By Vince Golle (Bloomberg) Transport prices are rising as lots of of container ships that sometimes transit the important thing maritime artery of the Purple Sea and Suez Canal are rerouting after a large number of assaults by Iran-backed Houthi militants.

Mixed with disruptions at a drought-stricken Panama Canal within the Western Hemisphere, the rise in service provider transport charges poses headwinds for central bankers of their inflation combat.

Associated Articles:

OPED – May The Federal Reserve Repair Our Ports? by John Konrad

The Fed’s Inflation Struggle Faces A New Problem: A Dry Panama Canal By Laura Curtis

Federal Reserve Launches Monitor of Drybulk and Container Transport ‘Stress’ by Barry Parker

Meantime, the financial system in Vietnam exceeded expectations this yr and is poised for higher ends in 2024. For economies in lots of African nations subsequent yr, credible elections and improved governance are key.

Listed below are a number of the charts that appeared on Bloomberg this week on the newest developments within the world financial system:

World

Half of the container-ship fleet that repeatedly transits the Purple Sea and Suez Canal is avoiding the route now due to the specter of assaults, in response to new business information. The tally compiled by Flexport Inc. exhibits 299 vessels with a mixed capability to hold 4.3 million containers have both modified course or plan to. That’s about double the quantity from every week in the past and equates to about 18% of worldwide capability. Diverted voyages are extra pricey and should result in increased costs for shoppers on all the things from sneakers to meals to grease if the longer journeys persist.

Africa

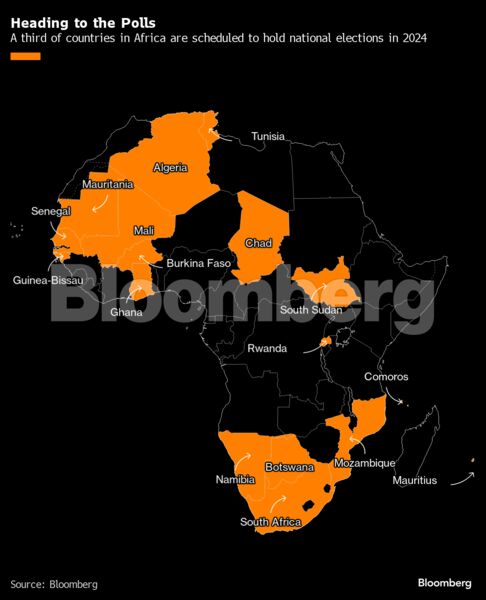

The theme for the African continent in 2024 seems to be all about who’s in cost. From South Africa to Algeria, a 3rd of the continent’s nations will select new governments, together with coup-hit Mali, Chad and Burkina Faso — if their junta leaders preserve their phrase. Credible elections and improved governance will type the bedrock for a number of the world’s poorest — and youngest — nations to scale back battle, spur financial progress and increase employment. The prevailing surroundings makes that troublesome.

Asia

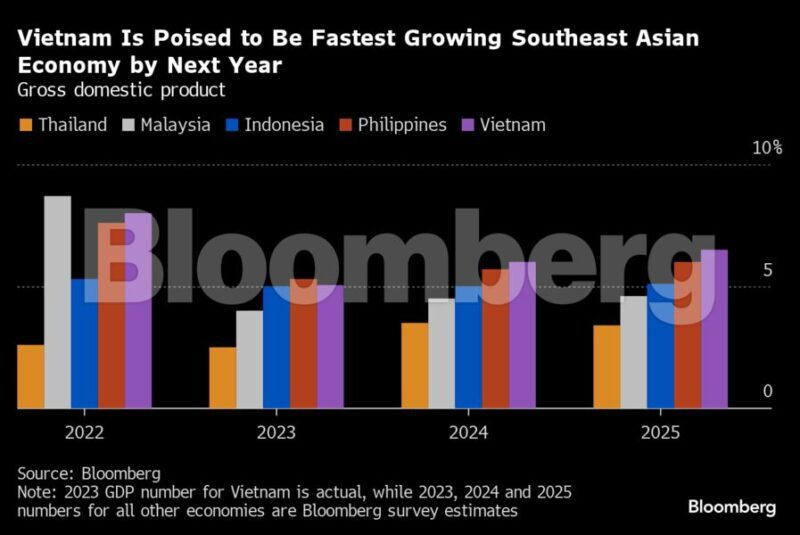

Vietnam’s financial system fared higher than anticipated in 2023, indicating it’ll preserve bettering as shopper demand returns, exports get better and investments surge. GDP rose 5.05% from a yr earlier after rising an preliminary 8.02% within the earlier yr. The financial system is predicted to return to six% progress subsequent yr, and vie for the best-in-Asia progress tag by 2025, a Bloomberg survey exhibits.

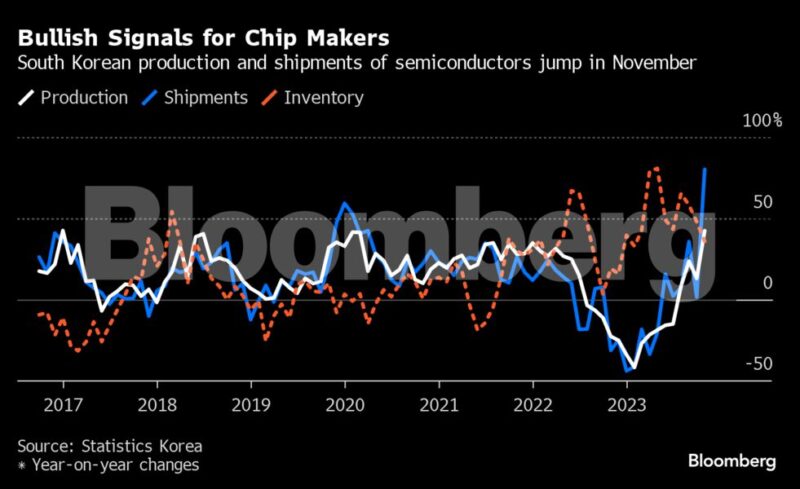

South Korea’s semiconductor business recorded the biggest positive aspects in years in each manufacturing and shipments, underscoring a revival of expertise momentum that bodes properly for the nation’s financial outlook subsequent yr and for the worldwide tech sector.

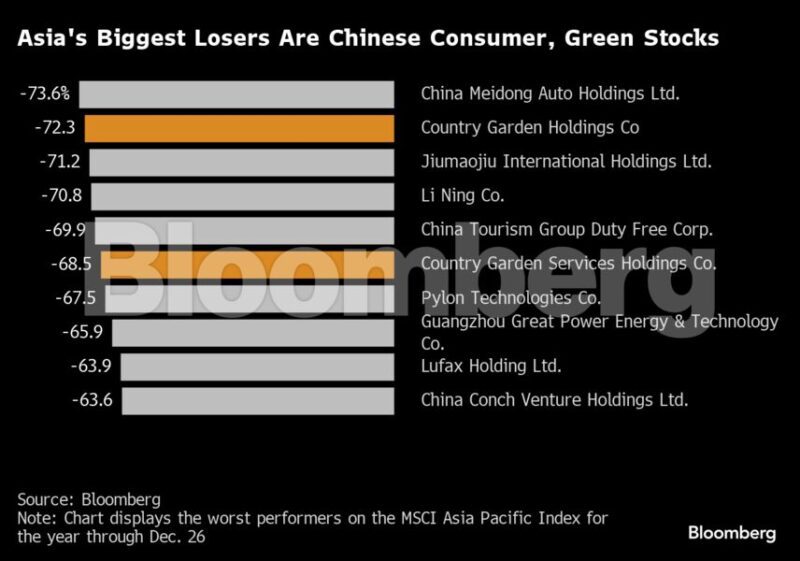

Buyers who purchased into the concept two years in the past that China’s shopper and inexperienced power shares stand to win large from President Xi Jinping’s renewed financial agenda would have seen their holdings pummeled in 2023.

Europe

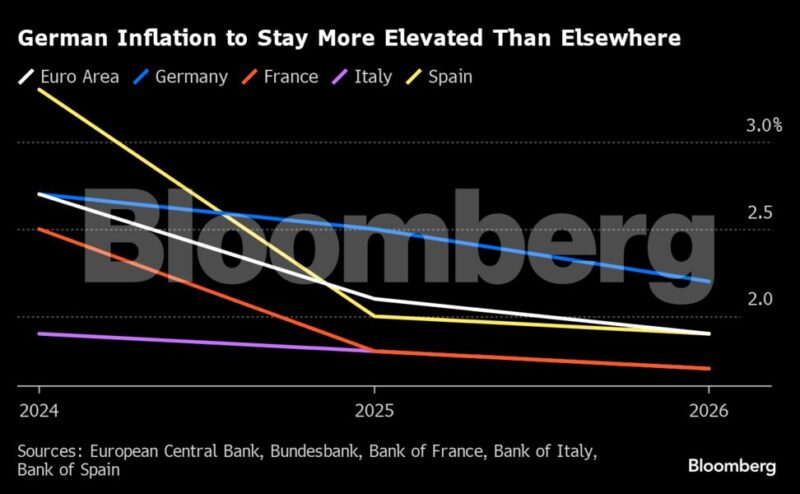

Spanish inflation remained regular on the finish of 2023, tempering a probable euro-zone pickup that will embolden policymakers to maintain pushing in opposition to bets on imminent interest-rate cuts. Though inflation might stay elevated within the close to time period, central banks in Spain, France and Italy all venture it’ll sluggish to 2% and even decrease in 2025. Germany’s Bundesbank isn’t so optimistic, seeing Europe’s largest financial system caught above the goal into 2026, saved increased by wages.

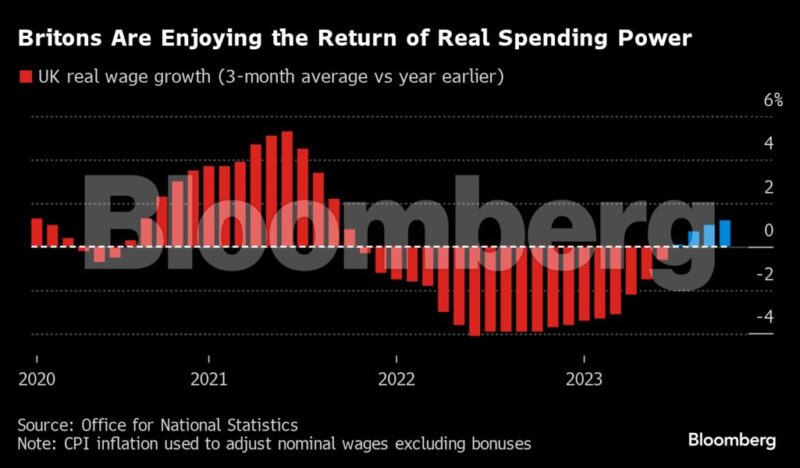

Britain’s financial system most likely will keep away from a recession in 2024 and strengthen within the second half of the yr as shoppers profit from falling inflation and the easing of a prolonged cost-of-living disaster. In mixture, the 52 economists surveyed by Bloomberg imagine the Treasury and the Financial institution of England will engineer a smooth touchdown for the financial system subsequent yr, with progress of 0.3%.

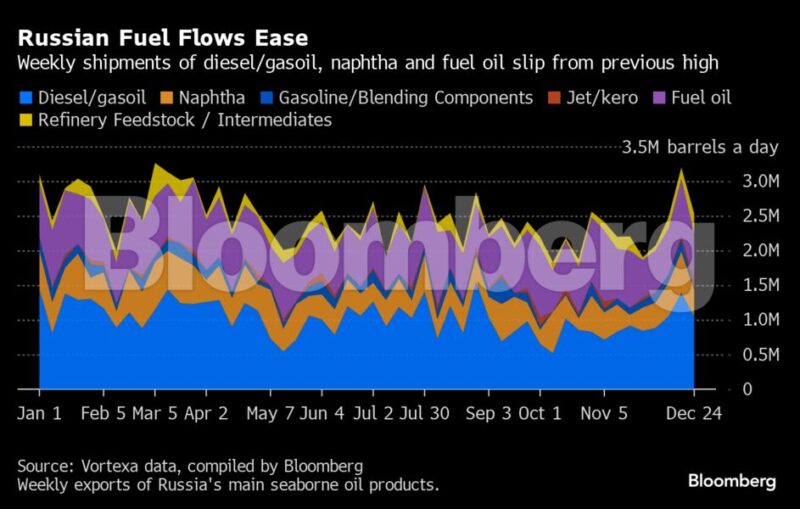

Russia’s oil-product exports dropped on a weekly foundation, led by a droop in shipments of diesel, naphtha and gasoline oil. Nevertheless, the four-week common climbed to the very best in additional than seven months amid a ramp-up in oil processing at Russian refineries.

North America

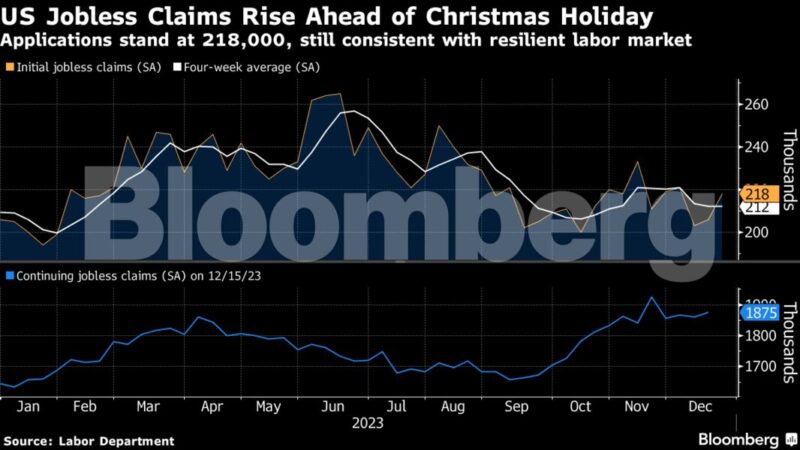

Preliminary purposes for US unemployment advantages elevated within the week main as much as Christmas, whereas remaining at a stage that’s in keeping with a resilient labor market.

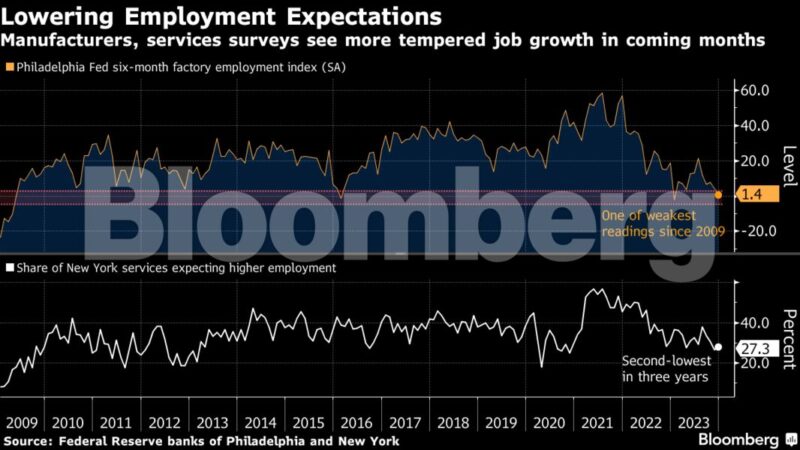

Employers anticipate to rent much less in 2024, in response to a number of regional Federal Reserve financial institution surveys, a development that’s set to restrict wage positive aspects and funky inflation pressures. On the similar time, the outcomes don’t point out an outright contraction in payrolls.

Rising Markets

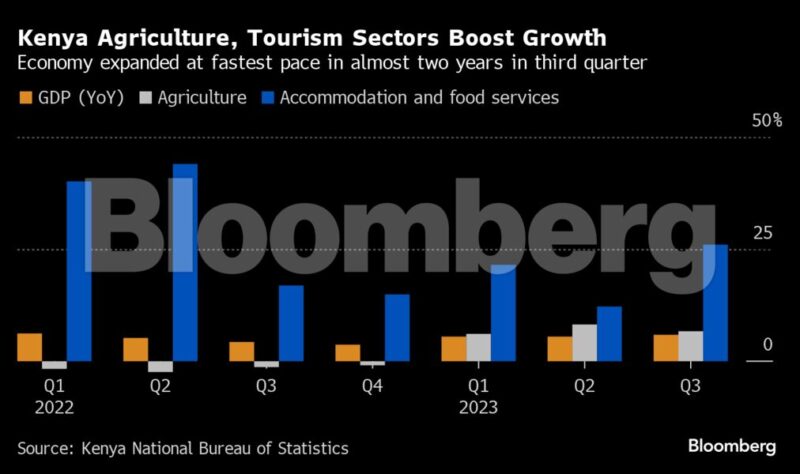

Kenyan shopper costs rose on the slowest tempo in nearly two years in December, whereas financial progress accelerated greater than anticipated within the third quarter, delivering some respite for the battered East African financial system.

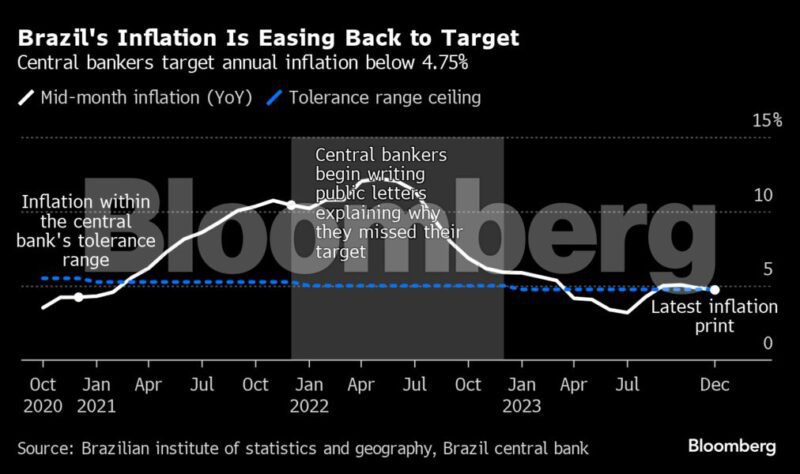

Brazil’s annual inflation slowed lower than anticipated in mid-December, highlighting the difficulties going through central bankers as they lower rates of interest whereas trying to haul costs to the tolerance vary by yr’s finish.

By Vince Golle © 2023 Bloomberg L.P.