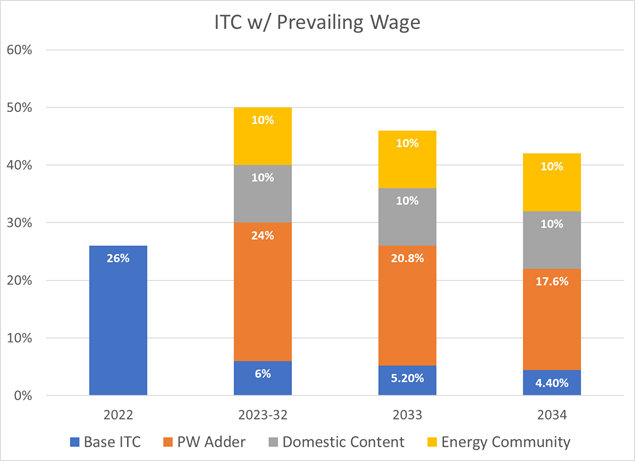

Clear Vitality Tax Credit

Amongst different credit, the clear power tax credit within the IRA preserve the historic standalone photo voltaic ITC till 2025 when the credit score shifts to technology-neutral. Primarily, after 2025 the IRA tax credit incentivize any technique of producing electrical energy with out emitting carbon dioxide (CO2). This contains stand-alone power storage, clear hydrogen, and superior and current nuclear, in addition to home manufacturing. Moreover, credit score recipients, together with photo voltaic, now have the choice to pick both the funding tax credit score (ITC) or manufacturing tax credit score (PTC). We anticipate that the majority photo voltaic operators will proceed to favor the ITC, a minimum of within the preliminary years. The under illustrates the bottom ITC and adders obtainable to bigger photo voltaic initiatives assembly labor necessities (further incentives can be found for smaller initiatives, together with the flexibility to think about interconnection prices in calculating whole undertaking value eligible for the ITC). These credit will start to part out the later of 2032 or when the electrical energy sector emits 75 p.c much less CO2 than 2022 ranges. This can for the primary time straight join clear power credit to decarbonization aim, and guarantee they’re obtainable to realize it.

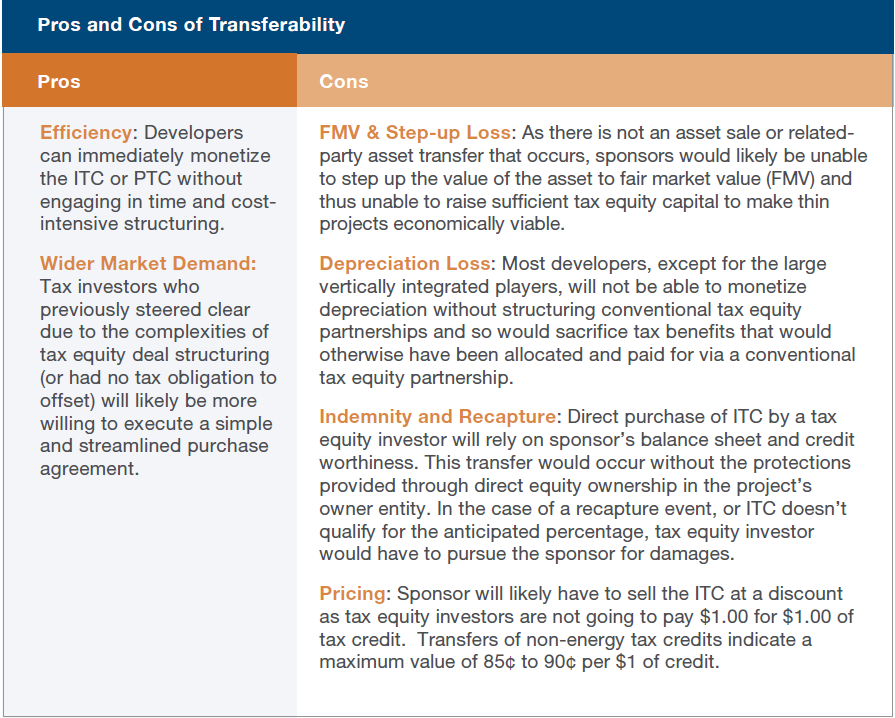

Necessary to notice that the IRA units the bottom ITC at siAlthough we count on that the IRA’s new direct-pay and transferability choices will permit new members with out tax obligations, comparable to electrical cooperatives and municipal utilities, to assemble renewables, we don’t count on the brand new choices to gradual urge for food for conventional structured tax fairness transactions. To start with, we count on steering and preliminary demonstration of the brand new choices to take a minimum of a 12 months, advantaging conventional tax fairness investments within the close to time period. However even over the long term, we count on structured tax fairness financing will stay extra enticing to company companions due to its decrease recapture threat, its potential to monetize depreciation, and the chance it offers for initiatives to be valued at honest market worth fairly than value. The chart under offers a high-level overview of the benefits and downsides of transferability versus structuring from a sponsor’s perspective.

Past the adjustments in methodology for buyers to amass tax credit, the IRA permits photo voltaic initiatives to elect Manufacturing Tax Credit (PTC) as an alternative. This opens the potential of structuring a PTC funding just like the PAYGO financing tax fairness construction that exists within the wind section of the market at the moment. Inside the photo voltaic house, this might present further profit in geographies with excessive yields and the place manufacturing is very predictable.

Implications for Builders

We count on a restricted optimistic influence on present initiatives provided that the 2022 ITC price has now elevated to 30 p.c from the anticipated 26 p.c with out triggering labor necessities. We count on this 30 p.c to increase into 2023 and for 60 days after the IRS points new steering, giving near-term initiatives an surprising increase. As well as, the brand new adders obtainable for initiatives in fossil gas transition communities “power communities” and for initiatives incorporating home content material will drive wanted funding in each. The

Broad Tax Modifications that

IRA seeks to drive clear funding in “power communities, which can be regarded as power transition communities – communities which have borne the brunt of fossil gas utilization and shouldn’t be left behind within the shift to wash power. Per the IRA, power communities embrace:

- Brownfield websites,

- Areas with excessive historic fossil gas employment and at the moment excessive unemployment, and

- Areas the place coal mines and/or coal-fired energy crops have closed.

Thus, a powerful monetary incentive for initiatives in power communities will permit them to proceed powering America, however with new entry to wash power sources and funding. Along with the clear power and local weather advantages, the IRA’s funding in power communities could have untold public well being advantages for communities which were disproportionately impacted for too lengthy.

Clear Vitality Tax Credit

Amongst different credit, the clear power tax credit within the IRA preserve the historic standalone photo voltaic ITC till 2025 when the credit score shifts to technology-neutral. Primarily, after 2025 the IRA tax credit incentivize any technique of producing electrical energy with out emitting carbon dioxide (CO2). This contains stand-alone power storage, clear hydrogen, and superior and current nuclear, in addition to home manufacturing. Moreover, credit score recipients, together with photo voltaic, now have the choice to pick both the funding tax credit score (ITC) or manufacturing tax credit score (PTC). We anticipate that the majority photo voltaic operators will proceed to favor the ITC, a minimum of within the preliminary years. The under illustrates the bottom ITC and adders obtainable to bigger photo voltaic initiatives assembly labor necessities (further incentives can be found for smaller initiatives, together with the flexibility to think about interconnection prices in calculating whole undertaking value eligible for the ITC). These credit will start to part out the later of 2032 or when the electrical energy sector emits 75 p.c much less CO2 than 2022 ranges. This can for the primary time straight join clear power credit to decarbonization aim, and guarantee they’re obtainable to realize it.

Necessary to notice that the IRA units the bottom ITC at six p.c if new labor circumstances aren’t met, however permits for a step-up to 30 p.c if labor circumstances are met (the PTC is equally structured). To be able to obtain the total ITC (or PTC), prevailing-wage labor necessities have to be met for all initiatives over one megawatt (MW). This contains:

- Fee of prevailing wages throughout development, in addition to for labor on repairs or alterations in the course of the five-year recapture interval on the ITC (for initiatives over one MW).

- Use of ample apprenticeship ratios, until demonstrably unavailable.

- Additive ITC bonuses can be obtainable for ample use of home content material in addition to development in an power group. At 10 p.c every, a 50 p.c ITC is feasible for initiatives that meet each further standards. For smaller initiatives, a further 10–20 p.c is accessible for photo voltaic initiatives positioned in sure low-income communities, low-income residential buildings, or on tribal land.

- Transmission upgrades can be thought of qualifying property for the calculation of the ITC when a part of a undertaking beneath 5 MW.

Moreover, for the primary time the IRA extends “direct pay” of tax credit to non-profit entities for all useful resource varieties and for a restricted time to all entities for brand spanking new classes, comparable to carbon seize and storage (CCS). Direct pay signifies that qualifying entities might elect to obtain a direct cost of the worth of the credit score, eliminating the necessity for participation by an investor with a ample tax obligation to monetize them. Entities not eligible for direct pay, together with for-profit companies, are allowed a one-time switch of every 12 months’s eligible credit to an unrelated taxpayer. We’ll proceed to evaluate the professionals and cons of the brand new transferability provisions as in comparison with conventional tax fairness financing. Transferability will likely be efficient in early 2023, though forthcoming IRS steering is critical to reply questions on the way it will work.

Broad Tax Modifications that Have an effect on Photo voltaic Financing

A number of common tax provisions have implications for clear power financing, most notably the brand new guidelines concerning calculation of company taxes. For taxable years starting after 2022, the IRA will apply an alternate minimal tax to C-corporations which have a mean annual adjusted monetary assertion revenue (i.e., “e book” revenue) for any three-year interval in extra of $1 billion. The IRA doesn’t change current depreciation schedules, however bonus depreciation advantages are slated to part out between 2023 and 2026, which can have long term impacts on undertaking finance, as mentioned additional under.

What’s Subsequent?

What’s clearer now than ever earlier than is that clear power will drive home local weather motion and supply new alternatives for renewable power development, procurement, and funding. President Biden signed the IRA on August 16, 2022, and now it heads to the Inner Income Service (IRS) for implementation and steering. Whereas the IRA offers a home path to start constructing a greater tomorrow, it’s now on the shoulders of the renewable power group to execute on the duties forward of us and to make sure the longer term we create is one which advantages all.