Within the final week of October, the weekly common value on the Nord Pool market was the best since mid-June. Between October 26 and 30, the Iberian Peninsula’s MIBEL market reached the bottom value of all markets, supported by excessive wind vitality era. TTF gasoline futures remained on the €50/MWh degree for the third consecutive week.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind vitality manufacturing

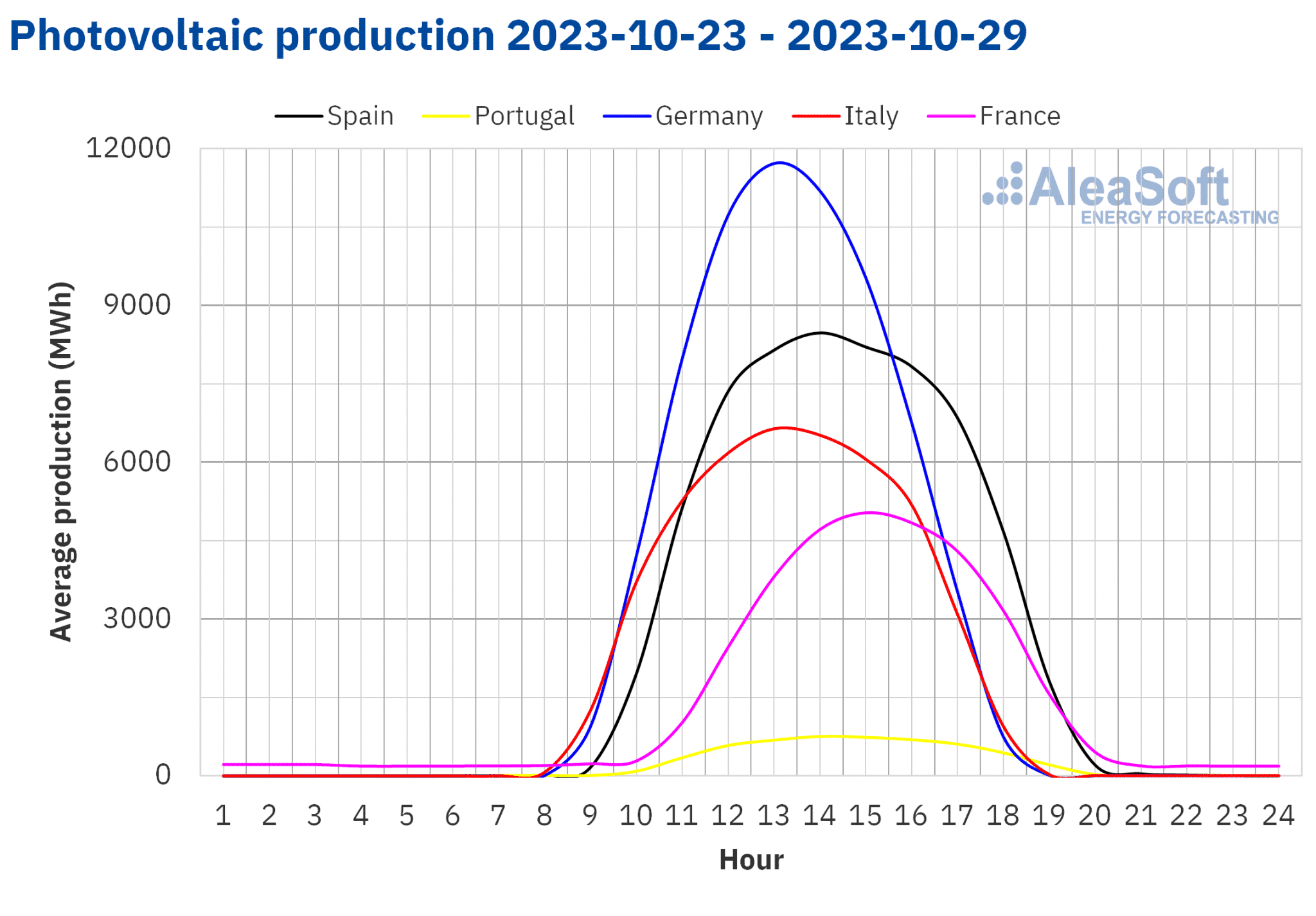

Within the week of October 23, most main European electrical energy markets skilled a lower in photo voltaic vitality manufacturing in comparison with the earlier week. The German market skilled the biggest lower of 36%. The Spanish market registered the smallest lower of 0.5%. In distinction, the Portuguese and Italian markets recorded will increase in photo voltaic vitality manufacturing of seven.8% and 5.9% respectively.

In line with AleaSoft Power Forecasting‘s photo voltaic vitality manufacturing forecasts for the week of October 30, a rise is anticipated in Germany and Spain. The Italian market would be the exception to this pattern.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

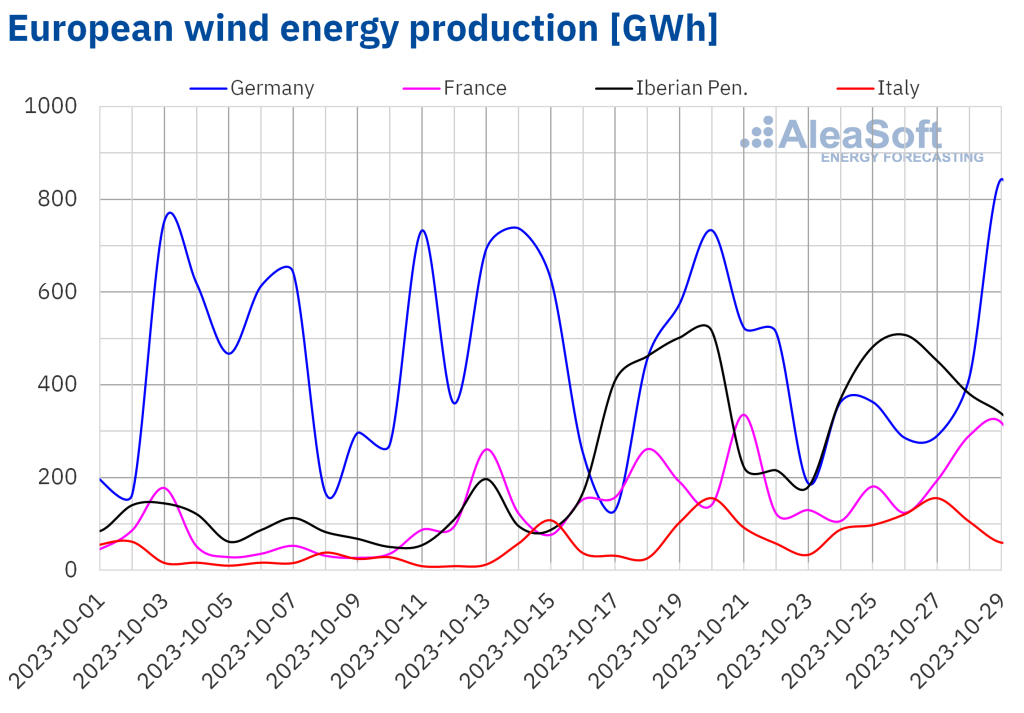

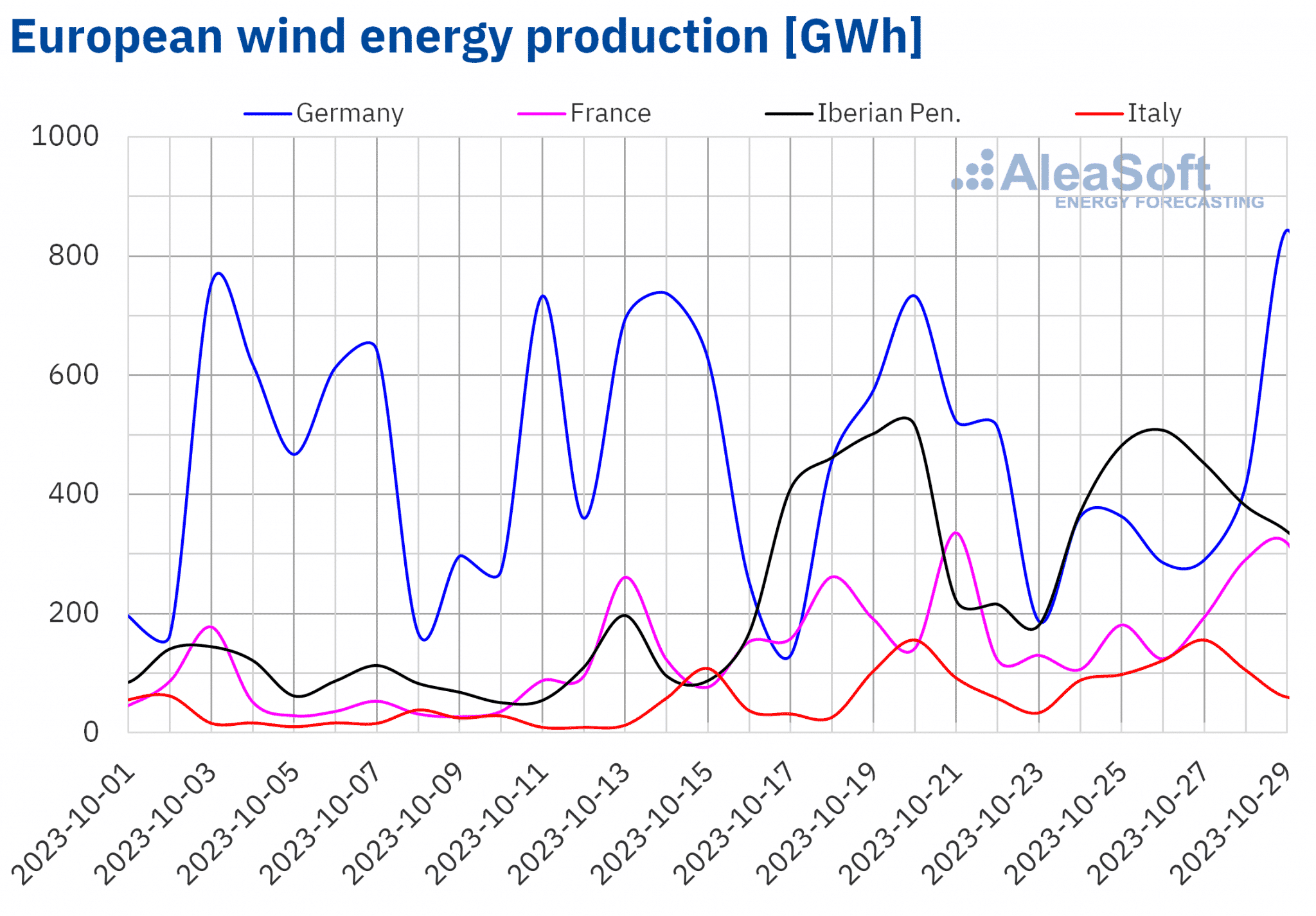

Within the week of October 23, wind vitality manufacturing elevated within the Southern European markets in comparison with the earlier week. The Italian market registered the biggest improve with 31%. Within the Spanish and Portuguese markets, manufacturing elevated by 9.8% and three.6% respectively. In Germany, wind vitality manufacturing decreased by 14% and in France by 1.3%. Regardless of the decline in weekly manufacturing, 843 GWh of wind vitality was generated in Germany on October 29, the best degree since mid-March.

In line with AleaSoft Power Forecasting‘s wind vitality manufacturing forecasts for the week of October 30, the manufacturing utilizing this expertise will improve in all analyzed markets besides the Iberian Peninsula.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Electrical energy demand

Within the week of October 23, all main European markets noticed a rise in electrical energy demand in comparison with the earlier week. The will increase ranged from 0.8% within the German market to eight.8% within the Dutch market.

Throughout the identical interval, common temperatures decreased in many of the markets analyzed, apart from Germany. The Iberian Peninsula and France registered temperature decreases of greater than 1°C. Within the remaining markets, the typical temperature lower didn’t exceed 0.8°C.

In line with AleaSoft Power Forecasting‘s demand forecasts, solely Portugal and the UK are anticipated to see a rise in demand for the week of October 30. In the remainder of the analyzed markets, a lower in demand is anticipated as a result of All Saints’ Day vacation on November 1.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

European electrical energy markets

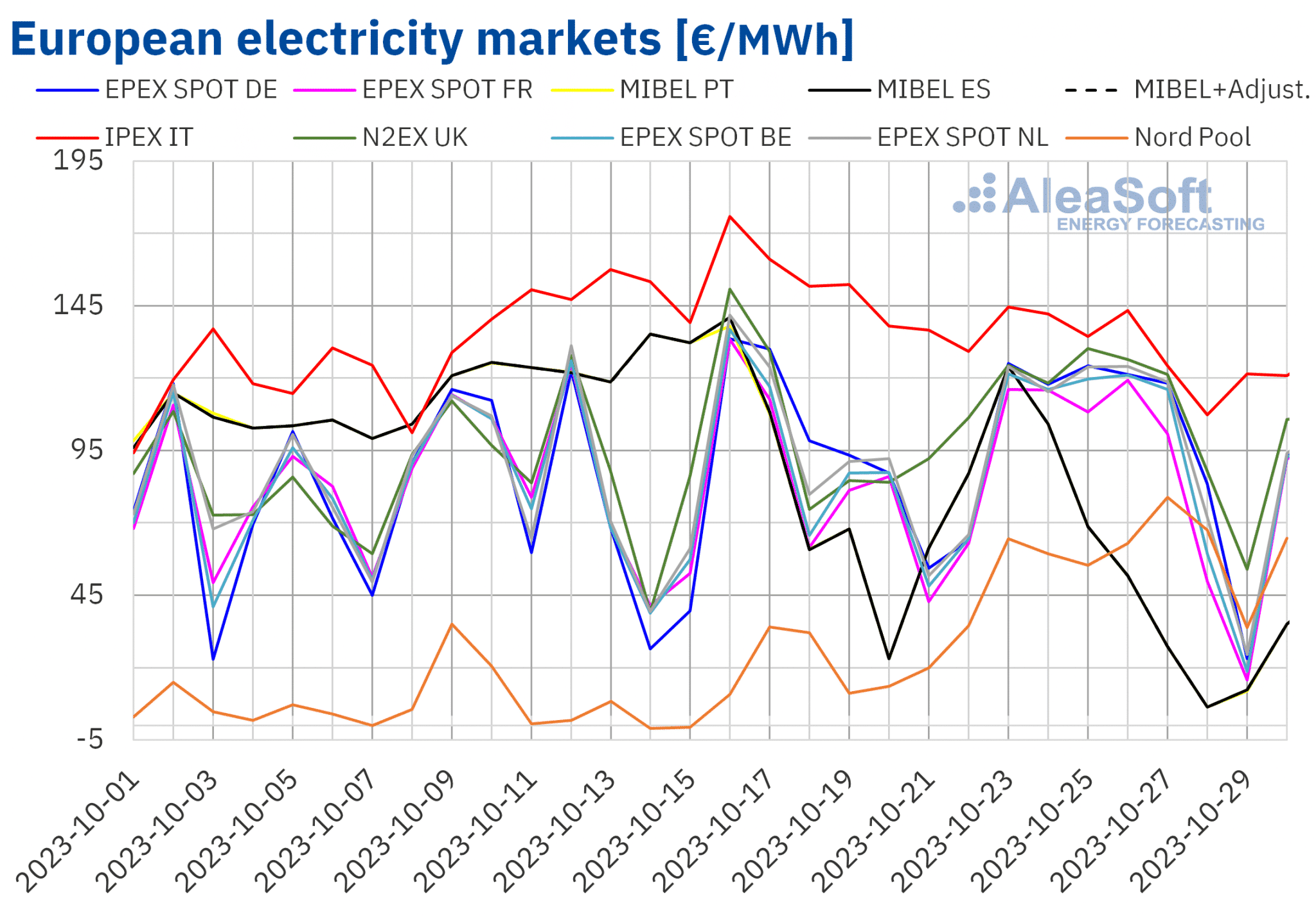

Within the week of October 23, costs on the EPEX SPOT markets in Central Europe and the N2EX market within the UK remained round €120/MWh till Friday 27. Over the weekend, costs fell to a mean of €70/MWh on Saturday 28, and €27/MWh on Sunday 28. In comparison with the earlier week’s costs, the weekly common on these markets elevated by a mean of 8.2%.

Costs on the MIBEL market in Spain and Portugal, the IPEX market in Italy and the Nord Pool market within the Nordic nations assorted. The Italian market registered the best costs among the many analyzed markets, with a mean value of €131.09/MWh throughout the week and a lower of 12% in comparison with the earlier week.

The Iberian market registered the bottom costs, with a weekly common of €56.38/MWh in Spain and €56.35/MWh in Portugal. Between October 26 and 30, MIBEL reached the bottom costs of all markets, supported by excessive wind vitality manufacturing. The every day common value reached a low of €6.45/MWh on Friday 28. That is the bottom value since January. There have been three hours with zero value on Friday and 4 on Saturday.

The Nordic market confirmed a markedly completely different improvement to the remainder of the markets. Costs continued the upward pattern of the earlier week and reached a weekly common of €60.36/MWh, a rise of 171% in comparison with the earlier week. This was the week with the best costs since mid-June.

Most markets, apart from the Italian and Nordic markets, registered zero or unfavourable hourly costs over the weekend. The UK market registered the bottom costs on Saturday 28, with £-3.90/MWh between 4:00 and seven:00. The very best hourly value of the week was €215.02/MWh, registered on the Iberian market between 20:00 and 21:00 on Monday 23. That is the best hourly value within the final ten months, apart from the €220.00/MWh registered on Monday of the earlier week.

AleaSoft Power Forecasting‘s value forecasts point out that within the first week of November, costs will fall in many of the European electrical energy markets analyzed, influenced by the November 1 vacation and the resultant drop in demand.

Supply: Ready by AleaSoft Power Forecasting utilizing information from OMIE, EPEX SPOT, Nord Pool and GME.

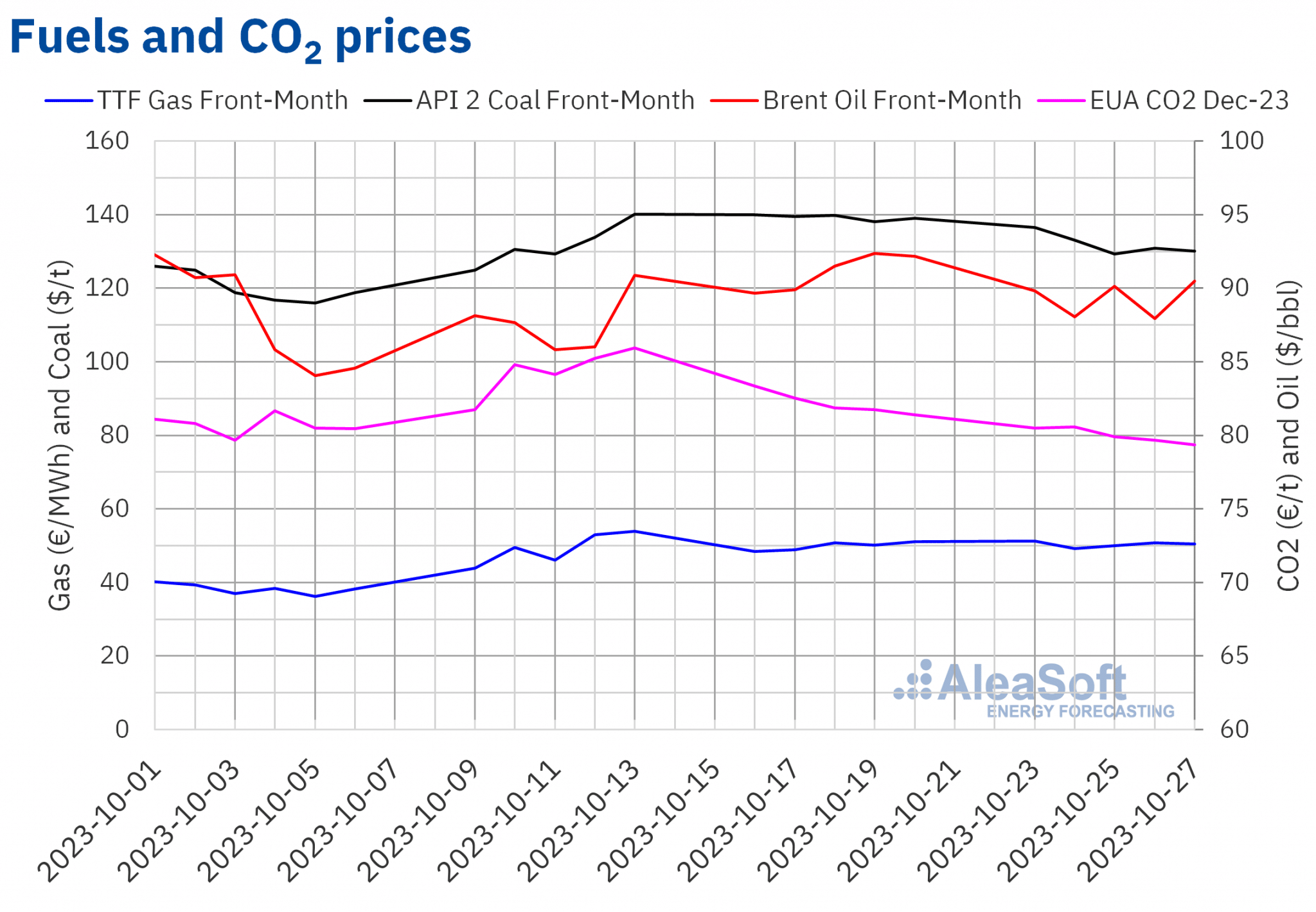

Brent, fuels and CO2

Within the final week of October, front-month Brent oil futures on the ICE market declined barely from the earlier week. Costs ranged between $88 and $90, with a weekly common of $89.29 per barrel, 2.0% decrease than the earlier week’s common. On Friday, October 27, futures closed at $90.48 per barrel, the best value of the week.

The escalation of the battle in Israel led to the value rally on the finish of the week and will likely be one of many points that can drive oil costs in early November.

Costs for Entrance-Month TTF gasoline futures on the ICE market stay within the €50/MWh vary for the third consecutive week. The common value for the final full week of October was €50.36/MWh, barely above the earlier week’s common by 0.9%.

Fuel reserves in European Union nations are virtually full, so there isn’t any actual worry of provide issues throughout the winter. Even with these inventories, costs stay excessive attributable to a nervous market attributable to the battle within the Center East. Chevron has introduced the top of the labor dispute on the Australian LNG plant. This could ease the stress on gasoline costs, however within the quick time period, developments within the Israeli battle will decide the pattern.

Costs of CO2 emission rights futures on the EEX market for the reference contract of December 2023 proceed the downward pattern of the earlier week. The futures began the week at €80.50 per ton, the settlement value on Monday 23, and closed on Friday at €79.35 per ton. That is a part of a common downward pattern in costs because the finish of February, when costs reached €100 per ton. Since then, costs have been falling and transferring away from the €100/ton degree.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ICE and EEX.

AleaSoft Power Forecasting’s evaluation on the prospects for vitality markets in Europe and the financing and valuation of renewable vitality tasks

The subsequent webinar within the month-to-month webinar collection of AleaSoft Power Forecasting and AleaGreen will likely be held on November 16. The matters of the webinar would be the prospects for European vitality markets for winter 2023-2024 and the imaginative and prescient of the longer term for batteries and vitality storage. On this event, Luis Marquina de Soto, President of AEPIBAL, the Enterprise Affiliation of Batteries and Power Storage, will be part of the webinar.