In a brand new weekly replace for pv journal, OPIS, a Dow Jones firm, provides bite-sized evaluation on photo voltaic PV module provide and value developments.

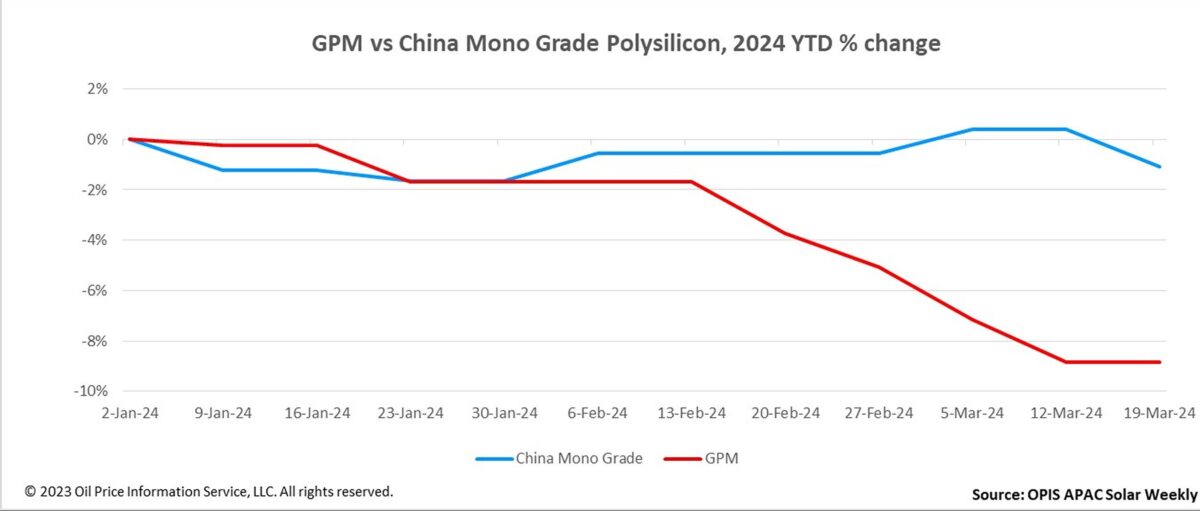

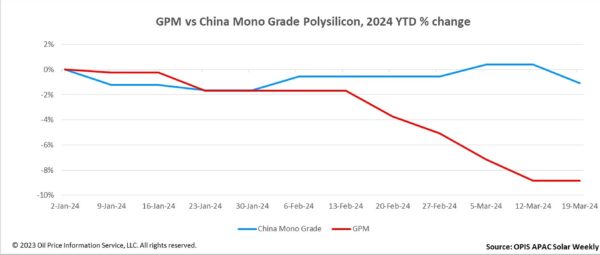

The International Polysilicon Marker (GPM), the OPIS benchmark for polysilicon exterior China, remained regular at $23.813/kg this week, unchanged from the earlier week, reflecting steady market fundamentals

A supply conversant in the worldwide polysilicon market instructed OPIS that costs are poised to fluctuate inside a good vary, because the dynamics of provide and demand within the polysilicon market exterior of China aren’t anticipated to bear vital adjustments within the quick time period.

In parallel, it was reported final week that development has commenced on a solar-grade polysilicon facility in Oman, boasting an annual output of 100,000 MT. In response to a supply with data of this undertaking, development is predicted to finalize by the third quarter of subsequent 12 months, with trial manufacturing slated to begin within the fourth quarter. If all proceeds as deliberate, the manufacturing facility might probably generate a polysilicon output ranging between 10,000 to twenty,000 MT by the tip of 2025.

In response to a polysilicon market supply primarily based in China, the first benefit of the Oman undertaking, as a polysilicon plant exterior of China, stems from its cost-effectiveness technique. The manufacturing gear was sourced from China and China Nationwide Chemical Engineering Sixth Development was engaged because the undertaking contractor. The latter has labored on quite a few polysilicon tasks by main Chinese language corporations. Moreover, the economic park housing the Oman polysilicon undertaking accommodates a further steel silicon undertaking with an annual manufacturing capability of fifty,000 MT, additional contributing to price discount of the polysilicon undertaking, the supply added.

A market observer highlighted that if the cells and modules manufactured utilizing the low-cost polysilicon from the Oman manufacturing facility sooner or later are deemed compliant with the regulation mandating provide chain traceability for merchandise imported into the US, it might probably exert stress on costs throughout the worldwide polysilicon market.

China Mono Grade, OPIS’ evaluation for polysilicon costs within the nation have been assessed at CNY60.33 ($8.34)/kg this week, down CNY0.92/kg, or 1.50% from the earlier week, reflecting buy-sell indications heard.

Quite a few sources attribute the latest decline in polysilicon costs primarily to the inflow of low-priced provides from Tier-2 and Tier-3 polysilicon factories, leading to an total market value lower. These producers are motivated by two components: the necessity to clear current stock and the will to forestall additional stockpiling, driving them to actively promote their merchandise at costs ranging between CNY55/kg and CNY58/kg.

Contrarily, costs from Tier-1 polysilicon corporations stay comparatively steady. This stability stems from their functionality to provide premium P-type polysilicon, which is well-suited for n-type downstream merchandise.

As famous by a market observer, there may be presently an extra of 100,000 mt of polysilicon stock out there, roughly equal to greater than two weeks’ price of manufacturing. The majority of this stock consists of polysilicon unsuitable for n-type downstream merchandise.

The supply added that to handle these inventories, some polysilicon producers have carried out a bundled gross sales technique. This entails requiring prospects all in favour of buying n-type polysilicon to additionally purchase P-type polysilicon concurrently. To incentivize this, polysilicon producers provide a sure low cost on the general value of the bundled buy.

In response to a downstream supply, the prevalent excessive stock of wafers, together with deliberations by some wafer factories to reduce manufacturing, suggests a looming chance of a short-term decline in polysilicon costs, owing to the anticipated weakening demand.

OPIS, a Dow Jones firm, gives vitality costs, information, knowledge, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. It acquired pricing knowledge belongings from Singapore Photo voltaic Trade in 2022 and now publishes the OPIS APAC Photo voltaic Weekly Report.

The views and opinions expressed on this article are the creator’s personal, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and want to reuse a few of our content material, please contact: editors@pv-magazine.com.