Join day by day information updates from CleanTechnica on e mail. Or observe us on Google Information!

There’s no different technique to put it: GM has struggled badly in its transition to EVs. However current developments have led me to consider that GM could also be higher positioned than it seems to be: if I’m proper, and if GM doesn’t mess up, it might be one of many winners on this transition and recuperate misplaced floor by the latter a part of this decade. Let’s have a look at the components that immediate me to say this.

#1. “Manufacturing Hell” appears to be over

So far as I keep in mind, the time period “Manufacturing Hell” was popularized by Elon Musk again in 2017. These have been the times when the way forward for EVs was being fraught within the over-automatized manufacturing traces for the Tesla Mannequin 3. If this automotive had failed (and plenty of anticipated that to be the case), little question the EV transition would’ve been delayed for just a few extra years, although it’s exhausting to say precisely what number of.

Regardless, the reality is that a technique or one other most automakers have struggled with “Manufacturing Hell,” so I’m taking the freedom to make use of that time period past Tesla’s particular expertise with the Mannequin 3. Many people nonetheless keep in mind how Volkswagen struggled to ramp up ID.3 and ID.4 manufacturing (primarily due to software program points), Renault — regardless of appreciable expertise with the Zoe — additionally managed to butcher the arrival of the Megane E-Tech, and even mighty BYD had a tough couple of years again in 2019–2020 when a big discount in Chinese language subsidies mixed with difficulties bringing on-line the upcoming Blade Battery.

In GM’s case, Manufacturing Hell was associated to the difficulties in ramping up Ultium manufacturing, and, later, fixing software program points for the Blazer EV. And, to be clear, it tousled badly: Ultium was offered roughly similtaneously the Blade Battery, but BYD managed to resolve its points a full three years earlier than GM — apparently — bought the hold of it.

But it surely looks as if GM is lastly getting it, and the present lineup makes me assume the corporate might have a couple of ace up its sleeve.

#2. GM’s present proposition is value aggressive

Again in 2020 GM offered “Ultium,” a modular skateboard ready to slot in an array of various autos. This provides complexity and weight when in comparison with the extra fashionable and standard “Cell-to-pack” and “Cell-to-chassis” preparations, but it surely is sensible once you need to deal with economies of scale and serve many segments with just one design.

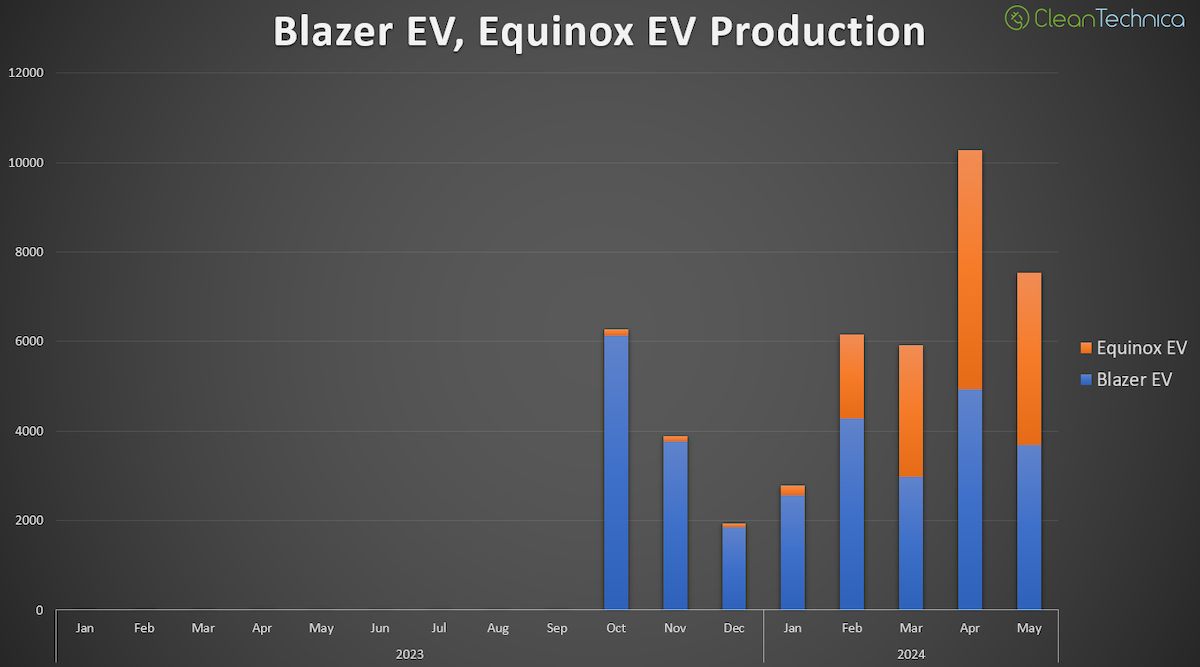

Two issues have led me to consider GM’s guess might repay. To start with: after having its very personal “manufacturing hell” with Lyriq manufacturing in Spring Hill (Tennesse) in addition to Blazer and Equinox EV manufacturing in Ramoz Arispe (Coahuila), plainly Ultium manufacturing is lastly ramping up:

If we’re to consider Mary Barra’s touch upon Ultium manufacturing, that is solely the primary section of the ramp-up, and better manufacturing ranges are coming within the following months. Current information on gross sales (over 9,000 Ultium autos have been bought in Could within the US) helps this assertion, however we’ll have to attend for Q2 and Q3 numbers to make certain.

The second purpose I’ve excessive hopes in GM’s guess is that its costs appear to be on level. The Blazer EV is beginning at $50,000, whereas the Equinox is at present beginning at $41,000, with an upcoming model for $35,000. This implies each fashions are at present some $14,000 greater than their ICE equivalents … however as soon as the cheaper Equinox EV arrives, the distinction will shrink to $8,000, and as soon as we issue within the EV Tax Rebate within the US, it mainly turns to zero. Due to its value, decrease than the Tesla Mannequin Y and the Ford Mustang Mach-E, it’s the Equinox EV that seems because the potential champion within the upcoming ramp-up.

And herein lies the difficulty: if the Equinox efficiently ramps up, economies of scale will assist all fashions within the lineup, together with the upcoming Ultium Bolt and maybe even extra reasonably priced ones sooner or later.

However wait. Haven’t we seen this already? Chevy Bolt manufacturing ramped from 0 to some 3,000 models a month already in 2017, whereas the Ford Mustang Mach-E did significantly better, ramping from almost zero models in September 2020 to just about 7,000 in Could 2021, but in each instances manufacturing stagnated there and got here down later. However there’s something that makes me hopeful this won’t be the case with Ultium:

#3. The “Latin American Barometer” presents an optimistic image

EVs are generally bought at low income and even at a loss, both to ramp up and get economies of scale going, or in essentially the most egregious instances to adjust to emissions quotas and keep away from fines (therefore the time period “compliance automotive” for a car by no means meant to be produced profitably). Due to this, within the US and Europe, many reasonably priced EVs by way of the final decade have been discontinued after promoting solely a token variety of models, as they have been by no means meant for mass manufacturing.

Nevertheless, when these autos are exported into growing markets, the explanations to promote them at a loss are now not legitimate and extra reasonable costs seem. Within the case of North American producers, Latin America is the prime land for exports and the primary place the place we will see this distinction, which is why I consider we will use the markets south of the Río Bravo as a “barometer” to guage what costs EVs actually need to need to convey a revenue to the producer.

Within the case of the Bolt and the Mach-E, this “barometer” signifies each are bought at a loss or maybe at very low income. In 2023, the Bolt EUV arrived in Latin America at a value of round $50,000 (in Mexico, Colombia, Brazil, and Chile), coming all the way down to round $40,000 in 2024, nicely over the ~$32,000 it prices within the US as soon as we embrace taxes. As for the Mach-E, its Premium trim stands at $62,200 in Mexico, over $10,000 greater than the worth within the US together with taxes … and this can be a car in-built Mexico, so no tariffs or transport charges enter this equation. Worse even, the extra reasonably priced Mach-E trims aren’t obtainable within the area.

However Ultium autos have a special story. GM has up to now solely introduced one among them exterior the US: the Chevy Equinox EV, which has offered in Mexico in its “RS” Trim (I’m but to search out out if it’s the 2RS or the 3RS). Pricing begins at $45,000 in Mexico, which is virtually the identical because the US value earlier than taxes! Higher even, there’s a particular provide of $43,400 for pre-orders! Because of this the Equinox EV is definitely cheaper in Mexico than within the US!

We nonetheless have to attend for this mannequin to reach in different Latin American international locations, but when this pattern maintains, our “barometer” could also be indicating that GM is definitely able to promoting this automotive at comparatively low costs whereas making a revenue on it, one thing that neither the previous Bolt nor the Mach-E appear to be able to. And because of this in contrast to Ford, GM won’t be frightened about scaling loses and as a substitute will focus in producing as many of those autos as it might promote.

This info suits GM’s narrative, which is that it’s going to promote some 200 to 250,000 EVs this 12 months, making a revenue even within the least expensive trims by the tip of it because of the excessive quantity.

The window opening for GM

So, in abstract:

GM appears to have the ability to produce Ultium automobiles at a revenue, even for the most affordable trims. On this case, this implies an 85kWh automotive for underneath $42,000 and maybe by the tip of the 12 months for underneath $35,000.

GM appears (lastly) able to ramping up manufacturing.

GM has a platform able to becoming completely different fashions and might leverage it in additional reasonably priced fashions.

So far as the US market goes, I consider solely Tesla and Hyundai/Kia are at present in an analogous place, and each of them are extensively thought of the leaders within the EV transition. GM appears to be forward of Ford, it might nicely be forward of Stellantis (it’s exhausting to know what precisely is happening there as of late), and it’s positively forward of the Japanese manufacturers, which have foolishly refused to take part on this race. If GM’s able to sustaining its present momentum and providing the proverbial “Mannequin 2” in two or three years, it could nicely begin consuming into Toyota’s vital market share within the US.

However wait, this isn’t all the pieces.

It’s been repeated as a mantra that every one North American producers deserted low cost autos and might’t make them at a revenue anymore … and this can be true, so far as US manufacturing goes. However the reality is GM has had a lead in reasonably priced autos for a very long time in Latin America, with the Chevrolet Onix (~$19,000) being the third most bought automotive in Colombia and Brazil in 2023, whereas the Chevrolet Aveo (~$15,000) bought third place in Mexico that very same 12 months.

To win in overseas markets, GM should leverage each the Ultium platform and this expertise in Latin American factories to show these mass-market winners into EVs. China is forward, positive, however there’s one thing that you could be discover stunning:

As soon as the Equinox EV (85kWh battery) begins deliveries in Mexico, will probably be the most affordable EV in Latin America with a battery above 80kWh.

I’m not kidding. To get a battery like that these days in Latin America, you need to search for a BYD Tang (~$80,000), an XPeng G9 (~$75,000), or a GAC Aion V Plus (~$55,000); extra choices exist, however all of them are nicely above $45,000. This additionally applies to Europe by the best way: I discover fairly spectacular that the Equinox EV is at present being bought at roughly the identical value because the 52kWh VW ID.4.

If GM can construct a worthwhile, sub-$45,000, 85kWh SUV, as of 2024, that implies that it ought to have the ability to provide a worthwhile sub-$20,000, 45kWh automotive in three or 4 years … as long as it tries, in fact. The transition to EVs in Latin America is accelerating, however even essentially the most optimistic of us doubt we’ll attain 50% BEV earlier than 2029 or 2030. An Aveo EV or an Onix EV, leveraged upon Ultium and the upcoming LFP cells offered for the Bolt, could possibly be a whole winner in 2028 supplied it has reached value parity with gasoline variations by then. Within the shorter time period, the $35,000 Equinox and a good cheaper Bolt might win GM vital market share in growing markets. And if GM performs this proper, it might construct know-how in Mexico and the area to compete — once more — in growing markets which were misplaced to the Japanese and the Chinese language in the previous few years.

And this additionally suits present financial traits. As of 2024, North America is investing much more in growing EV provide chains than Europe (one thing I wouldn’t have predicted again in 2020) and likewise has the benefit of cheaper power because of the overproduction of fuel and the speedy deployment of renewables. Battery manufacturing may be very energy-intensive, so this issues fairly a bit.

Ultimate ideas

In fact, there are various methods this will fail.

It might be that GM is treating Mexico as an extension of the US market and likewise promoting the Equinox EV there at low income or at a loss, and the ramp-up can be much less clean than anticipated as a result of losses are piling up ( you Ford).

It might be that GM botches the transition to LFP and wastes one other three years getting the brand new Bolt up and working.

It might be that political will in the direction of EVs cools within the US and GM pauses its ramp-up, dropping this small window of alternative to develop into aggressive with the Chinese language manufacturers.

It might be that GM focuses on SUV-like autos for the US and abandons the Latin American markets (in addition to different growing markets). In spite of everything, it solely sells some half 1,000,000 automobiles within the area every year.

However, for now, I consider GM is an fascinating firm to observe, and, with some effort and luck, it might current a good problem to the Chinese language behemoths within the Latin American playground within the second half of this decade, maybe becoming a member of Hyundai/Kia as one of many leaders on this transition.

We must wait and see.

Have a tip for CleanTechnica? Need to promote? Need to recommend a visitor for our CleanTech Speak podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.