As freight markets push additional on, world ship recycling markets stay disadvantaged of tonnage, making it an more and more suffocating atmosphere for ship recyclers to function in, stories money purchaser GMS.

Bangladesh and Pakistan rely closely on imported ship’s metal, not just for home / large-scale infrastructure initiatives, but in addition for its comparatively ‘more healthy’ and ‘rust-free’ situation than different types of imported scrap metallic / metal (HMS 1, HMS 2, shredded metal, and so on.)

Subsequently, ship recycling stays a win-win / net-positive transaction for all events concerned, says GMS, as a relatively increased USD/ton is paid for the metal popping out of the world’s end-of-life ships that may in any other case be of no additional use. It is usually extra simply obtainable than native mining, logistics, and even imports.

“On the provision aspect, the dry bulk / container sectors proceed to surge in charges because the begin of the yr, leading to homeowners of even 25-30-year-old vessels discovering an honest route to maintain their models employed in.

“Furthermore, the continued and surprising surge in freight charges has not solely lured the tanker sectors in (leaving it positioned at traditionally robust ranges), however it has additionally taken the one-off Hong Kong Conference / specialist models that have been drip-feeding some much-needed life into an emaciated Alang again in January, away from the bidding tables.”

Tonnage scarcity hasn’t spared the Turkish market both, the place the Lira and native fundamentals conspired to lastly break the spine that held vessel costs firmly up this far, ensuing within the business seeing Aliaga consumers roll again ranges by about USD 10/MT this week, the much-anticipated first in a very long time.

Ongoing geopolitical hurdles stay elementary to this most up-to-date and sustained surge in constitution charges, says GMS. “This additionally begs the query as as to if China is even dealing with an financial downturn at current, so bullish have the buying and selling markets been of late.”

However, recycling areas are recovering from the lack of about USD 100/LDT in worth over the course of 2023 as Pakistan and Bangladeshi recyclers battled L/C and finance restrictions on all of their vessels till two months in the past. With political disruptions and elections almost settled throughout all sub-continent ship recycling markets, and India’s elections now being reportedly rescheduled till Could, nervy Alang recyclers are the one ones reticent to supply agency, a minimum of till the (anticipated) end result of the elections are confirmed.

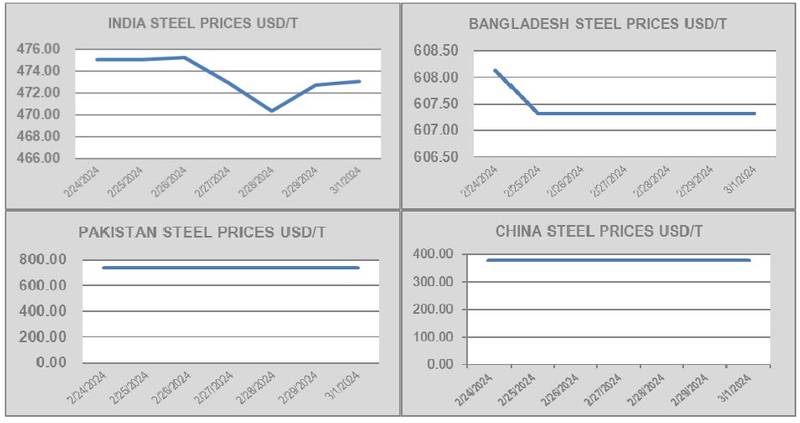

For week 9 of 2024, GMS demo rankings / pricing are: