Within the week of January 29, common costs in most main European electrical energy markets had been just like the earlier week. Photo voltaic power manufacturing continued to extend in most markets as the times obtained longer, whereas wind power manufacturing was typically decrease than the earlier week. Demand decreased in nearly all markets. CO2 futures continued to say no and fuel futures halted the downward development of latest months.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind power manufacturing

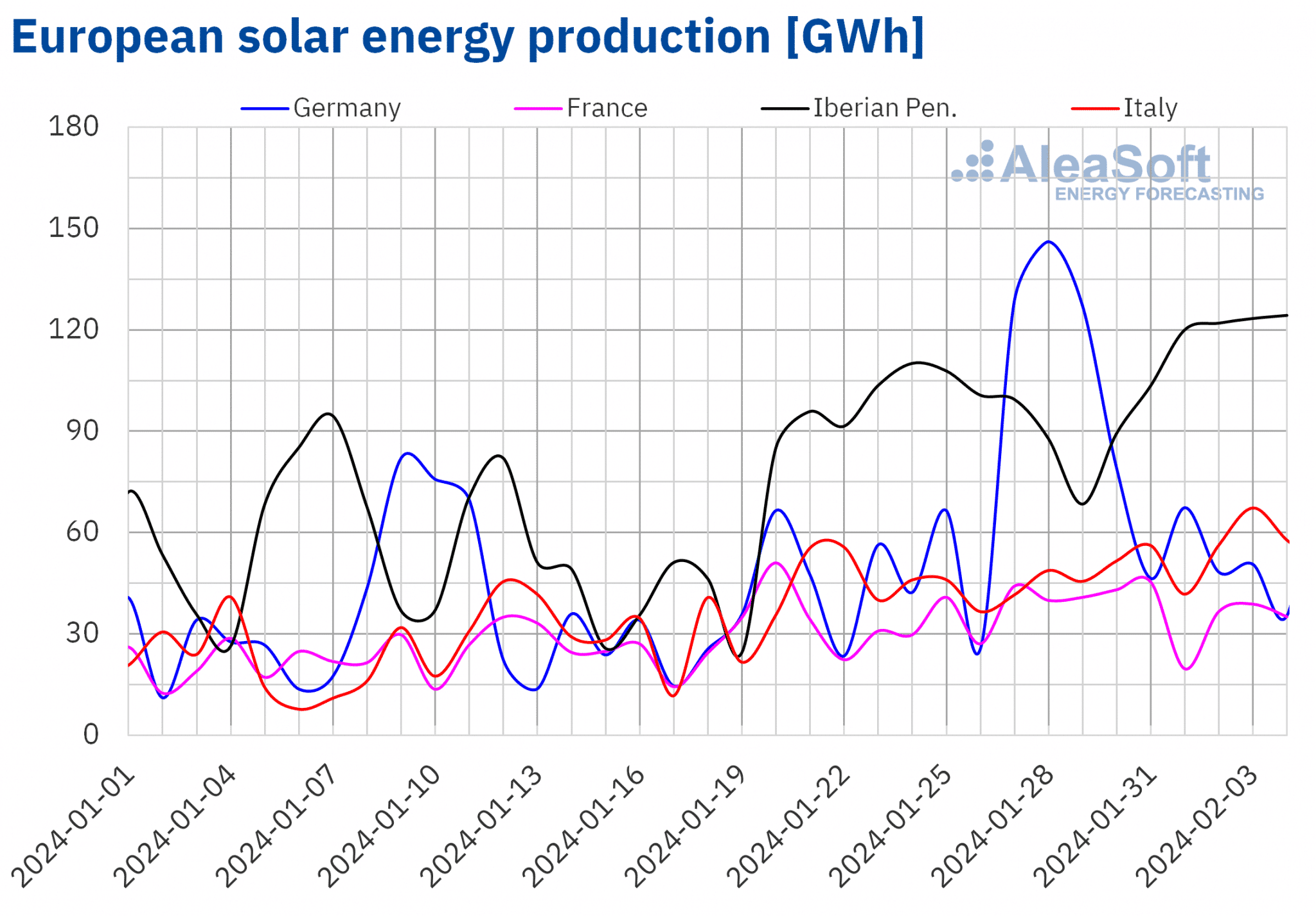

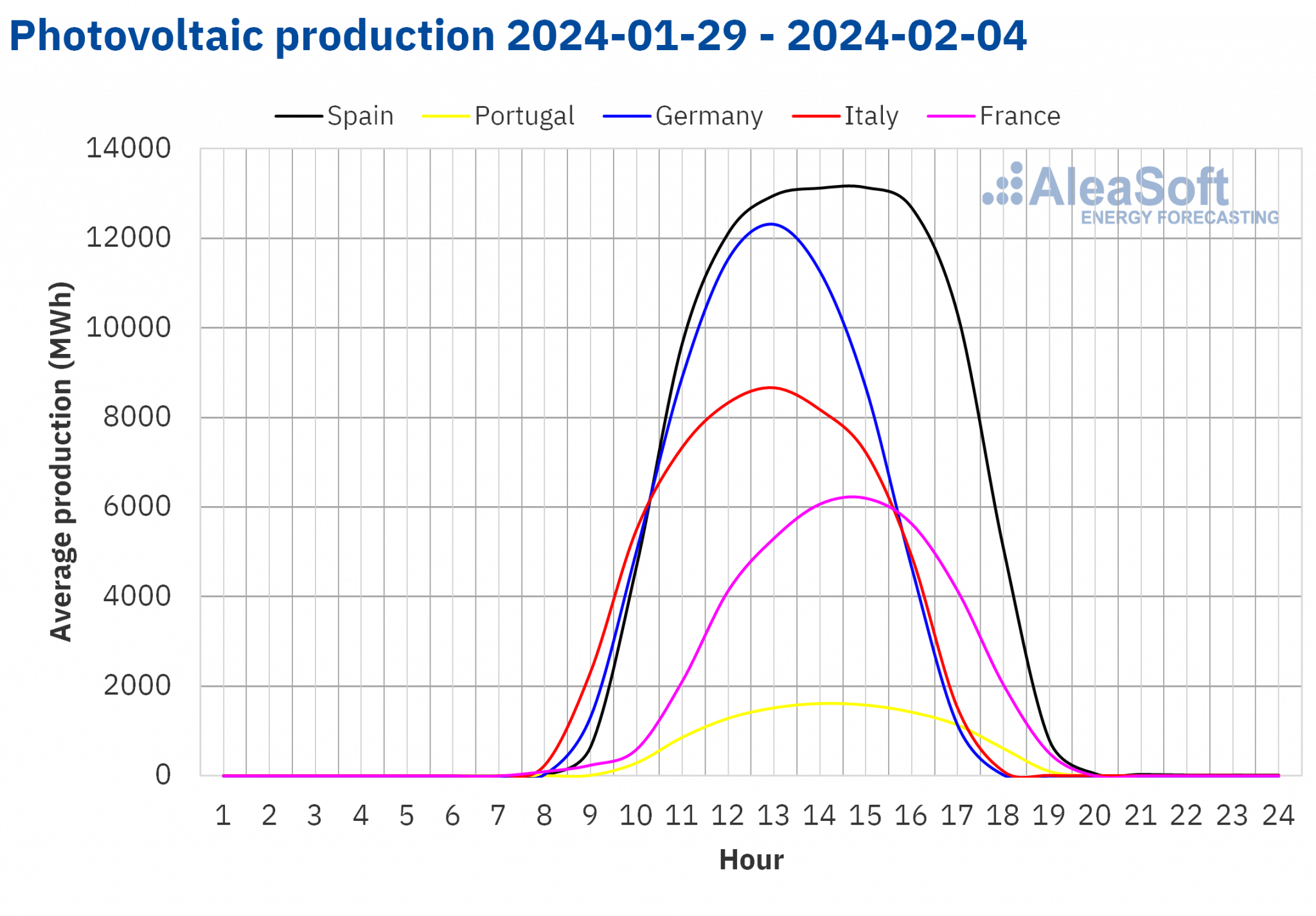

Through the week of January 29, photo voltaic power manufacturing continued to extend in the primary European electrical energy markets, because of longer days. This development has endured for the reason that starting of the yr within the Italian and French markets, with week?on?week will increase of 20% and 10%, respectively, within the aforementioned week. On the Iberian Peninsula, photo voltaic power manufacturing elevated for the second consecutive week, by 16% in Portugal and 6.3% in Spain. Nevertheless, the German market was the exception, registering a 7.0% lower in photo voltaic power manufacturing after a big improve within the earlier week.

The upward development in photo voltaic power manufacturing was additionally mirrored within the day by day values. In Spain, photo voltaic photovoltaic power manufacturing reached ranges final seen in October, with 104 GWh generated on Sunday, February 4. Italy and Portugal registered 67 GWh and 12 GWh respectively on Saturday, February 3, marking photo voltaic power manufacturing ranges not seen since October.

In keeping with AleaSoft Power Forecasting’s photo voltaic power manufacturing forecasts for the week of February 5, the development will reverse, with a rise in photo voltaic power manufacturing in Germany and a lower in Italy and Spain.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

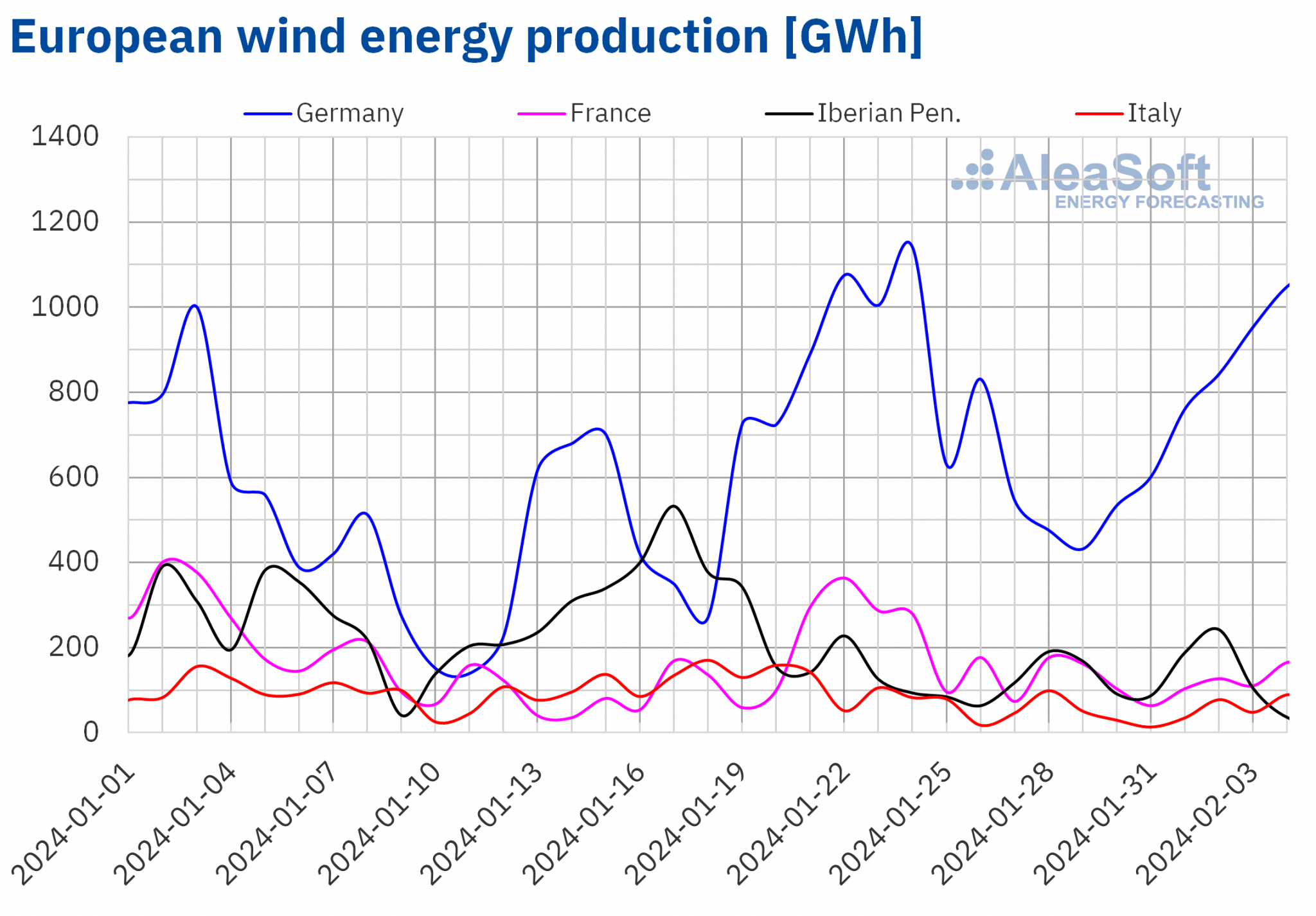

Wind power manufacturing registered declines in most main European electrical energy markets within the week of January 29 in comparison with the earlier week. Italy and Spain registered two consecutive weeks of declines, with decreases of 28% and 0.8%, respectively. Within the French and German markets, wind power manufacturing decreased by 43% and 9.2%, respectively. Solely the Portuguese market registered a 12% improve in manufacturing utilizing this know-how after the earlier week’s drop.

In keeping with AleaSoft Power Forecasting’s wind power manufacturing forecasts for the week of February 5, the downward development will persist within the German market. In distinction, wind power manufacturing will improve in France, Italy and the Iberian Peninsula.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

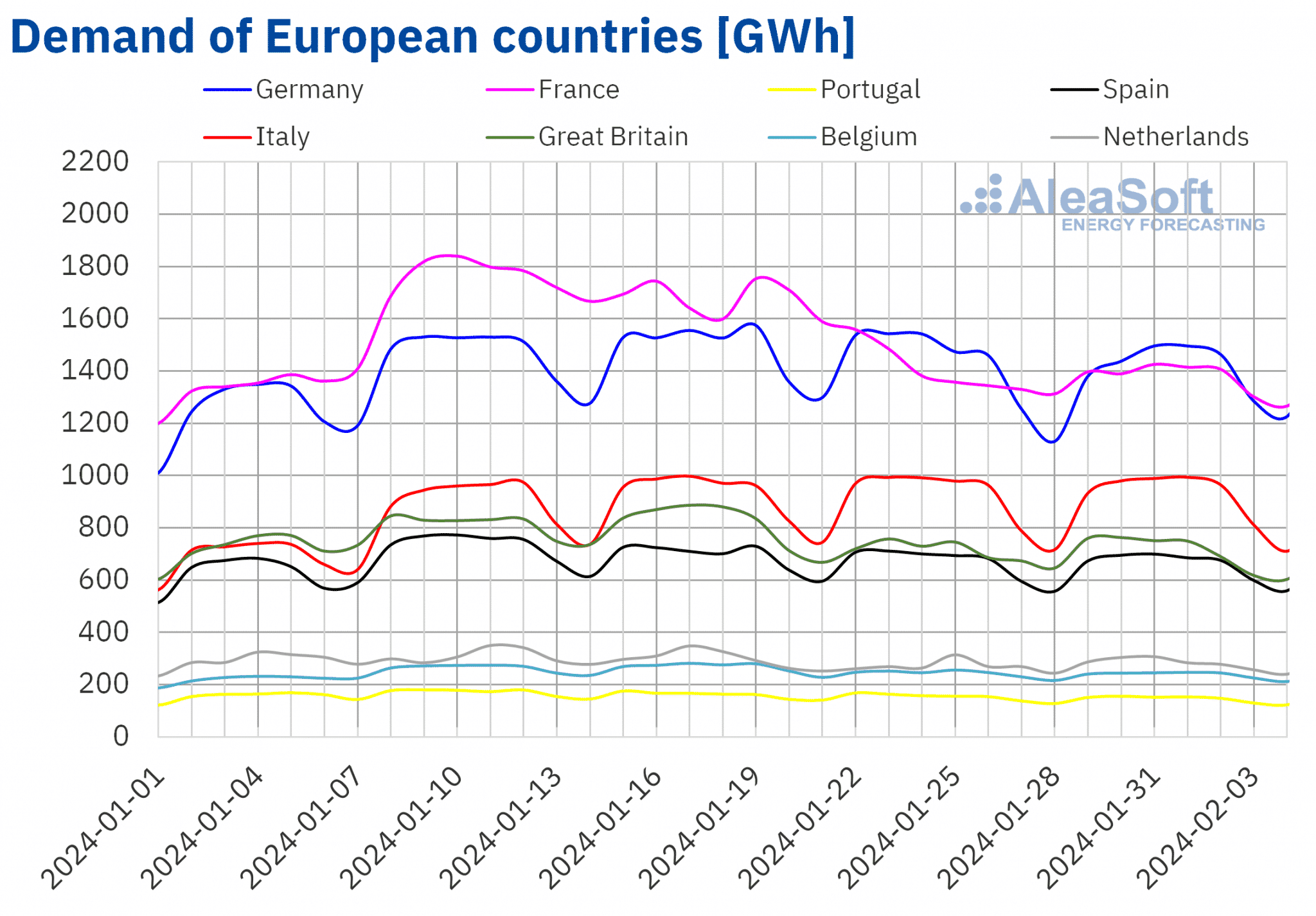

Electrical energy demand

Through the week of January 29, the primary European electrical energy markets registered a lower in electrical energy demand, following the downward development of earlier weeks. In Portugal, France and Spain, demand fell for the third consecutive week, with decreases of 4.9%, 1.7% and 1.3%, respectively. However, the markets of Belgium, Germany, Nice Britain and Italy registered declines for the second consecutive week, with decreases starting from 2.0% to 0.3%. The exception was the Netherlands market, which registered a 3.6% improve in electrical energy demand in comparison with the week of January 22.

On the similar time, common temperatures in Nice Britain, the Netherlands and Belgium elevated between 0.2 °C and 0.6 °C. In distinction, the analyzed markets which can be situated in Southern Europe registered decreases in common temperatures that ranged between 0.9°C and 0.1 °C. Within the German market, common temperatures remained just like these of the earlier week.

AleaSoft Power Forecasting’s demand forecasts point out that, for the week of February 5, the downward development will persist in France and Italy. In distinction, demand will improve in Germany, Spain, Portugal, Belgium, the Netherlands and Nice Britain in comparison with the week of January 29.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

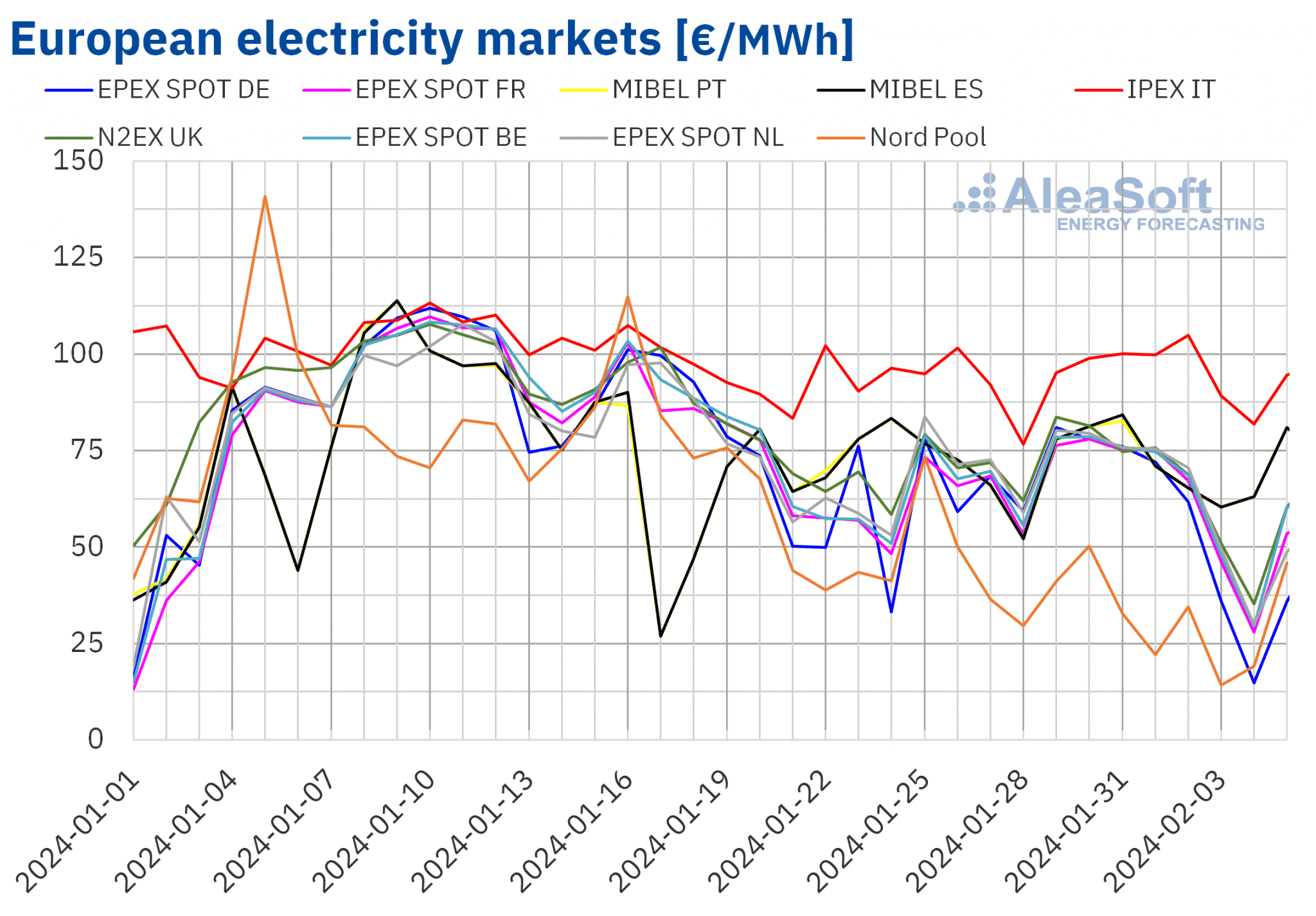

European electrical energy markets

Within the week of January 29, common costs of most main European electrical energy markets remained just like these of the earlier week. The exception was the Nord Pool market of the Nordic nations, which registered a drop of 32%. However, the slight variations registered had been additionally downward within the EPEX SPOT market of the Netherlands and Germany and within the N2EX market of the UK, which had been ?0.1%, ?1.1% and ?1.1%, respectively. In distinction, in the remainder of the markets analyzed at AleaSoft Power Forecasting, costs elevated between 0.6% within the MIBEL market of Portugal and 5.3% within the EPEX SPOT market of France.

Within the first week of February, weekly averages continued to be beneath €75/MWh in nearly all analyzed European electrical energy markets. The exception was IPEX market of Italy, which once more registered the best common, €95.68/MWh. However, the Nordic market reached the bottom weekly value, €30.56/MWh. In the remainder of the analyzed markets, costs ranged from €59.92/MWh within the German market to €71.89/MWh within the Spanish market.

Additionally, within the first 5 days of February, a number of markets registered hourly costs beneath €1/MWh. Within the German, Belgian, British, British, Dutch and Nordic markets, the variety of hours with costs beneath €1/MWh was 11, 3, 2, 8 and 6, respectively.

Through the week of January 29, weekly fuel costs registered a slight restoration. This led to the slight improve in costs registered in most analyzed markets. The decline in wind power manufacturing in markets resembling France, Spain and Italy additionally contributed to this habits. Nevertheless, the decline in demand restricted the will increase and in some instances contributed to the decline in costs.

AleaSoft Power Forecasting’s value forecasts point out that within the second week of February, they could lower in most European electrical energy markets. Elevated wind power manufacturing in most markets will favor this habits. As well as, demand would possibly lower in some markets.

Supply: Ready by AleaSoft Power Forecasting utilizing information from OMIE, EPEX SPOT, Nord Pool and GME.

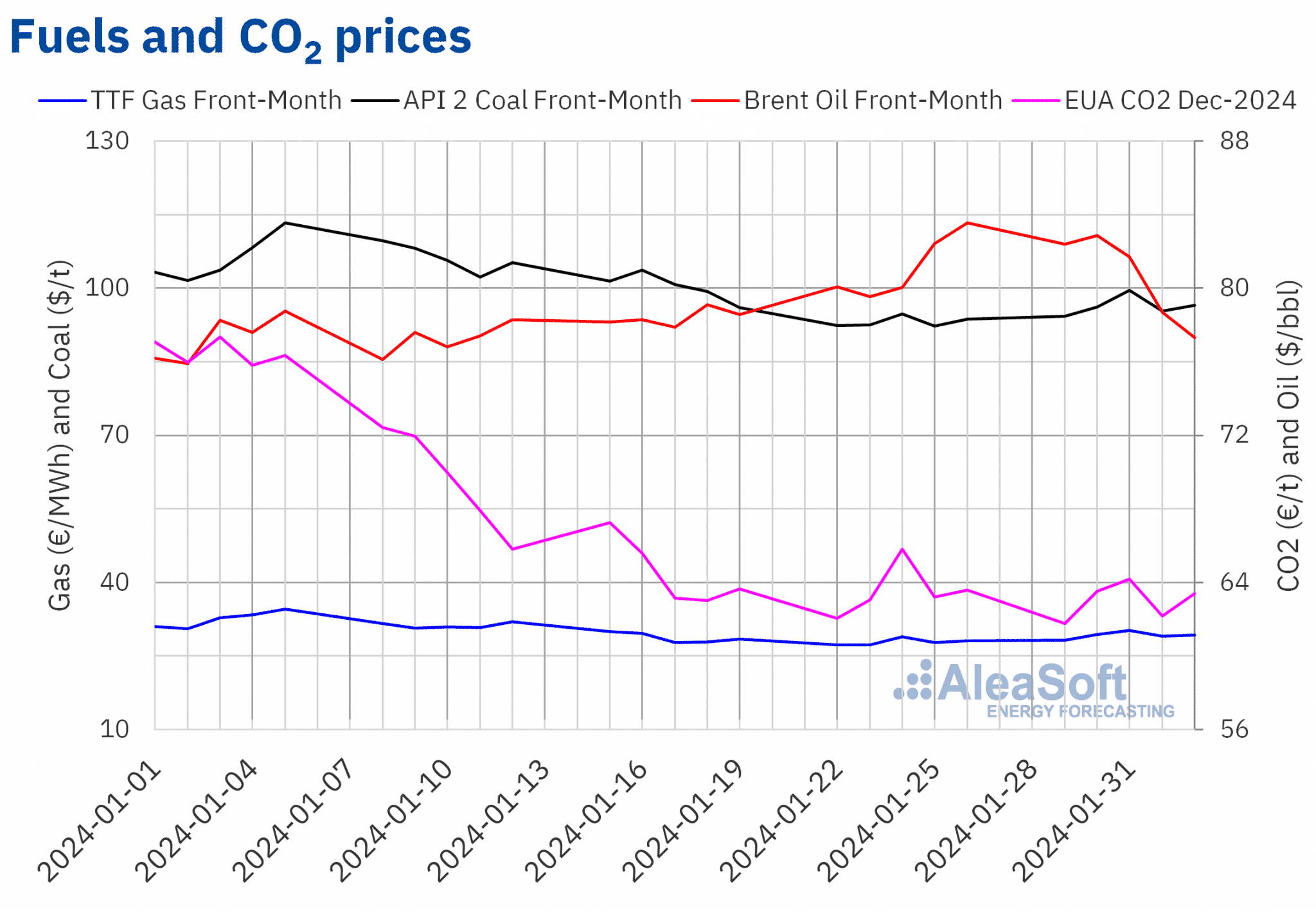

Brent, fuels and CO2

Brent oil futures costs for the Entrance?Month within the ICE market registered a downward development through the first week of February. Because of this, on Friday, February 2, these futures registered their weekly minimal settlement value, $77.33/bbl. This value was 7.4% decrease than the earlier Friday and the bottom within the final three weeks.

Considerations about financial and demand evolution in China exerted a downward affect on Brent oil futures costs within the first week of February. The shortage of expectations a few lower in rates of interest in america additionally contributed to those declines. As well as, oil shares elevated on this nation. However, on February 1, OPEC+ determined to take care of the agreed manufacturing ranges.

As for the settlement costs of TTF fuel futures within the ICE marketplace for the Entrance?Month, within the first classes of the week of January 29, they continued the upward development began on the finish of the earlier week. Because of this, on Wednesday, January 31, these futures reached their weekly most settlement value, €30.24/MWh. In keeping with information analyzed at AleaSoft Power Forecasting, this was the one time that settlement costs for this product exceeded €30/MWh through the second half of January. Within the first classes of February, settlement costs had been beneath €30/MWh once more. On Friday, February 2, the settlement value was €29.30/MWh. This value was 4.2% increased than the earlier Friday.

Instability within the Center East contributed to the rise in TTF fuel futures costs within the final classes of January. Nevertheless, nonetheless excessive European inventory ranges and considerable provide continued to exert a downward affect on costs.

As for CO2 emission rights futures within the EEX market for the reference contract of December 2024, on Monday, January 29, they registered the weekly minimal settlement value, €61.78/t. In keeping with information analyzed at AleaSoft Power Forecasting, this settlement value was the bottom for the reason that first half of November 2021. Thereafter, costs elevated till Wednesday, January 31. On that day, emission rights futures registered their weekly most settlement value, €64.17/t. Within the final session of the week, on Friday, February 2, the settlement value was €63.40/t, down 0.3% from the earlier Friday.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ICE and EEX.