Renewables are removed from the first energy supply within the U.S. Not is the price of renewable vitality, notably onshore wind and photo voltaic, essentially the most substantial hurdle to the vitality transition.

New obstacles loom massive. Predominant amongst these is connecting the infrastructure dots between new various sources and the present grid, all whereas sustaining resilience amid a transfer to non-dispatchable vitality sources.

COMMENTARY

It is a widespread development relating to dramatic advances—take into account the Web’s coming of age. Within the early 90s few may grasp the extent to which this new know-how would profoundly change our each day lives. Advance a decade to the early aughts, when market froth made it appear every Web firm would develop to take 100% market share.

The following bursting of this bubble, business consolidation, and eventual restoration confirmed some concepts might have been forward of their time, however their time did come. Contemplate on-line gross sales of pet merchandise; the dot-com bubble noticed a frenzy across the prospects and but by 2015, solely 8% of pet merchandise had been purchased on-line. Look forward 5 years to 2020 and this determine jumped to 30%.

Whereas drawing direct parallels may be harmful, one has to contemplate the next: between 2015 and 2020 wind and photo voltaic’s contribution to the grid greater than doubled from 5.3% to 10.7%. In 2022, it reached 13.7%.

The elevated use of such renewables can largely be attributed to a 42% drop within the unsubsidized levelized value of vitality (LCOE) of photo voltaic and a 27% discount within the LCOE of wind between 2015 and 2020. Nonetheless, there’s a protracted option to go to succeed in the 56% share the U.S. Power Info Company (EIA) associates with the uptake of the Inflation Discount Act (IRA).

Transition Headwinds

Whereas the economics, as depicted by LCOE, of renewables appears like a transparent win, a number of the best headwinds to renewables are inherently ignored within the calculation of their value. Principally, the shortcoming to provide electrical energy when and the place it’s wanted. The result’s that many are overlooking the necessity to construct out grid infrastructure and enhance vitality effectivity.

Grid infrastructure and associated allowing are substantial near-term hurdles. Optimum places for photo voltaic and wind manufacturing are routinely remoted from transmission and distribution strains, and constructing infrastructure to these areas requires a posh allowing course of and buy-in from myriad stakeholders throughout jurisdictions.This has led to idle queues of photo voltaic, wind, and battery tasks that cumulatively exceed the general put in grid capability.

As of July 2023, greater than 2,000 GW of renewable energy languished in line. That’s almost double the quantity of U.S. era capability, in response to the Federal Power Regulatory Fee (FERC). Add to this a sequence of loosely related grids fairly than one sturdy community and it turns into clear that reaching a few 50% renewable vitality share of the grid will likely be a lot more durable than reaching about 15%.

Investments Movement to Effectivity

With the present results of local weather change readily obvious and the looming menace rising bigger, the inexorable march towards extra environment friendly, dependable, and resilient distribution tells us that tying renewables to the grid is just a matter of time and know-how. Ahead-looking buyers and utilities alike acknowledge that rising use of renewables would require enhancing vitality effectivity.

Accordingly, the Worldwide Power Company (IEA) estimates that common annual investments in vitality effectivity might want to greater than double to $777 billion throughout the 2021-2030 interval from the 2016-2020 interval. A win-win, such effectivity investments would supply 16% of the emissions reductions wanted by 2030 to remain on a net-zero path (by comparability, photo voltaic and wind would contribute 33%).

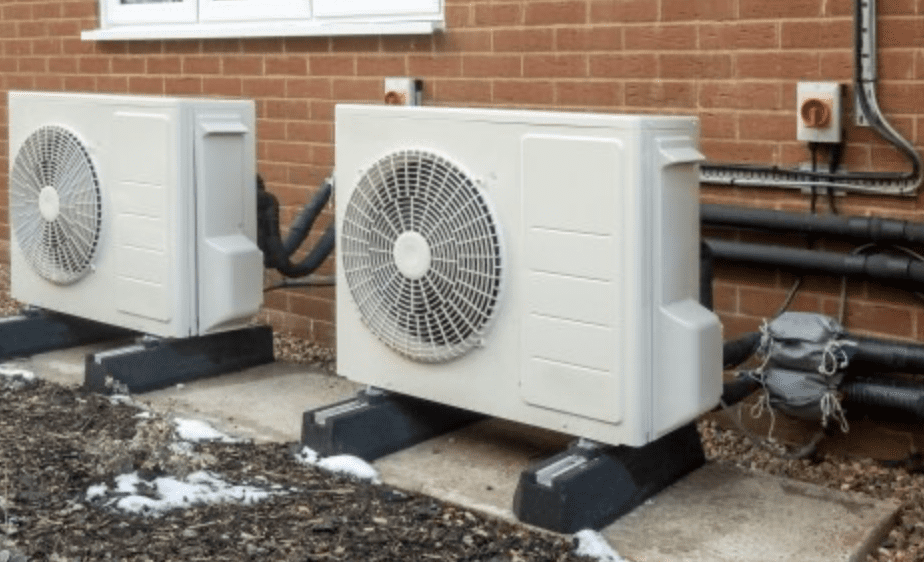

Additional including to the great thing about investments in effectivity is that a lot of the know-how is already out there. The aim is deploying it at scale, and the groundwork has already been laid. One notably enticing know-how that stands to deliver extra demand to the grid are warmth pumps.

In 2020 warmth pumps had a 7% share of vitality demand for heating, and by 2030 the IEA estimates this might attain nearer to twenty%. Amid the transition to a net-zero emissions economic system, the IEA asserts warmth pumps have the fourth-largest potential to scale back CO2 emissions throughout applied sciences with “market uptake,” proper behind EVs

There isn’t any straightforward change to flip and produce renewables on-line. Quite the opposite, at the same time as shopper demand will increase and know-how advances, the hole between the present state and widespread adoption looms. Nonetheless, unhiding the “hidden” vitality useful resource and investing in vitality effectivity presents each a bridge to, and a hall by way of, the transition to a low-carbon economic system.

—Levi Zurbrugg is a Senior Funding Analyst and Portfolio Supervisor at Saturna Capital.