Builders introduced 24 new energy buy agreements (PPAs) in Europe in November, for 1,132 MW of capability.

Pexapark has launched the December version of its PPA Occasions report, which incorporates all PPA offers closed in November.

Most PPA costs in Europe mirrored decrease electrical energy and uncooked materials costs. The Swiss consulting agency’s EURO Composite fell 3.3% month on month and stood at €52.20 ($56.90)/MWh. For comparability, in November final yr, European PPA costs reached €94/MWh.

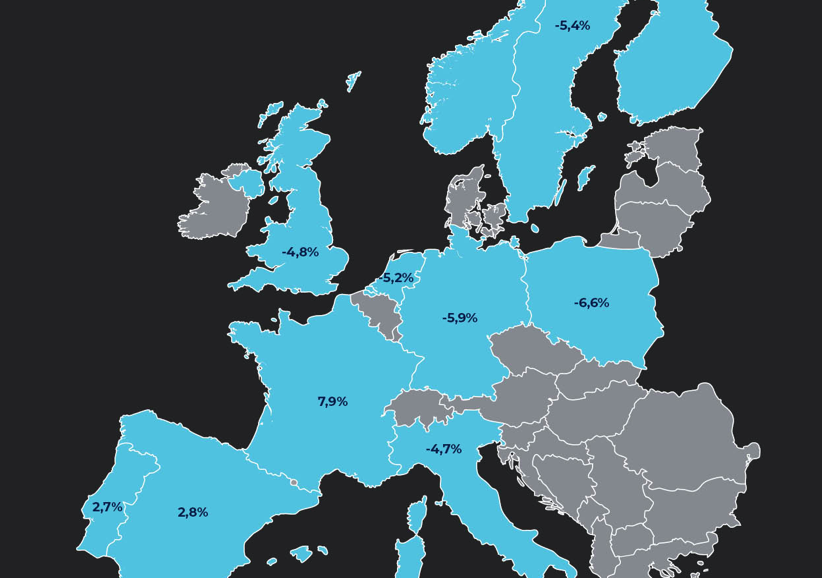

Whereas most international locations’ indices mirrored the downtrend, with Poland experiencing the steepest decline at -6.6%, some areas noticed reverse traits. For instance, PPA costs in Portugal and Spain noticed a rise of two.7% and a pair of.8% respectively. Moreover, PEXA France rose 7.9%.

Though in March Pexapark introduced the “starting of the golden period of PPAs in Europe”, evidently the forecasts haven’t been fully fulfilled. In November, 24 new PPAs have been introduced for a complete of 1,132 MW, which is 10 lower than the earlier month – a lower of 38% in comparison with the October document and a drop of 32% in comparison with the 1,643 MW signed then. In November 2022, 16 PPAs have been introduced with a complete capability of 1,881 MW.

For Pexapark, the highlights of November’s exercise embrace the signing of a comparatively uncommon photo voltaic PPA in Germany between Sunnic Lighthouse, a subsidiary of Enerparc, and British oil firm BP for 70.5 GWh per yr that may generate six new-build photovoltaic initiatives totaling 76.5 MW. The PPA will start in 2024 and can final for 10 years.

The consultancy additionally factors out that the Italian PPA market has skilled a big acceleration this yr with a give attention to onshore wind repowering reaching 18 agreements, and the pattern continues to evolve: 4 extra have been signed in November. In complete, they add as much as 855 MW, a rise of 143% in comparison with the 351 MW registered in 2022.

Spain, for its half, leads the cross-border PPAs. Below one in every of them, Matrix Renewables will present Merck with greater than 102 MW of photo voltaic capability over a decade, beginning in 2025, for its operations all through the European Union and Switzerland. The settlement is linked to a few new development photo voltaic initiatives in Spain.

The second settlement, lasting 10 years, has been signed by Renantis, previously Falck Renewables, with Merck by a 50 MW onshore wind portfolio in northwest Spain.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and want to reuse a few of our content material, please contact: editors@pv-magazine.com.