A basement fireplace breaks out in a single-family residence after a battery storage unit violently explodes. A photo voltaic storage battery burns down a home after malfunctioning. A battery storage unit explodes and causes greater than €100,000 ($106,000) price of harm. After quite a few such incidents, security exams are due on plenty of battery storage methods.

Headlines over the past couple of years have implied that lots of of hundreds of individuals in Germany who had been motivated by the vitality transition have naively had fire-hazard gadgets with a bent to blow up put in on their properties. That is misleading.

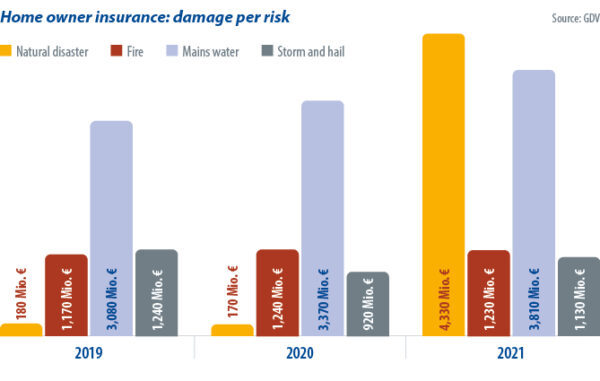

There are presently greater than 650,000 battery storage items in Germany. The quantity which have smoked or burned is just not completely clear. Counting the experiences of such incidents from the previous yr, the result’s a few dozen, though not all of them instantly triggered main injury. All in all, a small quantity within the wider nationwide context, when in comparison with the 160,000 fireplace incidents in residential buildings counted yearly by the insurance coverage affiliation Gesamtverband der Deutschen Versicherungswirtschaft.

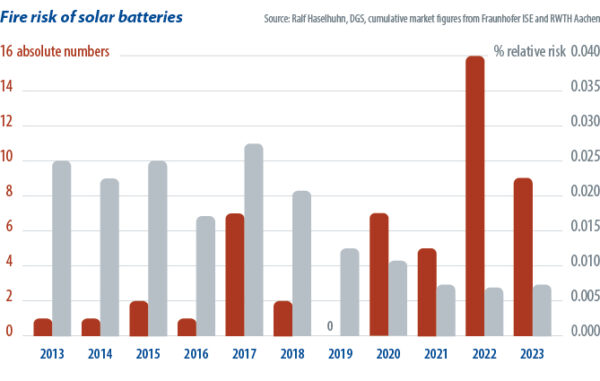

In reality, battery-related incidents are trending down, regardless of a rise within the quantity put in. Fridges and incorrectly used energy strips are much more regularly answerable for fires. Though lithium-ion batteries statistically do have a sure fireplace threat, this consists of these utilized in storage items, laptops, drills, e-scooters, or cordless vacuum cleaners.

Debatable threat

This doesn’t imply that an vitality storage system can’t burst into flames, as system proprietor Werner Beuerle properly is aware of. On Might 8, 2022, his battery storage unit exploded within the basement of his residence close to Calw, Germany.

“At first it smoked like a cigarette,” mentioned Beuerle, who was in his home when the accident occurred. After increasingly smoke got here out of the basement, he suspected that one thing was brewing. Shortly after, the battery exploded so violently that home windows and doorways had been despatched flying. Flames leapt up the facade from the basement home windows on three sides of the home. The house owner suffered from smoke inhalation and spent the night below medical remark.

The fireplace division arrived and extinguished the blaze. Smoke had unfold all through the home. The fumes bought into family contents and the construction, Beuerle mentioned. Every little thing was ruined.

“The insurance coverage firm nonetheless tried to save lots of my upholstered furnishings by giving it an ozone tub,” he mentioned.

However that didn’t work. In the long run, all of it needed to go: furnishings, fittings, and even memorabilia. The injury was appreciable. To revive the home to a liveable situation, employees needed to strip the constructing to its shell. Beuerle and his spouse had been relocated to non permanent housing. He described the incident as akin to successful the lottery however in reverse – additionally extraordinarily unlikely whereas very unfortunate.

Knowledgeable insurers

Fortunately, Beuerle’s insurance coverage firm lined his bills. Crucially, he had knowledgeable his constructing insurer upfront of the set up of a battery vitality storage system on his property and set the sum insured excessive sufficient for his residence and contents. Insurers say that the set up of battery storage has no impact on the constructing insurance coverage.

Nonetheless, owners that set up PV methods and batteries in Germany ought to contact their insurers.

“This ought to be performed with the set up,” mentioned Matthias Cohrs, a serious loss adjuster within the claims division of German insurer GEV.

For owners, GEV has been masking photo voltaic methods and storage at no further value since 2018. Regardless of the stage of insurance coverage protection, set up ought to be carried out by certified personnel. To additional reduce the danger of fireside, the German Photo voltaic Vitality Society (DGS) has revealed skilled guidelines for the set up and operation of battery storage methods. For instance, battery storage items ought to be put in in a spot the place the air is dry, the temperature doesn’t fall under 10 C and there are not any flamable supplies within the neighborhood. It might not be advisable to put in batteries subsequent to a gas-fired heating system.

Servicing is one other key requirement. Householders ought to have their photo voltaic methods and battery items serviced on the intervals advisable by the producer or threat paying a excessive value sooner or later. If upkeep intervals should not correctly noticed, the insurer could cut back advantages within the occasion of a declare. Extending legal responsibility insurance coverage to cowl a PV system and battery storage can be price contemplating. This turns into significantly related if a fireplace causes injury to neighboring buildings, akin to within the case of a semi-detached home.

Another excuse to speak to the insurer is the elevated worth of the constructing. PV methods and their related battery storage items collectively value a number of tens of hundreds of euros. This ought to be taken under consideration.

Sufficient protection

That’s the method Beuerle took. He didn’t must pay the price of his destroyed home or to exchange its contents. When it got here to non permanent lodging, Beuerle was left on the hook for some bills however a good portion was lined by his insurer. As a result of scale of the work required, Beuerle was solely in a position to transfer again into his home after 325 days. Actual phrases for masking non permanent housing prices range between insurers. In Germany, a fundamental insurance coverage coverage could present €100 per day for resort lodging for a most of 100 days, with extra premium choices masking a interval of 200 days.

Beuerle’s insurer supplied €200 per day, however this was deducted from the agreed sum lined by the coverage. Whereas this left the house owner with some further prices, these may probably be recouped via authorized motion. Beuerle plans to sue his storage producer, making use of German product legal responsibility legal guidelines, for the sum that was not settled by his insurance coverage firm.

Regardless of the upheaval, Beuerle hasn’t turned his again on PV storage. He has put in a brand new battery system and has already knowledgeable his insurance coverage firm. This time, nevertheless, the unit is positioned in his indifferent storage. If one other incident happens, the injury can be extra manageable.

“I’m not afraid of vitality storage methods,” he mentioned. “I by no means have been and I’m not now.”

Beuerle mentioned the insurance coverage firm was additionally high-quality with the addition of a brand new storage unit to his coverage and his premiums are as agreed earlier than the hearth. His perspective to storage fireplace dangers is mirrored within the method made by the insurance coverage business. HDI Insurance coverage confirmed, when requested, that battery storage is just not a hazard it asks about in the course of the course of constructing insurance coverage functions. Likewise, GEV assesses the danger of battery storage methods to be manageable.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and want to reuse a few of our content material, please contact: editors@pv-magazine.com.