As international nuclear ambitions surge, the trade’s gasoline provide chain faces important gaps. Can superior fuels like HALEU (high-assay low-enriched uranium) and TRISO (TRi-structural ISOtropic particle gasoline) bridge the demand for next-gen reactors or will provide limits maintain again nuclear’s potential?

For practically six many years, the nuclear trade’s gasoline panorama has marked a comparatively steady trajectory. The world’s business nuclear energy vegetation, 95% of that are water-cooled, have typically relied on a mature front-end provide chain for low-enriched uranium oxide (UO 2) pellet gasoline. “Demand was roughly steady,” protecting tempo with an growth of the nuclear fleet within the Seventies and Eighties, defined Jacopo Buongiorno, director of the Middle for Superior Nuclear Vitality Methods (CANES) on the Massachusetts Institute of Know-how (MIT). For the reason that speculative “nuclear renaissance” bubble within the late 2000s, uranium costs have been in flux, pushed partly by “an imbalance between projected demand and capability for enrichment, conversion, and fabrication,” he stated.

Between 2020 and 2024, all three elements noticed a surge “by an element of three,” Buongiorno famous. Whereas exacerbated partly by a pushback towards Russian gasoline in mild of its aggression in Ukraine, the market’s unprecedented volatility is caught between formidable international decarbonization targets and provide limitations. On the 2023 U.N. Local weather Change Convention (COP28), a coalition of twenty-two nations set an aspirational purpose to triple nuclear energy capability by 2050—a imaginative and prescient that might skyrocket uranium demand, with projections for 2040 starting from 63,000 tonnes of uranium (tU) in a low-demand state of affairs to a staggering 184,000 tU if small modular reactors (SMRs) change into extensively adopted.

The implications might be stark, Buongiorno advised. “Don’t get me flawed, I feel, actually, this group is in the most effective place it has been in many years. There’s a lot to be enthusiastic about. The alternatives are huge, however there are additionally many challenges.”

New Must Accommodate Superior Nuclear

Buongiorno’s blunt evaluation got here as an introduction to a symposium MIT hosted on the finish of October aptly titled “No Gasoline? No Get together.” The occasion introduced collectively trade leaders, nuclear expertise builders, analysis scientists, and gasoline cycle specialists who laid out how integral a dependable and diversified gasoline provide chain will probably be to the nuclear trade’s aspirations.

A central takeaway from the symposium was clear: the nuclear trade should urgently scale up its technical and manufacturing capabilities for superior fuels to energy the reactors of tomorrow. “Nearly all superior reactors require higher-enrichment gasoline, for which, in the meanwhile, we don’t have amenities at business scale,” Buongiorno underscored.

The range of fuels is critical. Excessive-temperature gas-cooled reactors usually depend on TRi-structural ISOtropic (TRISO) particle gasoline for his or her enhanced security properties, whereas quick reactors could use metallic fuels or blended oxide fuels (MOX) to attain excessive burnup and environment friendly transmutation of long-lived isotopes. Modern gasoline varieties, reminiscent of uranium nitride and uranium silicide, are additionally being explored for his or her greater uranium density and thermal conductivity, which may enhance gasoline efficiency below excessive situations.

Up to now, greater than 20 superior reactor designs are actively pursuing high-assay low-enriched uranium (HALEU), a specialised gasoline enriched to ranges between 5% and 20%. Nonetheless, whereas HALEU may allow prolonged gasoline cycles, enhance reactor security, and extra environment friendly utilization of uranium sources, at present, “there isn’t any market,” Jonathan Hinze, president of nuclear gasoline market intelligence agency UxC, stated bluntly. “We now have ideas of a market, however we don’t have the precise market.”

For now, the superior gasoline cycle might want to depend on the low-enriched uranium (LEU) provide chain. However, that provide chain is already below stress. “We’re shifting away from 100% Russian provide within the U.S., and different markets are equally shifting away,” he stated. “That’s an enormous provide supply, and there are going to be implications of that which might be nonetheless not felt for years to return.” In the meantime, compounding that problem is that the superior gasoline cycle would require a number of latest amenities that don’t at present exist, together with specialised enrichment vegetation to deconversion and gasoline fabrication processes.”

|

|

1. Urenco USA in October 2024 received a 10-year Indefinite Supply/Indefinite Amount contract from the U.S. Division of Vitality to supply high-assay low-enriched uranium (HALEU) from new home capability at its New Mexico facility. At the moment assembly one-third of U.S. utilities’ enrichment wants, Urenco USA is already increasing and within the licensing course of to complement as much as 10% for LEU+. Courtesy: Urenco |

Nuclear gasoline suppliers have begun stepping as much as the problem. Enrichment large Urenco (Determine 1) is investing billions of {dollars} to ship HALEU enrichment capabilities within the UK and U.S. by the mid-2020s, in addition to creating a devoted HALEU enrichment plant within the UK, concentrating on the early 2030s for preliminary materials availability, stated Magnus Mori, head of Market Growth and Technical Gross sales at Urenco. “It’s a paradigm change, it’s a shock to the system.” However it poses immense dangers, he advised. “We will take orders, however we don’t have the momentum, the important mass for a personal investor to take all of the funding danger,” he stated.

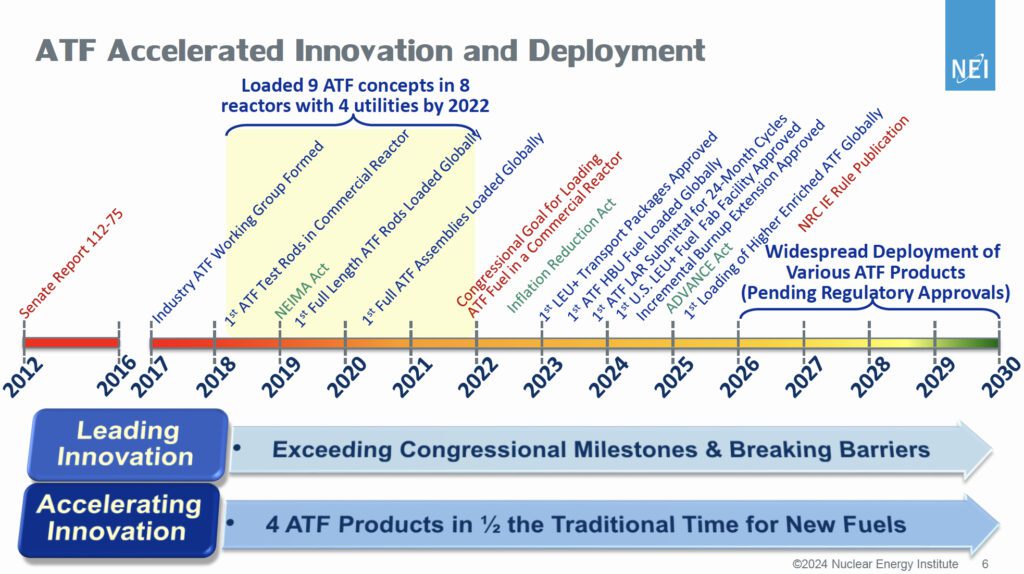

Innovation in Motion: Accident-Tolerant FuelsAn particularly notable triumph for the nuclear trade over the previous decade has been its improvement and commercialization of accident-tolerant fuels (ATFs). An trade idea used to explain new applied sciences within the type of new cladding and/or gasoline pellet designs, ATF applied sciences basically leverage new supplies that enhance fission product retention and are structurally extra immune to radiation, corrosion, and excessive temperatures. And since they might be paired with gasoline enrichments of as much as 10% (LEU+), they might probably lengthen the time between refueling from 1.5 to 2 years and cut back the quantity of gasoline wanted by about 30%, leading to much less waste and used nuclear gasoline. Whereas ATF applied sciences have been below improvement because the early 2000s, they acquired a marked enhance within the wake of the March 2011 Fukushima accident because the Division of Vitality (DOE) aggressively carried out plans below its congressionally mandated Enhanced Accident Tolerant Gasoline (EATF) program to develop ATFs for current mild water reactors (LWRs). The DOE championed totally different gasoline designs from three main gasoline distributors: Framatome, Normal Electrical/GNF, and Westinghouse/Normal Atomics. However the push for ATF has regained dramatic momentum lately, pushed by a confluence of coverage, regulatory, and market forces. Developments have typically aligned with broader nuclear sector targets, together with commercialization and economies of scale, establishing a strong regulatory infrastructure, and sustaining worldwide management in gasoline applied sciences. “We’ve hit the bounds of 62 GW-days per metric ton uranium burnup and 5% enrichment,” defined Al Csontos, director of Fuels on the Nuclear Vitality Institute (NEI), in October. “We now need to go greater,” with the purpose of reaching 10% enrichment and 75 GW-days per metric ton burnup for two-year cycles. The financial implications are profound, he famous. Longer gasoline cycles may cut back the frequency of refueling outages, that are each expensive and disruptive. “For those who go to 24-month cycles, now you’re doing one outage yearly,” stated Csontos. “At websites like Vogtle, the place there aren’t sufficient resort rooms close by to deal with all of the contractors throughout outages, fewer outages would make a giant distinction,” he stated. Increased burnup ranges additionally handle a important difficulty in waste administration. “You possibly can have extra gasoline effectivity, much less waste,” Csontos added. “It’s about utilizing the vegetation in a different way to supply extra energy.” Progress has been swift. Business loaded its first ATF lead check assemblies (LTAs) in reactors in 2018 (at Southern Co.’s Hatch plant, which included two varieties of GE/GNF ATF cladding designs. By 2023, it had marked a shocking listing of milestones, together with the Nuclear Regulatory Fee’s (NRC’s) first-of-a-kind approval for the usage of ATF gasoline. Extra lately, in October 2024, Framatome’s GAIA gasoline assemblies with PROtect Enhanced Accident Tolerant Gasoline (E-ATF) accomplished their third 18-month gasoline cycle at Plant Vogtle in Georgia, marking the conclusion of a four-and-a-half-year analysis. That milestone marked “a lifecycle of operation of the world’s first full-length PROtect E-ATF gasoline rods with each pellets and cladding in an working pressurized water reactor,” Framatome famous.

Nonetheless, to fulfill the rising energy demand pushed by electrification and digitalization whereas making certain the reliability of the prevailing fleet, new urgency is ramping as much as increase deployment of ATF and LEU+ applied sciences, Csontos advised. Utilities require as much as 13 GW of further capability by 2030, and new nuclear initiatives are nonetheless a decade away from completion, he famous. A current NEI survey of 56 nuclear websites estimated greater than 70% have a stage of curiosity or are planning a number of uprates with a mixed capability improve of three GWe, he famous. About half of the nation’s fleet, in the meantime, has “various curiosity or plans” for a number of of the enabling adjustments related to ATF, LEU+, prolonged gasoline cycles, and risk-informed Lack of Coolant Accident (RI-LOCA) methodologies, with deployment focused within the 2028 –2030 timeframe, he stated. Business stays, to this point, on monitor to deploy batch portions within the mid-to-late 2020s. Nonetheless, for now, the NRC’s regulatory path for environment friendly licensing for ATF/LEU+/excessive burnup fuels is concentrating on a 2027 timeframe. This consists of the important “Elevated Enrichment Rulemaking,” which is designed to take “the highest off of the 5% enrichment restrict,” Csontos stated. The regulatory change will probably be important to accommodate the trade’s transfer towards enrichment ranges of as much as 10% for LEU+ fuels, with the potential to succeed in as much as 20% for superior functions, he famous. Whereas “websites have danger mitigation as their important purpose,” licensing and regulatory hurdles pose dangers, he stated. “Actually, it’s about danger mitigation when it comes to money and time,” he added. “They need the ability uprate, however they don’t need to danger it going longer or failing as a result of there’s one thing occurring with the regulatory half.” Efforts to handle these challenges have gained momentum, with the ADVANCE Act enjoying a key position. “The ADVANCE Act is there to attempt to push the regulator to be extra trendy and to attempt to be useful contemplating the constructive points of nuclear energy,” he stated. To speed up deployment timelines, trade stakeholders are collaborating with the NRC to streamline licensing processes. “We’re making an attempt to get these efficiencies locked in now for all of the superior reactor fuels and every part else, so we will begin shifting ahead with that in a greater, extra well timed method, so we don’t spend 20 years licensing new gasoline,” Csontos stated. |

International Laser Enrichment (GLE), which is working to commercialize laser enrichment as a substitute for the standard gasoline centrifuge enrichment course of and concentrating on manufacturing by 2030, anticipates a job for presidency help to kickstart the market. Not like Centrus Vitality, “We don’t want the DOE [U.S. Department of Energy] to be a purchaser of any product we produce,” stated Nima Ashkeboussi, GLE vice chairman of Authorities Relations. “We see utilities prepared to purchase that materials. However we do assume there’s a house for DOE to enter in some form of cost-share or milestone-based awards with us so as to add capability to {the marketplace}.”

The DOE has already taken steps to incentivize the HALEU market. In October, it introduced awards for each HALEU enrichment and deconversion initiatives. Incremental progress can be surfacing for spent nuclear gasoline (SNF) recycling. As Temi Taiwo, director of the Nuclear Science and Engineering Division at Argonne Nationwide Laboratory, advised, recycling may dramatically enhance the sustainability of the gasoline cycle. Taiwo acknowledged, nonetheless, that demonstrating the feasibility and cost-effectiveness of scaling up recycling applied sciences poses a key problem.

The Hen-Egg Dilemma of Fabricating Novel Fuels

Fabricating gasoline to fulfill rising calls for faces comparable challenges. In keeping with Dave Petti, an trade veteran who has been instrumental in advancing high-temperature nuclear reactor fuels, fabricators face the final word “chicken-and-egg” downside. “You’d want a sustained demand, sort of like a metric ton per 12 months, to actually help a gasoline fabrication facility,” he stated. With out that constant, high-volume demand, Petti famous that suppliers are tasked with utilizing extremely enriched uranium and mixing it down for every particular person reactor idea. Petti additionally underscored that the dearth of readability on how rapidly reactors will come on-line makes it tough for gasoline distributors to correctly dimension their manufacturing amenities. Bridging that hole would require strategic investments, each from the non-public sector and authorities, Petti advised.

|

|

Nonetheless, some corporations are already making ready to fulfill demand. BWX Applied sciences (BWXT), the one firm at present producing TRISO within the U.S., is contemplating a “purpose-built,” Class 2 TRISO manufacturing facility, famous Andrew Davidson, BWXT undertaking supervisor of Specialty Fuels Fabrication and Uranium Restoration (Determine 2). Nonetheless, it will solely think about the funding, which may require “a number of tons of of tens of millions” of {dollars} if the corporate is “assured that the market exists to pay again that funding earlier than we go off and take that step.”

Finally, the hole may maybe be resolved by rising ideas of a shared worldwide gasoline cycle infrastructure that might assist mitigate dangers and prices for particular person gamers. Buongiorno advised the U.S., European Union, UK, Canada, South Korea, Japan, United Arab Emirates, and maybe Australia ought to take into consideration creating joint enrichment amenities, which might add some safety on the enrichment aspect. “Maybe even a shared LEU reserve within the type of UO 2,” he stated might be worthwhile. “It’s not a zero-cost funding, but it surely’s not monumental within the larger scheme of issues, and it may truly insulate our nations from massive fluctuations within the costs of uranium and uranium enrichment.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).