In accordance with an announcement from the workplace of New York Gov. Kathy Hochul, the U.S. Division of Power (DOE) and the New York State Power Analysis and Growth Authority (NYSERDA) have reached a memorandum of understanding (MOU) to facilitate clear vitality financing for large-scale renewable tasks. The MOU will permit New York State to leverage the DOE Mortgage Applications Workplace (LPO) and strengthen the cooperation between federal and state vitality departments.

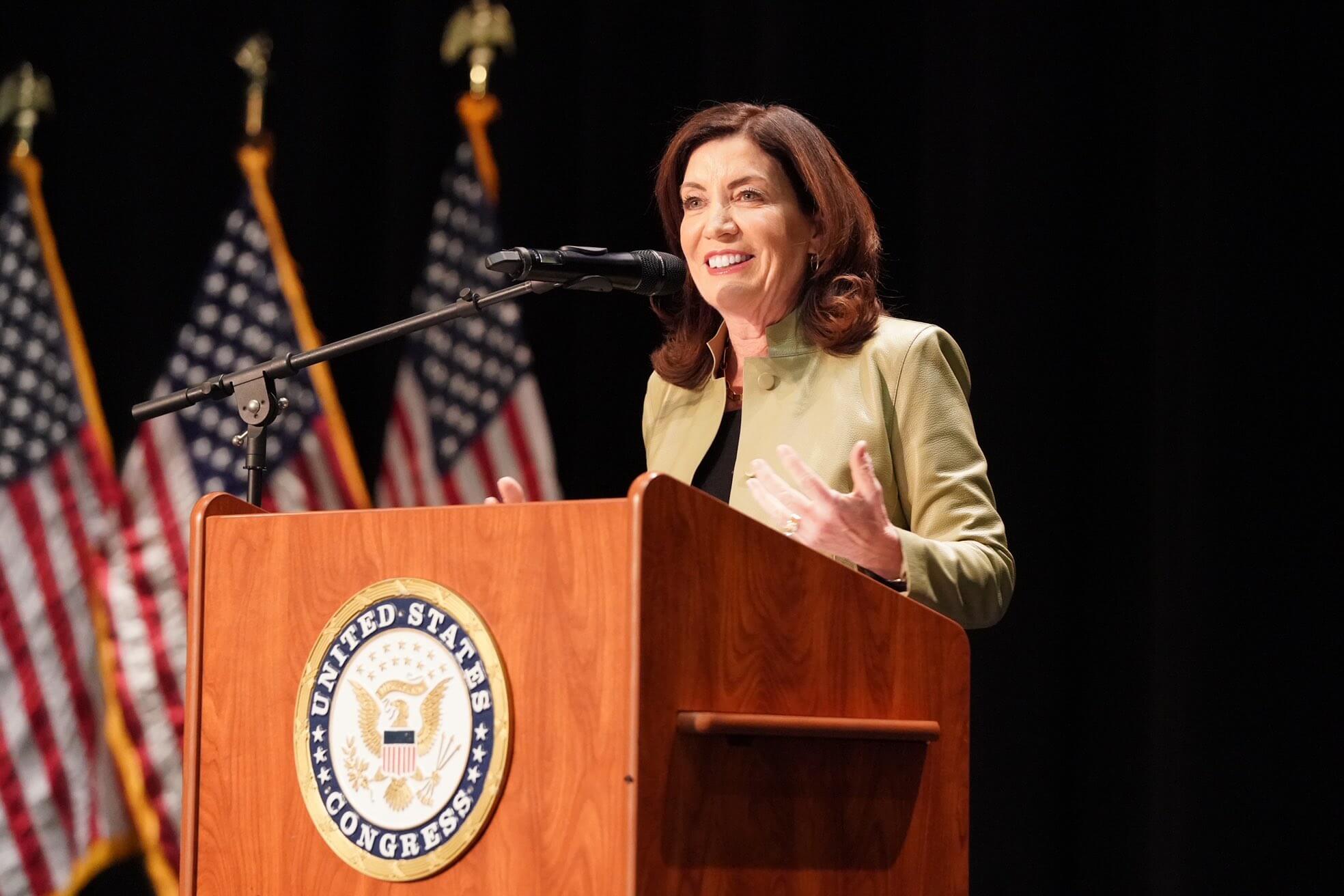

“This new partnership between New York State and the U.S. Division of Power illustrates a shared perception amongst New York and federal leaders that point is of the essence,” says Gov. Hochul. “We should pave a transparent path ahead for clear vitality.”

Throughout the bounds of this new partnership, NYSERDA and DOE have outlined a course of to facilitate the overview of functions from utility scale photo voltaic, onshore and offshore wind clear vitality tasks making use of for financing by means of the LPO. This would come with tasks already beneath contract with NYSERDA, in addition to these that can contract with NYSERDA sooner or later.

Beneath the Title 17 Mortgage Assure Program, LPO might, topic to acquiring required credit score approvals, present financing to eligible tasks for as much as 80% of eligible mission prices, with a tenor depending on mission wants and anticipated asset life, and in any occasion, not exceeding 30 years.

This partnership will allow clear vitality tasks in New York to entry different financing choices contemplating the present inflationary and excessive rate of interest surroundings. Any price financial savings that would profit tasks from accessing LPO loans might be shared with New York State ratepayers and probably allow billions of {dollars} in financial savings.

“This partnership highlights the facility of federal and state collaboration as we work towards attaining key local weather objectives,” says Doreen M. Harris, president and CEO, NYSERDA.

Beneath the Title 17 Clear Power Financing Program, LPO can finance tasks within the U.S. that assist clear vitality deployment and vitality infrastructure reinvestment to scale back greenhouse fuel emissions and air air pollution.

Title 17 was created by the Power Coverage Act of 2005 and has since been amended twice. The laws expanded the scope of Title 17 to incorporate sure state-supported tasks and tasks that reinvest in legacy vitality infrastructure, and it leverages further mortgage authority and funding obtainable for tasks involving progressive vitality applied sciences.

There are 4 mission classes throughout the Title 17 Clear Power Financing Program:

- Modern Power: Initiatives that deploy new or considerably improved expertise that’s technically confirmed however not but extensively commercialized within the U.S.

- Modern Provide Chain: Initiatives that make use of a brand new or considerably improved expertise within the manufacturing course of for a qualifying clear vitality expertise or for tasks that manufacture a brand new or considerably improved expertise.

- State Power Financing Establishment (SEFI)-Supported: Initiatives that assist deployment of qualifying clear vitality expertise and obtain significant monetary assist or credit score enhancements from an entity inside a state company or financing authority.

- Power Infrastructure Reinvestment (EIR): Initiatives that retool, repower, repurpose or substitute vitality infrastructure that has ceased operations or improve working vitality infrastructure to keep away from, scale back, make the most of or sequester air pollution or greenhouse fuel emissions.