Inflation, fundamentals, currencies (besides in India), vessel pricing, and total weakening sentiments have beset the ship recycling market over the previous week, experiences money purchaser GMS.

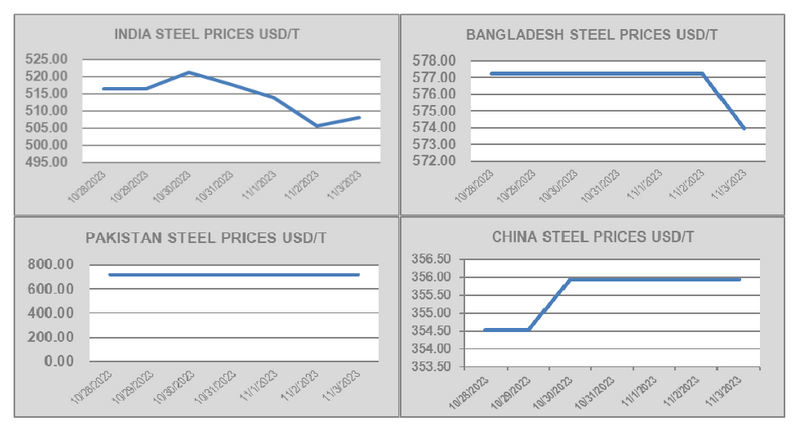

The results have been felt throughout all of the sub-continent ship-recycling locations (even Turkey to an extent), which have cooled by about US$ 20/LDT over current weeks, says GMS. Nevertheless, India and Bangladesh have reported stunning will increase in metal plate costs during the last week.

“Seemingly on the again of worldwide metal plate costs, which have reportedly improved by about 3% over the course of the week, there’s a rising optimism that the ship recycling trade might probably be set for a firmer conclusion to 2023, particularly if present metal plate developments proceed optimistically and have concurrently elevated vessel costs upon the conclusion of Diwali holidays / November.”

Furthermore, in response to current experiences from the bottom, Turkish import metal costs have additionally appreciated by about US$ 11/T, and vessel costs have (straight or not directly) mirrored this firming by bettering about US$ 10/MT on their very own, putting all provide ranges from Aliaga again within the US$ 300/MT area as soon as once more.

“However, there stays the continuing international scarcity of tonnage as largely older, 90s constructed bulkers are being launched for recycling (together with the odd container unit), while provide is but to hit acceptable ranges for the yr. This may increasingly definitely change as we head into 2024 and when all markets are hopefully firing and frequently bettering / upgrading their amenities to Hong Kong Conference requirements, with a purpose to have the required capacities for the anticipated quantity of vessels that’s anticipated to enter into the recycling area subsequent yr.”

Total, after a interval of low provide over the last quarter and a recycling market that has declined from the peaks seen earlier within the yr above US$ 600/LDT, solely to lose over US$ 100/LDT in worth in just a few quick months over the summer time, trade gamers all are hoping for a constructive conclusion to the yr from probably the most secure recycling market – or on the very least, an optimistic welcoming of Q1 2024, says GMS.

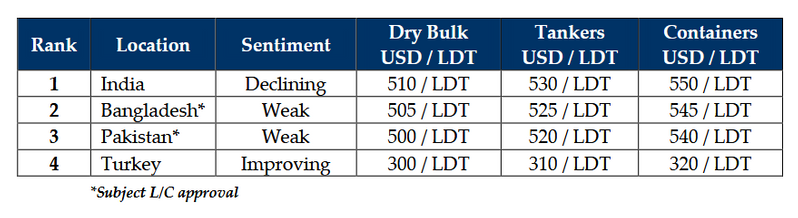

For week 44 of 2023, GMS demo rankings / pricing for the week are: