A lot has been manufactured from the difficult macroeconomic setting dealing with cleantech over this previous yr – excessive rates of interest are slowing and even choking off initiatives downstream, whereas innovation on the earlier phases should discover methods to develop with entry to fewer enterprise {dollars} than in earlier years. Nonetheless, beneath the floor, we’re observing shifts within the dynamics of cleantech innovation that supply trigger for optimism.

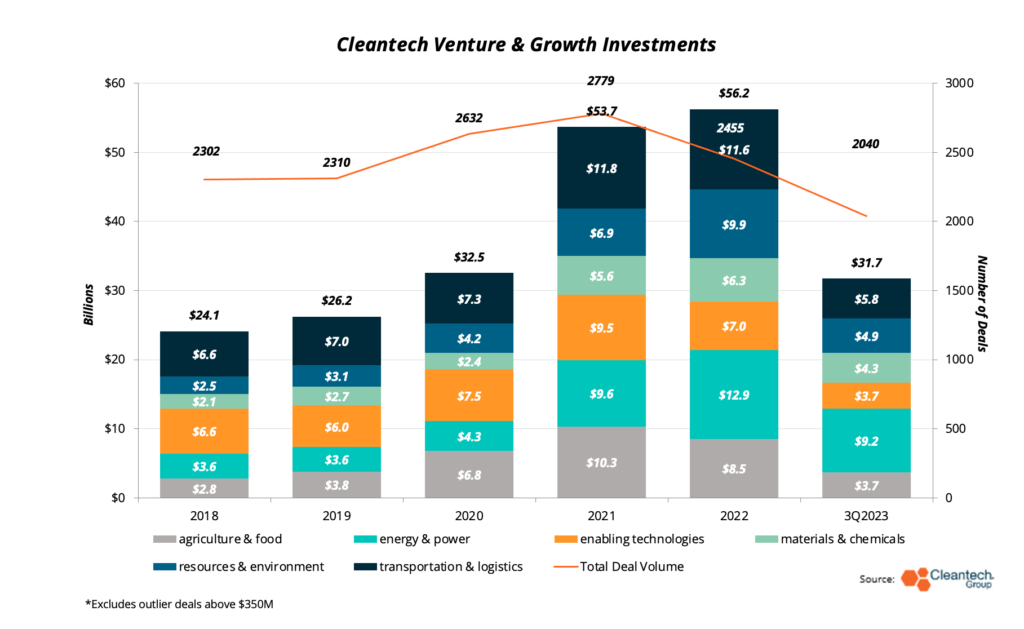

As mentioned within the 2023 Development Watch included in our annual Cleantech 50 to Watch report, cleantech innovators are angling towards the tougher issues in local weather change, whereas on the similar time getting youthful and coming from extra numerous geographies. Seed investments are a better share of total enterprise investments now greater than ever. Whereas the chart above clearly signifies a drop in investments from the 2021 and 2022 funding craze, the priority over a tough touchdown has begun to evolve into preparation for an extended tail for these able to compete over the long term, in difficult segments.

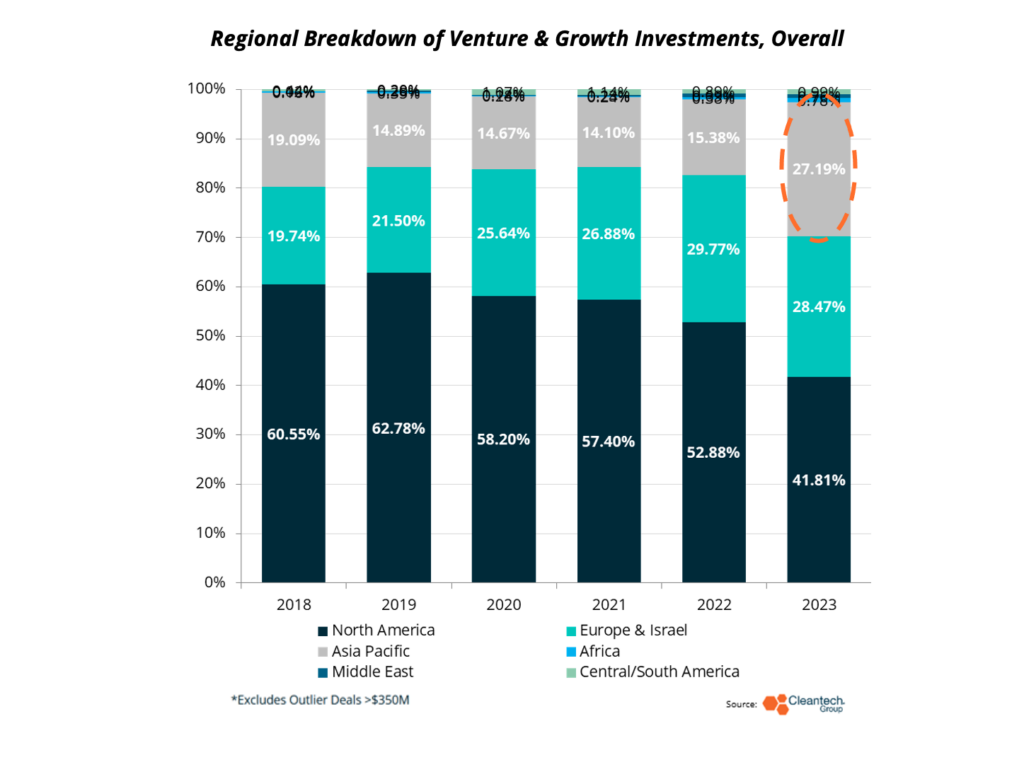

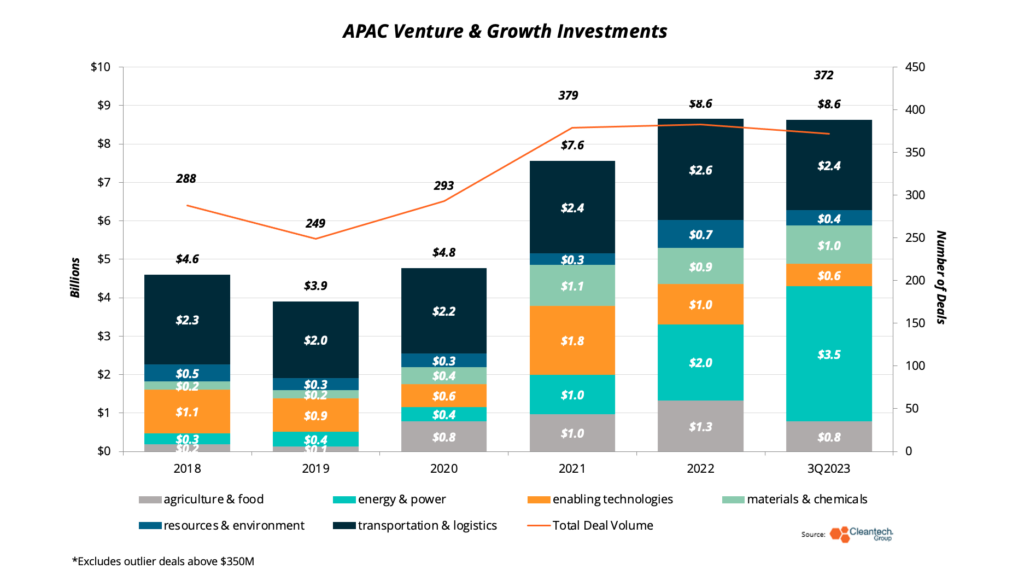

Within the third quarter of 2023, we noticed just a few of those traits develop even additional. Clear now could be that the spike in Asia-Pacific fundraising rounds initially noticed in our APAC Cleantech 25 will now be one of many headlines of 2023. Progress investments in APAC-based innovators has comprised its highest share since we started monitoring the area a decade in the past. What’s extra, in three quarters of 2023, the area has recorded as many {dollars} invested and practically as many offers as in all of 2022.

Embedded on this pattern is the numerous traction that APAC-based innovators in upstream parts for Vitality & Energy have been in a position to construct lately. We’ve got famous all through the previous few years that, whereas long-recognized because the battery and renewables manufacturing powerhouse of the world, APAC-based innovation is pushing the envelope in supplies innovation and high quality merchandise in these areas.

In consequence, it’s no coincidence that that Vitality & Energy investments have exploded within the area whereas Supplies & Chemical compounds investments in 2023 have simply edged out their whole in 2022. Notable offers in these sectors this previous quarter included:

- Hithium (China), an innovator in lithium-ion batteries and core parts, raised $622M from a consortium of largely China-based buyers. Hithium’s capabilities lengthen past battery manufacturing to optimization of electrode supplies and battery recycling applied sciences.

- I-Pulse (Singapore), a nano-electronics firm with know-how to create high-power, extremely exact digital pulses for superior manufacturing of metals and mining, raised a $79.4M spherical.

- Sinoscience Fullcryo (China), an innovator in cryogenic liquification of hydrogen (for storage and transport) raised a $110.5M progress fairness spherical.

Elsewhere within the battery ecosystem, French lithium-ion module producer Verkor raised a $907M progress fairness spherical for its gigafactory in Dunkirk. Innovators in graphene – a light-weight, high-strength materials central to advances in battery conductivity – noticed a breakout quarter:

- Lyten, an innovator with a novel reactor know-how to provide 3D graphene from methane, raised $207M. Lyten’s know-how is predicted to be important to advances in lithium-sulfur vitality storage, a high-density, lower-cost vitality storage method that depends on fewer important supplies.

- Common Graphene, an innovator in graphene manufacturing utilizing chemical vapor deposition, closed a $4.8M spherical.

- BeDimensional will advance their proprietary 2D graphene crystal manufacturing method with a $5.3M fundraising spherical.

This notable quarter in graphene manufacturing seems on its face to be an outlier, however it gels with a pattern that we’ve noticed over the previous yr. Novel manufacturing strategies round battery supplies are persevering with to realize company and investor consideration, because the aggressive benefits in lithium-ion batteries are more-and-more shaped at nanoscale manufacturing enhancements (see latest Perspective on cathode manufacturing innovation).

As battery supplies manufacturing turns into extra refined, infrastructure for onshore provide chains continues to strengthen. Whereas battery recyclers might want to work with manufacturing scrap till battery provide from end-of-life autos comes on-line, we will clearly see which recyclers have put a flag within the floor to handle the reverse provide chains after they materialize. Within the U.S., Redwood Supplies raised a $1B spherical whereas Ascend Parts raised a $542M spherical, additional strengthening their place out there.

Stepping away from the Vitality & Supplies nexus, the Agriculture & Meals business group was one of many few that skilled no drop-off in fundraising quantities from Q2 to Q3. Extra considerably, this previous quarter was the primary time in years that different proteins weren’t even within the high three Ag & Meals sectors receiving funding.

Nearly all of funding this quarter went to precision agriculture, crop inputs, and applied sciences for animal and aquaculture administration. The pattern in crop inputs is a continuation of 1 we’ve noticed for the previous few years (see call-out in deep tech part of the Cleantech 50 to Watch Development Watch) – international crop output should serve a rising international inhabitants within the face of climate sample modifications – inputs to make crops extra productive and resilient are prone to be a pattern for years to return.

Some key offers in crop inputs and decarbonization of animal proteins this quarter included:

- Atlas Agro (Switzerland) plans to broaden manufacturing of inexperienced nitrate-based fertilizers to the Americas with its latest $325M spherical.

- Microbial crop vitamin and safety innovator Aphea.Bio (Belgium) raised a $78M Sequence C spherical, citing targets to fund pilots and broaden amenities.

- Low-impact fish farming know-how innovator eFishery (Indonesia) raised a $200M discovered from a sequence of blue-chip APAC buyers, together with Temasek and SoftBank.

- CH4 International (U.S.) has engineered a seaweed-derived livestock feed complement to cut back methane emissions from enteric fermentation. The corporate raised a $29M Sequence B this quarter.

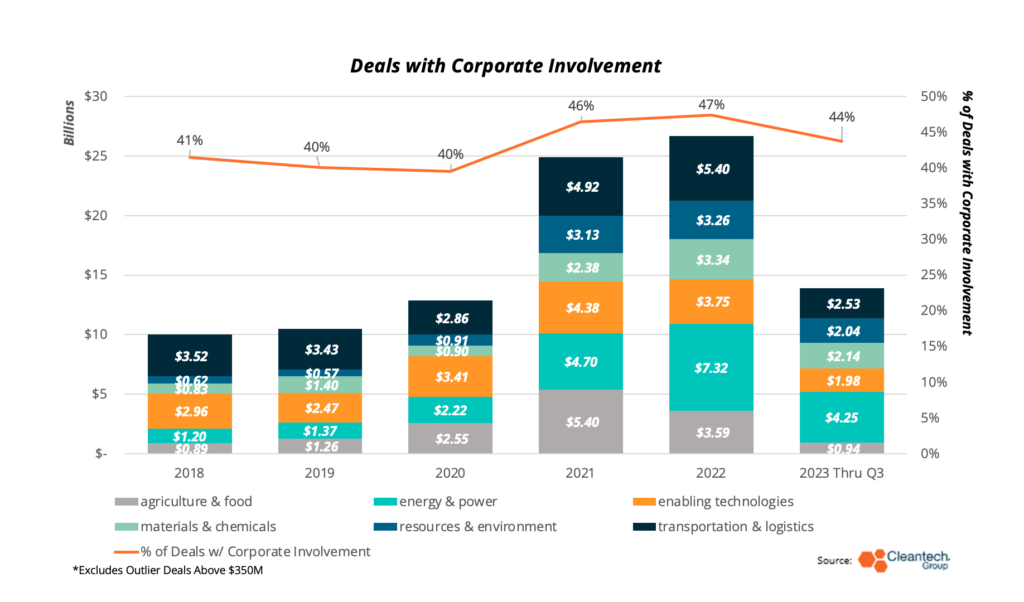

A motive for optimism in Q3’s fundraising numbers is that whereas some business teams noticed a pullback by buyers, participation from company buyers is usually in line with latest years, and in absolute numbers will nonetheless outpace the pre-pandemic years. It is a important indicator that the downstream demand homeowners are remaining within the applied sciences which might be nonetheless present process improvement in the present day.

Company engagement – be it via investments or partnerships – developed in clear themes all through Q3 as properly. Some key developments occurred in:

- Nuclear fusion. Sumitomo introduced a partnership with Tokamak Vitality (UK) for joint know-how improvement. Helion (U.S.) and Nucor partnered to develop a 500MW fusion energy plant, particularly for purposes in metal manufacturing.

- Precision agriculture. Precision-spraying innovator Good Apply (U.S.) was acquired by John Deere. Bayer and CRISPR innovator Pairwise (U.S) introduced a partnership to develop purposes for short-stature corn.

- Carbon seize, use, storage (CCUS) – Amazon continues to put money into and companion with CCUS innovators, getting into into an settlement with 1pointfive (U.S.) and CarbonCapture (U.S.) to seize as much as 350,000 tons of emissions. Carbon Engineering (Canada) was acquired by Occidental Petroleum for $1.1B, with plans to make use of the know-how in 100 direct air seize crops.

We stay up for bringing you our tackle 2023 This fall traits in early 2024. Preserve a watch out for the 2024 International Cleantech 100 record, additionally due out in early 2024, the place we are going to have a look at these similar traits via a year-in-review lens and ship our perspective on the 100 most promising cleantech innovators within the ecosystem in the present day.