Three interregional transmission strains connecting six U.S. states will obtain the primary $1.3 billion tranche of $2.5 billion in federal funding designated underneath the Transmission Facilitation Program (TFP), a revolving fund enacted by the 2021 Bipartisan Infrastructure Act.

The U.S. Division of Power (DOE) Grid Deployment Workplace’s (GDO’s) first picks underneath the TFP, unveiled on Oct. 30, will present federal funding and preliminary value restoration, serving as “capability contracts” to offer up-front “anchor tenant” funding on new and upgraded transmission strains.

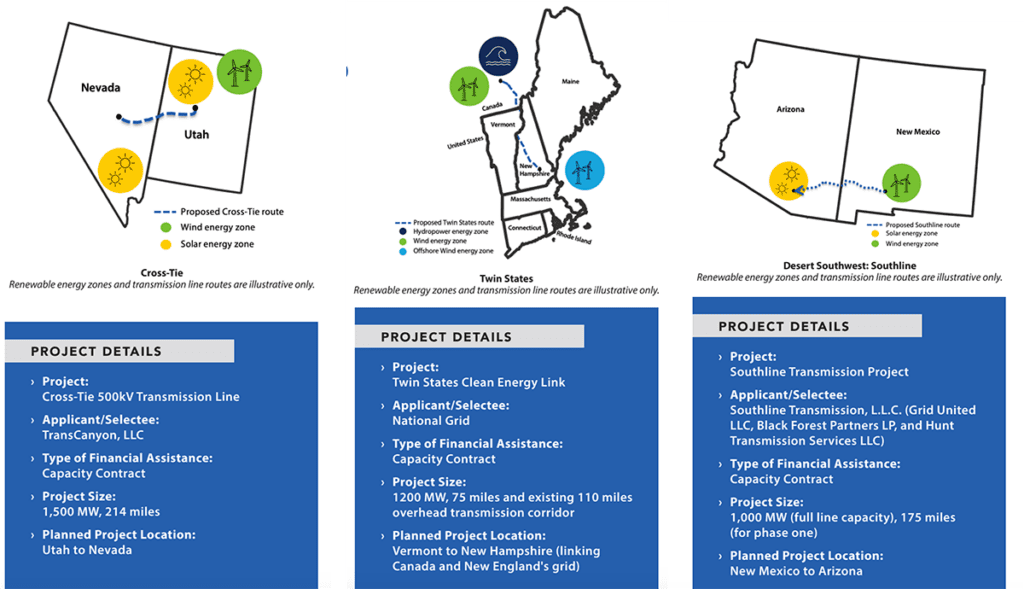

The DOE’s TFP choices—a mixed transmission capability of three.5 GW—unveiled on Monday embrace:

TransCanyon’s 1.5-GW Cross-Tie 500 kV Transmission Line. The 214-mile undertaking will join Utah and Nevada when it goes into service in 2027 and doubtlessly relieve congestion on different key transmission strains within the area. It is usually designed to permit California, Nevada, Utah, and Wyoming to import and export renewable vitality. TransCanyon estimates the undertaking’s estimated value is $750 million.

Nationwide Grid’s Twin States Clear Power Hyperlink. The 1.2-GW excessive voltage direct present (HVDC) undertaking is proposed to function a bidirectional line between New England and Québec, Canada. “As a bi-directional line, Twin States will allow clear vitality producers in New England, reminiscent of offshore wind, to export extra capability to Quebec throughout occasions of decrease home demand, offering a essential increase to the area’s clear vitality financial system,” Nationwide Grid notes. Nationwide Grid estimates the Twin States proposal might value of “underneath $2 billion to design, engineer, allow, and construct,” although it notes the determine “is topic to vary as we obtain extra info and conduct outreach to stakeholders.” It suggests undertaking development would happen between late 2026–2030, with the undertaking going surfing in 2030–2031.

Desert Southwest: Southline. This 1-GW double-circuit 345-kV undertaking seeks to construct a 175-mile transmission line from Hidalgo County, New Mexico, to a substation in Vail, Pima County, Arizona, as the primary section of a bigger deliberate transmission undertaking to handle the necessity for elevated switch functionality within the Desert Southwest. “The design gives the potential to move energy bi-directionally and can allow wind and photo voltaic assets from the Desert Southwest to achieve key markets whereas enhancing the grid reliability of the border area,” Southline says. The TFP choice is for the primary 175-mile section (Hidalgo, New Mexico) to Vail, Arizona) of the undertaking, which is anticipated to start operations by the tip of 2027. Southline anticipates Section 2 (Afton, New Mexico, to Hidalgo, New Mexico), which can increase the road to 280 miles, will probably be accomplished by 2028.

“With TFP’s endorsement, Southline’s timeline will probably be meaningfully accelerated to reliably and cost-effectively ship new assets to fulfill the area’s rising vitality wants,” mentioned Doug Patterson, managing associate of Black Forest Companions, a agency that serves because the undertaking’s managing member. “Now we have labored collaboratively with stakeholders over the previous 14 years to get Southline prepared in a means that maximizes advantages and minimizes impacts, and the TFP capability contract is the catalyst we and different award recipients have to get these essential initiatives into service.”

A Huge Step to Handle Transmission’s ‘Rooster and Egg’ Problem

The DOE’s TFP choices stem from a phased solicitation strategy that started in 2022. The primary solicitation was restricted to requests for capability contracts for brand spanking new or substitute initiatives of at the least 1 GW and upgrades of present strains of at the least 500 MW that may very well be accomplished by December 2027. As well as, Congress requires that the TFP program prioritize applied sciences that improve the capability, effectivity, resilience, or reliability of an influence transmission system, facilitate interregional capability to help equitable financial progress and contribute to subnational objectives to decrease greenhouse gases.

The TFP permits the DOE to borrow as much as $2.5 billion via capability contracts, loans, and DOE participation in public-private partnerships inside an electrical hall that serves a nationwide curiosity. The choices on Monday—all capability contracts—will now transfer right into a due diligence and contract negotiation section. The DOE expects to signal contracts by the tip of the yr.

Underneath a capability contract framework, the DOE primarily serves as an “anchor tenant,” shopping for as much as 50% of the whole proposed transmission capability for phrases of as much as 40 years, it has defined. The federal authorities then contracts with a 3rd occasion to market the capability, looking for to maximise the federal government’s returns. It then sells the capability contract to get better the remaining prices incurred as soon as the undertaking’s long-term monetary viability is secured. TFP capability contracts characterize “the contractual proper to schedule and use transmission service for the time period of the settlement,” the DOE notes.

As Rob Gramlich, president of energy sector consulting agency GridStrategies LLC, instructed POWER, the TFP is a “novel and thrilling” program that would deal with a “perennial ‘rooster and egg’ drawback” that has challenged the nation’s much-needed transmission growth. “This system is a small program, however I feel a extremely necessary one,” he mentioned. “Congress might do extra with the price range for this system in future years,” he mentioned, however the TFP sequence—permitting for the DOE’s capability reservation earlier than transmission development, after which permitting the road’s subscribers to pay again the federal government—is a notable step ahead. “That sequence guarantees to work lots higher than the present stalemate,” he mentioned.

A Obvious Want for Extra Transmission

Because it unveiled its first TFP choices on Monday, the DOE additionally printed the finalized The Nationwide Transmission Wants Research, the newest iteration of its three-year transmission constraint evaluation via 2040. The DOE considers the examine a “state of the grid report that identifies urgent nationwide transmission wants. Whereas the Wants Research doesn’t prescribe options or establish a grasp transmission plan, it’s statutorily required underneath Part 216(a) of the Federal Energy Act as an important prerequisite earlier than the DOE can designate a hall.

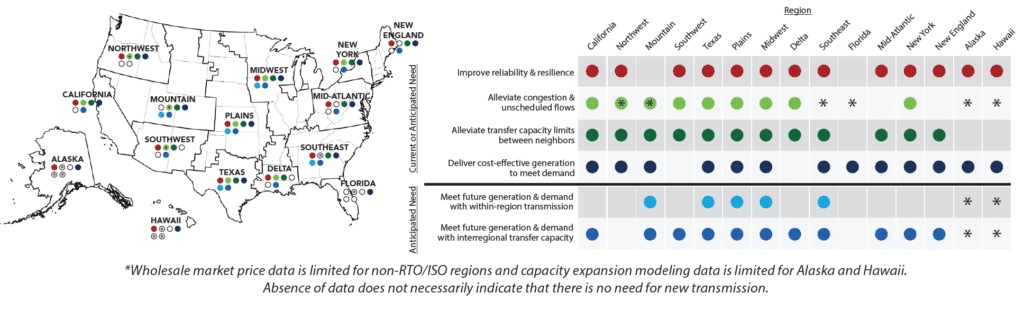

The freshly launched Wants Research underscores three factors. One is that “there’s a urgent want for brand spanking new transmission infrastructure.” Second, “interregional transmission ends in the biggest advantages,” and third, and maybe crucially, “wants will shift over time” because the vitality transition, evolving regional demand, and more and more excessive climate have an effect on the grid.

Almost all areas within the U.S. “would acquire improved reliability and resilience from extra transmission investments,” it suggests, and a few areas have acute reliability and resilience wants that extra transmission deployment can deal with. As well as, “Areas with traditionally excessive ranges of within-region congestion—the Northwest, Mountain, Texas, and New York areas particularly—in addition to areas with unscheduled flows that pose reliability dangers—California, Northwest, Mountain, and Southwest areas—want extra, strategically positioned transmission deployment to scale back this congestion,” it says.

Among the many examine’s key findings is that by 2030, “giant relative deployments of interregional switch capability are wanted between the Delta and Plains, Midwest and Plains, and between the Mid-Atlantic and Midwest areas to fulfill future calls for of the ability grid.” By 2040, a major want arises “for brand spanking new interregional transmission between almost all areas.”

One other key discovering is the proportion of general transmission circuit-miles put in to handle particular system reliability wants “has grown with time, from 44% in 2011 to 74% in 2020.” On the similar time, nevertheless, transmission investments decreased through the second-half of the 2010s. Yet one more concern is that the share of energized initiatives traditionally borne by nonincumbent builders—often known as service provider builders—decreased from 40% in 2013 to lower than 5% in 2020.

These challenges have had a major impression on the grid. Congestion has pushed up wholesale electrical energy costs in particular areas. Whereas the Wants Research means that wholesale market value differentials are the biggest between Arizona and Texas, it additionally demonstrates “the highest worth of recent interregional transmission exists throughout the three electrical interconnections,” the DOE mentioned.

The examine additionally highlights interconnection queue backlogs. As an April 2023–launched analysis by Lawrence Berkeley Nationwide Laboratory (Berkeley Lab) suggests, on the finish of 2022, greater than 10,000 interconnection requests have been lively all through the U.S., representing greater than 2,000 GW of potential era and storage capability (95% of which was photo voltaic, battery storage, or wind vitality). Whereas the DOE suggests many causes exist for interconnection backlogs, it highlights that energy crops don’t have enough entry to present transmission programs. “There’s a necessity for critical upgrades on the transmission system, and people prices can generally be value prohibitive for the ability mills versus making these upgrades in a transmission planning setting,” it says.

Gradual Coverage Enhancements, Extra on the Horizon

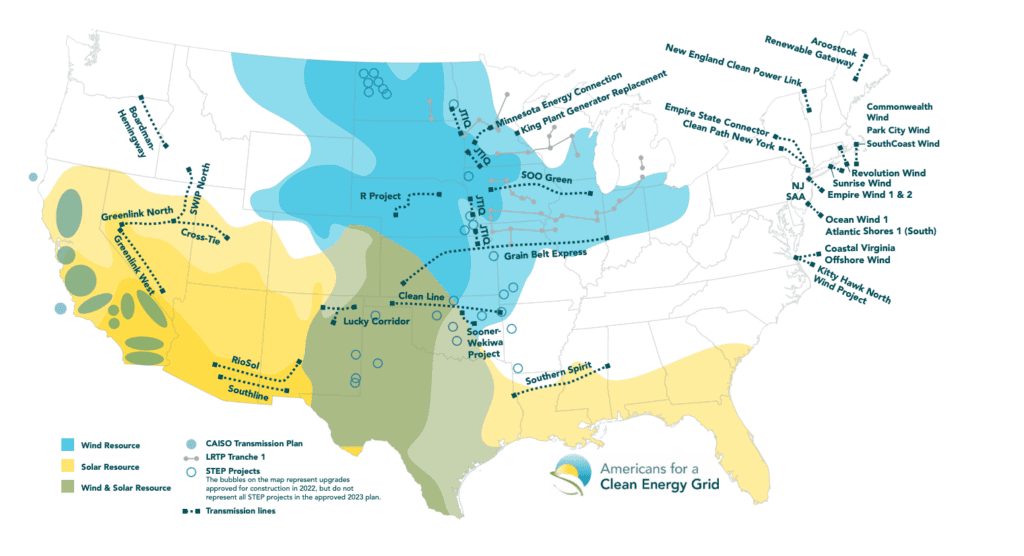

Owing to current reforms, the much-needed transmission growth appears to have begun an upward trajectory. In keeping with a GridStrategies September 2023–issued replace on the progress and standing of U.S. transmission, an estimated 36 high-voltage transmission initiatives—in comparison with 22 recorded in 2021—are “shovel prepared,” and will interconnect round 187 GW of producing capability.

“A lot of the expansion is from new transmission initiatives to interconnect offshore wind initiatives within the Northeast and MidAtlantic,” the GridStrategies report notes. However new initiatives “serving a spread of functions” have additionally emerged in different areas. “Vital load progress, growing U.S. manufacturing, information heart demand (fueled not too long ago by synthetic intelligence), buyer demand for clear era, and more and more favorable economics for renewable vitality attributable to market traits in addition to the Inflation Discount Act and different insurance policies, are probably driving better market curiosity in transmission,” it says.

If accomplished, the 36 initiatives might add roughly 10,000 miles and 132 GW of recent transmission capability. “For reference, the present U.S, transmission system accommodates roughly 240,000 circuit miles of transmission that function at 230 kV and above, so these new initiatives solely add about 4% to the whole mileage of the high-voltage transmission system,” the report notes. “Nevertheless, a lot of the proposed strains are extra-high voltage, which permits them to hold extra energy with decrease losses than typical present transmission strains. In consequence, these grid growth initiatives enhance the transmission system’s capability by about 15%.”

Nonetheless, in keeping with the report, value restoration stays crucial barrier to a transmission growth. “Transmission is basic public good, the place the beneficiaries are broadly dispersed. Market demand doesn’t come till 5 years sooner or later, however it’s important to sink the capital now into the allowing and development,” Gramlich defined.

Together with the TNF, which Gramlich famous is “well-structured” to beat some cost-recovery hurdles, the DOE earlier this month unveiled $3.5 billion in Bipartisan Act funding underneath the Grid Resilience and Innovation Partnerships (GRIP) program to enhance grid flexibility and energy system resiliency. As POWER reported, almost $1 billion will probably be invested in complete transformational transmission initiatives.

Allowing stays one other substantial problem. Many initiatives have spent a decade or extra underneath growth earlier than starting development, slowed by the tempo of federal allowing and interagency delays. Gramlich, nevertheless, advised new efforts might enhance allowing timeframes.

“I’m excited in regards to the DOE’s current actions associated to its lead company authority,” he mentioned. In August 2023, the DOE proposed a rule designating it because the lead company for federal authorization and permits. The rule, notably, units a two-year deadline for federal administrative motion on all transmission strains. Allowing reforms handed within the June 2023 debt-ceiling settlement additionally streamline Nationwide Environmental Coverage Act (NEPA) utility and documentation processes, and set limits for company opinions.

—Sonal Patel is a POWER senior affiliate editor (@sonalcpatel, @POWERmagazine).