Within the week of February 26, costs within the European electrical energy markets had been larger than within the earlier week. The exception was the Iberian market, the place costs fell and had been the bottom, one thing that has been taking place since February 18. Weekly Iberian wind vitality manufacturing was the very best since October, which led to the bottom weekly common value ever in Spain. Fuel and CO2 costs halted the downward pattern and elevated in comparison with the earlier week.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind vitality manufacturing

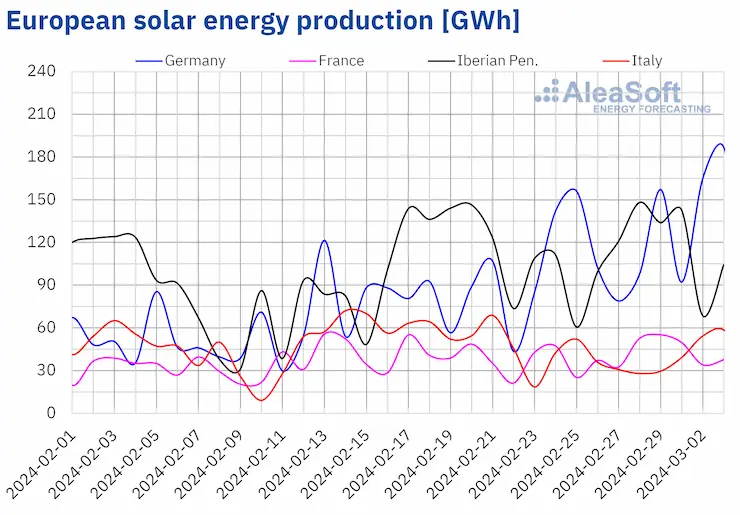

Within the week of February 26, photo voltaic vitality manufacturing elevated in most main European electrical energy markets in comparison with the earlier week, persevering with the upward pattern for the third consecutive week. Will increase ranged from 6.1% in Spain to 30% in Germany. France, with a 15% improve, reversed the earlier week’s drop. Italy, however, registered a 17% drop in photo voltaic vitality manufacturing for the second consecutive week.

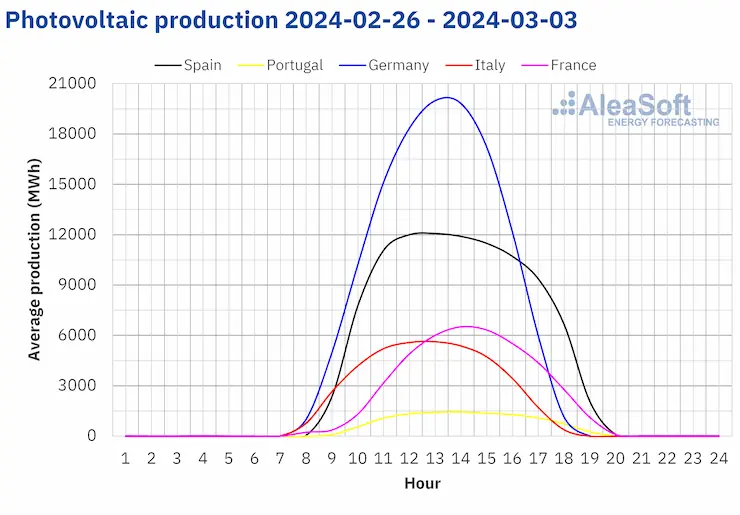

With the arrival of spring and the rise in sunlight hours, each day photovoltaic vitality manufacturing in some markets returned to ranges final seen in autumn. On February 28, the Portuguese market generated 14 GWh, the very best worth for the reason that finish of September and in addition the very best worth ever registered for a February month, breaking the earlier report of February 20 when technology reached 13 GWh. The German and Spanish markets additionally registered the very best photo voltaic vitality manufacturing since October, with 187 GWh generated on March 3 in Germany and 119 GWh generated on March 1 in Spain.

For the week of March 4, in accordance with AleaSoft Power Forecasting’s photo voltaic vitality manufacturing forecasts, this week’s upward pattern will proceed in Germany and Italy. Nevertheless, the Spanish market will register a lower in photo voltaic vitality manufacturing in comparison with the earlier week.

Supply: Ready by AleaSoft Power Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Power Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

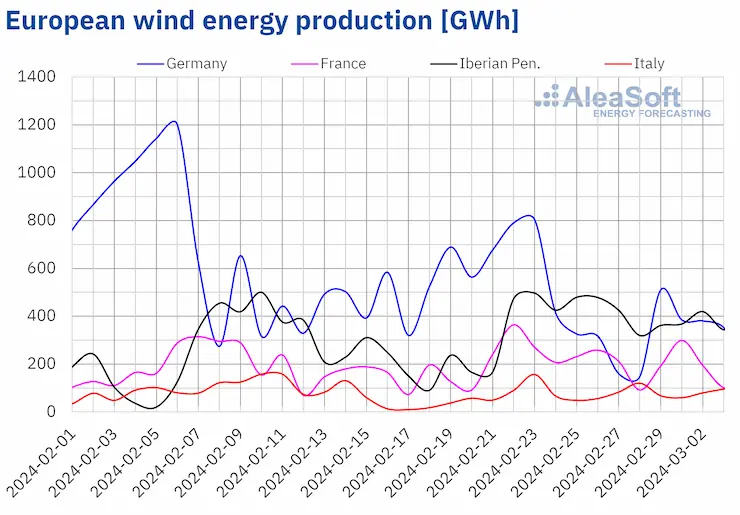

Within the week of February 26, wind vitality manufacturing elevated for the second consecutive week within the Iberian Peninsula and Italy. In each instances the rise was 11%. The German and French markets reversed the upward pattern of the earlier week and registered manufacturing decreases of 47% and 12%, respectively.

Sturdy wind on the Iberian Peninsula introduced weekly manufacturing to ranges final seen in late October. In the course of the week of February 26, the Spanish market generated 2102 GWh utilizing this expertise and the Portuguese market generated 546 GWh.

For the week of March 4, AleaSoft Power Forecasting’s wind vitality manufacturing forecasts point out a rise in Italy and Germany, whereas in France and the Iberian Peninsula it should lower.

Supply: Ready by AleaSoft Power Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

Electrical energy demand

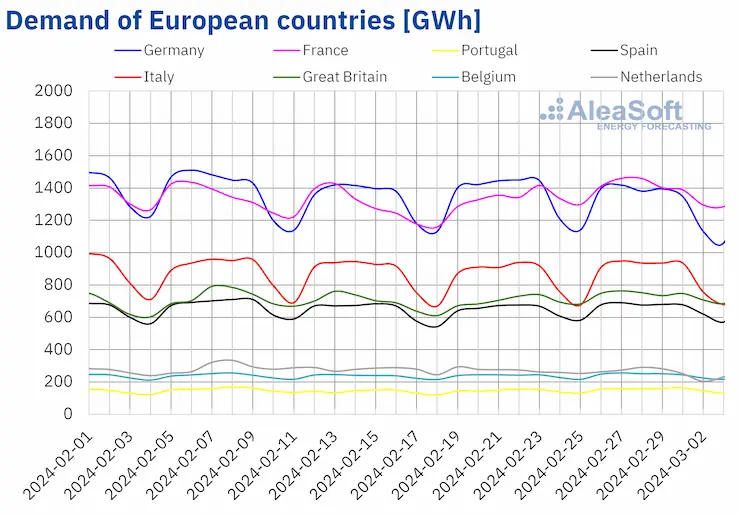

Within the week of February 26, electrical energy demand elevated for the second consecutive week in most main European electrical energy markets in comparison with the earlier week. The Portuguese market registered the biggest improve, 5.7%. The Belgian, Spanish and Italian markets registered the smallest improve, 2.0% every, with Italy reversing the earlier week’s downward pattern. Demand declined solely within the Dutch and German markets, by 5.3% and 4.0% respectively. This was the third consecutive weekly decline for the Netherlands, whereas Germany reversed final week’s pattern.

The rise in demand was associated to the drop in common temperatures. In most analyzed European markets, common temperatures for the week fell between 0.6 °C and 1.7 °C in comparison with the earlier week. The exception was Italy, the place common temperatures elevated by 0.4 °C.

For the week of March 4, in accordance with AleaSoft Power Forecasting’s demand forecasts, the upward pattern will proceed and demand will improve in Belgium and the Iberian Peninsula. In Germany and the Netherlands, demand will even rise, reversing the earlier week’s drop. In distinction, France, Italy and Nice Britain will register a drop in demand.

Supply: Ready by AleaSoft Power Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

European electrical energy markets

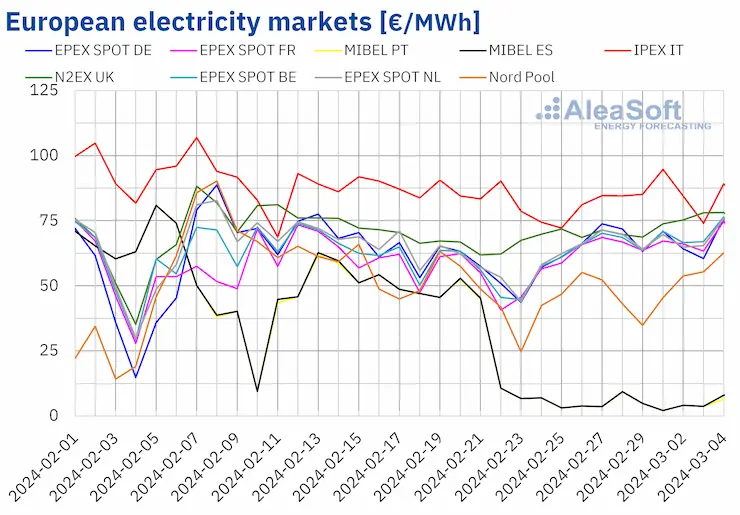

After the restoration registered within the final days of the earlier week, through the week of February 26, costs in the primary European electrical energy markets oscillated, registering averages larger than these of the earlier week most often. The exception was the MIBEL market of Spain and Portugal, with a fall of 81%. The EPEX SPOT market of Belgium and France reached the biggest rise, 21%. Alternatively, the IPEX market of Italy and the Nord Pool market of the Nordic international locations registered the smallest will increase, 2.5% and 4.5%, respectively. In the remainder of the markets analyzed at AleaSoft Power Forecasting, costs elevated between 8.2% within the N2EX market of the UK and 18% within the EPEX SPOT market of Germany.

Within the final week of February, weekly averages had been beneath €70/MWh in most analyzed European electrical energy markets. The exceptions had been the British market, with a mean of €72.22/MWh, and the Italian market, with a mean of €84.11/MWh. In distinction, the Portuguese and Spanish markets registered the bottom weekly costs, €4.52/MWh and €4.53/MWh, respectively. These costs had been the bottom ever within the Spanish market and the second lowest within the Portuguese market. In the remainder of the analyzed markets, costs ranged from €48.57/MWh within the Nordic market to €67.56/MWh within the Belgian market.

Since February 18, the MIBEL market has consecutively registered the bottom each day costs among the many primary European electrical energy markets. In the course of the week of February 26, this market registered 73 hours with costs beneath €1/MWh. Of those, there have been 44 hours with a value of €0/MWh, fourteen of which registered on Sunday, March 3. On that Sunday, excessive ranges of renewable wind and photo voltaic vitality manufacturing mixed with the low demand common for this present day of the week.

In the course of the week of February 26, the rise within the common value of gasoline and CO2 emission rights and the rise in demand in most analyzed markets led to larger costs within the European electrical energy markets. The decline in wind vitality manufacturing in markets reminiscent of Germany and France additionally contributed to this conduct. Nevertheless, the rise in wind and photo voltaic vitality manufacturing on the Iberian Peninsula resulted in important value decreases within the MIBEL market.

AleaSoft Power Forecasting’s value forecasts point out that within the first week of March, European electrical energy markets costs may proceed to rise. Within the case of the MIBEL market, costs may also begin to get better in that week. The rise in demand and the autumn in wind vitality manufacturing in most markets will result in this conduct. The drop in photo voltaic vitality manufacturing within the Spanish market will even contribute to cost rises on this market.

Supply: Ready by AleaSoft Power Forecasting utilizing knowledge from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

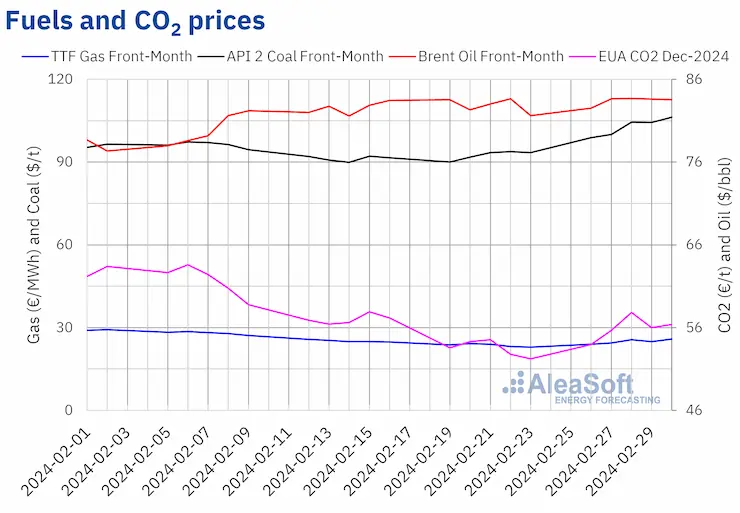

Within the final week of February, Brent oil futures for the Entrance?Month within the ICE market registered their weekly minimal settlement value, $82.53/bbl, on Monday, February 26. Within the first three classes of the week, costs elevated and on Wednesday, February 28, they reached the weekly most settlement value, $83.68/bbl. This value was the very best for the reason that first half of November 2023. Within the final classes of the week, costs remained secure. On Friday, March 1, the settlement value was $83.55/bbl, 2.4% larger than on Friday of the earlier week.

Within the final week of February, expectations in regards to the continuation of OPEC+ manufacturing cuts within the subsequent quarter contributed to maintain settlement costs above $83/bbl in nearly each session of the week.

Manufacturing lower bulletins made on the finish of the week by Russia and different OPEC+ member international locations might need an upward affect on Brent costs within the first week of March.

As for TTF gasoline futures within the ICE marketplace for the Entrance?Month, on Monday, February 26, they reached the weekly minimal settlement value, €24.01/MWh. Over the last week of February, costs elevated in nearly all classes. In consequence, on Friday, March 1, these futures registered their weekly most settlement value, €25.81/MWh. In accordance with knowledge analyzed at AleaSoft Power Forecasting, this value was 13% larger than the earlier Friday.

Forecasts of low temperatures and decrease wind vitality manufacturing contributed to the rise in TTF gasoline futures costs, in addition to provide disruptions from Norway. Nevertheless, regardless of the will increase, ample provide of liquefied pure gasoline and excessive ranges of European reserves stored settlement costs beneath these registered within the first weeks of February.

As for CO2 emission rights futures within the EEX market for the reference contract of December 2024, they began the week of February 26 with a settlement value of €53.97/t, the week’s minimal. Within the first three classes of the week, costs elevated to succeed in the weekly most settlement value, €57.84/t, on Wednesday, February 28. In accordance with knowledge analyzed at AleaSoft Power Forecasting, this settlement value was 6.0% larger than the earlier Wednesday. However within the final classes of the week, settlement costs remained beneath €57/t. On Friday, March 1, the settlement value was €56.37/t, 8.0% larger than the earlier Friday.

Supply: Ready by AleaSoft Power Forecasting utilizing knowledge from ICE and EEX.

AleaSoft Power Forecasting’s evaluation on the prospects for vitality markets in Europe and the financing of renewable vitality initiatives

In the course of the month of March, AleaSoft Power Forecasting and AleaGreen are selling their lengthy?time period value curve forecasting studies for European markets. Lengthy?time period value forecasts of AleaSoft Power Forecasting and AleaGreen function hourly granularity, confidence bands and as much as 30?yr horizons. These forecasting studies may be helpful to get service provider financing and to dimension a PPA.