Overseas shareholders suspended participation within the Arctic LNG 2 challenge because of sanctions, renouncing their duties for financing and for offtake contracts for the brand new Russian liquefied pure fuel (LNG) plant, the every day Kommersant reported on Monday.

The challenge, seen as a key ingredient in Russia’s drive to spice up its LNG international market share to twenty% by 2030 from 8%, was already dealing with difficulties because of U.S. sanctions over the battle in Ukraine and an absence of fuel carriers.

China’s state oil majors CNOOC and China Nationwide Petroleum Corp (CNPC) every have a ten% stake within the challenge, which is managed by Novatek, Russia’s largest LNG producer and proprietor of a 60% stake within the challenge.

Kommersant, citing unnamed sources within the Russian authorities, stated each Chinese language corporations, along with France’s TotalEnergies and a consortium of Japan’s Mitsui and Co and JOGMEC – which even have a ten% stake every – declared power majeure on participation within the challenge.

Novatek, CNOOC, JOGMEC and Complete didn’t instantly reply to requests for remark. CNPC and Mitsui declined to remark.

The newspaper stated the suspension could result in Arctic LNG 2 shedding its long-term contracts on LNG provides, whereas Novatek should finance the challenge by itself and promote the seaborne fuel on the spot market.

Preliminary investments within the Arctic LNG 2 challenge stood at $21 billion. It already confronted difficulties in elevating funds following Western sanctions towards Russia.

Sanctions have additionally resulted in Novatek declaring power majeure over LNG provides from the challenge, trade sources instructed Reuters final week.

The European Union can also impose restrictions on Russia’s LNG provides.

A Beijing-based trade official with direct information of the matter instructed Reuters final week that CNPC and CNOOC have each requested the U.S. authorities for exemptions from sanctions on Arctic LNG 2.

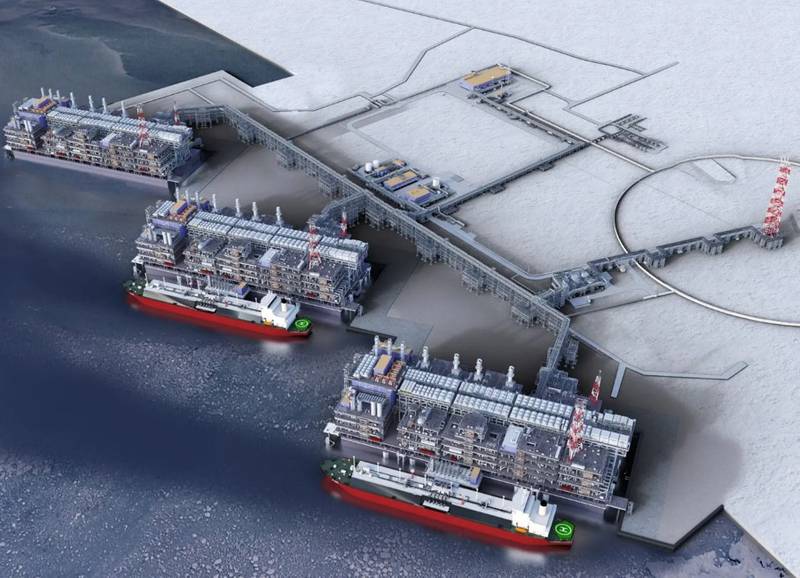

With three processing trains, Arctic LNG 2’s capability is supposed to be 19.8 million metric tons per yr and 1.6 million tons per yr of steady fuel condensate. Manufacturing is because of begin in early 2024.

Its first LNG tankers have been anticipated to set sail within the first quarter of subsequent yr, in line with Novatek.

However trade sources say industrial LNG provides from the challenge are actually anticipated no sooner than the second quarter of 2024.

(Reuters – Reporting by Lidia Kelly in Melbourne and Vladimir Soldatkin in Moscow; Further reporting by Andrew Hayley in Beijing;Enhancing by Edmund Klamann and Jamie Freed)