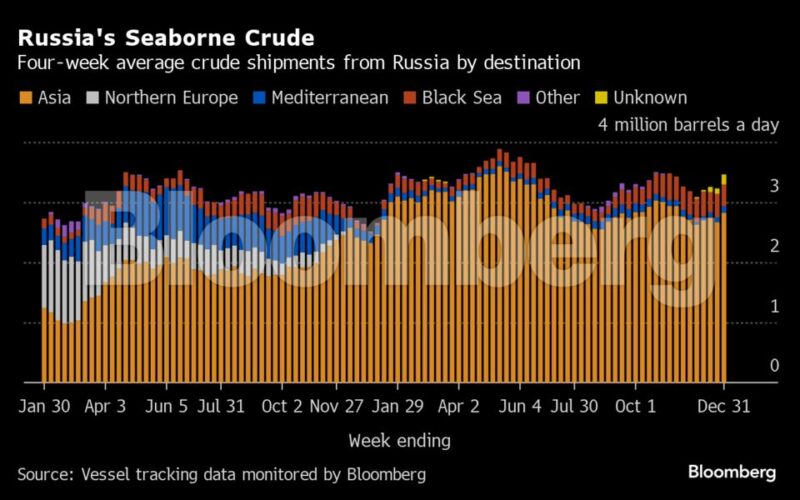

By Julian Lee (Bloomberg) Russia’s seaborne crude exports ended the 12 months on a excessive, as four-week common shipments climbed to the highest since early November and weekly flows jumped to essentially the most since July.

About 3.46 million barrels a day of crude had been shipped from Russian ports within the 4 weeks to Dec. 31, tanker-tracking information monitored by Bloomberg present. That was up by 230,000 barrels a day from the interval to Dec. 24. The extra unstable weekly common jumped by 560,000 barrels a day to three.78 million.

4-week common crude shipments had been about 120,000 barrels a day beneath their Could-June degree — the baseline utilized by Moscow for the discount in mixed crude and product exports it has pledged to its companions within the OPEC+ group.

Russia has stated it’ll deepen its oil export cuts to 500,000 barrels a day beneath the Could-June common through the first quarter of 2024, after Saudi Arabia stated it could extend its unilateral one-million-barrel-a-day provide discount and a number of other different members of the OPEC+ group agreed to make additional output curbs. The Russian lower will probably be shared between crude shipments, which will probably be decreased by 300,000 barrels a day, and refined merchandise, in response to Deputy Prime Minister Alexander Novak.

For December, the discount was set at 300,000 barrels a day, unfold throughout each crude and refined merchandise in undefined proportions. That complicates assessments of whether or not Russia is assembly the dedication to its OPEC+ companions.

About 1.7 million barrels a day of Russia’s crude exports move by means of the Purple Sea, the place service provider vessels are more and more coming below assault from Houthi rebels in Yemen. Tankers carrying Moscow’s oil are unlikely to be focused, however that doesn’t rule out the danger of a ship carrying Russian provides being hit by mistake.

Shipments of Russia’s Sokol crude to India, which takes many of the cargoes of that grade, have faltered. 5 out of six ships heading for the ports of Paradip and Vadinar got here to a halt in December. 5 are actually heading again by means of the Strait of Malacca, although they proceed to point out their Indian locations. The sixth stays idle off Sri Lanka.

4 extra cargoes of Sokol crude have been loaded onto ships which can be additionally exhibiting locations in India. Of these, one is anchored east of Singapore, one is idling west of the Philippines and the opposite two had been final seen near the South Korean port of Yeosu, the place they loaded the cargoes through ship-to-ship switch.

Russia’s oil processing slipped once more in late December. Extra storm warnings for the Black Sea curtailed operations on the Tuapse plant, which ships the majority of the gas it produces overseas through the Black Sea.

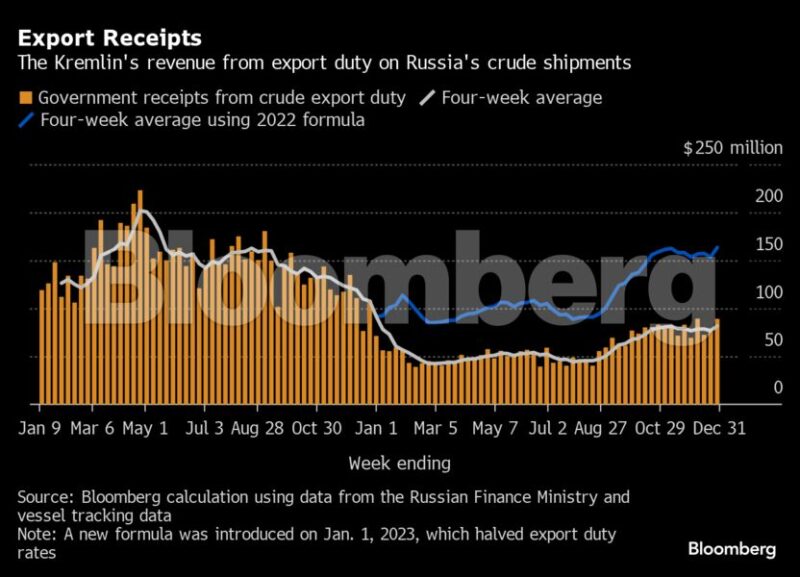

The Kremlin’s four-week revenues from oil export duties rose to their highest degree for the 12 months. Russia has scrapped oil export duties with impact from the beginning of 2024, with oil producers set to pay larger output taxes.

Flows by Vacation spot

Russia’s seaborne crude flows within the 4 weeks to Dec. 31 rose to 3.46 million barrels a day. That was up from 3.23 million barrels a day within the interval to Dec. 24. Shipments had been about 120,000 barrels a day beneath the typical seen in Could and June.

All figures exclude cargoes recognized as Kazakhstan’s KEBCO grade. These are shipments made by KazTransoil JSC that transit Russia for export by means of Novorossiysk and the Baltic port of Ust-Luga and usually are not topic to European Union sanctions or a value cap.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to differentiate them from these shipped by Russian firms.

Asia

Noticed shipments to Russia’s Asian clients, together with these exhibiting no last vacation spot, rose to 2.99 million barrels a day within the 4 weeks to Dec. 31, up from 2.75 million barrels a day within the interval to Dec. 24. They had been the very best since October.

About 1.08 million barrels a day of crude was loaded onto tankers heading to China within the 4 weeks to Dec. 31. China’s seaborne imports are supplemented by about 800,000 barrels a day of crude delivered immediately from Russia by pipeline, both immediately, or through Kazakhstan.

Flows on ships signaling locations in India averaged about 1.03 million barrels a day within the 4 weeks to Dec. 31.

Each the Chinese language and Indian figures will rise because the discharge ports grow to be clear for vessels that aren’t at present exhibiting last locations.

The equal of about 680,000 barrels a day was on vessels signaling Port Stated or Suez in Egypt, or are anticipated to be transferred from one ship to a different off the South Korean port of Yeosu. These voyages usually finish at ports in India or China and present up within the chart beneath as “Unknown Asia” till a last vacation spot turns into obvious.

The “Different Unknown” volumes, working at about 170,000 barrels a day within the 4 weeks to Dec. 31, are these on tankers exhibiting no clear vacation spot. Most of these cargoes originate from Russia’s western ports and go on to transit the Suez Canal, however some may find yourself in Turkey. Others may very well be moved from one vessel to a different, with most such transfers now going down in the Mediterranean, off the coast of Greece.

Europe and Turkey

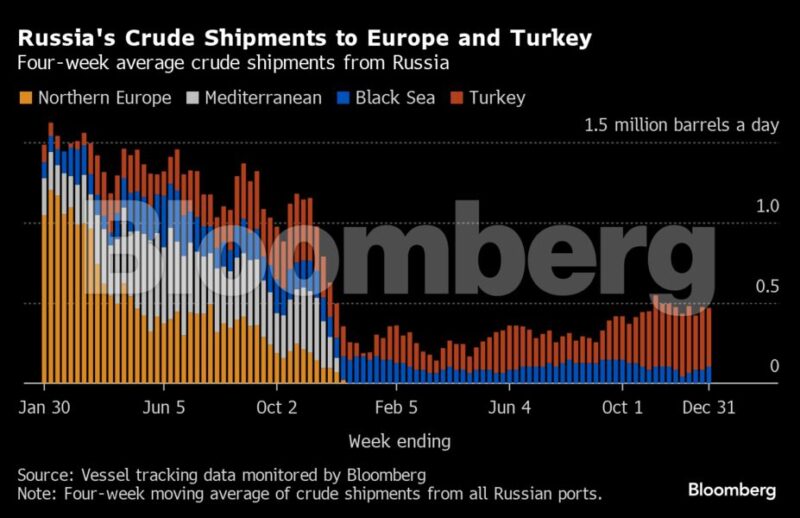

Russia’s seaborne crude exports to European international locations have collapsed since Moscow’s troops invaded Ukraine in February 2022. A market that consumed about 1.5 million barrels a day of short-haul seaborne crude, coming from export terminals within the Baltic, Black Sea and Arctic has been misplaced virtually utterly, to get replaced by long-haul locations in Asia that are way more pricey and time-consuming to serve.

Mixed flows to Turkey and Bulgaria, Russia’s solely two remaining consumers near its western ports, have stabilized between about 450,000 and 500,000 barrels a day, tanker-tracking information present.

Exports to Turkey edged decrease to about 365,000 barrels a day within the 4 weeks to Dec. 31. They’re nonetheless near 3 times as excessive because the lows they hit in July and August.

Flows to Bulgaria, now Russia’s solely European marketplace for crude, edged as much as a six-week excessive of about 104,000 barrels a day in the latest four-week interval. Flows are recovering from earlier disruption at Novorossiysk, although the halt to shipments from the Black Sea port has affected the typical till year-end. Bulgaria’s parliament has authorised a measure that may finish imports of Russian oil from March, 9 months sooner than permitted below an exemption to EU sanctions on purchases of Moscow’s oil.

No Russian crude was shipped to northern European international locations, or these within the Mediterranean within the 4 weeks to Dec. 31.

Vessel-tracking information are cross-checked towards port agent studies in addition to flows and ship actions reported by different info suppliers together with Kpler and Vortexa Ltd.

Export Income

Inflows to the Kremlin’s struggle chest from its crude-export responsibility rose to $89 million within the seven days to Dec. 31. In the meantime four-week common revenue additionally gained, rising by $5 million to a five-week excessive of $82 million, its highest in a 12 months.

The export responsibility price for December was $3.37 a barrel, based mostly on a mean Urals value of $79.23 through the calculation interval between Oct. 15 and Nov. 14. That was about $9.39 a barrel beneath Brent over the identical interval.

Export responsibility was abolished on the finish of 2023 as a part of Russia’s long-running tax reform plans.

Origin-to-Location Flows

The next desk exhibits the variety of ships leaving every export terminal.

A complete of 35 tankers loaded 26.5 million barrels of Russian crude within the week to Dec. 31, vessel-tracking information and port agent studies present. That’s up by about 3.9 million barrels from the determine for the earlier week and the very best weekly quantity since July.

All figures exclude cargoes recognized as Kazakhstan’s KEBCO grade. One cargo of KEBCO had been loaded at Novorossiysk and one at Ust-Luga through the week.

By Julian Lee © 2024 Bloomberg L.P.