The Spanish electrical energy market registers detrimental costs for the primary time and, along with Portugal, continues to have the bottom costs in Europe.

Within the final week of March, the Iberian MIBEL market registered the bottom costs in Europe for the eighth consecutive week and the Spanish market registered detrimental costs for the primary time in its historical past on April 1. In most main European electrical energy markets, costs fell in comparison with the earlier week. In a number of markets this was the week with the bottom common, or the second lowest common, in 2024 up to now. Declining demand and elevated renewable vitality manufacturing favored these declines. Portugal and France registered wind vitality manufacturing information for a March month on the 27th and 28th, respectively.

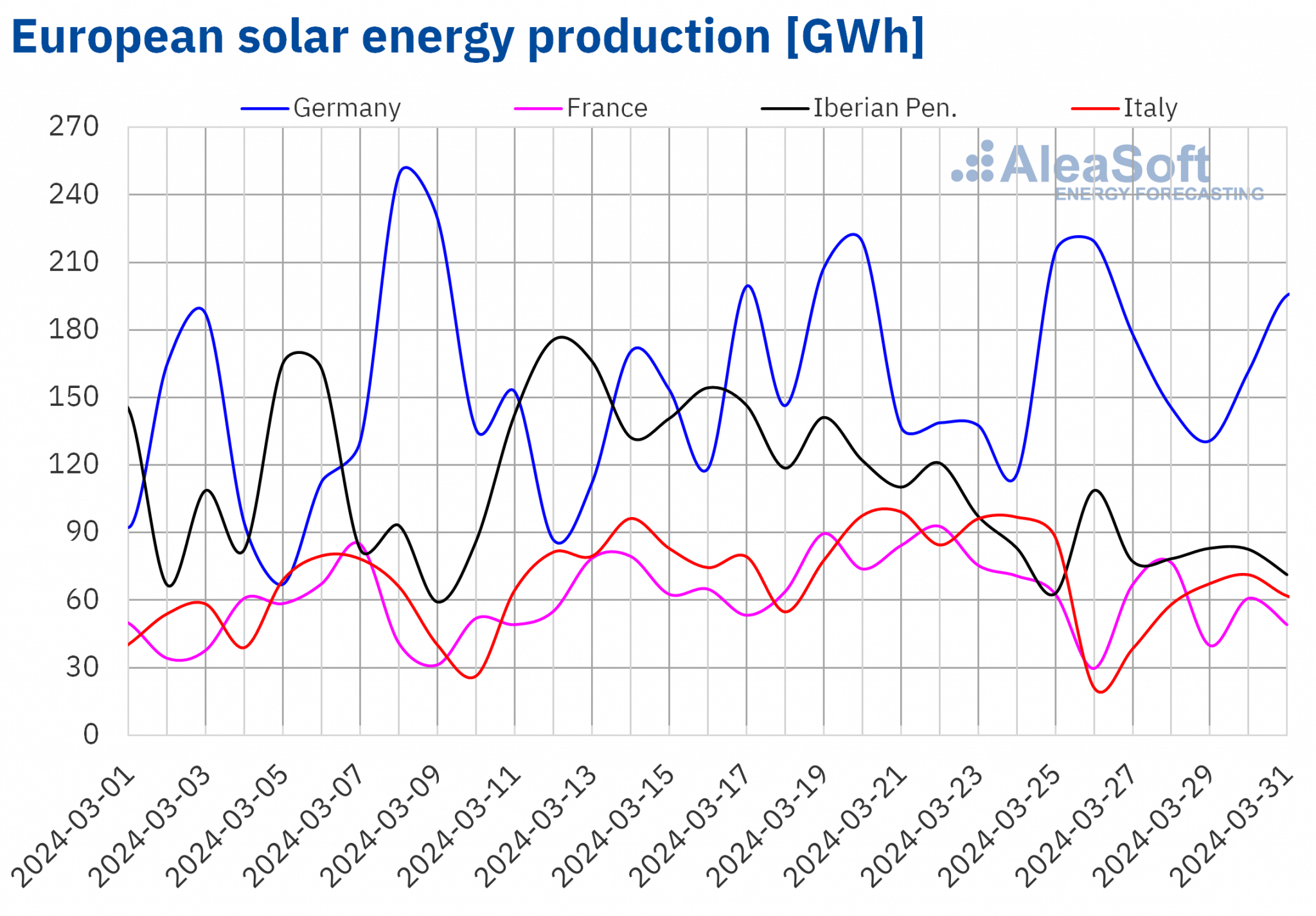

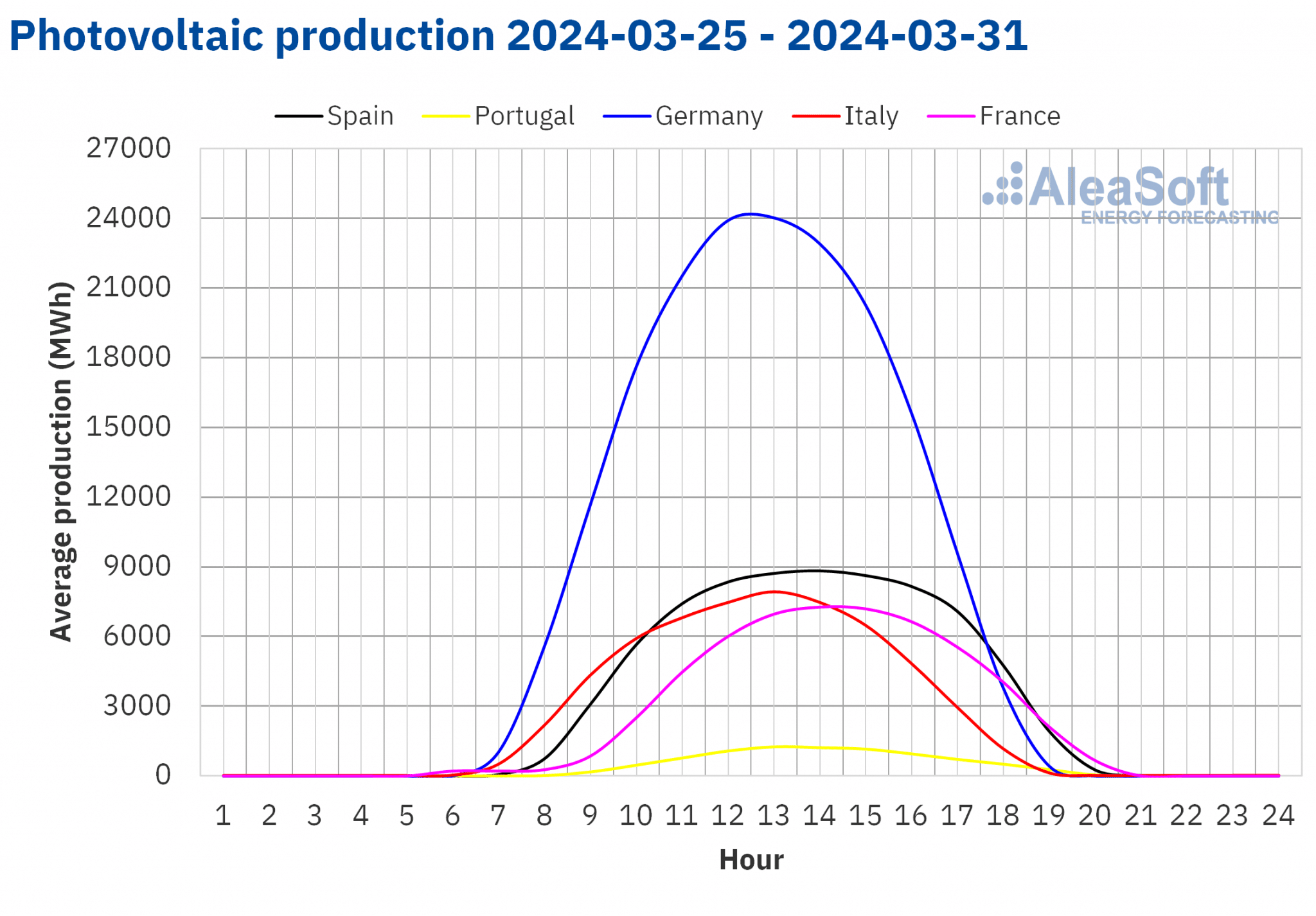

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind vitality manufacturing

Within the week of March 25, photo voltaic vitality manufacturing decreased in most main European electrical energy markets in comparison with the earlier week. The Italian market registered the most important drop, 33%, reversing the upward pattern of earlier weeks. The Portuguese market, which had the smallest decline, 16%, fell for the second consecutive week. The German market was the exception. On this market, photo voltaic vitality manufacturing elevated by 13%, persevering with the upward pattern of the earlier week.

For the week of April 1, in response to AleaSoft Vitality Forecasting’s photo voltaic vitality manufacturing forecasts, the downward pattern will reverse and photo voltaic vitality manufacturing will improve in Germany, Spain and Italy.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, Pink Eléctrica and TERNA.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, Pink Eléctrica and TERNA.

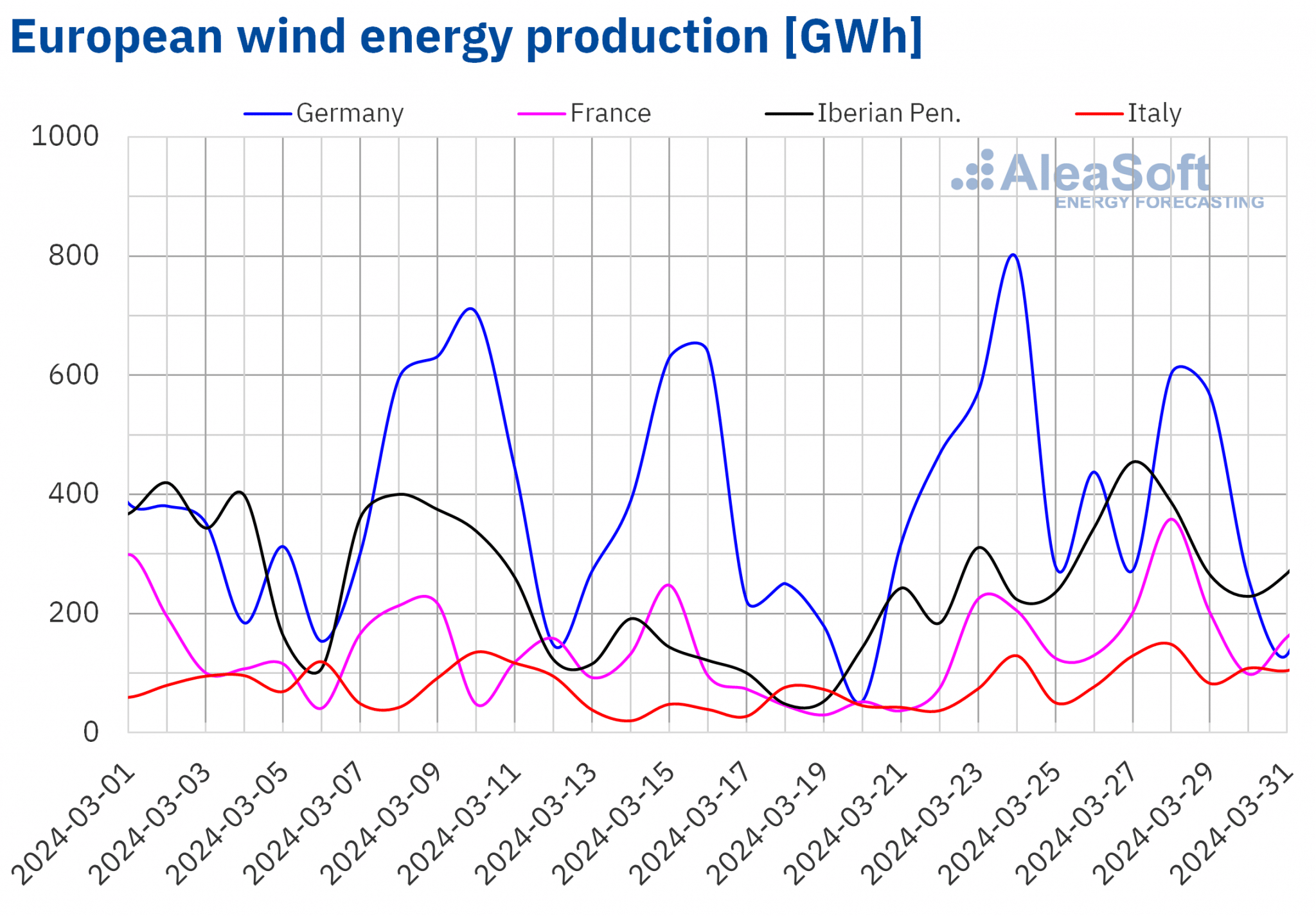

Within the final week of March, wind vitality manufacturing elevated in most main European markets in comparison with the earlier week, persevering with the upward pattern of the earlier week. Will increase ranged from 47% within the Italian market to 90% within the French market. In distinction, the German market registered a wind vitality technology lower for the third consecutive week, this time by 3.3%.

Portugal and France registered the best ranges of every day wind vitality manufacturing for a March month in historical past. On March 27, the Portuguese market generated 106 GWh of wind vitality and, on the next day, the French market generated 359 GWh. In each instances, manufacturing ranges corresponded to values final registered within the second half of February.

Through the week of April 1, in response to AleaSoft Vitality Forecasting’s wind vitality manufacturing forecasts, it would improve in Germany and France and it’ll lower within the Iberian Peninsula and Italy.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, Pink Eléctrica and TERNA.

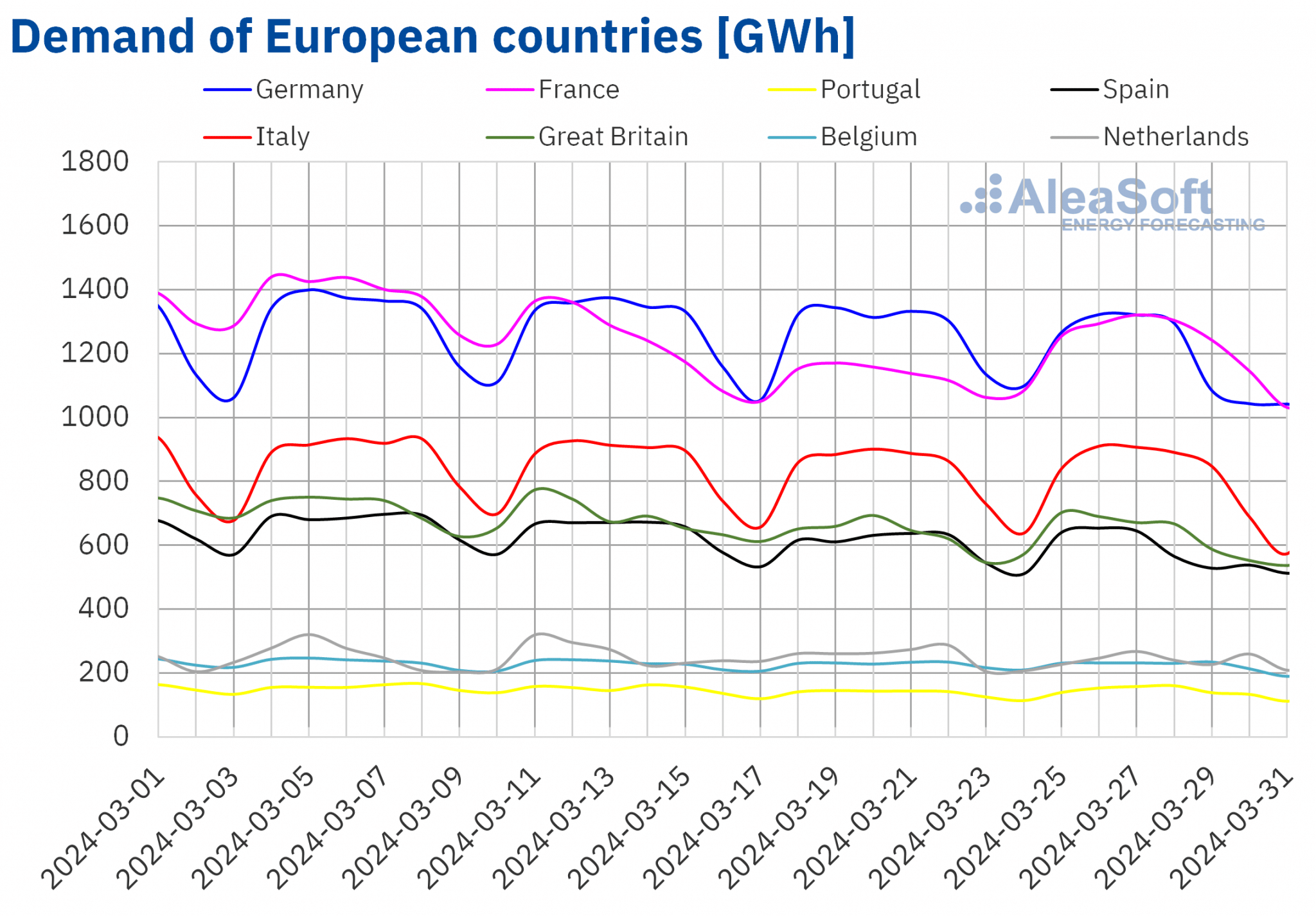

Electrical energy demand

Within the week of March 25, electrical energy demand fell in most main European electrical energy markets in comparison with the earlier week, persevering with the downward pattern of earlier weeks. The German market, the place demand fell for the fifth consecutive week, registered the most important drop, 5.4%. The Belgian market, which had the smallest drop, 1.4%, continued its downward pattern for the fourth consecutive week. In distinction, France, Portugal and Nice Britain reversed the earlier week’s downward pattern and registered will increase in demand of 9.0%, 4.2% and 0.4%, respectively.

Within the final week of March, a number of European international locations celebrated Easter and in some areas there was a public vacation on Holy Thursday or Good Friday, which had an affect on demand.

Between March 25 and 31, common temperatures decreased in most analyzed markets. The decreases ranged from 4.9 °C in Portugal to 0.2 °C within the Netherlands. Common temperatures elevated solely in Germany and Italy, by 1.4 °C and 0.1 °C, respectively.

For the week of April 1, in response to AleaSoft Vitality Forecasting’s demand forecasts, it would improve in Germany, Portugal, Italy and the Netherlands. In distinction, demand will decline in France, Belgium, Spain and Nice Britain.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, Pink Eléctrica, TERNA, Nationwide Grid and ELIA.

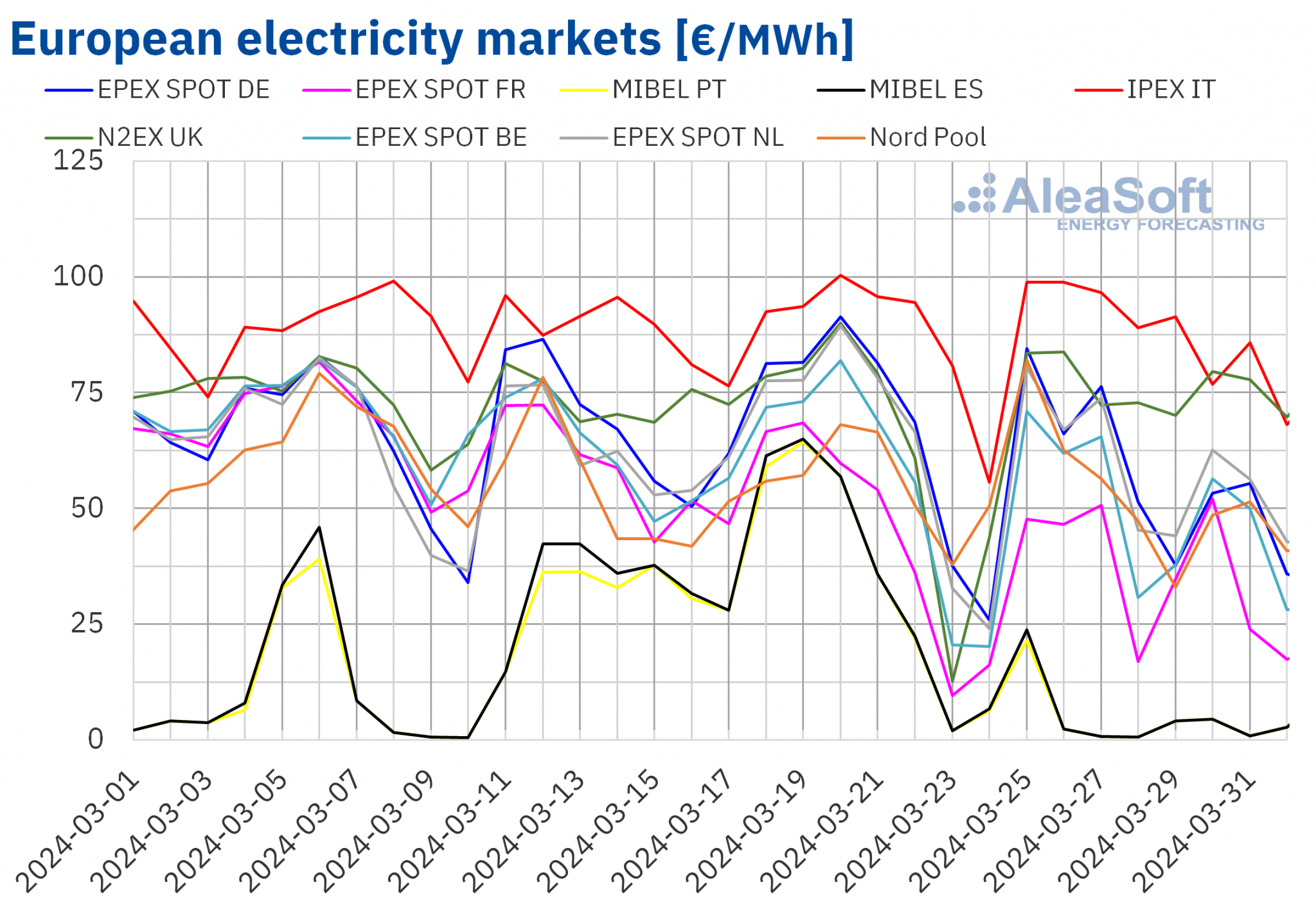

European electrical energy markets

Within the week of March 25, costs in most main European electrical energy markets decreased in comparison with the earlier week. Weekly costs of France and Belgium within the EPEX SPOT market, €39.01/MWh and €53.32/MWh, respectively, have been the bottom this 12 months up to now in every of those markets. Within the case of the MIBEL market of Portugal and Spain and the EPEX SPOT market of the Netherlands, common costs for the week of March 25 have been the second lowest this 12 months, with values of €4.98/MWh, €5.30/MWh and €61.37/MWh. Value declines ranged from 86% within the Portuguese market to 1.4% within the Nord Pool market of the Nordic market. Alternatively, within the IPEX market of Italy and the N2EX market of the UK costs rose, by 3.9% and 21% in every case.

Within the final week of March, the Iberian MIBEL market costs have been the bottom in the principle European electrical energy markets for the eighth consecutive week. Each day costs on this market have been the bottom virtually uninterruptedly since February 7, except for 5 days when the Nord Pool market occupied this place. The very best weekly costs have been these of the Italian market, which normally registers the best costs, this time at €91.04/MWh.

As for hourly costs, the Spanish market registered the primary three hours with detrimental costs in historical past. On Monday, April 1, between 14:00 and 17:00, the value on this market was ?€0.01/MWh. Between March 26 and April 2, the MIBEL market registered 53 hours with zero or detrimental costs. Such low hourly values meant that the costs of March 28 and 27, €0.66/MWh and €0.75/MWh in every case, have been the third and fourth lowest within the final decade, after the costs of March 10 and 9 of this 12 months, €0.54/MWh and €0.59/MWh respectively.

Different European markets registered detrimental hourly costs between March 25 and April 2, though to a lesser extent than within the Iberian market. Within the German, Belgian, French and Dutch markets there have been some hours with zero or detrimental costs on April 1 and a pair of. Within the Dutch market there was additionally an hour with a value of €0/MWh on March 28.

Within the final week of March, the autumn in demand in most markets, the rise in wind vitality manufacturing in most of them and in photo voltaic vitality manufacturing in Germany favored the autumn in electrical energy market costs, even if gasoline costs remained just like these of the earlier week and CO2 costs elevated. In distinction, the autumn in photo voltaic vitality manufacturing in Italy and the rise in demand in Nice Britain led to larger costs in these markets.

AleaSoft Vitality Forecasting’s value forecasts point out that within the first week of April costs in most main European electrical energy markets will fall in comparison with the earlier week helped by decrease demand in a number of markets and better renewable vitality manufacturing in Germany, France and Italy. The exception would be the MIBEL market, which is able to get well from final week’s declines because of decrease wind vitality manufacturing, though weekly common costs will nonetheless be decrease than the week earlier than Easter.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from OMIE, EPEX SPOT, Nord Pool and GME.

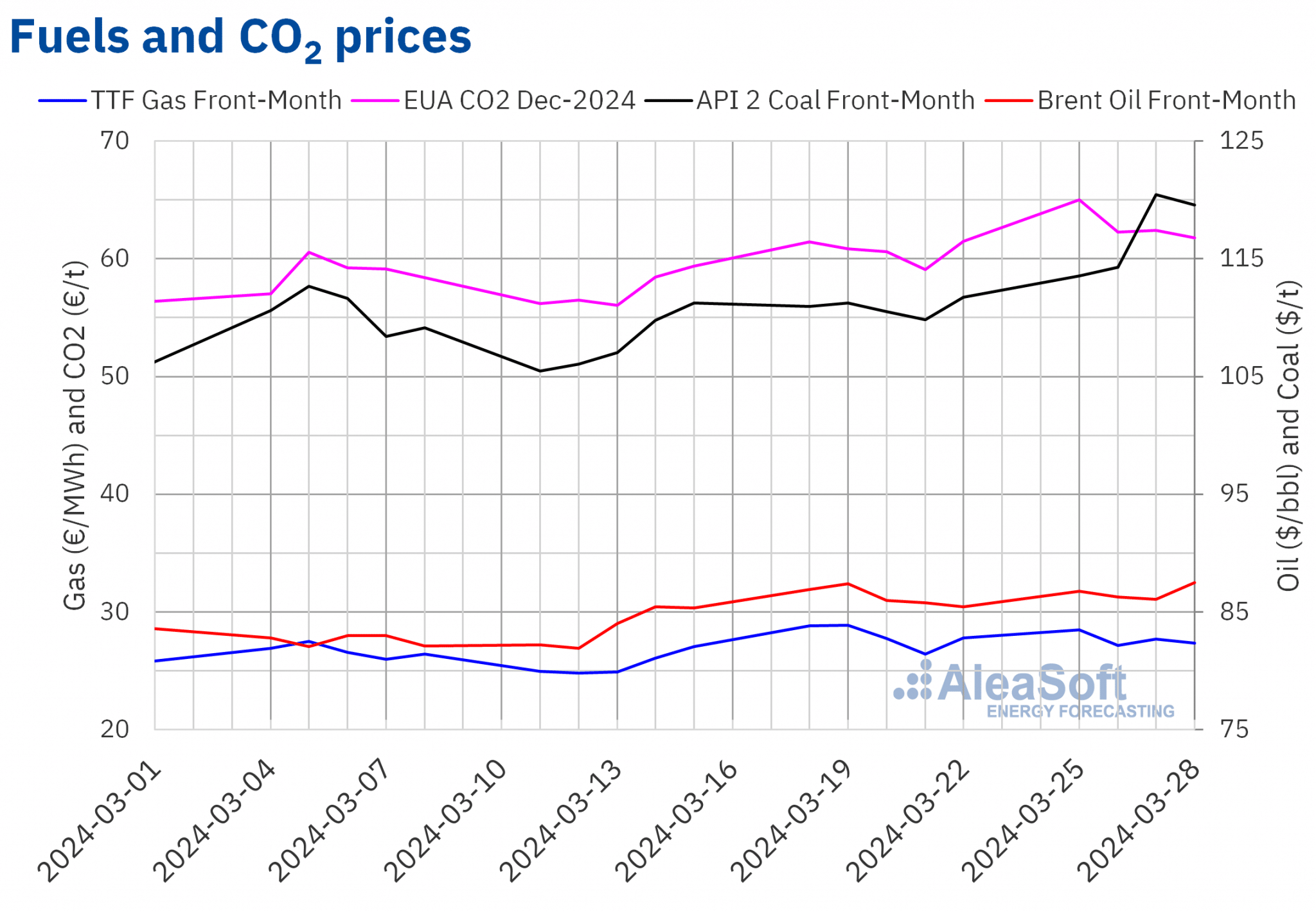

Brent, fuels and CO2

Within the final week of March, settlement costs of Brent oil futures for the Entrance?Month within the ICE market have been above $85/bbl. On Wednesday, March 27, these futures registered their weekly minimal settlement value, $86.09/bbl. Alternatively, on Thursday, March 28, they reached their weekly most settlement value, $87.48/bbl. In keeping with information analyzed at AleaSoft Vitality Forecasting, this value was 2.0% larger than the earlier Thursday and the best for the reason that finish of October 2023.

Within the final week of March, OPEC+ manufacturing cuts and instability within the Center East helped to maintain Brent oil futures costs above $85/bbl. Within the first week of April, prospects of elevated demand in China may exert its upward affect on costs. This week’s OPEC+ assembly will even affect the evolution of Brent oil futures costs.

As for TTF gasoline futures within the ICE marketplace for the Entrance?Month, on Monday, March 25, they reached their weekly most settlement value, €28.49/MWh. Nonetheless, on Tuesday, March 26, the settlement value fell by 4.8% from the day prior to this. Tuesday’s settlement value, €27.13/MWh, was the weekly minimal. In keeping with information analyzed at AleaSoft Vitality Forecasting, this value was 6.0% decrease than the earlier Tuesday. Within the final classes of the week, settlement costs have been larger, however remained beneath €28/MWh. On Thursday, March 28, the settlement value was €27.34/MWh, 3.6% larger than the earlier Thursday.

European reserve ranges, considerable provide from Norway and forecasts of upper temperatures in early April contributed to TTF gasoline futures costs remaining beneath €28/MWh in most classes within the final week of March.

As for settlement costs of CO2 emission rights futures within the EEX market for the reference contract of December 2024, over the last week of March they remained above €60/t. On Monday, March 25, these futures registered their weekly most settlement value, €65.00/t. In keeping with information analyzed at AleaSoft Vitality Forecasting, this value was 5.8% larger than the earlier Monday and the best for the reason that second half of January. In distinction, on Thursday, March 28, these futures registered their weekly minimal settlement value, €61.80/t. This value was nonetheless 4.6% larger than the earlier Thursday.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ICE and EEX.

AleaSoft Vitality Forecasting’s evaluation on the prospects for vitality markets in Europe and the financing and valuation of renewable vitality tasks

Present electrical energy market costs could also be an issue for renewable vitality builders who used overly optimistic value forecasts to enhance financing circumstances. Lengthy?time period value forecasts of AleaSoft Vitality Forecasting and AleaGreen have a scientific foundation that gives coherence and high quality. As well as, these forecasts have hourly granularity, confidence bands and as much as 30?12 months horizons. Lengthy?time period value curve forecasting reviews can be found for the most important European markets, in addition to for markets of America and Asia.