In mid-March 2024, Canada’s Silfab Photo voltaic, a high-efficiency module producer with plans to increase into South Carolina, stated it could supply glass from US-based PV panel recycler Solarcycle. Solarcycle is planning a $344 million photo voltaic glass fab within the US state of Georgia, provided by recycled panel supplies.

“We’re excited concerning the potential for home photo voltaic manufacturing development to offer jobs and R&D improvement within the US,” Solarcycle Chief Working Officer (COO) Rob Vinje advised pv journal.

World development

Andries Wantenaar, from market intelligence firm Rethink Know-how Analysis, stated that “demand for photo voltaic glass is trying strong. It’s a rising market with comparatively secure costs.” He famous a 66% improve in each a part of China’s photo voltaic manufacturing business in 2023, and much more speedy development exterior China, the place output doubled from 65 GW in 2022, to round 130 GW in 2023.

“When you make photo voltaic glass, you’ve got a really giant and really quickly rising market exterior of China to promote to,” stated Wantenaar. “You received’t be caught within the state of affairs of Western polysilicon makers, whose prospects are the wafer makers in China who are actually shopping for from Chinese language polysilicon makers completely at costs properly under the Western marginal value of manufacturing.”

Glass materials costs are comparatively secure. “The worth of solar-grade glass has been cussed for a minimum of a decade now as a result of it’s a very figured-out product,” stated Wantenaar. The caveat is that tumbler is an energy-intensive product, which is a robust value issue, and one motive why China dominates its manufacturing. Wantenaar estimated that China holds “round 90%” of the photo voltaic glass market, increased than its 80% PV module share.

Two sides

Wantenaar believes glass will signify an even bigger share of module prices sooner or later, as different parts develop into extra cost-efficient and the bifacial module pattern, usually that includes glass on each side reasonably than a glass entrance mixed with a polymer backsheet, intensifies.

“Bifacial just lately handed 50% market share, Chinese language manufacturing outputs, and can proceed to develop, to maybe 75% in 2030,” stated the analyst.

Bifacial glass modules usually use two 2 mm glass panes, typically 1.6 mm, versus standard panels, that function 3.2 mm glass. The usage of thinner glass may require completely different heat-strengthening processes and which will influence high quality.

The pattern towards glass-glass is one thing researchers on the US Division of Vitality’s (DOE) Nationwide Renewable Vitality Laboratory (NREL) are trying into, relating to module sturdiness.

“The actually skinny glass is optimized for transport and logistics, not essentially for sturdiness efficiency within the area,” stated Teresa Barnes, who manages the PV reliability and system efficiency group at NREL, and serves as head of the DOE-funded Sturdy Module Supplies (Duramat) analysis consortium.

“Traditionally, silicon PV modules have been made with rolled and textured cowl glass whereas skinny movie has used antimony-free float glass with a thickness of two mm or 3 mm,” stated Barnes. “Thinner is feasible but it surely’s trickier because of the heat-tempering course of.”

It might be that tumbler materials made for the North American market can have completely different mechanical necessities than for different areas.

“Excessive climate, corresponding to hail, may imply that US modules would wish the thicker-tempered glass,” stated Barnes.

There are additionally comparable indicators coming from Europe.

“The pattern right here is to seek out niches,” stated Martin Zugg, managing director of German glass producer Interfloat, which is owned by India’s Borosil. “It’s onerous to discover a area of interest however we see producers growing increasingly more new area of interest markets, which incorporates hail-resistant panels that require thicker glass, roof-integrated modules, and building-integrated PV functions.”

Interfloat produces sufficient low-iron, high-transmission textured photo voltaic glass for two GW of modules per yr. It makes glass with thicknesses starting from 2 mm to six mm, in standard in addition to customized and special-request dimensions.

The usage of thicker glass may give native glass producers a market alternative and decrease transport-related prices.

“Glass is an costly materials to ship,” stated the NREL’s Barnes. “Logistics prices, transport, and storage are all paid by the PV module producer.”

First Photo voltaic impact

US-based thin-film PV large First Photo voltaic is increasing capability with 13 GW of operational output as of September 2023, and plans for 25 GW of worldwide annual nameplate capability in 2026, with 14 GW in the US.

That growth trajectory is triggering glass business funding to provide it with the float glass it wants for its thin-film modules. In the US, producers NSG Group and Vitro Architectural Glass have introduced contracts and plans for devoted strains to serve First Photo voltaic.

In India, the place First Photo voltaic just lately inaugurated its 3.3 GW Sequence 7 module plant, French supplies firm Saint Gobain is reportedly bringing manufacturing on-line at a plant within the state of Tamil Nadu with the intention to provide the American producer.

In November 2023, NSG stated it could add clear conductive oxide (TCO)-coated glass capability in Ohio to provide First Photo voltaic, planning the transfer in early 2025. NSG has produced TCO-coated glass for thin-film PV for greater than 25 years.

“Yearly the photo voltaic market is larger and larger; extra capital, extra sources,” stated Stephen Weidner, who heads NSG’s North American architectural glass and photo voltaic merchandise teams. “We see this on a world foundation.”

Glass for photo voltaic is turning into extra vital. “It has gone from nearly nothing 10 years in the past, to 10% to fifteen% of the whole provide of the flat glass market in North America,” stated Weidner. “Our aim is to develop with the market. That signifies that by finish of [2024] we can have three float strains in North America devoted to the photo voltaic section, an extra two strains in Vietnam, additionally one in Malaysia, which we transformed to TCO from architectural glass earlier.”

Vitro Architecural Glass can be including US capability to provide First Photo voltaic. In October 2023, it introduced an growth of its contract with First Photo voltaic and a plan to spend money on a plant in Pennsylvania, in addition to in adapting present PV glass services. The corporate stated in a press release that it anticipated “vital development” in photo voltaic glass enterprise because of the “nearshoring” impact in the US.

IRA influence

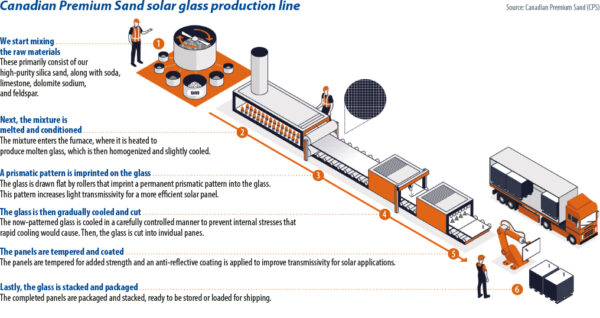

In addition to influencing First Photo voltaic and its rising glass provide chain, insurance policies such because the US Inflation Discount Act (IRA), are additionally spurring crystalline silicon manufacturing funding, triggering Canadian Premium Sand (CPS), a brand new entrant from Canada, to announce a photo voltaic panel glass challenge. CPS plans to construct a manufacturing facility in Selkirk, Manitoba, to provide 1.8 mm to 4 mm glass module covers in sufficient quantity for six GW of photo voltaic panels per yr.

“We’re estimating demand within the North America area for photo voltaic sample glass to succeed in almost 100 GW by 2030, pushed by the reshoring of the photo voltaic panel manufacturing provide chain within the US,” stated Anshul Vishal, who heads up company improvement at CPS.

The enterprise introduced offtake agreements with the likes of Swiss module producer Meyer Burger, Canada-based Heliene, and Qcells, owned by South Korea’s Hanwha. Additional offtake discussions with different potential patterned photo voltaic glass prospects are beneath manner, in line with Vishal, with plans to succeed in 100% contracted standing previous to building.

The CPS built-in glass challenge wants a CAD 880 million ($639 million) funding to arrange the plant and to develop a silica sand web site. The plan contains a number of strains of tempered and patterned photo voltaic glass, together with anti-reflective and anti-soiling coating strains, to be on-line in 2026.

“It’s a challenge endorsed by each provincial and federal authorities businesses and the environmental permits are in place,” stated Vishal. “We simply had the sand materials examined in Europe, which confirmed that we will use easy, low-cost, and environmentally accountable processes to refine it to patterned photo voltaic glass-grade specs.”

CPS will have the ability to faucet the Manitoba power combine for low-CO2-emission hydroelectricity and wind energy. Being within the North American Free Commerce Settlement zone at a web site that’s three to 4 days overland from prospects – supporting less complicated transport and fewer potential disruption – are different location-related benefits, in line with Vishal.

A consortium is contracted to construct the CPS plant. It contains Henry F. Teichmann, a world glass plant contractor based mostly in the US; France-based industrial engineering agency Fives Group; Italian glassmaking gear provider Bottero; and two Canadian companies, Elrus Combination Techniques, a mineral processing gear supplier; and PCL Constructors, a civil engineering agency.

Recycled glass

Like CPS, the plant deliberate for two-year outdated Solarcycle has an annual capability with the module equal of 5 GW to six GW of era capability – however utilizing recycled glass. Utilizing recycled supplies recovered from end-of-life crystalline silicon panels means the recovered glass has the fitting chemical composition. It’s already a low-iron materials, as Solarcycle’s Vinje sees it, and that may scale back power demand and embodied carbon.

“It’s the first low iron rolled glass plant to be constructed within the US market,” stated the COO. “We’re at the moment receiving provides from worldwide glass processing gear suppliers whereas the contracts for engineering, building, and a number of subsystems are being negotiated with US-based suppliers.”

Within the works is an 800-meter-long patterned glass manufacturing line with each cold and warm processing segments. It features a specifically designed cross-fired regenerative furnace building that reuses exhaust gases to cut back gas consumption; scorching rolled processing gear; and the slicing, grinding, glass tempering, and different chilly finish course of steps wanted to make glass for dual-and single-glass modules.

Solarcycle just isn’t the one glass provider seeking to profit from utilizing recycled materials. Canada’s CPS additionally stated it plans to make use of recycled glass cullet from exterior sources in its merchandise whereas the likes of Japan’s AGC and Saint Gobain have additionally introduced tasks.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.