Join each day information updates from CleanTechnica on e-mail. Or observe us on Google Information!

The excellent news: oil demand is cooling. The unhealthy information: it’s not but completed rising. One can’t actually declare oil demand is “falling” (but), however development has slowed right down to its lowest degree in over a decade, with 2024 being a pivotal yr. Let’s take a look at the realities of oil demand and its future from a cleantech perspective!

The place we’re standing

Earlier than we begin, it’s price presenting just a few numbers to get our readers updated.

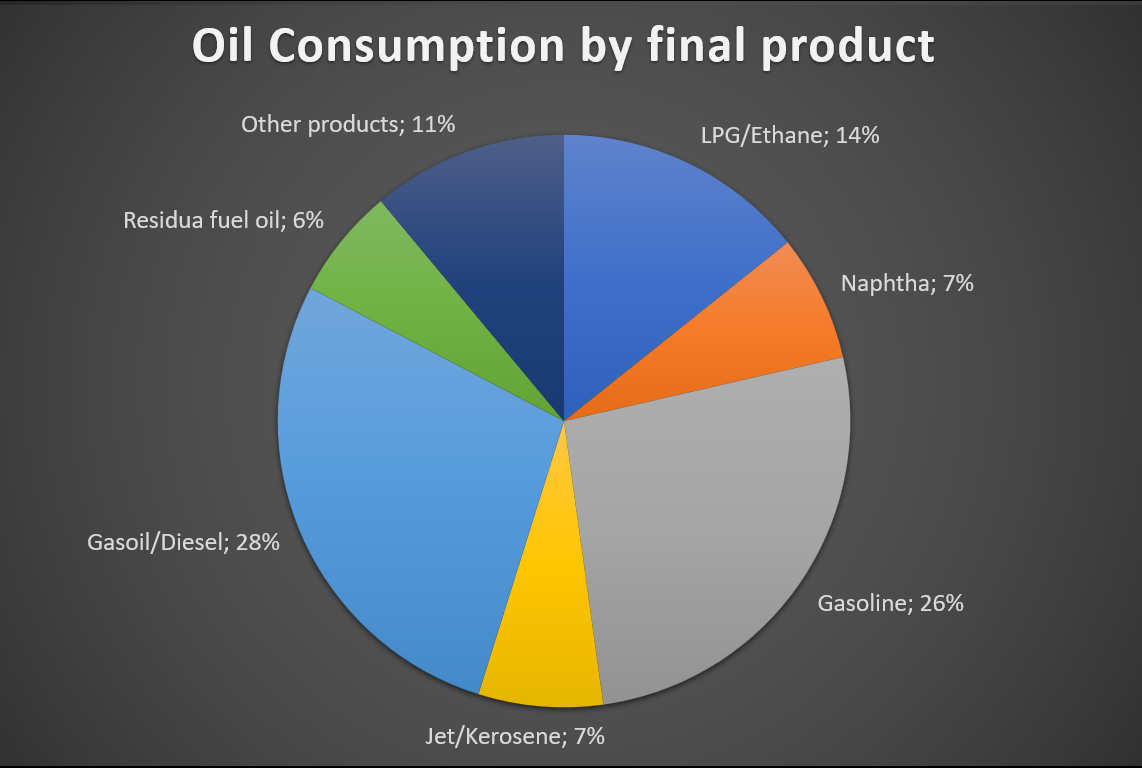

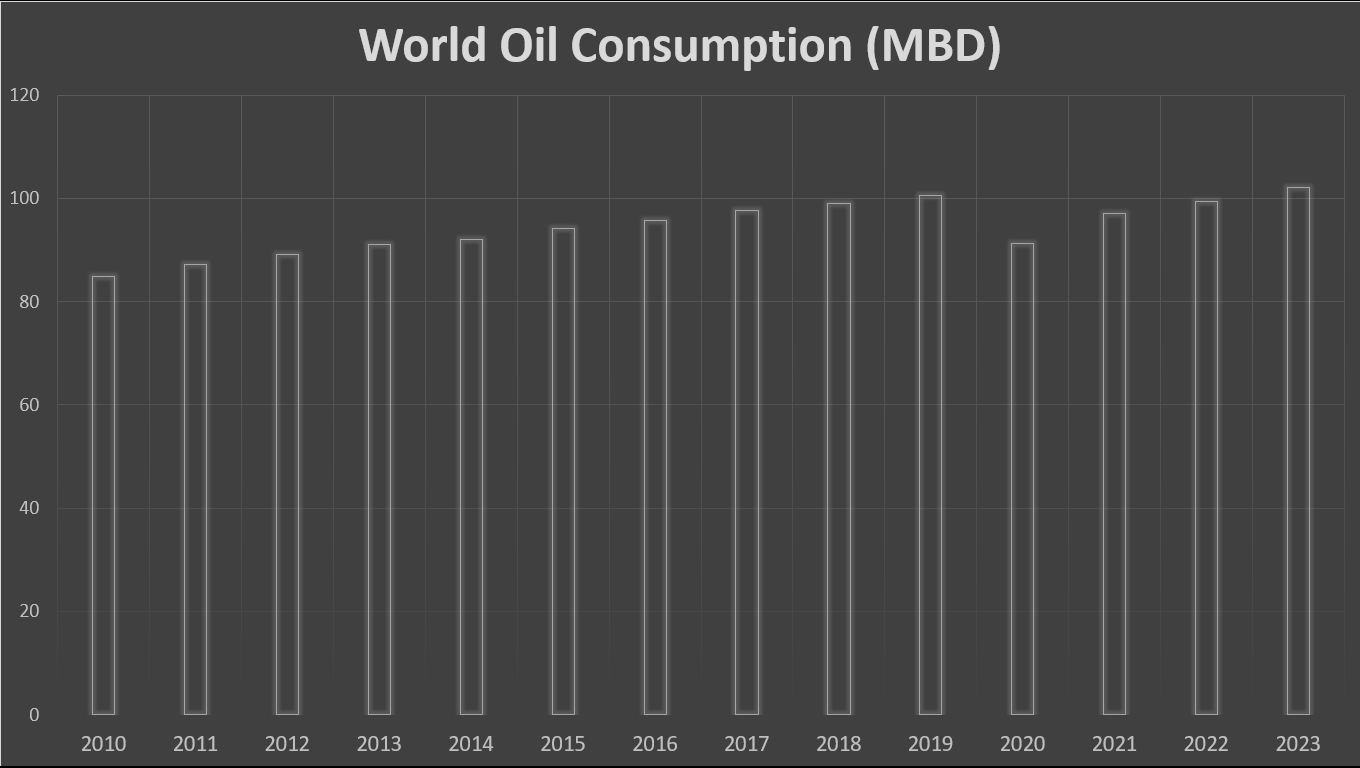

Oil consumption may be measured in some ways, however my favourite one is million barrels per day consumption, or mbd. These days, world oil consumption clocks in at simply above 100 mbd (102.1 mbd in 2023): round two-thirds of which are burned to maneuver issues round, with the remaining getting used for Liquefied Petroleum Fuel (LPG, 14%), Naphtha (7%) and different merchandise (11%), of which round 6% are plastics.

It wasn’t all the time this excessive. Again in 2010, oil demand was 16% lower than right now: 84.8 mbd. However the 2010’s have been a golden decade for oil, with over 1.5 mbd yearly will increase (half of this demand coming from China), attending to 100.6 mbd consumption in 2019. The pandemic introduced that right down to 91 mbd in 2020, however consumption recovered quick, and the document from 2019 was as soon as once more damaged in 2023:

For these of us who care concerning the local weather disaster, that is unhealthy information. However in 2024, lastly, issues began to vary.

You see, after the pandemic, oil demand recovered quicker than many anticipated (or hoped), at ranges even larger than these from the golden 2010’s. However by late 2023, a schism began to seem between the 2 largest establishments forecasting oil demand: the European IEA, and the group of oil exporting nations, OPEC.

In early 2024, the IEA was forecasting a rise in oil demand for that yr of “solely” 1.2 mbd, beneath the 2010’s common. OPEC, in the meantime, was anticipating the nice instances to proceed (for them), with demand to develop 2.3 mbd. Such a stark distinction had not been seen in over a decade, and it made for lots of headlines.

Enable me to spoil the top: it appears, for now, that the IEA was proper and OPEC was mistaken. And it appears 2024 marked the turning level between a booming oil market, and a languid one which’s prone to finish its development within the foreseeable future.

2024: the yr that bucked the development

It began early. China had pushed oil demand development for years, however its financial system was not rising as quick because it as soon as had: amidst a extreme constructing disaster, diesel consumption was far beneath what had been anticipated just some months prior. Already in late 2023, weak demand and booming oil manufacturing within the US pressured OPEC+ to droop its deliberate will increase (OPEC+ recurrently produces lower than it might in an effort to prop up costs, and these days some 5 mbd are being stored out of manufacturing by the group).

Again then, I used to be already questioning why no person was mentioning EVs as an element. As practically half of the automobiles bought in China had a plug, it appeared naive accountable oil demand woes on the constructing sector alone. However hey, in all probability these seasoned analysts knew greater than I did, proper?

As months handed, OPEC insisted that oil demand would get better within the second half of the yr. Although, it was pressured but once more in March to postpone its deliberate manufacturing will increase. However the veil was but to fall, and most analysts insisted this was a short lived consequence of the disaster in China.

It began altering round mid-year. OPEC’s forecast (2.3 mbd demand development in 2024) had remained unchanged, however as the primary half of the yr noticed tepid development yr on yr (<1 mbd in Q1, <0.8 mbd in Q2), it was changing into increasingly clear that oil demand would want to mainly explode within the second half of the yr for this forecast to turn into a actuality. In the meantime, a number of components began questioning the narratives from OPEC and Massive Oil: EV gross sales exploded in China, bringing the “EV falling demand” narrative to an finish; Chinese language impartial refineries drastically decreased their operations; and important disruptions within the Center East (which usually would’ve brought about oil costs to spike) had little impact on value, indicating a market assured on oil abundance. Slowly however absolutely the narrative began to vary as the belief set in: China’s oil demand woes weren’t a short lived difficulty, however a structural change. They have been right here to remain.

As of September, China has had 6 steady months of falling oil consumption (yr on yr), making it clear that the nation will now not drive urge for food for the gasoline. Even worse for oil: when the nation lastly reacted to the financial disaster, one of many major investments was in a “cash-for-clunkers” scheme designed to get ICEVs off the street and change them — principally — with EVs, additional destroying gasoline demand.

As actuality set in, OPEC as soon as once more postponed its oil manufacturing will increase, now set for January 2025: that is 16 months later than initially deliberate, and it’s virtually sure they are going to be postponed once more. After insisting for the primary half of the yr that oil demand would get better within the second half, the group additionally needed to decrease its development forecasts by 500,000 barrels a day. Even then, they continue to be at an more and more implausible 1.8 mbd. In the meantime, the IEA has not been blind to the winds blowing, and it has lowered its personal development forecast to a extra sensible 920,000 barrels a day. Although, the precise quantity will solely be identified in 2025.

But, OPEC stays cussed. They’ve now realized that China is a misplaced trigger, however they hope for the remainder of the creating world (and India specifically) to switch her. However as an analyst put it lately: the danger for OPEC (and Massive Oil) is that China begins exporting its low urge for food for oil within the type of low-cost EVs and photo voltaic panels … and as we’ve seen within the booming markets of the creating world, that is precisely what’s taking place.

Which brings us to the final a part of our evaluation: what comes subsequent?

Situation 1: A world the place reasonably priced oil is plentiful

Oil is plentiful, nevertheless it’s getting more and more tougher to entry. This can be a situation the place there are nonetheless large reserves obtainable everywhere in the world for an extraction value beneath, say, $30 (a quantity which might theoretically enable for oil to fall to $40 with out bankrupting producers). After all, this situation is hypothetical.

These days, oil demand retains rising regardless of EVs for plenty of causes. First, the creating world stays more and more hungry for power and, as oil costs keep comparatively low, consumption does enhance to a point. Second, some sectors, like petrochemicals or jet gasoline, are unlikely to get replaced within the quick time period, additional propping up demand. What we have now here’s a situation the place gasoline and diesel demand will fall, being partially offset by LPG, jet gasoline, and petrochemicals.

As a aspect be aware, right here at CleanTechnica, Michael Barnard has mentioned that aviation is not going to develop to pre-pandemic ranges of demand, however that’s one thing I discover laborious to consider, as tourism is a rising business within the International South. I agree with most of Michael’s evaluation on most issues, however this one I’m nonetheless uncertain about: jet gasoline consumption is but to get better to pre-pandemic ranges, however I feel it’s solely a matter of time.

Again to the matter at hand, even when demand for LPG or jet gasoline rises, it’s doubtless that many analysts are underestimating the speed at which gasoline and diesel demand will diminish. As Zach mentioned just a few days in the past, creating nations will leapfrog ICEVs and leap into EVs at quicker charges than most individuals anticipate, and that features India. The IEA, for instance, calculates that gasoline consumption will cut back by a mere ~1.8 mbd by 2030, and that’s thought-about “optimistic” by many analysts … however I feel it’s severely underestimating the influence from EVs.

When you keep in mind our tough calculations from final yr, we will assert that each 100 million EVs bought displace some 2 mbd consumption. It’s affordable to forecast that 100 million EVs might be bought in 2024–2027 after which one other 100 million in 2028–2030, which implies the influence will simply attain 4 mbd by then, properly above the IEA “optimistic” situation.

The problem right here is that the abundance of low-cost oil coming from US shale, Brazil, Guyana, and different non-OPEC producers (who usually are not sure by OPEC’s cuts), paired with tepid demand, will imply costs get decrease within the medium time period, bringing them nearer to the marginal value of extracting oil, and considerably promote its consumption, significantly in much less developed economies … and the US.

Even with low-cost fuel, ICEVs are nonetheless costlier to gasoline and keep than EVs, however the stress to modify is way decreased with a gallon of gasoline at $2 or much less. This could make the transition extra depending on political will, and, if that fails, it means demand might continue to grow for some time or plateau for just a few years.

So, in a world with plentiful oil, we’d anticipate tepid demand to carry decrease costs, which can undoubtedly hurt the transition, however shouldn’t matter a lot in the long run as clear applied sciences take over increasingly sectors of the financial system. However local weather change is already making a multitude, so this isn’t a constructive situation: we’d be depending on political will to part out fossil fuels, and that’s one thing sadly missing in a number of nations, together with the US with its new administration.

Situation 2: A world the place reasonably priced oil is scarce

Brazil’s new discoveries are outlined as extremely deep oil. US shale producers have been displaying diminishing returns for some time, as these oilfields attain peak manufacturing a lot prior to the standard ones. Venezuela’s huge reserves are primarily extra-heavy crude within the Orinoco Belt, which might make it costly to develop it even when the nation wasn’t led by Maduro. With many oilfields around the globe reaching maturity, it’s attainable that the one area with huge and simply accessible reserves is the Center East, however we all know they’re keen to limit manufacturing if meaning larger earnings, so don’t rely on them to make oil low-cost.

On this situation, the identical story performs out, with falling oil costs as tepid demand means the market is oversupplied as early as 2025. However that’s the place the similarities finish: as costs get decrease, funding will fall, and costlier fields will wrestle. Oil manufacturing will inevitably falter, and at this level, its costs might turn into unstable, fluctuating dramatically at any time when demand outpaces provide, and vice versa.

This instability, paired with the doubtless reluctance to speculate cash in costly oilfields that might properly be unprofitable just a few years down the street, will make costs development larger within the medium development (and provides extra energy to OPEC+ so far as the oil market is worried). However, as no person likes excessive costs and instability, on this situation it’s doubtless many extra nations will promote clear applied sciences to rid themselves of this pesky expense. Within the earlier situation, I forecasted 200 million EV gross sales by the top of 2030, however that might simply flip into 300 million or extra if oil costs get excessive sufficient.

If oil is scarce, and the one motive we’re producing as a lot of it’s due to very excessive (and rising) demand, the inevitable discount will wreak havoc on oil producers and it’s prone to speed up the phaseout of fossil fuels: on this situation, political will to struggle local weather change is not going to be required to make a swift and efficient transition.

Last ideas

I solely superficially talked about the newly elected US president, Donald Trump: it’s a on condition that his insurance policies will favor fossil fuels, however the outcomes are but to be seen, and a sliver of hope endures. For one, US oil and fuel manufacturing is already going through capital restraint, as firms consolidate and prioritize earnings over funding. For one more, if Trump does get his method with tariffs, the outcome might result in decrease consumption total, bringing oil demand down by as a lot as 500,000 barrels a day. Each of those claims have been made by oil-related media, so I don’t assume they’re attempting to greenwash Trump’s actions … I feel they’re genuinely anxious.

Trump is prone to damage EV adoption within the quick time period within the US, however I hope the know-how is mature sufficient that it’ll not make as a lot of a distinction (and we’re but to see what occurs with Musk and Tesla). As for the remainder of the developed world, they might not undertake EVs as quick as China and a few creating nations, however the development is obvious by now and oil demand has little hope of rising in mature economies, with OECD demand anticipated to fall.

New applied sciences are coming, they usually might work in each instructions. US shale oil producers appear to turn into extra environment friendly by the month, so even when oil is pricey right now, it might not be tomorrow. However, similar to that, it could be that biofuels and batteries cut back jet gasoline demand prior to anticipated (so Michael might but be proper about this). For now, the best influence is prone to come from EVs: anticipate diesel to endure a major hit (as gasoline already does) as quickly as large electrical vans enter the scene en masse.

Basically, what we’re seeing is a de-coupling between oil demand and financial development, pushed by the electrification of transport and renewable power technology: this course of marked the second half of 2024 and can proceed to press oil demand sooner or later. OPEC’s and Massive Oil’s hopes are positioned on larger power demand total, and the fast-growing economies within the creating world.

However they’ll quickly see these hopes are misplaced.

Chip in just a few {dollars} a month to assist assist impartial cleantech protection that helps to speed up the cleantech revolution!

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Speak podcast? Contact us right here.

Join our each day publication for 15 new cleantech tales a day. Or join our weekly one if each day is simply too frequent.

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage