In the second week of March, costs in European electrical energy markets confirmed few variations in comparison with the earlier week, besides within the MIBEL market, the place they doubled. Even so, the Iberian Peninsula registered the bottom costs. Photovoltaic vitality manufacturing in Spain and Portugal reached the degrees of the top of August and set one other document for a March month. Wind vitality manufacturing fell in most markets. On March 14, Brent futures reached their highest value since early November, $85.42/bbl.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind vitality manufacturing

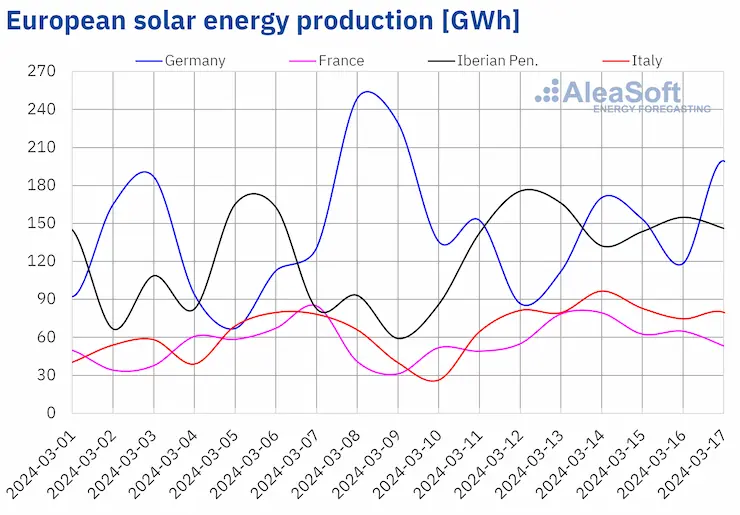

Within the week of March 11, photo voltaic vitality manufacturing elevated in most main European electrical energy markets in comparison with the earlier week. The Spanish market reached the biggest enhance, 48%, reversing the downward pattern of the earlier week. The French market registered the smallest enhance, 12%, rising for the third consecutive week. The German market was an exception to the upward pattern. On this market, after 4 weeks of will increase, photo voltaic vitality manufacturing fell by 2.5%.

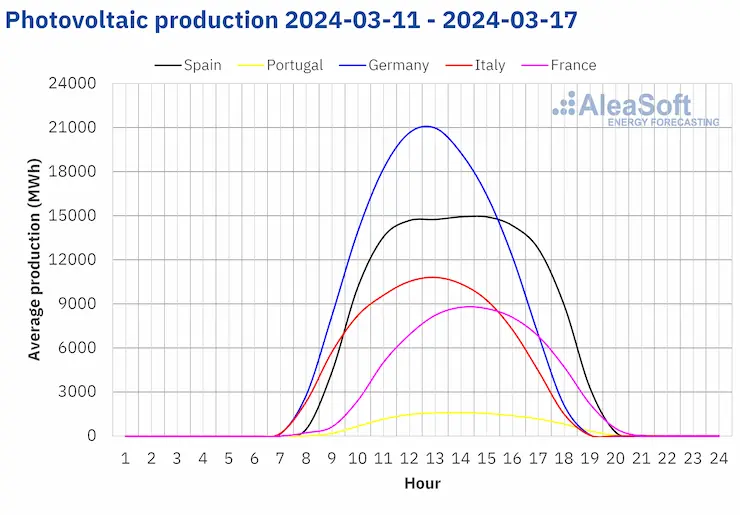

Within the Iberian Peninsula, the very best photo voltaic photovoltaic vitality manufacturing information for a March month had been damaged once more. On the 12th, the Spanish and Portuguese markets produced 143 GWh and 14 GWh, respectively. These manufacturing ranges had been final registered on the finish of August.

For the week of March 18, in line with AleaSoft Vitality Forecasting’s photo voltaic vitality manufacturing forecasts, the pattern registered within the earlier week can be reversed. Photo voltaic vitality manufacturing will enhance in Germany however it’s going to lower in Spain and Italy.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

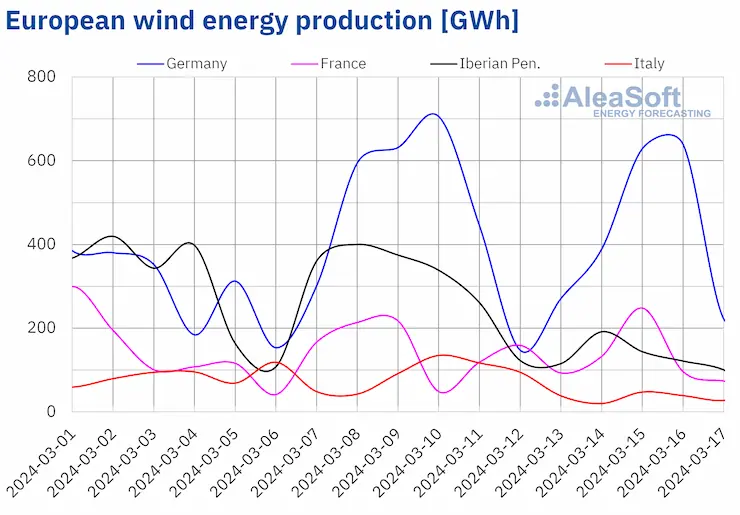

Within the week of March 11, wind vitality manufacturing decreased in most main European electrical energy markets in comparison with the earlier week. The Portuguese market registered the biggest decline, 61%, persevering with the downward pattern of the earlier week. The German market registered the smallest decline, 4.9%, reversing the earlier week’s enhance. Then again, wind vitality manufacturing in France elevated by 1.1%, additionally reversing the earlier week’s pattern.

For the week of March 18, AleaSoft Vitality Forecasting’s wind vitality manufacturing forecasts predict that the traits registered in most markets in the course of the week of March 11 will reverse. Wind vitality manufacturing will enhance within the Iberian Peninsula and Italy and it’ll lower in Germany and France.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

Electrical energy demand

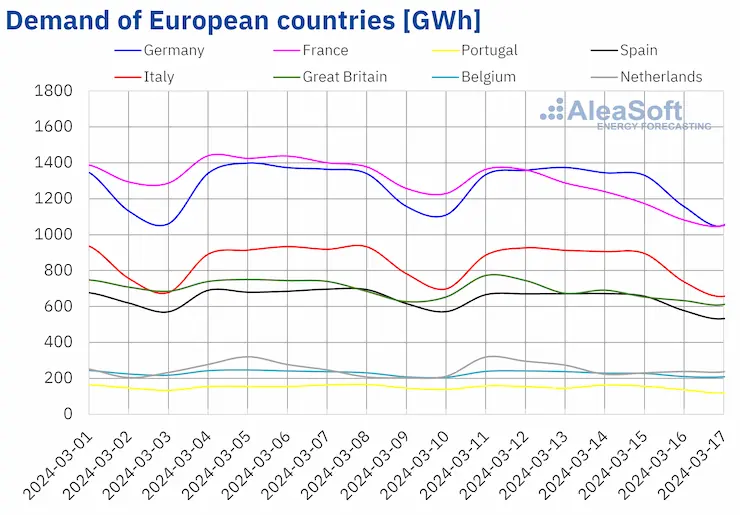

Within the week of March 11, electrical energy demand fell on every week?on?week foundation in most main European electrical energy markets, persevering with the downward pattern of the earlier week. The French market, the place demand fell for the second consecutive week, registered the biggest decline, 11%. The Belgian market registered the smallest decline, 1.2%, additionally for the second consecutive week. The Dutch market was the exception to the downward pattern. On this market, after 4 weeks of decline, demand elevated by 4.1%.

On the identical time, common temperatures elevated in all analyzed European markets. Will increase ranged from 1.1 °C in Italy to three.3 °C in Portugal.

For the week of March 18, in line with AleaSoft Vitality Forecasting’s demand forecasts, the downward pattern will proceed in France, Spain, Italy and Belgium. In distinction, demand will enhance in Germany, Portugal, Nice Britain and the Netherlands.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

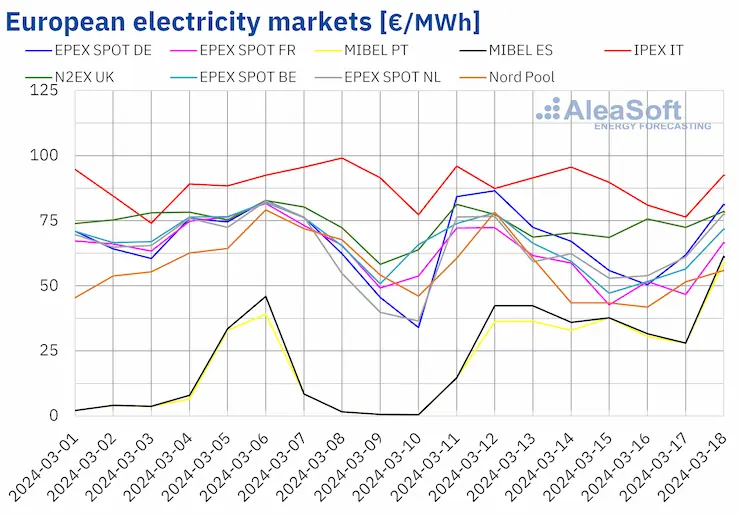

European electrical energy markets

In the course of the week of March 11, common costs in most main European electrical energy markets remained little modified from the earlier week. The exception was the MIBEL market of Spain and Portugal. After registering weekly costs beneath €15/MWh within the first week of March, within the week of March 11, it reached the very best share value rises once more, with weekly averages exceeding €30/MWh. The Spanish market common elevated by 136% and the Portuguese market, by 141%. Weekly costs additionally rose within the N2EX market of the UK and within the EPEX SPOT market of the Netherlands and Germany, with will increase of 0.6%, 1.0% and 5.9%, respectively. In the remainder of the markets analyzed at AleaSoft Vitality Forecasting, costs declined between 2.5% within the IPEX market of Italy and 15% within the Nord Pool market of the Nordic nations.

Within the second week of March, weekly averages had been beneath €65/MWh in most analyzed European electrical energy markets. The exceptions had been the German market, the British market and the Italian market, with averages of €68.34/MWh, €73.50/MWh and €88.23/MWh, respectively. Then again, regardless of the will increase, the Portuguese and Spanish markets registered the bottom weekly costs once more, which had been €30.89/MWh and €33.24/MWh, respectively. In the remainder of the analyzed markets, costs ranged from €54.23/MWh within the Nordic market to €63.24/MWh within the Dutch market.

Relating to hourly costs, within the second week of March, solely the Iberian market registered costs beneath €1/MWh, regardless of the rise in its weekly common value. Most of those costs occurred on Monday, March 11. On that day, the MIBEL market registered 13 hours with a value of €0/MWh, underneath the affect of excessive ranges of wind vitality manufacturing in Spain.

In the course of the week of March 11, the decline within the common value of gasoline and CO2 emission rights exerted a downward affect on European electrical energy market costs. Electrical energy demand additionally fell in most analyzed markets. Then again, the autumn in wind vitality manufacturing led to increased costs in markets such because the Iberian market or the German market, the place photo voltaic vitality manufacturing additionally fell.

AleaSoft Vitality Forecasting’s value forecasts point out that within the third week of March costs would possibly observe the identical pattern of the present week in most analyzed European electrical energy markets.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from OMIE, EPEX SPOT, Nord Pool and GME.

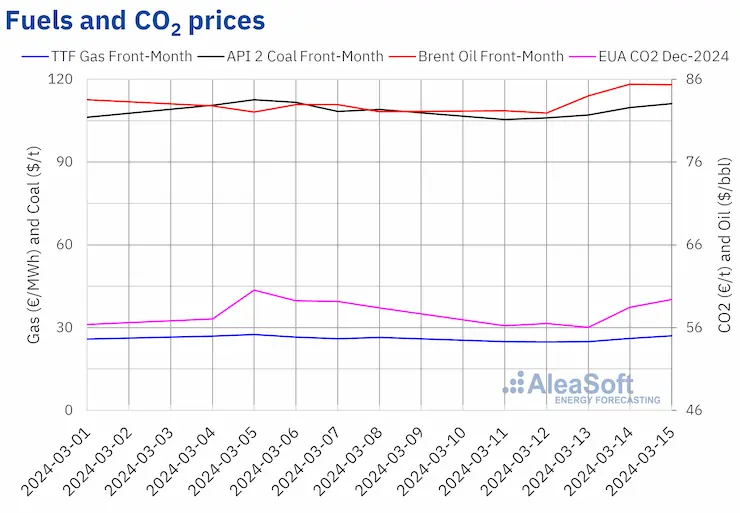

Brent, fuels and CO2

Settlement costs of Brent oil futures for the Entrance?Month within the ICE market registered value will increase in most classes of the second week of March. Nevertheless, on Tuesday, March 12, with a slight lower from Monday, these futures reached their weekly minimal settlement value, $81.92/bbl. Then again, on account of the registered will increase, on Thursday, March 14, they reached their weekly most settlement value, $85.42/bbl. In accordance with knowledge analyzed at AleaSoft Vitality Forecasting, this value was 3.0% increased than the earlier Thursday and the very best since early November 2023. On Friday, the settlement value was again down barely to $85.34/bbl, nonetheless 4.0% increased than the earlier Friday.

Within the second week of March, the Worldwide Vitality Company revised upwards its oil demand forecast for 2024, which led to settlement costs above $85/bbl within the final classes of the week. OPEC+ manufacturing cuts and the drop in oil shares of america additionally contributed to this conduct.

As for TTF gasoline futures within the ICE marketplace for the Entrance?Month, settlement costs remained beneath €25/MWh within the first three classes of the second week of March. These futures registered their weekly minimal settlement value, €24.77/MWh, on Tuesday, March 12. In accordance with knowledge analyzed at AleaSoft Vitality Forecasting, this value was 9.8% decrease than the earlier Tuesday and the bottom because the finish of February. As of Wednesday, March 13, costs began to rise till they reached their weekly most settlement value, €27.03/MWh on Friday, March 15. This settlement value was 2.4% increased than the earlier Friday.

Within the second week of March, provide considerations continued as a result of disruptions in exports from the Freeport liquefied pure gasoline plant in america. Forecasts of wind vitality manufacturing declines in a part of Europe and elevated demand in Asia additionally contributed to TTF gasoline futures costs will increase. Nevertheless, European reserve ranges prevented additional value rises.

As for settlement costs of CO2 emission rights futures within the EEX market for the reference contract of December 2024, they began the second week of March with declines and so they remained beneath €57/t till Wednesday. On that day, these futures registered their weekly minimal settlement value, €56.04/t. In accordance with knowledge analyzed at AleaSoft Vitality Forecasting, this value was 5.4% decrease than the earlier Wednesday and the bottom within the first half of March. Within the remaining classes of the second week of March, costs elevated. Consequently, on Friday, March 15, the settlement value was €59.39/t, 1.7% increased than on the earlier Friday.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ICE and EEX.

AleaSoft Vitality Forecasting’s evaluation on the prospects for vitality markets in Europe and the vitality transition

The third webinar of 2024 of AleaSoft Vitality Forecasting and AleaGreen passed off on Thursday, March 14. This webinar was the 42nd of their month-to-month webinar sequence and it featured visitor audio system from EY for the fourth time. Along with the prospects for European vitality markets, the webinar analyzed regulation, financing of renewable vitality initiatives, PPA, self?consumption, portfolio valuation, the inexperienced hydrogen public sale and the Innovation fund.

AleaSoft Vitality Forecasting and AleaGreen will maintain their subsequent webinar on April 11. On this event, the webinar will give attention to vitality storage and it’ll have the participation, for the third time, of Raúl García Posada, Director at ASEALEN, the Spanish Vitality Storage Affiliation.