In a brand new weekly replace for pv journal, OPIS, a Dow Jones firm, presents bite-sized evaluation on photo voltaic PV module provide and value developments.

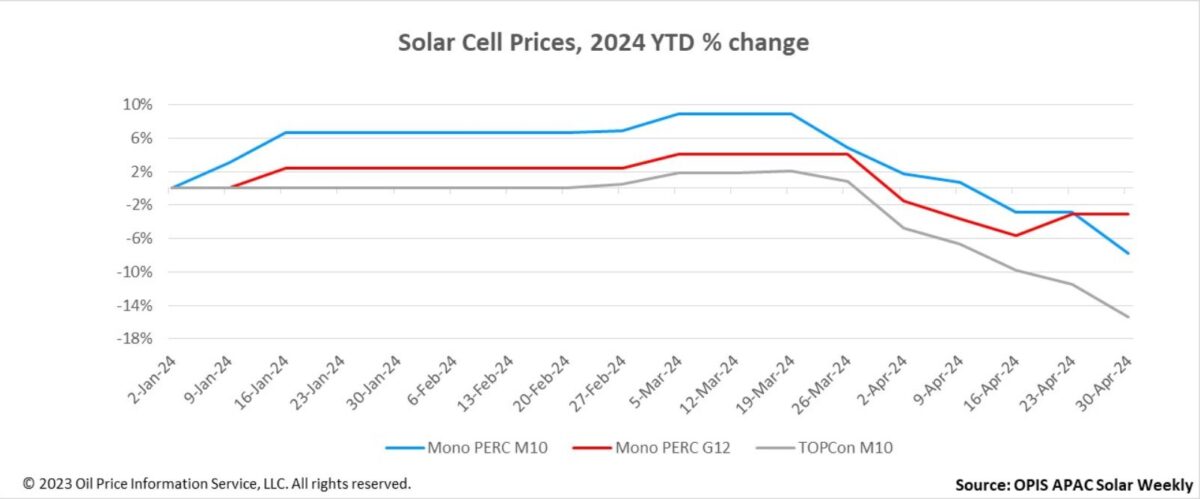

FOB China costs for each mono PERC M10 and TOPCon M10 cells prolonged declines this week, assessed at $0.0417/W and $0.0494/W, respectively, marking a lower of 5.01% and 4.45% from the earlier week.

FOB China costs for mono PERC G12 have steadied this week, holding at $0.0448/W. This stability might be attributed to the current initiation of a number of ground-mounted photo voltaic initiatives in China, which has spurred demand for this cell sort. The constrained manufacturing capability for these cells has led to intermittent provide tightness.

Within the Chinese language home market, mono PERC M10 cells had been priced at round CNY0.335($0.046)/W, whereas TOPCon M10 cells stood at roughly CNY0.397/W, as per the OPIS market survey. In line with a significant TOPCon cell producer, the present value pattern of cells is intently mirroring the worth pattern of wafers.

As well as, this supply acknowledged that there aren’t any indications of any demand elements favoring a reversal within the value pattern, and the one foreseeable answer to reverse the present sluggish market is to attend for some manufacturing capability to be regularly phased out.

Discussions have been ongoing about module producers planning to reduce manufacturing in Could. This has raised considerations amongst some insiders concerning the potential accumulation of cell stock. A distinguished cell producer subsequently anticipates that cell costs will maintain reducing in Could, with TOPCon cells doubtless experiencing a extra pronounced decline in comparison with the mono PERC cells, because the manufacturing output of the latter continues to shrink.

“The current state of affairs within the TOPCon cells market is proving to be fairly difficult,” the supply added, “with even Tier-1 cell producers counting on accepting OEM orders to maintain their operations.”

One other smaller cell producer shares an identical sentiment, indicating that the worth of mono PERC cells might hit its lowest level quickly as a result of manufacturing capability shrinkage. Including weight to this argument is the intention of a number one cell producer to additional lower the manufacturing capability of mono PERC cells in Could, based on the supply. Conversely, this supply anticipates that one other spherical of value cuts for TOPCon cells in Could appears unavoidable.

In line with a market watcher, some cell producers lately discovered investing in constructing TOPCon cell capability much less cost-effective as a result of pessimistic value pattern of this product. This supply additional elaborated that earlier this 12 months, as a way to mitigate losses, a number one built-in producer in nN-type merchandise selected to accomplice with one other lesser-known producer to ascertain TOPCon cell manufacturing capability. The target is to bolster the module manufacturing of this main n-type producer.

This mannequin, the place main gamers help smaller producers, share dangers, and have interaction in mutually helpful cooperation, might doubtlessly set the course for the way forward for enterprise operations, the supply added.

On the product sizes entrance, two distinguished cell suppliers have confirmed with OPIS that they’re set to start mass manufacturing of n-type 210R (182 mm x 210 mm) sized cells in Could or June. One in all them famous that these 210R merchandise are anticipated to make noticeable strides out there within the second half of this 12 months, presenting an important parameter for enhancing module energy output.

OPIS, a Dow Jones firm, gives power costs, information, knowledge, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. It acquired pricing knowledge belongings from Singapore Photo voltaic Alternate in 2022 and now publishes the OPIS APAC Photo voltaic Weekly Report.

The views and opinions expressed on this article are the creator’s personal, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.