I count on a curate’s egg form of yr for international cleantech innovation in 2024.

Cleantech Group sees loads of areas to be excited by, however after the over-exuberant and low rate of interest markets of 2021, we imagine the re-adjustment course of within the international cleantech enterprise portfolio has one other yr to run.

Particularly when you think about this era of “local weather stuckness” we’re in, and the uncertainty and instability within the macro setting, not least close to how all the numerous 2024 elections play out.

Within the second half of this thought-piece, we listing a number of expectations and hopes for 2024. For such, to have which means, it first requires an appreciation of the broader context.

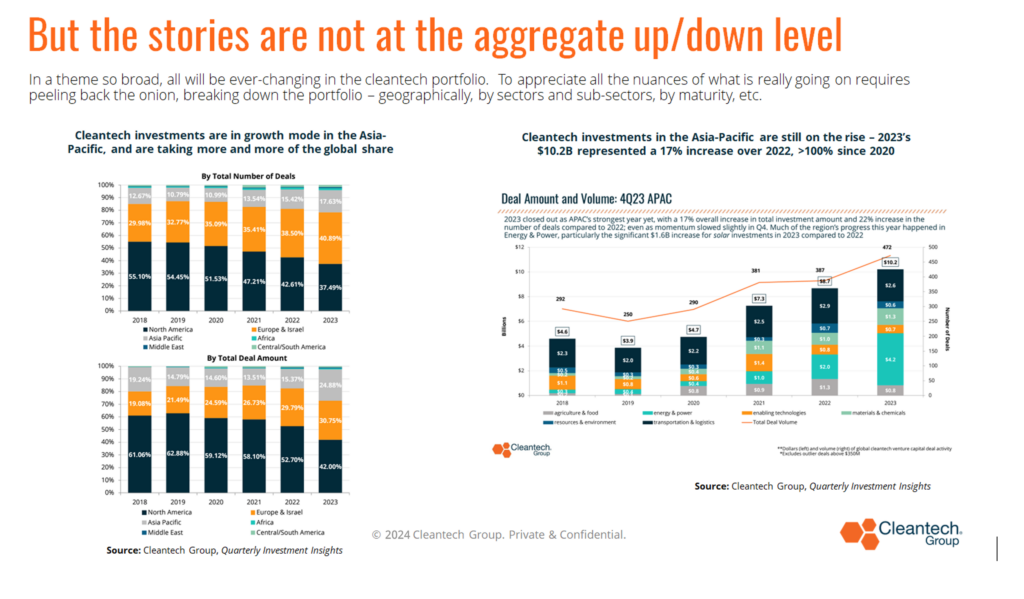

International cleantech enterprise and development capital investments had been 25% down on their 2022 ranges, however as I argued in my keynote at our current 22nd annual Cleantech Discussion board North America, such a blunt aggregated determine actually tells you little or no. Be it up, down, or flat.

That’s as a result of cleantech is a cross-cutting innovation theme, involving so many geographies, all of the sciences, all TRLs and firm growth phases (from pre-seed to mega-rounds for unicorns), and corporations we categorize into >1400 sectors and sub-sectors (as per our proprietary taxonomy), offering (potential) options to nearly each a part of the worldwide industrialized financial system you possibly can think about. Homogeneous it isn’t.

Cleantech innovation funding within the Asia-Pacific, for instance, continued its upward journey in 2023, and speaks to the continued globalization of innovation – nowhere extra so than in our area, the place options and good firms are coming from in every single place.

Not like in most innovation themes, the US at present accounts for lower than 50% of the worldwide deal rely in cleantech and that % has been persistently trending downwards for the previous couple of years.

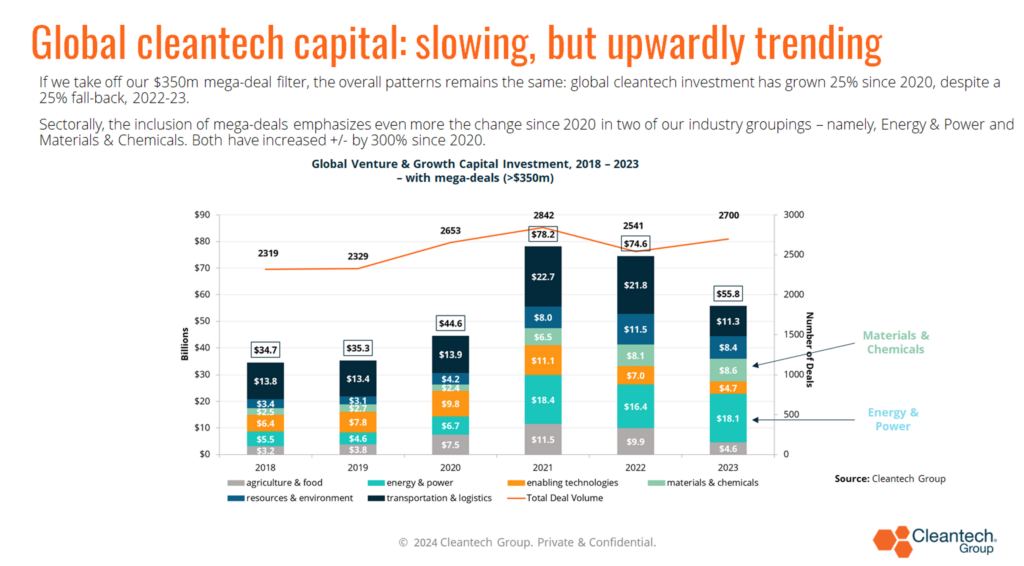

At a world stage, there may be additionally a special 25% quantity to remember – 2023 was 25% up on 2020, and we predict for any critical analyst of this multi-decade innovation journey, that is the extra essential 25% quantity to be targeted on, at this level.

It signifies the sense of a seamless upwardly trending journey from the Paris Accord onwards for our theme, writ giant. We regard the spikes of 2021 and 2022 because the anomaly interval, brought on by extremely popular areas in Agriculture & Meals and Transport & Logistics, as illustrated beneath.

Extra particularly, these two industrial areas have fallen again in 2023 by greater than 50% due to huge pullbacks in very explicit funding sectors, ones that had arguably turn into over-invested and over-heated – particularly:

- Various Proteins and Indoor Farming in our Agriculture & Meals industrial grouping:

- Various Proteins’ $577M whole for North America in 2023 was practically 7x lower than its $3.5B whole in 2021. The worldwide fall was nearer to 5x ($1.2B in 2023 vs >$5.5B in 2021)

- Indoor Farming’s $153M whole for North America in 2023 was practically 10x lower than its $1.45B whole in 2022. The worldwide fall was nearer to 6x over the identical interval.

- On-road autos and provide chains and logistics in our Transport & Logistics industrial grouping:

- Provide chains and logistics’ international $680M whole in 2023 sits in stark distinction to the >$20B (sure, $20B) that had been invested within the 9 quarters since 4Q 2020.

- At a world stage, on-road autos (assume EVs and primarily passenger EVs) pull-back is much less dramatic. Its $7.3B international whole for 2023 is extra a case of trending downwards, by 14% from 2022’s $8.5B, that after a fall of 16% from 2021’s $10.2B. Once more, aggregated information masks a whole funding shift, geographically.

- In 2021, North America accounted for greater than 50% of such investments

- In 2023, the Asia-Pacific, led by China and backed up by India, accounted for practically 70% of such.

These examples communicate to 2 key assertions, particularly that:

- 2021 and 2022 funding ranges had been extra-ordinary, particularly in how dramatic the funding ranges had been into provide chain and logistics within the Covid interval when their fragility and inefficiencies had been so brutally uncovered.

- Throughout the entire cleantech portfolio, there’ll without end be sub-sectors in development, some in fall-back mode, some over-valued and re-adjusting, others rising from earlier phases. Get used to it, individuals; it has at all times been thus.

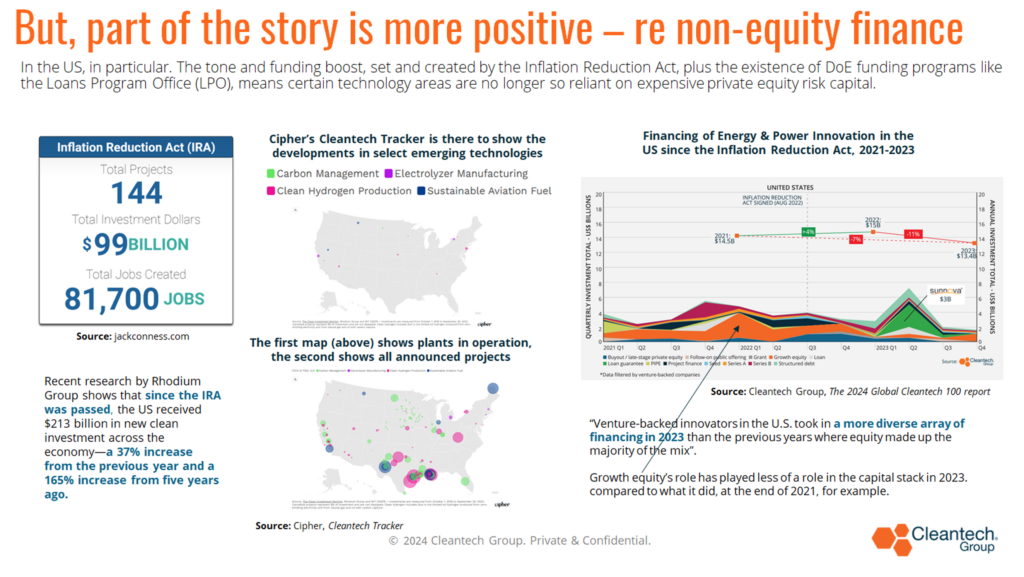

Nowhere is that this more true than within the US, the biggest single enterprise market on the earth.

Its 45% fall 2022-23 is probably the most dramatic re-adjustment/pull-back within the international dataset, reflecting the top of straightforward cash, much less receptive exit markets, particularly in IPOs, and reflecting the pronounced up/down cycles which have at all times characterised US Enterprise Capital.

That may really feel all fairly gloomy as we head into 2024, however truly there are three huge “however’s” to remember:

- The early stage continues to be robust, notably in among the hardest to abate sectors. Encouragingly, by this era, “deeptech” cleantech – assume areas like batteries, cement, fusion, and metal – have accounted for 13% of all investments throughout 2022 and 2023 (vs. 6% throughout 2018-2020). A brand new funding wave targeted on deeper decarbonization options for the 2030+ interval has established itself.

- There’s nonetheless loads of dry powder, and though fundraising is more durable than two years again, say, new funds are nonetheless getting raised by probably the most credible fund managers.

- 2023 has seen a wholesome emergence within the US of non-equity finance within the later-stage capital stack, stimulated by the Inflation Discount Act, alongside the Bipartisan Infrastructure Legislation. We should always have a good time the truth that costly development fairness has been capable of play much less of a task within the financing of future manufacturing vegetation and on this new interval, we’re seeing increasingly more initiatives in key decarbonization sectors be introduced and go into building.

In opposition to all that background, listed below are out a few of our hopes and expectations for 2024….

Count on Vitality & Energy investments to stay resilient.

Investments into Vitality & Energy cleantech firms globally have elevated practically 300% since 2020, stimulated by power insecurity and geopolitics, enabled by renewables, led by photo voltaic, providing such aggressive pricing, and within the context that we have to meet the objective of trebling renewable capability by 2030, as a part of the drive in direction of agreed local weather targets. The race is on.

Particularly in areas that relate to the challenges of velocity, scale and optimizing efficiencies.

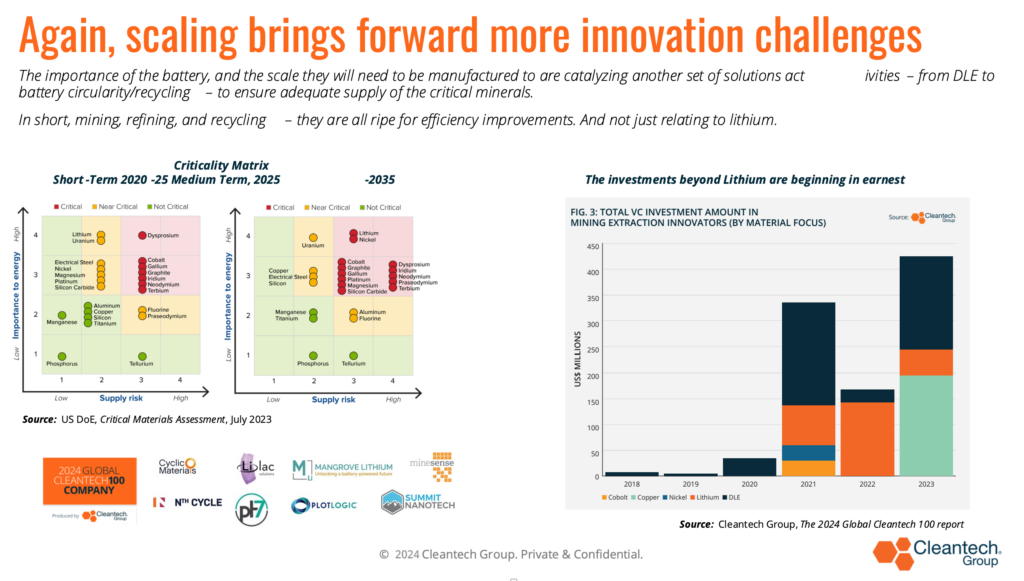

The push for scale begets an entire sequence of different innovation challenges/alternatives – not least in power storage and supplies.

With batteries, each side to enhance efficiencies and obtain cost-downs are being pursued – from improvements referring to the anode to the cathode, from different chemistry choices (enabled by graphene, for instance) to recycling (to shore up entry to the crucial minerals).

Count on the push for resilience within the provide of crucial minerals to proceed (past lithium).

There have been main investments in securing lithium’s availability – be that through direct lithium extraction or recycling – for the final 2-3 years. We count on to see this basic pattern proceed however with extra give attention to different components, too – be that copper, cobalt, nickel, zinc. The listing (concerningly) goes on and on.

Count on the supplies revolution to proceed in 2024.

Decarbonization at significant scale can not occur with such minerals in satisfactory provide however nor can they occur with out new supplies being developed ever sooner, cheaper.

Instance areas would possibly embrace sorbent innovation to assist cut back prices of Direct Air Seize, or new catalysts to supply e-fuels for aviation and transport; or supplies to retailer warmth at excessive temperatures (1300°-2000°C), thereby unlocking industrial course of warmth markets.

Like Vitality & Energy this industrial class in our taxonomy has seen international investments enhance by roughly 300% since 2020. We count on to see supplies innovation investments in 2024 stay robust.

Within the spirit of sooner and cheaper, we count on AI in Cleantech to be checked out more durable and more durable in 2024.

Nothing new at one stage, however we’re busy figuring out companies whose complete worth propositions are constructed on AI’s distinctive capabilities (vs only a device to create incremental enhancements). One space of excessive potential is the flexibility to turbo-charge, through larger computing energy, the event of latest supplies, new components, and many others. During the last 2-3 years, the heaviest funding space for AI in cleantech has been round precision harvesting, climate prediction, crop and soil monitoring, farm administration and good irrigation. Recycling and battery intelligence are areas on the rise too.

Count on some blood on the streets in 2024.

Protecting it actual, we all know bridge loans and insider rounds have been widespread of late, within the hope of driving out a tricky fundraising setting and to keep away from down-rounds. Not every part is postpone-able and we count on to see some powerful selections having to be made in 2024, resulting in an increase in consolidations, secondaries, and bankruptcies (in sub-sectors the place there could also be too many “me-too’s”).

One such space may be within the carbon administration help providers enviornment. Not the carbon removing firms, themselves, however extra within the monitoring and verification know-how and market firms. So many have been invested into, 2020-2023, however we’re in a interval the place the carbon offsets markets aren’t working effectively sufficient and doubts on the standard of knowledge and high quality for resultant offsets persist and are creating headwinds.

When it comes to hopes, greater than outright expectations, I’ll name out three to finish with.

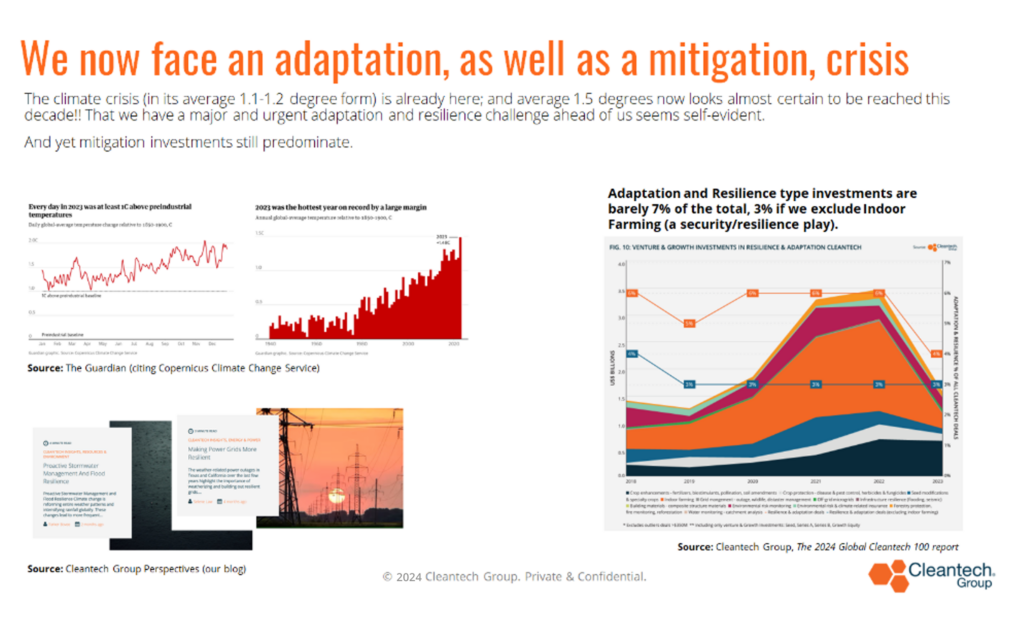

We hope to see the primary pureplay adaptation-focused fund, as a sign of acknowledgement of the sobering actuality that we’re merely not going to restrict the planetary temperature rise to something near 1.5°C.

We’re heading to a world the place droughts, floods, heatwaves, wildfires, and different climate-driven disasters will turn into regular elements of most years – for the remainder of our lives. To operate industrially, to operate as societies, now we have to put money into adaptation, in addition to mitigation. This may current some fascinating, and near-term, innovation-led alternatives.

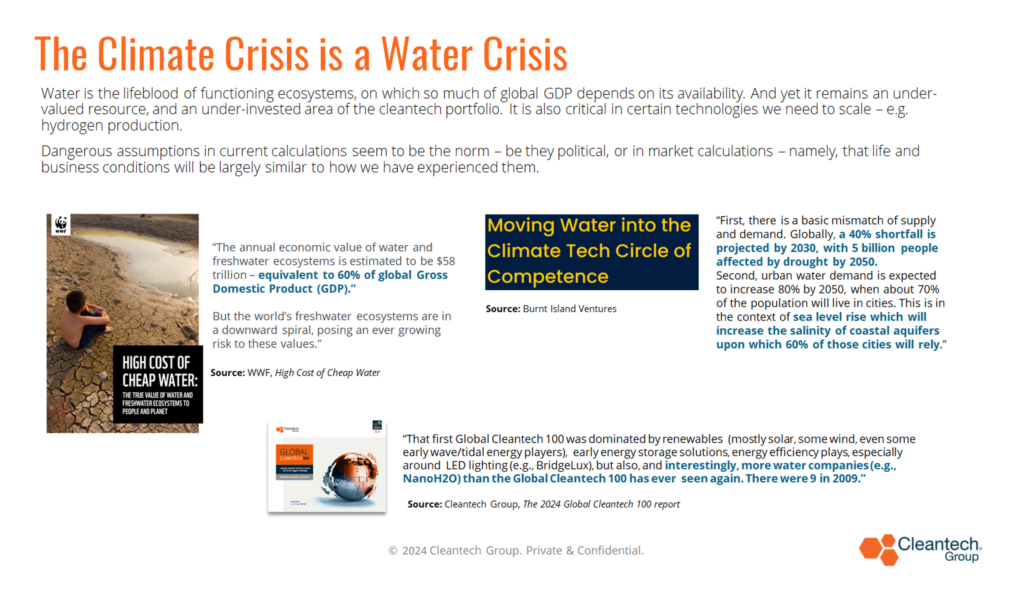

We hope to see a rising curiosity in water-related investments in 2024 – maybe beginning on the intersect of power and water.

Given how lengthy water investments have been a laggard, we don’t count on important change in 2024 however maybe no less than there may be some shift in appreciation of how the primary disaster we’re more likely to face within the coming years, is much less an power provide disaster however certainly one of water, the lifeblood of nature, trade, and society.

And eventually, we hope (even pray) for climate-progressive insurance policies to stay at greatest, largely unimpacted.

Be careful for the elephant within the 2024 room – how does local weather coverage and momentum get impacted by elections’ outcomes?

Sure, enterprise/development investments are in a re-adjustment section, as we enter 2024. However arguably, the innovation ecosystem has by no means been stronger, and it’s taking part in its half.

However to climb the ever-steepening mountain, we’d like all different stakeholders to play their half – coverage, huge finance, company leaders – to innovate, to behave sooner, to stay as much as their phrases and pledges, to stimulate the demand, to develop new-look financing devices, match for goal for the challenges forward.

Will 2024, dubbed by The Economist as “the best election yr in historical past”, with greater than 4 billion individuals heading to the polls, ship us idealogues and populists, or pragmatists able to argue that fixing local weather change will not be solely essential however is the path to larger nationwide safety and financial prosperity, if we are able to keep the course?

The three elections to observe, for his or her affect on the route of world cleantech for 2025+, are India, the EU and the US – India, due to its rising affect and sheer dimension; the EU, as a result of Europe has been the regular hand setting a constant tone in international dialogues for 3 a long time, and giving us rules that tax carbon, ban poisonous merchandise, and many others; and the US, as a result of having simply bought itself heading in direction of a extra decarbonized and industrial future, constructed on know-how, and home manufacturing and jobs, full-force Trumpism may hit the reverse course button.

Will we finish 2024 nonetheless wanting like a world sincerely transitioning away from fossil fuels, or will now we have taken a lurch backwards and be left to the whims and vagaries of some authoritarians?