Join each day information updates from CleanTechnica on electronic mail. Or observe us on Google Information!

- Panasonic Power and GM (collectively, the “Anchor Clients”) concurrently decide to multiyear offtake agreements for NMG’s lively anode materials, masking roughly 85% of NMG’s deliberate Section-2 absolutely built-in manufacturing, from ore to battery supplies.

- Offtake agreements are complemented by an combination US$50 million Tranche 1 Funding from Panasonic and GM to advance the event of NMG’s Section-2 Matawinie Mine and Bécancour Battery Materials Plant as per their respective specs.

- Strategic associate Mitsui and long-time investor Pallinghurst inject a complete of US$37.5 million into NMG’s growth, the mixture proceeds of which will probably be used to repurchase their beforehand introduced convertible notes.

- Offtake agreements and investments help NMG’s execution plan for its Section-2 Matawinie Mine and Bécancour Battery Materials Plan, marking a big milestone towards future funding by Anchor Clients of as much as US$275 million, topic to sure circumstances and a most possession threshold agreed between the related events.

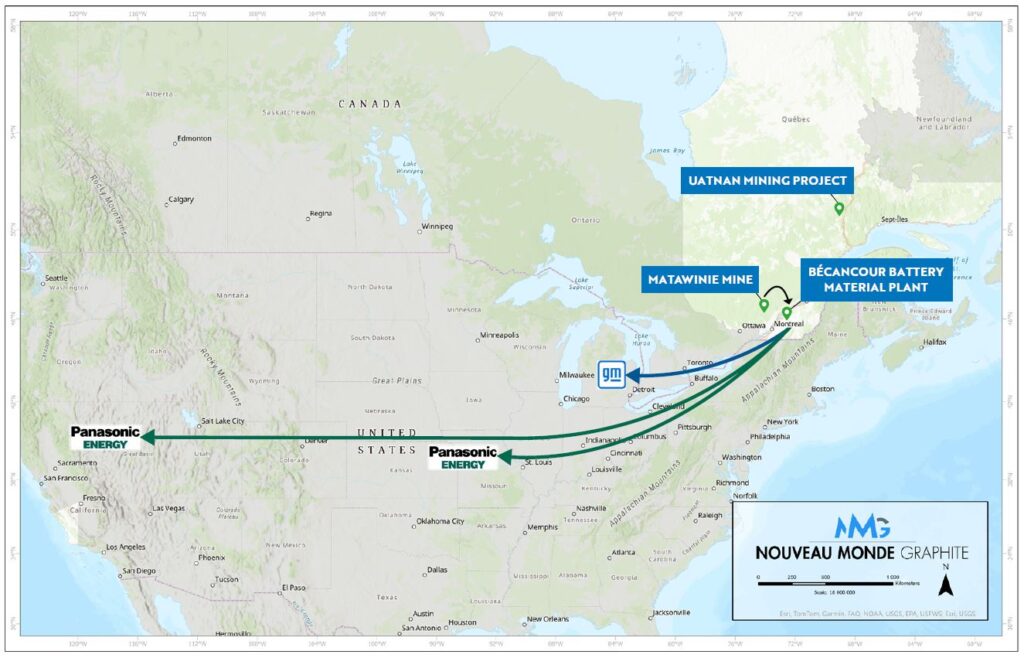

On the again of agreed-upon offtake agreements with Panasonic Power Co., Ltd. (“Panasonic Power”), an entirely owned subsidiary of Panasonic Holdings Company (“Panasonic”) (TYO: 6752), and Common Motors Holdings LLC, an entirely owned subsidiary of Common Motors Co. (collectively, “GM”) (NYSE: GM), Nouveau Monde Graphite Inc. (“NMG“ or the “Firm”) (NYSE: NMGTSX.V: NOU) has rallied Mitsui & Co., Ltd (“Mitsui”) (TYO: 8031) and Pallinghurst Bond Restricted (“Pallinghurst”) for an combination mixed funding of US$87.5 million to advance its growth towards business operations. Projected to turn out to be the primary absolutely built-in pure graphite lively anode materials manufacturing of its form in North America, NMG is ready to offer a carbon-neutral, dependable, sizeable, and ESG-driven supply of Canadian pure graphite for the native electrical automobile (“EV”) and lithium-ion battery market.

Arne H Frandsen, Chair of NMG, declared: “Immediately, influential actors in strategic minerals, trendy commodities, batteries, and EVs are coming collectively to drive the institution of a Canadian supply of graphite to help vitality autonomy, nationwide safety, and international decarbonization. I’m assured that such business and funding levers will represent the bedrock on which NMG can construct its Section 2 operations and extra. Congrats to colleagues at Panasonic Power, GM, Mitsui and Pallinghurst for this multifaceted transaction; collectively we’ll help the world’s transitions in the direction of a cleaner future.”

Eric Desaulniers, Founder, President, and CEO of NMG, reacted: “In our journey to place NMG because the North American chief of accountable mining and superior manufacturing, we had been searching for top-tier EV and battery producers to bolster our business imaginative and prescient. Because of visionary prospects and traders, we at the moment are transferring towards establishing a completely native and traceable worth chain. From the Matawinie ore, to the Bécancour lively anode materials, to our purchasers’ U.S. battery factories, we’re pioneering a resilient provide chain for the EV market.”

Eric Desaulniers, President, and CEO of NMG, recaps the highlights of right this moment’s parallel bulletins in a brief video captured on the Firm’s battery materials laboratory

A Stable Industrial Backing

The multiyear offtake agreements cowl the provision of a dedicated mixed annual quantity of 36,000 tonnes of lively anode materials by NMG to the Anchor Clients, representing roughly 85% of the Firm’s Section-2 manufacturing. With agreed upon pricing system linked to future prevailing market costs and undertaking financing ratio necessities, NMG can now exhibit sturdy long-term bankability underpinnings to lenders, traders, and shareholders.

In parallel, the Firm maintains intensive business discussions and continued product qualification with different tier-1 battery producers for the steadiness of its Section-2 manufacturing. Present market dynamics in North America, reflecting latest Chinese language graphite exportation limitations and stringent U.S. sourcing necessities for battery supplies, favorably place NMG’s native manufacturing. The Firm’s latest acquisition of the Uatnan Mining Mission for its Section-3 enlargement additionally present a lovely provide alternative for Western EV and battery producers seeking to safe and develop lively anode materials volumes as their manufacturing will increase.

Strategic Participation into NMG’s Enterprise Plan

The Anchor Clients, immediately or by means of an affiliate, have every agreed to make an preliminary US$25 million fairness funding in NMG topic to sure circumstances (the “Tranche 1 Funding”), for a complete of US$50 million, to help the development of NMG’s Section-2 operations — the Matawinie Mine and the Bécancour Battery Materials Plant — aligned with their respective battery specs.

According to the beforehand introduced framework settlement between NMG, Panasonic Power and Mitsui, the Firm’s strategic associate Mitsui helps the attainment of this milestone and additional growth efforts in the direction of a ultimate funding resolution (“FID”) by investing US$25 million, topic to regulatory approvals and the necessities of MI 61-101 (as outlined beneath), pursuant to which Mitsui has agreed to subscribe for 12,500,000 Frequent Shares within the capital of NMG (the “Frequent Shares”) and 12,500,000 warrants on the identical pricing and different phrases because the Tranche 1 Funding, such proceeds for use to repurchase Mitsui’s convertible be aware dated November 8, 2022, as amended and restated (the “Mitsui Convertible Word”). NMG can even enter into an investor rights settlement (the “Investor Rights Settlement”) and registration rights settlement with Mitsui on the closing of their funding. Pursuant to the Investor Rights Settlement, Mitsui will probably be required to “lock-up” its securities for a interval of 12 months from the date of their funding. The Investor Rights Settlement additionally supplies Mitsui with sure rights referring to its funding in NMG, particularly sure board nomination and anti-dilution rights. Mitsui will probably be topic to a standstill limitation whereby it won’t be able to extend its holdings past 20% of the issued and excellent NMG Frequent Shares for a interval of three years.

Lengthy-time strategic investor Pallinghurst has additionally agreed to take part by way of a US$12.5-million funding, additionally topic to regulatory approvals and the necessities of MI 61-101, pursuant to which Pallinghurst has agreed to subscribe to six,250,000 Frequent Shares and 6,250,000 warrants on the identical pricing and different phrases because the Tranche 1 Funding, such proceeds for use to repurchase Pallinghurst’s convertible be aware dated November 8, 2022, as amended and restated (the “Pallinghurst Convertible Word” and along with the Mitsui Convertible Word, the “Notes”). NMG can even enter right into a registration rights settlement with Pallinghurst on the closing of their funding.

Such warrants are typically exercisable in reference to the Tranche 2 Funding at FID in accordance with their phrases. Every warrant will entitle the holder thereof to amass one Frequent Share (a “Warrant Share”) at a value per Warrant Share equal to the decrease of (i) the quantity in US$2.38 per Frequent Share and (ii) the quantity in US {Dollars} per Frequent Share equal to the closing value of the Frequent Shares on the buying and selling day instantly following the date on which the investments described above are introduced. The train of the warrants is topic to sure possession limitations.

Upon a constructive FID, the events’ business relationship can also be supposed to broaden by means of additional investments into NMG as a part of the development financing. The Anchor Clients, immediately or by means of an affiliate, along with potential co-investors, intend to take part in future funding of a complete quantity valued at roughly US$275 million, topic to sure circumstances and a most possession threshold agreed between the related events. Assisted by its monetary advisors, the Firm continues to advance financing efforts, together with with its different convertible noteholder, and is engaged with export credit score businesses, governments, and strategic traders, along with prospects to border a sturdy capital construction that leverages worldwide debt, authorities funding and fairness. BMO Capital Markets is performing as monetary advisor to the Firm in connection of sure of the transactions described herein.

Courtesy of Nouveau Monde Graphite (NMG).

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Speak podcast? Contact us right here.

Newest CleanTechnica TV Video

I do not like paywalls. You do not like paywalls. Who likes paywalls? Right here at CleanTechnica, we carried out a restricted paywall for some time, but it surely at all times felt improper — and it was at all times robust to resolve what we must always put behind there. In idea, your most unique and finest content material goes behind a paywall. However then fewer folks learn it!! So, we have determined to fully nix paywalls right here at CleanTechnica. However…

Thanks!

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.