Germany-based RWE, among the many world’s main corporations in growth of offshore wind vitality, stated it can purchase three main initiatives off the East Anglia coast of the UK from Sweden’s Vattenfall in a $1.2 billion deal.

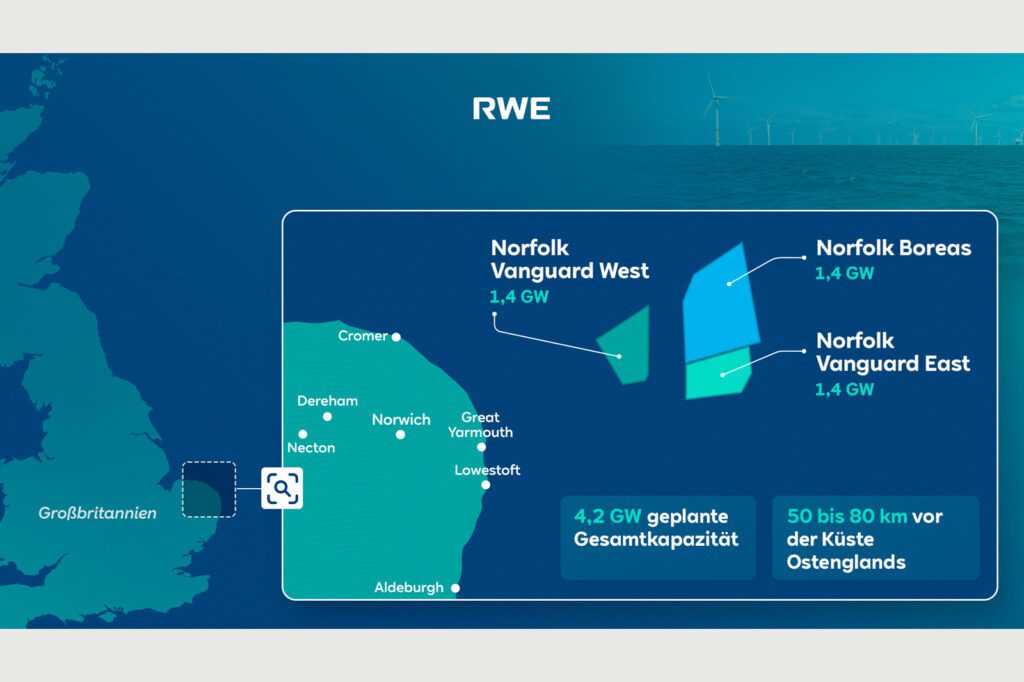

RWE on Dec. 21 stated the initiatives, every with deliberate technology capability of 1.4 GW, are within the Norfolk Offshore Wind Zone, sited 50 to 80 kilometers off the coast of Norfolk in East Anglia. The acquisition settlement is for the Norfolk Vanguard West, Norfolk Vanguard East, and Norfolk Boreas installations, that are all anticipated to enter service by 2030.

The three initiatives, which have been in growth for greater than a decade, have already got secured seabed rights, grid connections, and different key permits for operation. RWE stated the Norfolk Vanguard West and Norfolk Vanguard East initiatives are the closest to getting into business operation, however nonetheless have to safe a Contract for Distinction, or CfD, in one of many upcoming public sale rounds.

Restart Growth

RWE stated it can restart growth of the Norfolk Boreas undertaking. Vattenfall had paused work on that set up earlier this yr, saying Boreas was now not was financially viable. Anna Borg, Vattenfall’s chief government, advised the BBC the brand new settlement “with RWE is nice information for the UK’s vitality safety.”

Vattenfall already had signed a most well-liked provider settlement with Vestas for generators for the Norfolk initiatives, regardless of beforehand naming Siemens Gamesa as its most well-liked provider. Vattenfall had stated it will use 92 of Vestas’ V236-15MW generators, that are Vestas’ largest mannequin. Vestas was additionally named in exclusivity agreements for Norfolk Vanguard East and Norfolk Boreas. Vestas stated Norfolk Vanguard East and Norfolk Boreas may function as many as 184 V236-15MW generators between them.

Sven Utermöhlen, CEO of RWE Offshore Wind, stated, “With the acquisition of the Norfolk Offshore Wind Zone portfolio, we’re taking up three well-advanced offshore wind initiatives from Vattenfall. I’m very comfortable that we’ll work with Vattenfall in direction of facilitating crew continuity to make sure the profitable handover and additional growth of the initiatives. Equally I’m trying ahead to persevering with the work with the provision chain corporations. We are going to ship these as a part of our Rising Inexperienced funding and progress program.”

Billions in Funding

RWE at its Capital Markets Day 2023 earlier this yr introduced plans to take a position €55 billion ($60.7. billion) worldwide from 2024 to 2030, with a purpose of rising its clear vitality portfolio to greater than 65 GW by 2030.

“The UK has been certainly one of our most vital core markets for many years. We’re delighted that we are able to now additional contribute to reaching the UK’s formidable build-out targets for offshore wind,” stated Tom Glover, RWE’s UK Nation Chair. “The well timed and environment friendly deployment of offshore wind is crucial to make sure the UK’s home vitality safety, in addition to reaching our internet zero targets. We very a lot welcome the UK authorities’s current choices on future offshore wind auctions which offers us with the boldness to take a position and represents a optimistic step in maximizing the UK’s clear vitality potential, making certain sustained and lowest costs for shoppers and creating good high quality jobs.”

Borg advised the BBC that Vattenfall will keep a presence within the UK, each with onshore and offshore wind farms. The corporate is constant growth of an 800-MW floating wind farm within the North Sea.

“Each the UK and the offshore market stay enticing over the long run, and we’ll focus our offshore investments in initiatives that are acceptable to our present threat urge for food whereas persevering with to function and develop our current fleet of property,” stated Borg.

—Darrell Proctor is a senior affiliate editor for POWER (@POWERmagazine).