The Southwest Energy Pool (SPP) is poised to turn out to be the primary regional transmission group (RTO) to supply coordinated operation throughout the Japanese and Western Interconnections, bridging a historic hole to doubtlessly increase regional reliability, financial savings, and efficiencies.

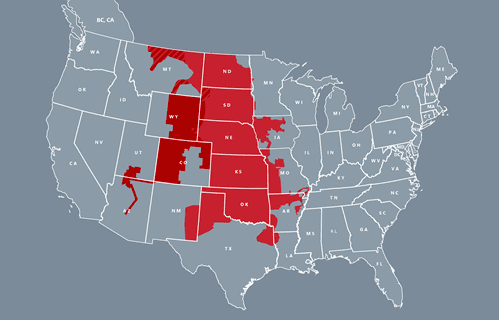

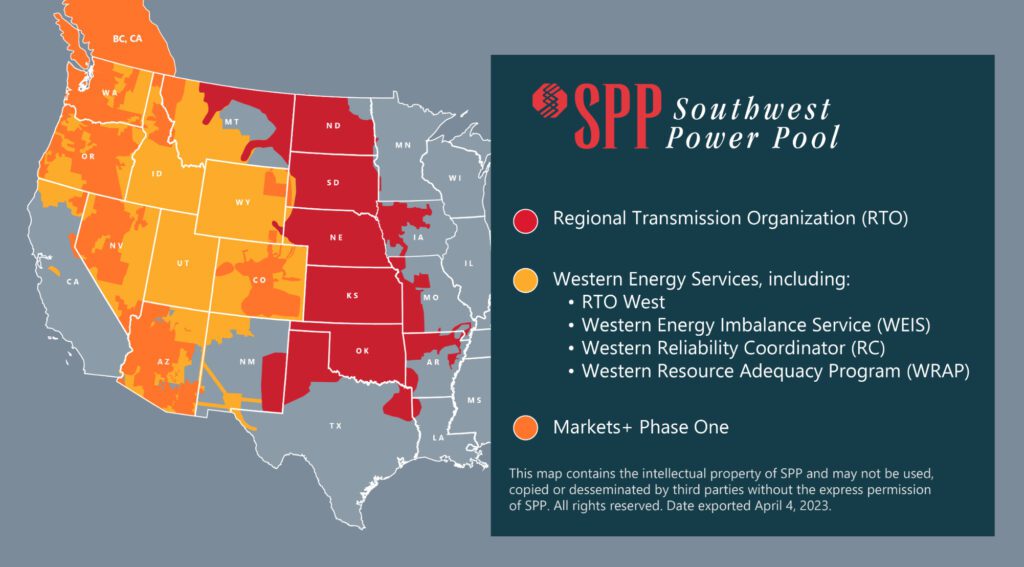

SPP, which has operated as an RTO since 2004, at the moment has 110 member corporations in its Japanese Interconnection service territory of 552,885 sq. miles. Earlier this month, the entity introduced that seven western utilities are getting ready to hitch the RTO as full members when SPP’s RTO West—the growth of its Built-in Market—goes reside in spring 2026.

The utilities embrace Basin Electrical Energy Cooperative, Colorado Springs Utilities, Deseret Era and Transmission Cooperative, Municipal Vitality Company of Nebraska (MEAN), Platte River Energy Authority, Tri-State Era and Transmission Affiliation, and three areas of the Western Space Energy Administration (WAPA): Colorado River Storage Mission (CRSP), Rocky Mountain Area (RM) and Higher Nice Plains-West (UGP).

On Sept. 12, WAPA, a Division of Vitality (DOE) entity that markets and transmits hydropower from federal hydropower vegetation, mentioned CRSP, RM, and UGP would pursue closing negotiations to increase their participation within the SPP RTO West.

SPP earlier this month additionally revealed that Basin Electrical has dedicated to pursue membership. Whereas Basin Electrical, MEAN, Tri-State, and WAPA’s UGP-East Area are already members of SPP—having joined the RTO in 2015 once they positioned their respective amenities within the Japanese Interconnection beneath SPP’s tariff—their determination to pursue RTO membership will successfully embrace their Western Interconnection amenities, an SPP spokesperson informed POWER.

“That is the primary main growth of SPP’s RTO service territory since October 2015 when it grew from 9 to 14 states by incorporating the Built-in System into its full suite of market and transmission providers,” the grid operator famous.

Leaving the WEIS for RTO West

Whereas the group of seven western utilities has negotiated phrases and situations of becoming a member of the RTO, which SPP’s board accepted in July 2021, membership agreements should be signed by Oct. 10, SPP famous.

All seven utilities at the moment take part in SPP’s Western Vitality Imbalance Service (WEIS) market, which SPP launched in 2021. The WEIS balances the demand for real-time vitality and the ability produced by greater than 150 producing models in its footprint. “The WEIS, which facilitates environment friendly real-time vitality dispatch, offered an estimated $31.7 million in web advantages for members in 2022 and diminished wholesale vitality prices by $1.35/MWh,” SPP mentioned.

Nevertheless, when the group formally joins the RTO in 2026, they’ll go away the WEIS and take part within the RTO built-in market, wherein all members, each japanese and western will take part. “The famous enhancements to reliability and elevated worth for members was a key driver for making the transfer to full RTO membership,” SPP added.

A Bigger Growth Envisioned

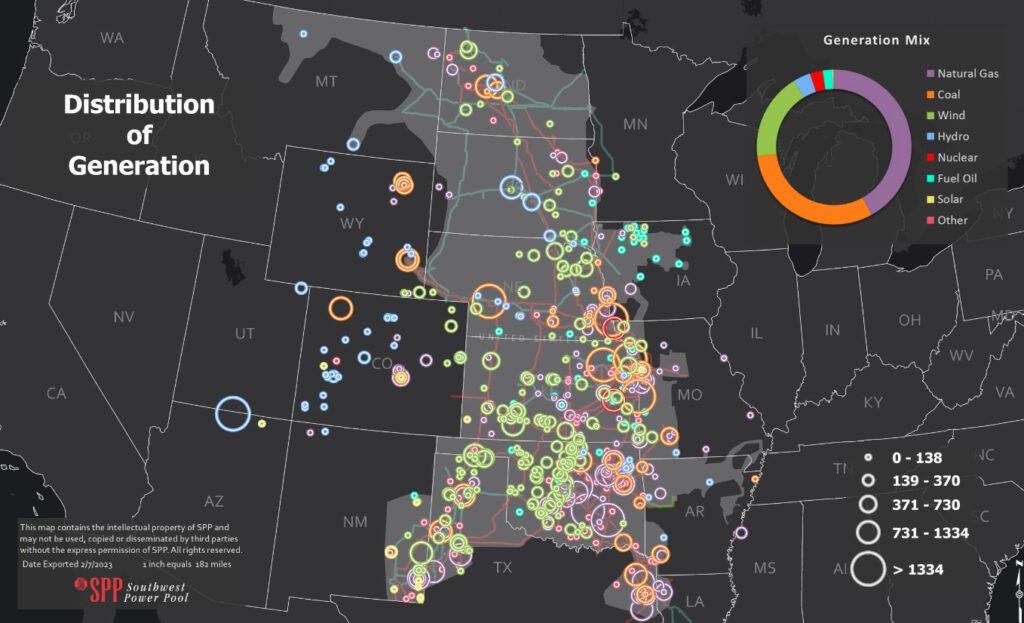

In response to SPP, RTO West is a part of a long-term market growth technique designed to ship elevated worth to its present and new members. The expansion will permit “SPP and its members to reinforce sustainability and reliability within the west and includes optimizing vitality markets throughout three DC ties, creating new alternatives for vitality transfers and elevated resilience for each present and future members,” it has mentioned.

Trying additional forward, the grid entity plans to combine extra members beginning in 2027. “Different western entities curious about becoming a member of SPP’s rising RTO market footprint have a deadline of March 1, 2024, to sign their curiosity in the event that they want to take part available in the market by March 2027,” it famous.

The introduced dedication by the seven utilities follows years of session. A number of have explored SPP’s RTO growth within the Western Interconnection since October 2020, evaluating the phrases, prices, and advantages of placing Western amenities beneath the RTO’s tariff.

An SPP Brattle research printed in 2020 prompt the transfer can be mutually useful, poised to supply $49 million a yr in financial savings. Up to date modeling assumptions about participant footprint, technology portfolios, pure fuel costs and projected hydrology situations made public in September 2022 prompt increasing SPP to the West may produce a web whole of $55 million to $73 million.

“Within the 2022 research, the Eastside sees [adjusted production cost (APC)] advantages of $3 to $8 million/yr, in comparison with $17 million/yr within the 2020 SPP Research; the Westside sees APC advantages of $68 to $81 million/yr within the 2022 Research, in comparison with $16 million/yr within the 2020 SPP Research,” Brattle mentioned. “Further advantages not calculated embrace elevated reliability and resiliency, system flexibility, and diminished administrative charges.”

WAPA famous that “Participation within the SPP RTO within the West is predicted to supply operational and reliability advantages together with enhanced transmission planning and growth mechanisms.” The initiative “is in line with WAPA’s dedication to develop other ways of doing enterprise to retain and improve the worth of WAPA’s sources in a dynamic vitality trade.” WAPA added the transfer aligns with commitments to maintain tempo with adjustments within the trade, which may “be certain that we, together with our prospects, are well-positioned for the continued success of our mission to soundly present dependable, cost-based hydropower and transmission to our prospects and the communities we serve.”

A Daring New Path for SPP

The prospect is poised to ship a step change for SPP, an entity fashioned within the Japanese Connection in 1941 when 11 regional energy corporations banded collectively to maintain an Arkansas aluminum issue powered across the clock to fulfill crucial protection wants. Whereas the group was retained to take care of regional electrical reliability and coordination, after the 1965 Northeast blackout, SPP joined 12 different entities to kind what turned the North American Electrical Reliability Company (NERC). In 1991, it applied working reserve sharing, and in 1997, it turned an authorized reliability coordinator. It earned its RTO designation from the Federal Vitality Regulatory Fee (FERC) in 2004.

In 2007, SPP launched its first real-time balancing market after which transitioned to a day-ahead market to turn out to be a single, consolidated balancing authority in 2014. In December 2019, it started serving prospects within the West when it launched its Western Reliability Coordination service on a contract foundation. In February 2021, it efficiently expanded its providers with the profitable launch of the WEIS.

In response to data-driven grid evaluation service GridStatus, SPP’s transfer to combine Western amenities—the “largest RTO/ISO growth since MISO South in 2013”—may lead to “larger connectivity and unified planning over the patchwork of the West,” and it may assist “facilitate a discount in each energy costs in addition to whole emissions.”

GridStatus notes, citing the Nationwide Renewable Vitality Laboratory’s 2021 Seams research, that the japanese and western grids are interconnected by solely about 1.3 GW of high-voltage direct present ties. “In a single sense, these utilities becoming a member of SPP is solely the continuation of the identical traits seen elsewhere over the previous 30 years, however it is a notably notable step in that it brings consolidated operational administration to a considerable portion of each the japanese and western interconnects,” it mentioned.

As GridStatus notes, whereas the japanese grid is dominated by wholesale markets, the California Impartial System Operator (CAISO) is the one ISO/RTO within the West. CAISO, notably, manages the Western Vitality Imbalance Market (WEIM), the West’s first real-time vitality market, which, established in 2014, at the moment has 22 members. Whereas SPP’s potential RTO West members are all members in its WEIS market, none take part in CAISO’s WEIM.

“With real-time buying and selling established, the subsequent aim has been extra fulsome day-ahead participation and optimization. CAISO’s variant is the Prolonged Day-Forward Market (EDAM), whereas SPP is engaged on Markets+,” GridStatus famous. “Regardless of over a decade of labor in the direction of westward growth from CAISO it appears doable that SPP has taken pole place,” on condition that CAISO is “uniquely managed by California’s legislature,” it mentioned.

Nevertheless, GridStatus predicts that in early 2024, “a serious shoe will drop” within the “ongoing battle” for real-time choices and day-ahead proposals. The Bonneville Energy Administration (BPA), an entity that markets wholesale electrical energy from 31 federal dams within the Northwest, is slated to “determine which day-ahead market, if any, they’ll be a part of,” it says.

“CAISO has lengthy relied upon hydropower imports from the Pacific Northwest and definitely covets that enormous, clear, and maybe most significantly, dispatchable, useful resource as a planning software. Regardless of their proximity to California, the truth that BPA continues to be contemplating SPP’s Markets+ in a transparent signal of the aforementioned political trepidation.”

—Sonal Patel is a POWER senior affiliate editor (@sonalcpatel, @POWERmagazine).