A Singapore-led consortium has introduced that the unreal intelligence (AI) utility it developed to fight greenwashing considerations will now be capable to entry nationwide knowledge on inexperienced buildings, and help banks issuing sustainability-linked loans (SLLs) in the true property sector in figuring out potential initiatives whereas monitoring whether or not these initiatives obtain particular efficiency targets.

The utility, referred to as Mission NovA!, was incepted in 2021 by Singapore’s central financial institution alongside different business gamers to assist monetary establishments higher determine inexperienced financing alternatives and local weather dangers by AI.

“After we began, we didn’t have a really particular use case,” stated Danielle Jiang, deputy director of the Financial Authority of Singapore (MAS)’s AI improvement workplace at a Singapore Fintech Competition panel dialogue on Tuesday. A call was made final yr to deal with actual property SLLs, contemplating the constructed surroundings’s important contribution to international carbon emissions and the surge in reputation of the financing instrument, Jiang stated.

The expansion of SLLs – loans that incentivise sustainable enterprise actions by tying a borrower’s rates of interest to its achievement of formidable pre-determined sustainability efficiency targets (SPTs) – has been exponential within the city-state, quadrupling in quantity since 2019.

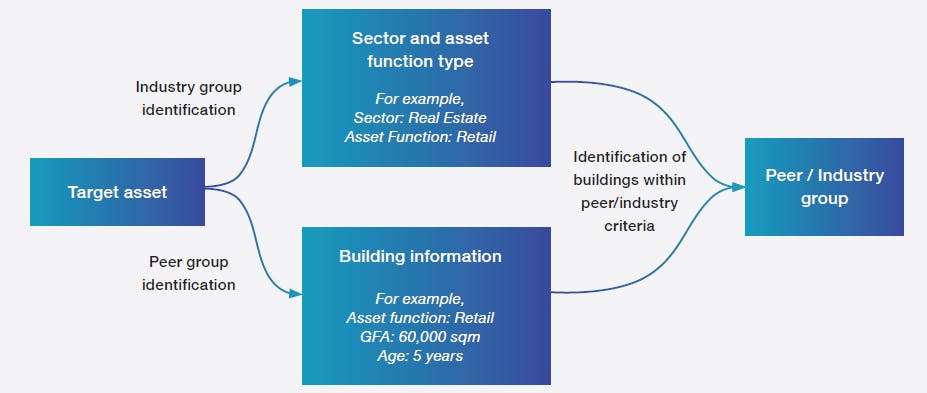

By collaborating with the nation’s Constructing and Building Authority to combine its Tremendous Low Power Constructing (SLEB) database into the AI utility, property-specific peer and business benchmarks may be generated for extra correct comparisons, stated MAS in a press launch. These benchmarks can then assist monetary establishments set formidable key efficiency indicators (KPIs) targets for debtors, which has confirmed to be difficult thus far because of scarce and inconsistent knowledge.

A circulate chart exhibiting the steps taken to generate benchmarks for the true property sector by property traits corresponding to kind, utilization and age. Picture: Financial Authority of Singapore

“Monetary establishments want extra exact targets as a result of we have to have air cowl to ensure that the targets we set will stand in opposition to the check of being good and dependable, versus greenwashing,” stated Kelvin Tan, head of sustainable finance and investments, Asean from HSBC, which is likely one of the consortium members.

The entry to at-source knowledge – or knowledge that’s collected instantly from the unique sources utilizing gadgets with sensors linked to the web – permits banks to observe the progress debtors make in opposition to the chosen SPTs in a well timed method, which may doubtlessly forestall overstating of sustainability claims.

“For the time being, how we monitor these performances is sort of static. We don’t take a look at it from a predictive viewpoint. If we are able to make use of AI to have a look at it in a extra predictive method, that can make it a really highly effective software,” added Tan, talking on the identical panel as Jiang.

The power to forecast future efficiency in opposition to SPTs utilizing AI additionally allows proactive interventions when debtors are prone to breach pre-agreed targets, shared Tan Kiat How, senior minister of state of Singapore’s nationwide improvement ministry on the occasion.

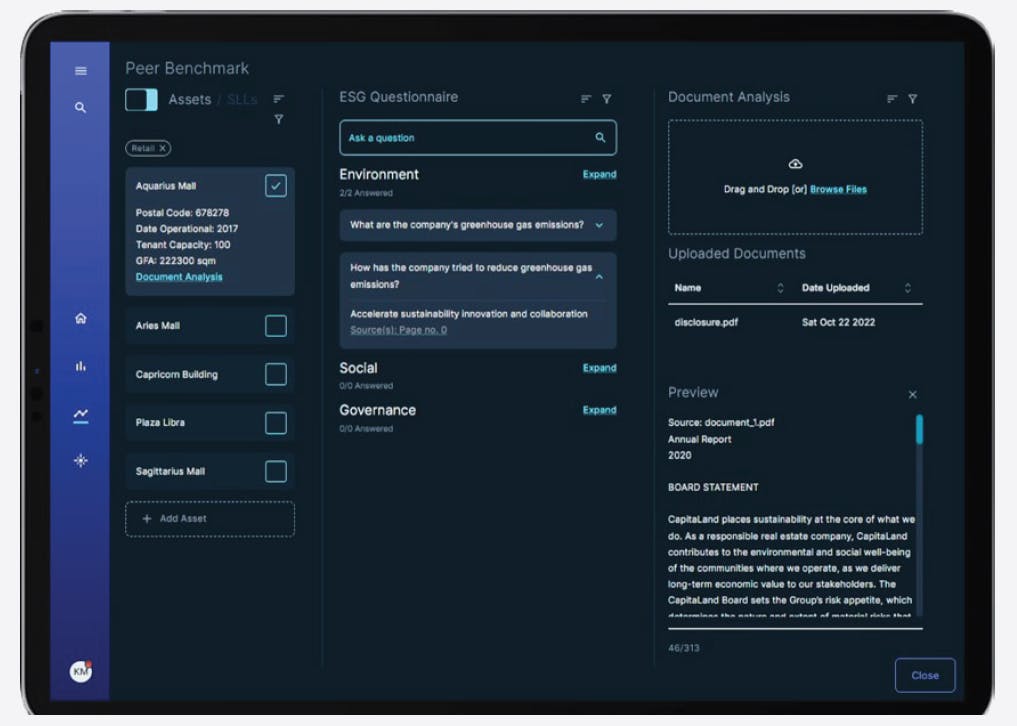

Moreover, the pure language processing capabilities of the AI utility can automate the extraction and categorisation of sustainability info from a borrower’s disclosure paperwork. This could minimize down the time spent and errors from manually reviewing these paperwork.

A screenshot of how NovA!’s proprietary pure language processing engine can extract info from disclosure paperwork to reply a pre-defined set of questions that banks sometimes ask when onboarding debtors. Picture: Financial Authority of Singapore

Based mostly on pilot assessments of the software by consortium members, together with the Singapore-based subsidiary of British lender Normal Chartered and Japan’s Sumitomo Mitsui Banking Company (SMBC), NovA! can doubtlessly determine and facilitate SLL issuances amounting to SG$300 million (US$222.5 million) in comparison with present techniques.

The elevated transparency round sustainability targets from the sharing of information between taking part banks has additionally been estimated to avoid wasting one to 2 man days per SLL for the setting of every KPI.

The 23 consortium members embody all three Singapore-based banks DBS, OCBC and UOB, state investor Temasek, Japan’s largest financial institution Mitsubishi UJF Monetary Group (MUFG), British actual property firm Savills and carbon credit score certifier Verra. Eco-Enterprise understands that discussions are at present underway with Verra about their contribution to the challenge and particulars can be introduced in due time.

On Tuesday, NovA! launched a whitepaper which referred to as on potential tenderers for a second enterprise district that town state is planning for to think about using the AI platform to acquire inexperienced financing. The Jurong Lake District – positioned outdoors Singapore’s metropolis centre and within the western a part of the island – has been envisioned as a mannequin sustainable district which can present over 100,000 new jobs and 20,000 properties by 2050.

Singapore’s buildings account for over 20 per cent of the nation’s carbon emissions. Embodied carbon, which refers to emissions ensuing from the extraction, manufacturing and transportation of building supplies, can account for as much as 40 per cent of emissions over a constructing’s lifetime in international locations like Singapore, the place the lifespan of buildings are shorter with city renewal.

Singapore is at present exploring the appliance of the brand new AI utility to related use instances within the energy, manufacturing and transportation industries, earlier than increasing it globally.

Transferring ahead, NovA! will deal with creating incentives for industries to decarbonise, Jiang stated.

“Lots of effort goes into validation and monitoring, which prices as much as 75 per cent of the entire worth chain. So can AI and knowledge make it quicker and cheaper? ESG shouldn’t be a really painful compliance course of,” she stated. “It must drive worth for society, which suggests when you do good, you ought to be rewarded.”