Within the second week of October, European electrical energy market costs rose. Some hourly costs had been above €200/MWh, which was additionally the case on Monday, October 16. The rise was supported by greater gasoline and CO2 costs, which registered their highest ranges since February and August, respectively. Elevated demand and decrease photo voltaic vitality manufacturing additionally drove costs up, whereas wind vitality helped costs to fall on some days.

Concentrated Photo voltaic Energy, photovoltaic and wind vitality manufacturing

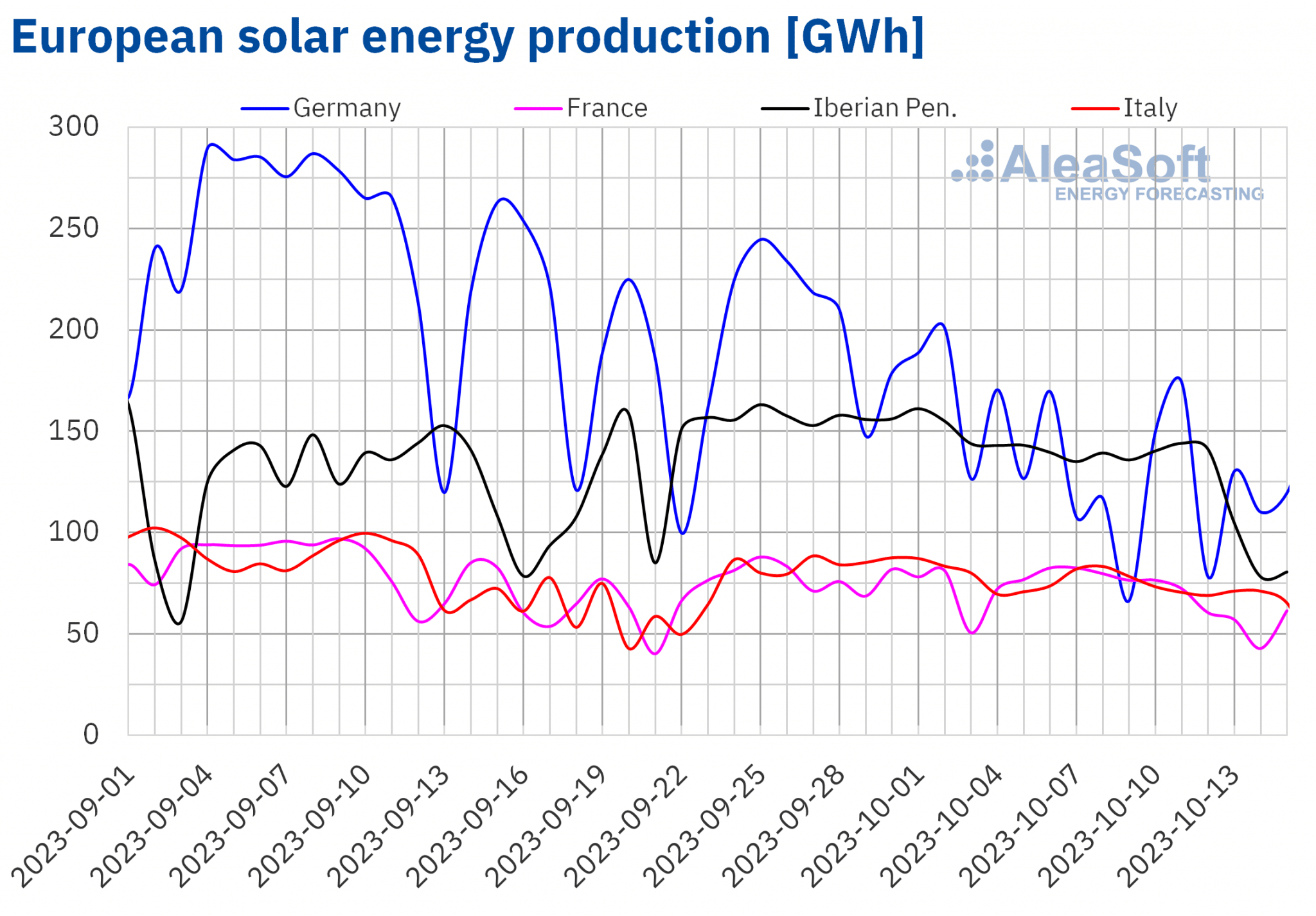

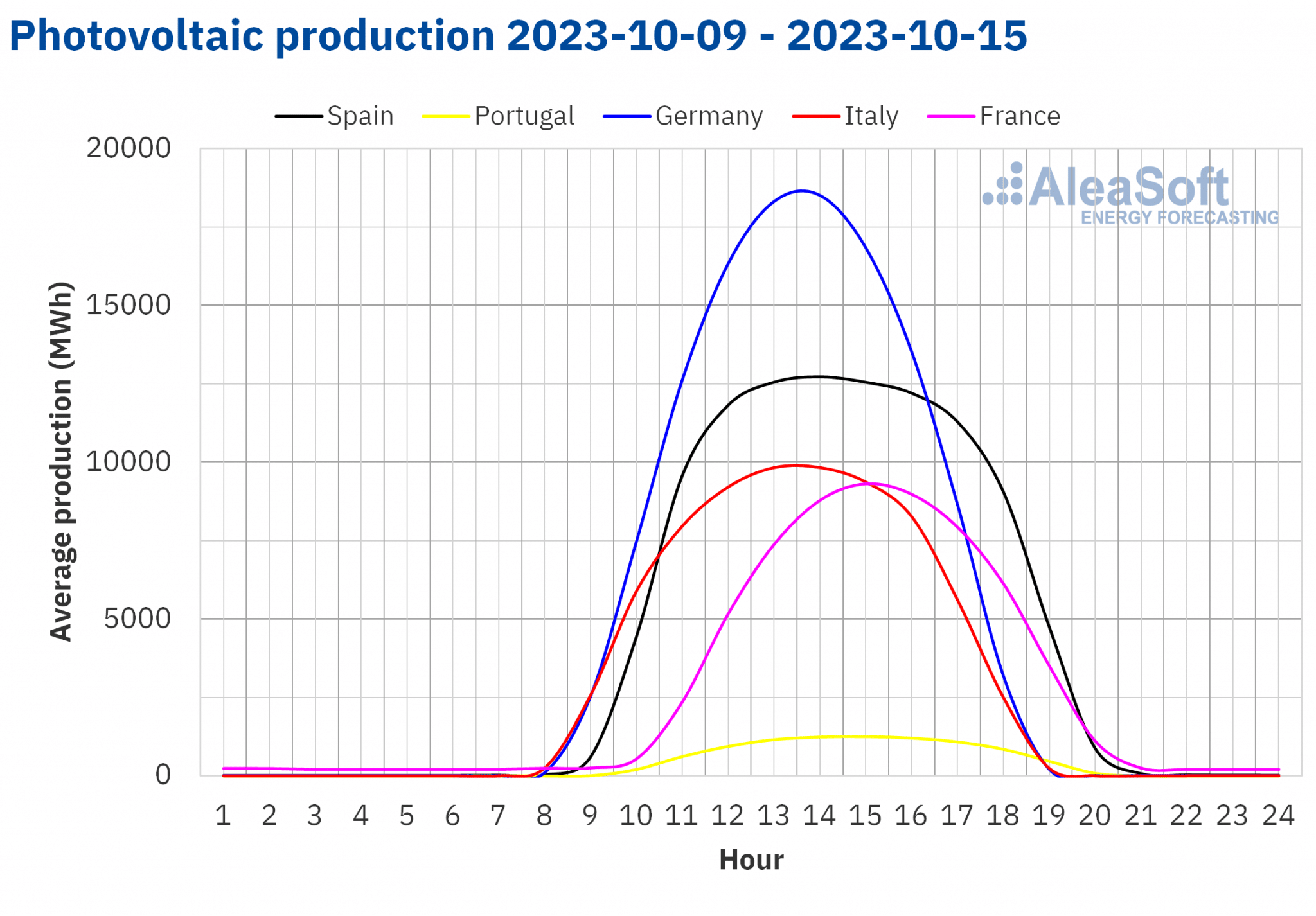

Within the week of October 9, photo voltaic vitality manufacturing decreased in comparison with the earlier week in the principle European electrical energy markets. The most important drop, 23%, was registered within the Portuguese market. Within the different markets, the drop in photo voltaic vitality manufacturing ranged from 19% in Germany to eight.1% in Italy.

Regardless of the weekly drop in photo voltaic vitality manufacturing associated to the seasonal change, when evaluating photo voltaic photovoltaic vitality manufacturing within the first half of October 2023 with the identical interval in earlier years, since 2019, the file was damaged in all analyzed markets.

Throughout the first half of October 2023, the best photovoltaic vitality manufacturing, 2036 GWh, was registered within the German market, a rise of 5.4% in comparison with the identical interval in 2022 and 62% in comparison with 2019. In Mainland Spain, photovoltaic vitality manufacturing for the primary fifteen days of October 2023 was 1613 GWh, a rise of 37% and 286% in comparison with the identical interval in 2022 and 2019, respectively. The bottom manufacturing, 160 GWh, was registered in Portugal, however nonetheless represented a rise of 33% in comparison with 2022 and 228% in comparison with 2019.

For the week of October 16, in keeping with AleaSoft Power Forecasting’s photo voltaic vitality manufacturing forecasts, photo voltaic vitality manufacturing is anticipated to lower within the analyzed markets.

Supply: Ready by AleaSoft Power Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Power Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

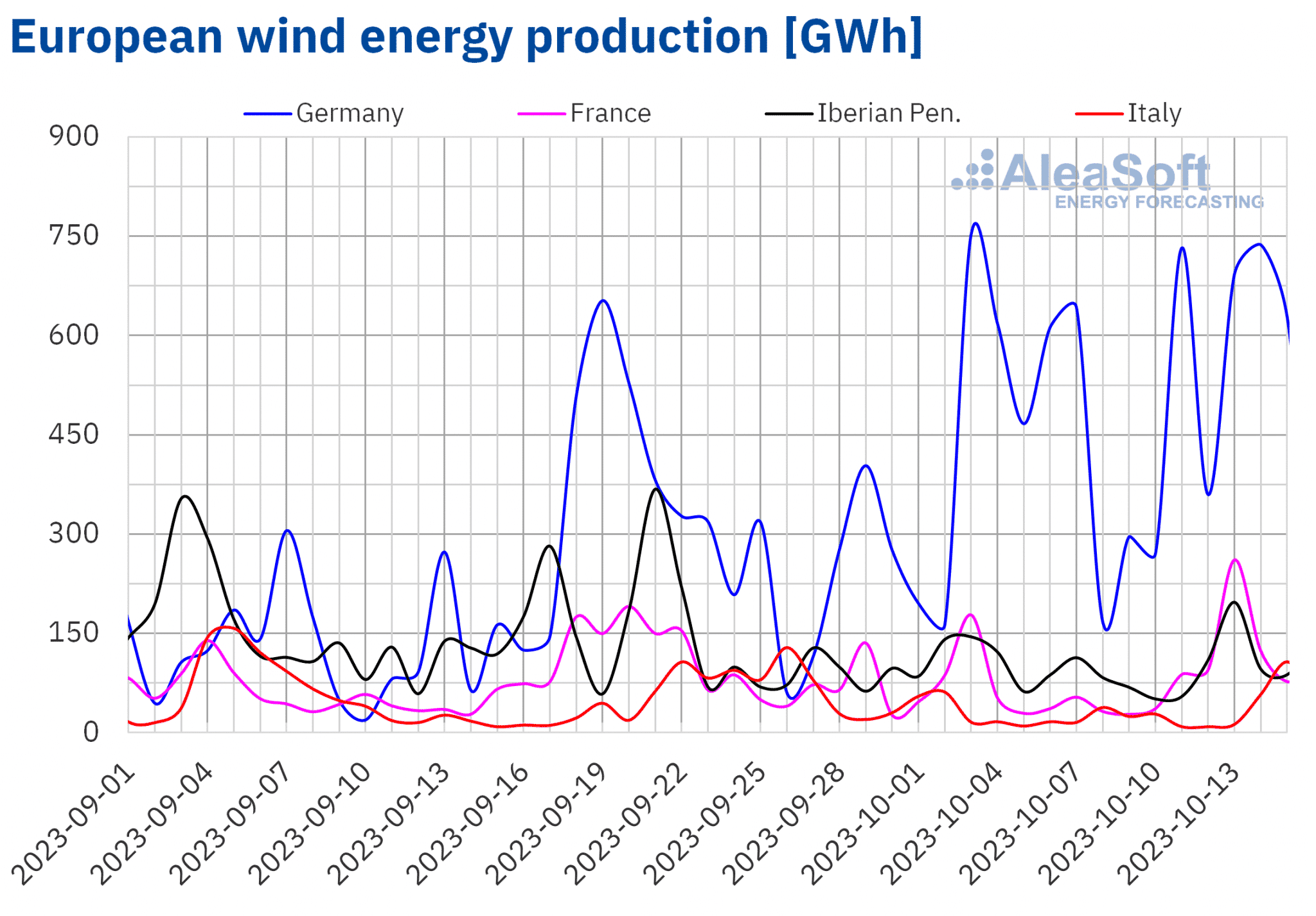

Within the case of wind vitality manufacturing, the week of October 9 introduced per week?on?week improve in many of the markets analyzed at AleaSoft Power Forecasting. The most important improve, 51%, was registered within the French market. On this market, 261 GWh was generated with wind vitality on Friday, October 13, which is the best worth registered because the starting of August. Within the different markets, the rise ranged from 8.6% in Germany to 43% in Italy. The exceptions had been the markets on the Iberian Peninsula, the place general wind vitality manufacturing fell by 12% in comparison with the earlier week.

For the week of October 16, AleaSoft Power Forecasting’s wind vitality manufacturing forecasts point out that wind vitality manufacturing will improve in all analyzed markets, aside from Germany.

Supply: Ready by AleaSoft Power Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

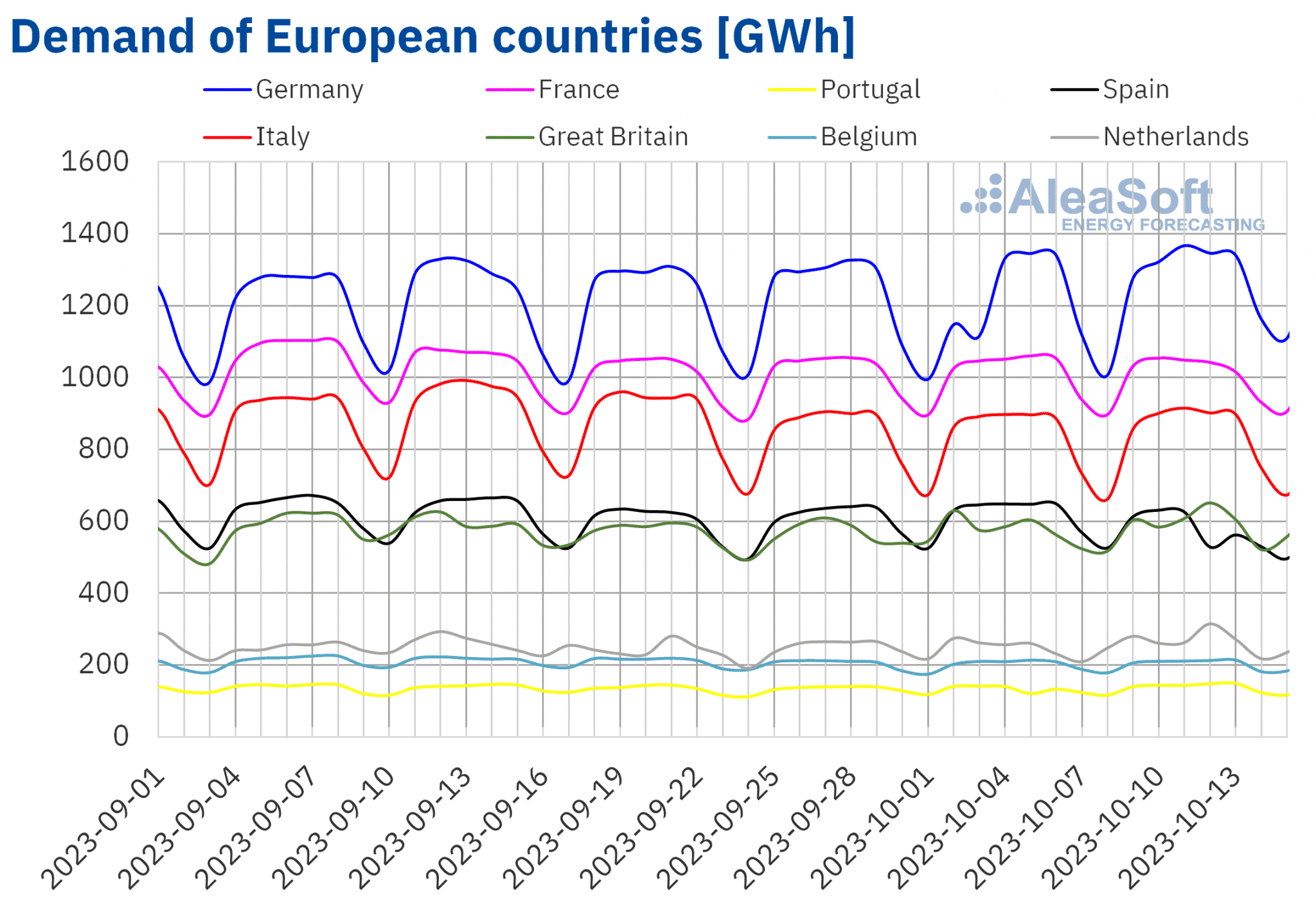

Electrical energy demand

Throughout the week of October 9, electrical energy demand elevated in comparison with the earlier week in many of the most important European markets. Will increase ranged from 0.6% within the Belgian market to six.2% within the German market. Within the case of Germany, the rise was associated to the restoration of the labor fee after the earlier week’s celebration of Germany’s Unity Day on October 3. One thing related occurred in Portugal, the place Portugal’s Republic Day was celebrated on October 5, which favored a 5.3% improve in demand in that market within the second week of October.

Alternatively, demand fell in solely two of the principle European electrical energy markets. In Spain, the drop was 7.6%, and it was associated to the celebration of Spain’s Nationwide Day on Thursday, October 12. Demand additionally fell within the French market, on this case by 0.6%.

Throughout the identical interval, common temperatures fell in many of the analyzed markets, starting from 2.0 °C in Nice Britain to 0.1 °C in Germany and Italy. The exception was France, the place common temperatures elevated by 0.4 °C in comparison with the primary week of October.

For the week of October 16, in keeping with AleaSoft Power Forecasting’s demand forecasts, electrical energy demand is anticipated to extend in many of the most important European markets, excluding Germany.

Supply: Ready by AleaSoft Power Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

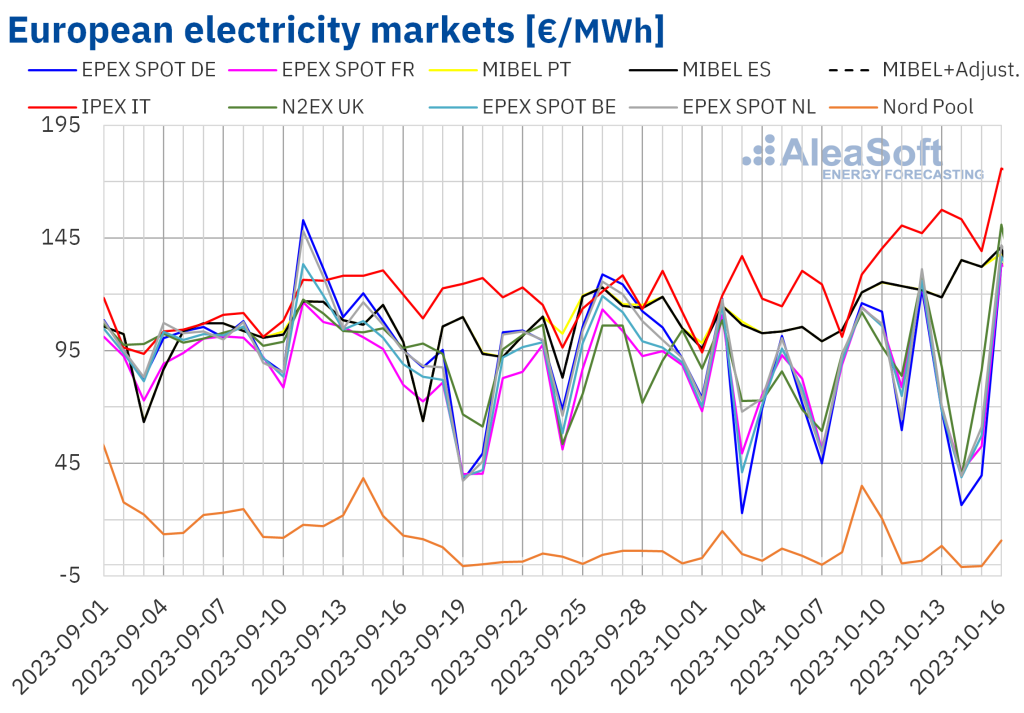

European electrical energy markets

Throughout the week of October 9, costs in all European electrical energy markets analyzed at AleaSoft Power Forecasting rose in comparison with the earlier week. The most important share worth rise, 70%, was reached within the Nord Pool market of the Nordic nations, whereas the smallest improve, 1.7%, was registered within the EPEX SPOT market of the Netherlands. Within the different markets, costs elevated between 5.0% within the EPEX SPOT market of Germany and 20% within the IPEX market of Italy.

Within the second week of October, weekly averages had been under €95/MWh in many of the analyzed European electrical energy markets. The exceptions had been the Spanish, Italian and Portuguese markets. The Italian market reached the best common, €145.30/MWh. Within the case of the MIBEL market of Portugal and Spain, the averages had been €125.39/MWh and €125.41/MWh, respectively. In distinction, the bottom common worth, €9.25/MWh, was reached within the Nordic market. In the remainder of the analyzed markets, costs ranged from €77.92/MWh within the German market to €90.55/MWh within the N2EX market of the UK.

Regardless of the will increase in weekly common costs, within the second week of October, unfavourable hourly costs had been registered within the German, Belgian, British, Dutch and Nordic markets, influenced by excessive wind vitality manufacturing values. The bottom hourly worth, ?€7.10/MWh, was reached within the Dutch market on Sunday, October 15, from 14:00 to fifteen:00.

However within the second week of October hourly costs above €200/MWh had been additionally registered on a number of events in many of the analyzed European markets. This was additionally the case on Monday, October 16 in all analyzed markets, aside from the Portuguese and Nordic markets. On that day, the best hourly costs had been registered from 19:00 to twenty:00 CET. Within the German, Belgian, French, Italian and Dutch markets, a worth of €240.00/MWh was reached. Within the case of the French and Italian markets, this worth was the best since August 24. Alternatively, within the case of the Spanish market, an hourly worth of €220.00/MWh was reached on October 16 from 19:00 to twenty:00 CET, which was the best worth because the finish of January. On the identical day and hour, the British market additionally reached the best hourly worth since January, at £241.19/MWh.

Throughout the week of October 9, the rise within the common worth of gasoline and CO2 emission rights, the rise in demand in most markets and the final decline in photo voltaic vitality manufacturing led to greater costs within the European electrical energy markets. Within the case of the MIBEL market, wind vitality manufacturing within the Iberian Peninsula and nuclear vitality manufacturing in Spain decreased, contributing to the rise in costs.

AleaSoft Power Forecasting’s worth forecasts point out that within the third week of October costs in many of the most important European electrical energy markets may proceed to rise, influenced by declining photo voltaic vitality manufacturing and rising demand in most markets. Within the case of the German market, the decline in wind vitality manufacturing may additionally exert an upward affect on costs.

Supply: Ready by AleaSoft Power Forecasting utilizing knowledge from OMIE, EPEX SPOT, Nord Pool and GME.

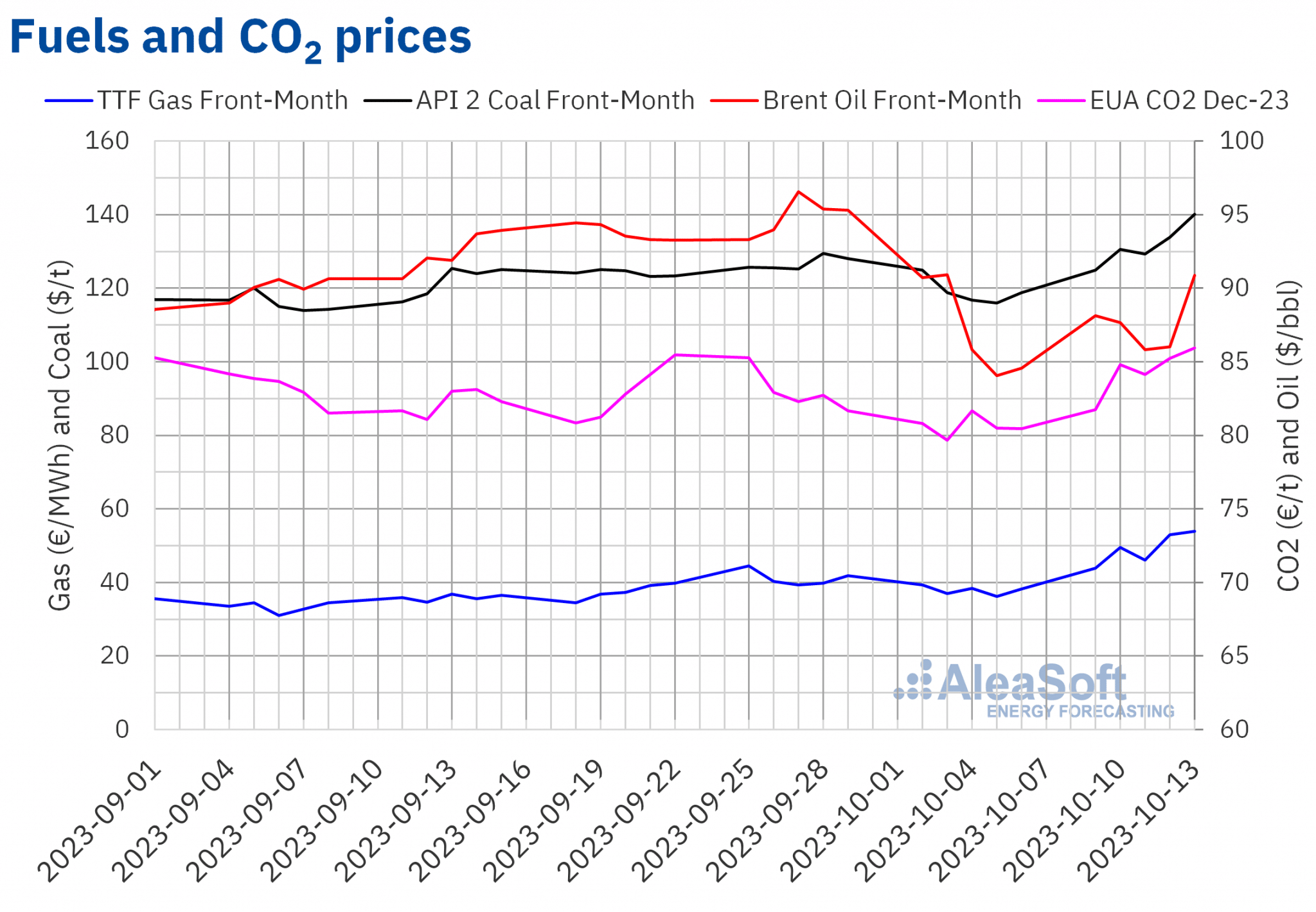

Brent, fuels and CO2

Settlement costs of Brent oil futures for the Entrance?Month within the ICE market remained above $85/bbl in the course of the second week of October. The weekly minimal settlement worth, $85.82/bbl, was registered on October 11. Alternatively, the weekly most settlement worth, $90.89/bbl, was reached on Friday, October 13. This worth was 7.5% greater than the earlier Friday.

Within the second week of October, issues in regards to the influence of the Center East battle on oil provide and OPEC’s world crude oil demand development forecasts exerted their upward affect on Brent oil futures costs. Nonetheless, knowledge confirmed a rise in crude oil shares of america that exerted some downward strain. Alternatively, within the second half of the week, america began to impose sanctions on tanker homeowners carrying Russian oil at a worth greater than the utmost worth imposed by the G7, which could additionally have an effect on provide.

As for settlement costs of TTF gasoline futures within the ICE marketplace for the Entrance?Month, they elevated in the course of the second week of October. On Monday, October 9, the weekly minimal settlement worth, €43.95/MWh, was reached. This worth was already 12% greater than the earlier Monday. The weekly most settlement worth, 53.98 €/MWh, was reached on Friday, October 13. This worth was 41% greater than the earlier Friday and the best since mid?February.

Within the second week of October, costs had been influenced upward by provide issues as a result of instability within the Center East, labor disputes at Australian liquefied pure gasoline export amenities and a pipeline leak within the Baltic Sea. As well as, the forecast of cooler temperatures in Europe additionally contributed to cost will increase, as these would favor a rise in gasoline demand for heating.

Settlement costs of CO2 emission rights futures within the EEX market for the reference contract of December 2023 remained above €80/t in the course of the second week of October. The weekly minimal settlement worth, €81.75/t, was registered on Monday, October 9, and it was 1.2% greater than the earlier Monday. Subsequent worth will increase led to a weekly most settlement worth of €85.95/t, reached on Friday, October 13. This worth was 6.8% greater than the identical day of the earlier week and the best because the finish of August.

Supply: Ready by AleaSoft Power Forecasting utilizing knowledge from ICE and EEX.

AleaSoft Power Forecasting’s evaluation on the prospects for vitality markets in Europe and the financing and valuation of renewable vitality initiatives

This Thursday, October 19, at 10:00 CET, a brand new webinar within the month-to-month webinar collection of AleaSoft Power Forecasting and AleaGreen will likely be held. On this event, the prospects for European vitality markets for the winter 2023?2024 will likely be analyzed. As well as, the webinar will deal with the financing of renewable vitality initiatives and the significance of market worth forecasting in audits and portfolio valuation. To handle these matters, audio system from Deloitte will take part for the fourth time within the webinar of October.