Diagram displaying warmth pump varieties and purposes. Supply: IEA (2024)

The report provides that two energy-intensive sectors could possibly be well-suited to utilizing warmth pumps: the pulp and paper sector, wherein round 55 per cent of present warmth demand could possibly be offered by industrial warmth pumps, and the chemical sector, for which round 18 per cent of demand could possibly be met.

Warmth pumps can be unlikely to serve demand for different energy-intensive sectors, nonetheless, as “only some early-stage prototypes exist for temperatures past 200C, all of that are removed from being prepared for the mass market”.

Even below the STEPS, the inventory of warmth pumps in buildings in China would double, reaching greater than 1,100GW by 2050 and contributing to constructing emissions falling by greater than 25 per cent, with fuel-switching choices resembling coal-to-gas additionally enjoying a job.

For mild industries, warmth pump-led CO2 emissions reductions below STEPs would “stay restricted”, as below the present coverage settings, warmth pumps could also be “deployed slowly”. Total, by 2050 heat-related emissions would solely fall by 15 per cent.

Considerably, the insurance policies required to fulfill local weather targets in China – and the remainder of the world – below the APS would see some industries “strongly mobilised”, the report says. Sectors resembling mining and equipment would want to develop, ramping up clean-energy expertise manufacturing to fulfill home and international demand.

Whereas this extra industrial exercise would elevate China’s warmth demand by 5 per cent within the APS in contrast with the STEPS, the related emissions can be greater than offset by the financial savings enabled by wider deployment of electrification and clear heating applied sciences.

Furthermore, the deployment of warmth pumps would enable for a 20 per cent decline within the power depth of warmth provide by 2050 – the power demand per unit of warmth – in comparison with right now, the report says.

The alignment between expanded warmth pump use and decarbonisation of the electrical energy system may see oblique emissions from energy technology for warmth drop by greater than 40 per cent by 2030 as extra renewable and nuclear energy comes on-line, it provides. By 2050, electrical energy’s share in warmth technology may exceed 75 per cent.

For instance, the IEA states that the pulp and paper sector may see coal use “nearly fully phased out by 2050”, if China’s local weather targets are met. The sector has already reduce the share of coal in its power wants from 43 per cent in 2010 to 10 per cent in 2022, resulting from electrification and coal-to-gas shifts.

Underneath the APS, direct coal use for area and water heating in China would fall by 75 per cent by 2030 and can be “nearly fully phased out” by 2040, with warmth pumps turning into a key expertise for heating in city and rural areas by 2050.

Nevertheless, important funding can be wanted on this situation to deploy sufficient warmth pumps to fulfill demand.

How efficient are warmth pumps as an answer for China?

With greater than 250GW of put in warmth pump capability in buildings in 2023, China accounts for greater than 25 per cent of world warmth pump gross sales and was the one main market to see warmth pump gross sales develop in 2023, the report says. In 2022, 8 per cent of all heating gear gross sales for buildings in China had been warmth pumps.

They’re “already the norm” for area heating and cooling in buildings in some elements of central and southern China, which don’t profit from centralised district heating. Rural areas are actually seeing a rising uptake of warmth pumps, resulting from coverage help to encourage rural areas to restrict coal consumption, the report provides.

The identical can be true for district heating, the place community operators are more and more putting in warmth pumps. Whereas the bulk are “air-source” pumps working at comparatively low temperatures, some networks are starting to make use of large-scale warmth pumps that recycle waste warmth from metal mills, sewage remedy processes and coal chemical vegetation.

They “provide some of the environment friendly choices for decarbonising warmth in district heating networks, buildings and trade”, in line with the report.

When it comes to each direct and oblique emissions, annual carbon emissions from a warmth pump at present put in in China are greater than 30 per cent decrease than these from gasoline boilers. “Shifting from fossil gas boilers to warmth pumps”, the report says, “would cut back CO2 emissions nearly all over the place they’re put in”.

Regardless of excessive upfront set up prices, warmth pumps additionally assist customers get monetary savings on power payments over their lifetimes, in line with the IEA.

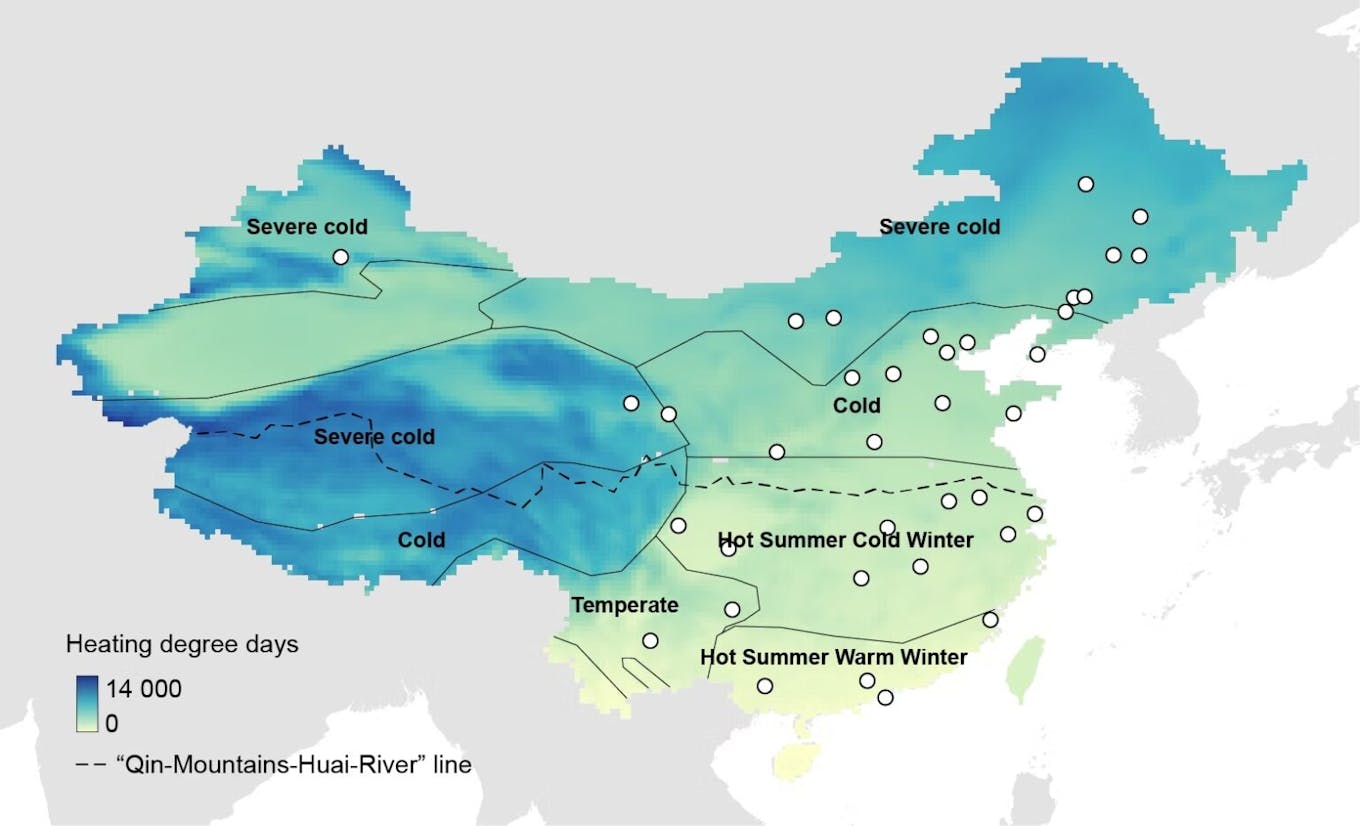

The picture under exhibits the completely different local weather zones throughout China. Air-to-air warmth pumps are more cost effective than each gasoline boilers and electrical heaters in some colder climates, in addition to in areas with sizzling summers and chilly winters.

Map of Chinese language local weather zones, heating diploma days and distribution of chosen Chinese language cities with greater than 1m inhabitants. The designations employed and the presentation of the fabric on the maps on this article don’t suggest the expression of any opinion in anyway on the a part of Carbon Temporary regarding the authorized standing of any nation, territory, metropolis or space or of its authorities, or regarding the delimitation of its frontiers or boundaries. Supply: IEA (2024)

Air-to-water warmth pumps get monetary savings over electrical heaters, though they’re solely cheaper than gasoline boilers in areas with aggressive electrical energy costs in comparison with gasoline.

Warmth pump use in energy-intensive industries is much less viable, as present applied sciences to generate temperatures above 200C are nonetheless largely below improvement.

Nevertheless, for mild industries, industrial warmth pumps are “far cheaper” than gasoline and electrical boilers and practically cost-competitive with coal boilers over their lifetimes, resulting from their excessive effectivity ranges, states the report.

Regardless of this, uptake is just not widespread, resulting from excessive upfront set up prices and lack of public consciousness of the effectiveness of warmth pumps.

Delmastro and Martinez Gordon inform Carbon Temporary:

“In sure processes different applied sciences [to heat pumps] may be more cost effective and extra acceptable, and – relying on coverage selections – completely different ranges of warmth pump deployment could also be stimulated. Nevertheless, to fulfill China’s carbon neutrality purpose, we estimate that warmth pumps want to produce not less than 20 per cent of warmth demand in mild industries by 2050.”

The report provides that state-of-the-art warmth pumps – warmth pump expertise that’s both newly-released or near launch – are well-placed to fulfill warmth consumption wants within the constructing sectors and lightweight trade sectors, and will theoretically provide about 40 per cent of demand.

As well as, China at present wastes warmth sources that could possibly be redirected by way of warmth pumps. In 2021, it generated 45EJ of waste warmth sources – nearly equal to the mixed heating demand of buildings and trade – from sources resembling nuclear energy vegetation, different energy vegetation, industrial exercise, information centres and wastewater, in line with the report.

How can coverage help warmth pump adoption?

Warmth pumps have “more and more featured” in China’s national-level power and local weather coverage as one side of the power transition. For example, the 14th “five-year plan” for a contemporary power system (2021-2025) requires the enlargement of fresh heating provision for end-users as a part of its electrification drive.

Nevertheless, Delmastro and Martinez Gordon clarify that the extra focused, sensible coverage suggestions within the IEA report “ought to [fall] below the umbrella of a transparent nationwide motion plan for heating decarbonisation, which is lacking now in China”.

This could enable China to set quantitative targets for warmth pump use that would supply a transparent sign to markets and promote wider funding in R&D, manufacturing and deployment.

2022 manufacturing capability (purple) and anticipated demand below the APS in 2025 (mild blue) and 2030 (darkish blue) for air-to-air heating and air-to-water warmth pumps in buildings. Supply: IEA (2024)

In the meantime, the report means that extra stringent efficiency necessities for brand new buildings, stronger power efficiency benchmarks, inclusion of warmth pump set up necessities in constructing codes and extension of the scope of the nationwide emissions buying and selling scheme (ETS) to incorporate trade may all drive warmth pump adoption.

Loans, tax credit and different monetary help mechanisms may deal with shopper reluctance to pay excessive upfront set up prices, provides the report.

The northern metropolis of Tianjin supplied grants of 25,000 yuan (US$3,700) for air-source warmth pump purchases, however this isn’t a typical follow – significantly in city areas.

Elevating consciousness of the advantages of business warmth pumps and lowering electrical energy prices for trade may speed up uptake in mild trade, the report says.

Electrical energy pricing incentives have already seen rural residential areas change from utilizing coal to utilizing gasoline for heating. Related incentives for electrical energy in rural elements of Beijing, in addition to subsidies for putting in warmth pumps, imply that warmth pumps are actually the most cost effective heating choice for households in that area, based mostly on IEA calculations.

Increasing this coverage nationwide may “additional improve the competitiveness of warmth pumps in areas the place electrical energy at present prices considerably greater than gasoline”, the report states.

Different measures that would make warmth pumps extra enticing to customers embrace combining warmth pumps with photo voltaic panels or photo voltaic thermal options, plus adapting the ability system to offer tiered electrical energy pricing and time-of-use energy market measures.

Lastly, extra restoration of waste power sources, mixed with thermal power storage applied sciences, may “optimise warmth provide by remodeling surplus electrical energy…into warmth and storing it to be used throughout the winter heating”, the report says.

“In northern Hebei, for instance”, it provides, “warmth recovered by warmth pumps from renewable energy and waste warmth may account for 80 per cent of the district warmth provide throughout winter in 2050”.

This story was revealed with permission from Carbon Temporary.