With Public-Non-public Partnerships (PPPs) reaching success for geothermal in Kenya, it has potential to draw undertaking financing for the remainder of Africa.

A paper by Jesse Nyokabi, Johnson Kilangi, Louise Mathu, Sharon Mwakugu, and Kumbuso Joshua Nyoni seems into the mechanism of Non-public-Public Partnerships (PPPs) and the way these can be utilized to mobilize undertaking financing for geothermal initiatives in Africa. It expands upon the premise of a earlier paper that reveals how PPP has enabled geothermal improvement in Kenya, paving the best way for the Japanese African nation to construct 985 MWe of put in geothermal energy capability as of the top of 2023.

The paper was introduced throughout the 2023 World Geothermal Congress in Beijing, China. The complete textual content of the paper may be accessed by way of this hyperlink.

The standing of geothermal in Africa

A lot of the geothermal energy potential in Africa is targeted on the international locations within the Japanese Africa Rift System (EARS), the place temperatures as excessive as 400 °C have bene reported at depths of 2300 meters. Kenya and Ethiopia are main the best way when it comes to put in capability, however geothermal sources have already been confirmed by drilling in Djoubiti, the Democratic Republic of Congo, and Zambia.

Energetic drilling of geothermal wells is ongoing in Djibouti, Ethiopia, and Kenya, whereas slim drilling has been accomplished in Tanzania, Uganda, and Zambia. Different international locations in East Africa are nonetheless within the floor exploration part of improvement.

The potential for retrofitting oil and gasoline wells for geothermal can be thought-about in oil and gas-producing international locations like Algeria, Angola, Libya, and Nigeria. A play fairway evaluation was accomplished (Petrolen & WellPerform, 2020) on the conversion of oil and gasoline wells to geothermal vitality, figuring out a number of necessities for its profitable deployment together with the assure of ample effectively integrity and a close-by warmth demand.

PPPs in Africa

Excessive upfront prices and danger stay one of many main obstacles to geothermal undertaking improvement. Facilitating financing of geothermal initiatives by PPPs will present the chance for brand new geothermal initiatives in Africa. PPPs enable governments to faucet into the experience, innovativeness, and suppleness of the personal sector in direction of the well timed conclusion of initiatives, monetary effectivity, and high quality assurance.

A authorities’s PPP framework sometimes evolves over time, and may fluctuate considerably from one nation to a different. Within the early phases, governments might concentrate on enabling or selling alternatives for PPPs. As soon as a number of PPPs have been applied, the PPP framework could also be strengthened by deal with their stage of fiscal danger. As an example, South Africa targeted on bettering public monetary managements for PPPs.

PPP legal guidelines and establishments have change into more and more frequent in Africa however are nonetheless in improvement in lots of instances. African governments are in several phases of implementing or creating PPP frameworks. The problem, nevertheless, is guaranteeing robust guidelines and laws, in addition to efficient implementation. A PPP program can solely be efficient if the legislative framework gives a transparent, truthful, predictable, and steady authorized surroundings.

A case examine of PPPs in Kenya

Maybe the most effective instance of a profitable PPP implementation in Africa is within the Menengai geothermal energy undertaking in Kenya. The members on this PPP are as follows – Geothermal Growth Firm (GDC) because the steam provider, Kenya Energy (KPLC) because the off-taker, Kenya Transmission Firm (KETRACO) because the celebration accountable for evacuation services, and three Unbiased Energy Producers (IPPs) to construct energy crops of 35 MW capability every.

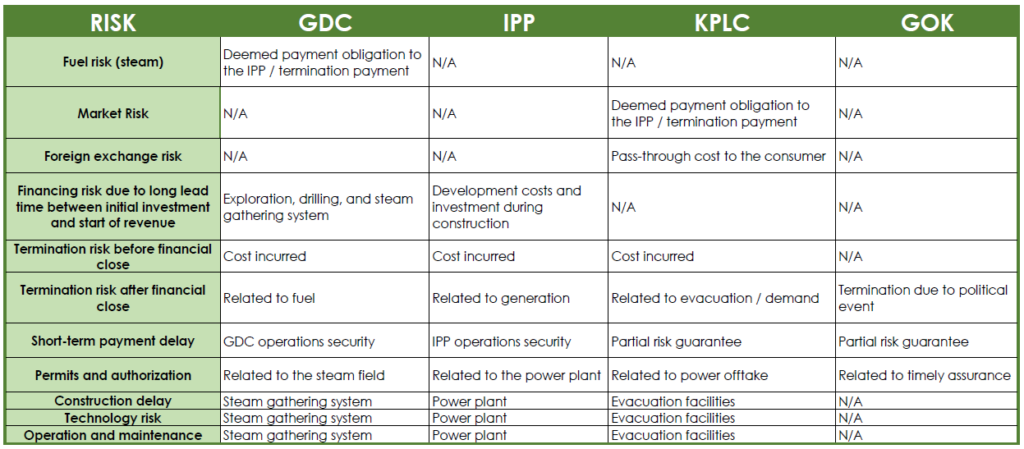

On this instance, the PPP mannequin permits for the distribution of undertaking dangers among the many completely different stakeholders.

Two PPP fashions have been utilized in Kenya. The primary mannequin was adopted for the Olkaria III geothermal energy undertaking, the place public funds had been used for the event of the sphere following exploration and a personal entity was licensed to drill appraisal and manufacturing wells, assemble an influence plant, and function and preserve it. The undertaking began with fairness financing by Ormat and debt financing that was facilitated by the renegotiation of the PPA with off-taker KPLC and a authorities safety package deal offered partially by the Multilateral Funding Assure Company (MIGA). Varied improvement finance establishments offered the required financing.

It’s value noting that the development of the Olkaria III geothermal energy plant started effectively earlier than Kenya had the primary PPP Act of 2013.

The second mannequin concerned the adoption of a Venture Implementation and Steam Provide Settlement (PISSA) underneath the Menengai Part I undertaking. The undertaking is being undertaken by a group seals enterprise mannequin the place state-owned GDC is liable for financing the early phases of steam useful resource improvement, together with drilling, and improvement of the steam gathering system. The IPPs then finance the development and operation of the ability crops and purchase steam provided by GDC.

A 3rd PPP mannequin is being applied for the Corbetti and Tulu Moyo initiatives in Ethiopia, the place an IPP enters into an settlement with the state of state company for the joint improvement of a geothermal discipline. Underneath this settlement, the licensee will drill exploration and manufacturing wells, and assemble and function the ability plant underneath a Construct-Personal-Function-Switch (BOOT) mechanism.

Hurdles for undertaking financing

Even with the chance sharing mechanism of PPPs, securing undertaking financing stays a problem for geothermal initiatives in Africa. An undeveloped monetary market is one in every of these challenges. A lot of the gamers within the African monetary market insist on collateral-based lending, making it unimaginable for a lot of initiatives sponsors to justify the heavy borrowing wanted for geothermal initiatives. Industrial banks are additionally hesitant to lend for lengthy tenures, making it virtually unimaginable to entry financing services with tenures of greater than 10 years in most African international locations.

The talents and experiences wanted to construction and handle PPPs for giant and sophisticated geothermal initiatives might also not be obtainable domestically, making it essential to contract usually very costly international consultants. Public our bodies usually lack the groups that may mix technical expertise with the abilities for structuring, procurement, and financing for PPPs. Thus, personal sector traders are additionally hesitant to have interaction in PPPs for geothermal initiatives.

Lastly, there was some detrimental publicity in Africa that has delay traders. Components comparable to insufficient transparency within the procurement course of, inconsistent determination making within the authorities, and adjustments in tax legal guidelines that present no safety to non-public traders have turned these traders away, selecting as a substitute to spend money on different international locations.