Costs at PJM Interconnection’s 2025/2026 base residual public sale (BRA) spiked to $269.92/MW-day for many assets within the wholesale energy market, pointing to a tightening supply-demand stability that might have vital implications for the regional transmission group (RTO).

The 2025/2026 BRA—a aggressive capability public sale that procures energy provide assets prematurely of the supply 12 months to fulfill demand within the area’s 13-foot footprint—procured 135,684 MW from June 1, 2025, via Could 31, 2026, PJM stated on July 30. Moreover, the overall Mounted Useful resource Requirement (FRR) obligation—the place an eligible load-serving entity meets fastened useful resource necessities with their very own capability assets—added one other 10,886 MW.

Mixed, the public sale and FRR commitments totaled 146,570 MW, representing an 18.5% reserve margin—solely barely above PJM’s 17.8% goal reserve margin however notably decrease than the 20.4% reserve margin procured for the 2024/2025 supply 12 months 12 months, PJM stated.

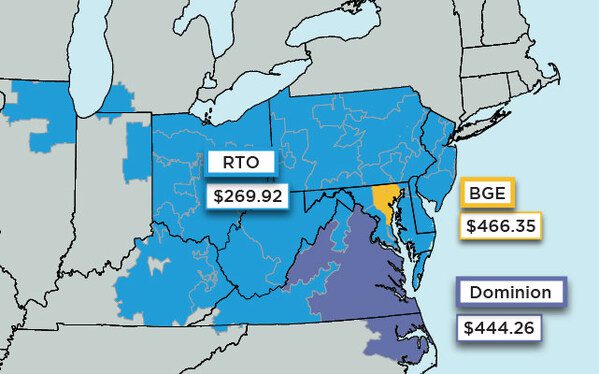

The public sale cleared a various mixture of assets: 48% fuel, 21% nuclear, 18% coal, 1% photo voltaic, 1% wind, 4% hydro, 5% demand response, and a couple of% from different sources. Nevertheless, two zones—BGE in Maryland and Dominion in Virginia—“cleared simply wanting their reserve requirement, leading to costs being set on the zonal cap.” Costs at BGE soared to $466.35, whereas Dominion reached $444.26.

“This is because of inadequate assets inside these areas and constraints on the transmission system that restrict the flexibility to import capability,” PJM defined. “These costs point out that these areas would profit from both further assets, further transmission to permit elevated imports into these areas or a mix of the 2.”

Outcomes Level to a Dire Want for Funding in New Technology

Whereas the RTO’s capability market—or Reliability Pricing Mannequin (RPM)—is only one of a number of wholesale energy markets PJM manages, the BRA capabilities as a bellwether for future funding wants, grid reliability, and the general well being of the ability provide system within the area.

In a nutshell, in comparison with PJM’s day-ahead and real-time power markets, the RPM ensures long-term grid reliability by securing future capability—the suitable energy of energy provide assets essential to fulfill predicted power demand usually three years into the longer term. The BRA primarily permits PJM to acquire useful resource commitments to fulfill the area’s unforced capability obligation for a capability supply 12 months (this public sale’s interval spans June 1, 2025, to Could 31, 2026).

As a complete, in every BRA, PJM goals to acquire a goal capability reserve degree for the RTO in a “least-cost” method whereas additionally taking into consideration reliability-based constraints on the placement and kind of capability that may be dedicated. PJM allocates the price of these commitments to load-serving entities (like NRG Power or Vistra) via a locational reliability cost, which is then paid to energy provide assets for efficiency. The full value for the 2025/2026 BRA was $14.7 billion, PJM stated on Tuesday.

BRA auctions are often held three years prematurely of the supply 12 months. Whereas the 2025/2026 public sale was initially scheduled to be held in Could 2022, it was suspended whereas FERC thought-about the approval of recent capability market guidelines. The current July 2024 public sale stems from a compressed schedule that goals to return to the three-year ahead foundation. In response to PJM, the subsequent BRA—for the 2026/2027 supply 12 months—is scheduled for December 2024.

However in comparison with earlier auctions, the 2025/2026 public sale outcomes level to a number of regarding developments. “The considerably greater costs on this public sale verify our issues that the availability/demand stability is tightening throughout the RTO,” famous PJM President and CEO Manu Asthana. “The market is sending a worth sign that ought to incent funding in assets.”

Surge in Costs Pushed by Retirements, Hovering Demand, Market Reforms

PJM famous that the surge in costs throughout most of its footprint is pushed prominently by “decreased provide provides into the public sale,” primarily “as a result of generator retirements.” About “6,600 MW of era have retired or have must-offer exceptions (signaling intent to retire) in contrast with the turbines that supplied within the 2024/2025 BRA,” it stated.

In the meantime, PJM stated the 2025/2026 BRA procured solely 110.3 MW of capability from new era and 753.8 MW from uprates to current or deliberate era. “The amount of recent era is down from the earlier BRA the place there was 328.5 MW of recent era,” it stated.

Public sale costs had been additionally pushed greater by a rise in projected peak load, PJM stated. Peak load forecast for the 2025/2026 supply 12 months surged upwards to 153,883 MW, in comparison with 150,640 MW for the 2024/2025 BRA, it famous.

As well as, the entity pointed to impacts from current market reforms accredited by the Federal Power Regulatory Fee (FERC). These embrace “improved reliability danger modeling for excessive climate and accreditation that extra precisely values every useful resource’s contribution to reliability,” it stated.

A Key Fear: Fourth 12 months in a Row The place Provide Sources Fell

A extra regarding issue for the RTO is that this 12 months the quantity of provide assets within the public sale fell but once more this 12 months. Because the RTO’s report exhibits, provide supplied into the RPM capability market declined by greater than 13 GW, falling to 135,692.3 MW within the 2025/2026 BRA. That compares to 148,945.7 MW of provide supplied within the 2024/2025 BRA.

“That is the fourth BRA in a row the place the overall capability supplied from non-[energy efficiency (EE)] assets has declined,” the report notes. As well as, the variety of constrained Locational Deliverability Areas (LDAs) dropped from 5 to 2 within the 2025/2026 BRA. “The full quantity of capability, excluding EE Sources, in RPM that cleared decreased by 5,743.6 MW from 140,415.8 MW within the 2024/2025 BRA to 134,672.2 MW within the 2025/2026 BRA,” it stated.

The public sale outcomes add new weight to PJM’s long-voiced issues about its supply-demand stability, which it says have grown extra precarious as useful resource retirements and cargo development exceed the tempo of recent era entry.

In a much-cited examine revealed in February 2023 exploring “a variety of believable eventualities as much as the 12 months 2030,” PJM recommended that as a lot as 40 GW of current era is prone to retirement by 2030. “This determine consists of 6 GW of 2022 deactivations, 6 GW of introduced retirements, 25 GW of potential policy-driven retirements, and three GW of potential financial retirements. Mixed, this represents 21% of PJM’s present put in capability,” it warned.

“The quantity of era retirements seems to be extra sure than the well timed arrival of alternative era assets and demand response, on condition that the amount of retirements is codified in varied coverage aims, whereas the impacts to the tempo of recent entry of the Inflation Discount Act, post-pandemic provide chain points, and different externalities are nonetheless not totally understood,” PJM stated within the 2023 report.

On Tuesday, the RTO underscored that reliability issues are already endemic to most of the North American bulk energy system (BPS). These issues have been echoed by different RTOs and the North American Electrical Reliability Corp. (NERC), the BPS’ reliability watchdog. Earlier this 12 months, NERC outlined eight essential elements which might be posing new hurdles for contemporary energy programs, given what it calls a “hypercomplex” danger surroundings.

PJM famous it had taken measures to facilitate the entry of recent useful resource entries, together with to implement FERC’s current era interconnection reform. However whereas PJM expects about 72,000 MW of assets shall be processed in 2024 and 2025 on account of the reform, it stated it remained involved “with the sluggish tempo of recent era building.”

Up to now, whereas lower than half—about 38 GW—of those assets have already cleared PJM’s interconnection queue, they “haven’t been constructed as a result of exterior challenges, together with financing, provide chain and siting/allowing points,” it famous.

“Interconnection course of reform is continuing, however hurdles stay for a lot of tasks exterior of our course of,” stated Stu Bresler, PJM government vice chairman of Market Companies and Technique, on Tuesday. “We’re contemplating methods to speed up those that can efficiently overcome these challenges and construct.”

Aggressive Turbines Recommend Increased Costs a Good Signal

Whereas commentary remains to be trickling in, aggressive turbines that take part within the organized wholesale market typically considered greater costs signaled by Tuesday’s public sale as promising.

“Whereas there’s nonetheless work to be finished, these worth indicators acknowledge the state of affairs PJM faces and will start to incentivize the funding wanted to ship a dependable system in PJM and in different U.S. markets,” stated Todd Snitchler, president and CEO of the Electrical Energy Provide Affiliation (EPSA), a nationwide commerce group representing aggressive turbines.

“Reliability watchdogs, regulators, policymakers, and PJM itself have been sounding the alarm that the misalignment of energy useful resource retirements and additions poses a critical reliability danger to the grid—particularly within the face of rising demand spurred by knowledge middle and manufacturing development amongst different elements like electrification, excessive climate, and coverage selections,” he added. “Whereas encouraging, the outcomes of 1 public sale don’t set up a development; nevertheless, this public sale does recommend that the preliminary market reforms instituted by PJM to handle the misalignment challenge had a optimistic impression.”

When working as designed, “aggressive electrical energy markets are the most effective mechanism to take care of affordable wholesale energy prices whereas facilitating the entry of recent, progressive applied sciences,” Snitchler defined. “Sufficient compensation, nevertheless, is required for the assets that hold the lights on to be out there when they’re wanted. A dependable system isn’t free, however aggressive electrical energy markets proceed to stay the most effective means to ship a dependable energy system with out unduly burdening clients with unnecessarily greater prices,” he stated.

PJM, nevertheless, indicated rather more work lies forward. Together with efforts to speed up the event of recent era to interchange retiring capability, steps it highlighted in its public sale evaluation embrace enhancing interregional switch capabilities to enhance reliability, addressing provide chain and financing challenges to facilitate venture completion, and rising collaboration with stakeholders to handle rising dangers from new applied sciences and rising demand.

PJM suggests it is going to additionally work to handle different shortcomings recognized by the public sale. The RTO on Tuesday famous that, as a complete, it failed the Three-Pivotal Provider (TPS) Check (the Market Construction Check). The TPS is actually used to judge native market energy. The take a look at ensures no single provider can unfairly affect market costs, sustaining aggressive market circumstances. It assesses market share and participant interactions, serving as an important set off for market energy mitigation to stability structural market energy and decrease pointless interventions. Failure of the take a look at resulted “within the software of market energy mitigation to all current era capability assets,” PJM stated. Mitigation was utilized to “a provider’s current era assets leading to using the lesser of the provider’s accredited Market Vendor Provide Cap for such useful resource or the provider’s submitted provide worth for such useful resource within the RPM Public sale clearing,” it defined.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).