The U.S. Senate on April 30 handed, by unanimous consent, a invoice to ban imports of unirradiated low-enriched uranium (LEU) produced in Russia. The invoice now heads to the president’s desk for signature into regulation.

The Senate handed the Prohibiting Russian Uranium Imports Act (H.R. 1042), which the Home of Representatives handed, additionally with unanimous consent, by a voice vote on Dec. 13, 2023. H.R. 1042 was launched by Rep. Cathy McMorris Rodgers (R-Washington) in February 2023, but it surely had the backing of a bipartisan group of Senators, together with John Barrasso (R-Wyoming), Joe Manchin (D-West Virginia), Jim Risch (R-Idaho), Martin Heinrich (D-New Mexico), Cynthia Lummis (R-Wyoming), Chris Coons (D-Delaware), and Roger Marshall (R-Kansas).

H.R. 1042 basically amends the USEC Privatization Act (42 U.S.C. 2297h–10a). It specifies that 90 days after the invoice’s enactment, no unirradiated low-enriched uranium that’s produced within the Russian Federation or by a Russian entity could be imported into the U.S.

“Unirradiated” means contemporary gas that has not but been utilized in a reactor, whereas “low-enriched uranium” refers to uranium merchandise in any type, together with uranium hexafluoride (UF6) and uranium oxide (UO2), through which uranium accommodates lower than 20% uranium-235 (U-235). That features pure uranium and different types, no matter whether or not the uranium is integrated into gas rods or full gas assemblies. (The prohibition, nevertheless, doesn’t apply to imports for nationwide safety functions.) The ban applies by means of no less than 2040.

To scale back provide disruption dangers, nevertheless, H.R. 1042 additionally grants the U.S. Power Secretary (in session with the Secretary of State and the Secretary of Commerce) waiver authority to permit sure imports of LEU if “no various viable supply of low-enriched uranium is obtainable to maintain the continued operation” of a nuclear reactor within the U.S.

As well as, it requires the Power Secretary to conduct a “thorough market analysis” of the anticipated LEU provide to find out “what, if any, U.S. federal help could also be wanted to help growth of manufacturing capability ample to interchange Russian provides.”

An Power Safety Crucial Designed to Set off a Home Provide Chain

A Home report in December argued that the measure would “create the market situations for the long-term business contracts that home gas producers must put money into new U.S. provide capability, together with uranium conversion and enrichment capability, which has atrophied considerably over the previous decade.”

Whereas the hassle partly responds to Russia’s invasion of Ukraine—which in February 2022 precipitated a “looming risk to international vitality safety created by dependence on Russian-supplied fuels”—the invoice’s key goal is first to create “long-term certainty that Russian fuels won’t enter the U.S. market,” the report famous. “This permits correct analysis of the market response, and different priorities for nuclear infrastructure, to establish what, if any, extra federal help is critical to help numerous and sufficient capability growth.”

The report additionally notes that the Home Committee on Power and Commerce thought of implementing the ban after developing the required gas cycle infrastructure. Nonetheless, it signifies that the committee finally concluded this strategy would “get the sequencing backwards,” doubtlessly resulting in market distortions and wasteful taxpayer spending.

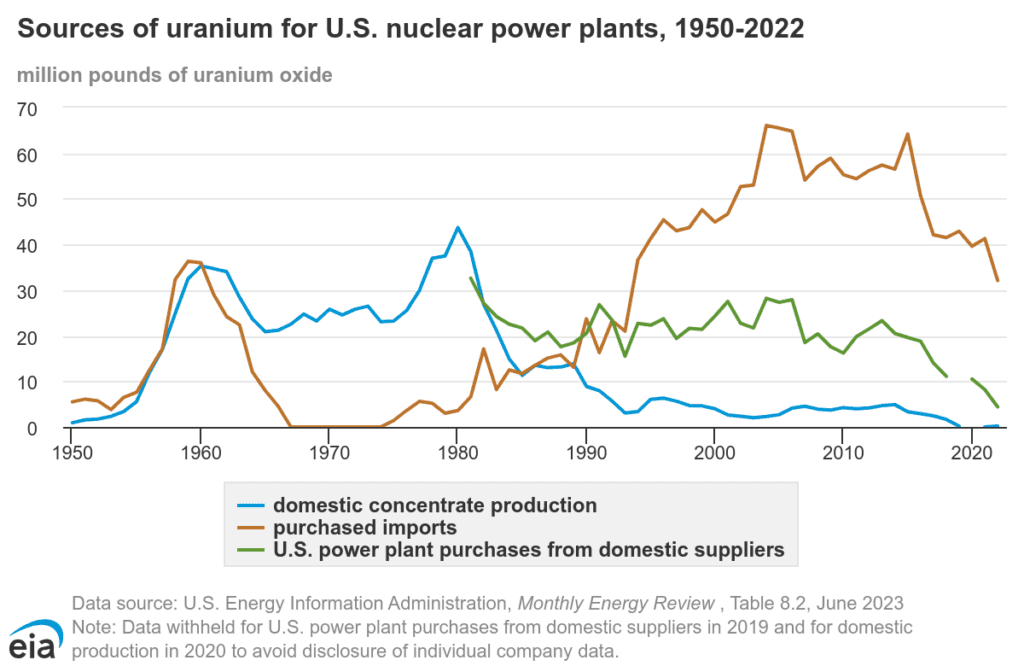

Russian-origin Enrichment Fuels 24% of U.S. Utility Demand

The ramifications of the ban are anticipated to be in depth. Based on the Power Info Administration (EIA), the U.S. imports a lot of the uranium it makes use of as gas, a pattern it has adopted since 1992. Homeowners and operators of U.S. civilian nuclear energy reactors bought 40.5 million kilos of U3O8e (equal) from U.S. and overseas suppliers in 2022, the company suggests. Most (27%) got here from Canada, adopted by Kazakhstan (25%), Uzbekistan (11%), Australia (9%), and 6 different international locations mixed (16%).

Solely an estimated 12% of U.S. purchases of uranium had been sourced from Russia, regardless that Russia dominates the world’s uranium capability (with a market share of about 45%). Nonetheless, U.S. utilities bought an estimated 3.9 million Russian-origin separative work items (SWU) in 2023—representing 24% of U.S. demand. U.S. enrichment crops supplied the remaining 27% whereas Western European crops supplied 49%.

A key concern voiced by lawmakers within the invoice’s supplies is that Russia has maintained “an influential place in international nuclear gas provide chains, significantly in uranium conversion and enrichment,” owing to the nation’s “manufacturing capability that far outstrips its personal home necessities and a vertically built-in, state-owned system that excludes exterior competitors.”

The scale of the “Russian state-owned enrichment capability, together with its giant enriched-uranium inventories, allows it to export enriched uranium merchandise at costs that might undercut allied and home producers, to the detriment of home provide chains, as U.S. Worldwide Commerce Fee (ITC) investigations have repeatedly discovered over the previous 30 years,” the supplies notice. “Truly, this previous March 2023, the ITC’s five-year overview of uranium from Russia discovered that absent present import limits, Russian suppliers would probably undersell home provides and depress costs, to the detriment of U.S. provide chains.”

The Ban’s Potential Impression on Gas Provide, Prices

POWER has reached out to business organizations to find out how the ban may have an effect on nuclear gas provides and nuclear energy economics over the quick and long run.

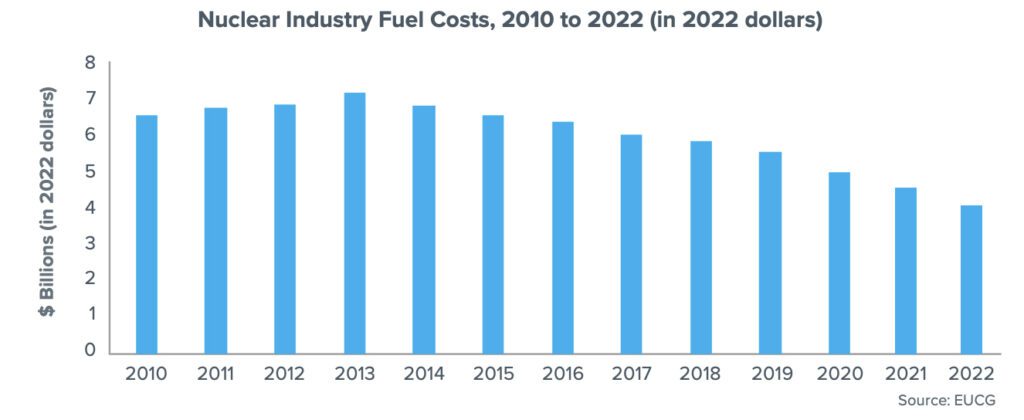

Based on the Nuclear Power Institute (NEI), in 2022, gas prices represented about 17% of whole producing prices. “Gas prices skilled a rise from 2009 to 2013, largely because of an escalation in uranium costs, which peaked in 2008. Since uranium is bought far prematurely of refueling and resides within the reactor for 4 to 6 years, the impact of this commodity value spike occurred a lot later after the uranium value improve occurred,” NEI defined in a current report. “Afterwards, uranium costs remained low for a few years, and a few utilities moved to shorter contract cycles. Regardless of a rise within the value of uranium since 2020 as a result of COVID-19 pandemic and the Russia-Ukraine struggle, gas prices for the U.S. fleet remained low in 2022.”

Utilities have lengthy been cautious of dangers related to their gas provide chains, given broad sanctions on Russian exports (although not imposed on uranium imports) in February 2022.

Constellation, a nuclear-heavy generator, in a current submitting, famous that, up to now, its nuclear gas deliveries haven’t been affected by the Russian-Ukraine battle. Nonetheless, the corporate stated it ramped up its acquisition of nuclear gas to extend its stock to proceed to function its fleet long-term and supply the required gas “to bridge potential Russian provide disruption by means of 2028, which is the date a number of suppliers are anticipated to have incremental extra capability on-line.”

Constellation initiatives 44%–47% of its capital expenditures for 2024 and 2025 will go to the acquisition of nuclear gas, it stated, and about 55% of its uranium focus necessities from 2024 by means of 2028 are provided by three suppliers. Nonetheless, it famous: “We work with a various set of home and worldwide suppliers years prematurely to acquire our nuclear gas and usually have sufficient nuclear gas to help all our refueling wants for a number of years no matter sanctions,” the corporate famous.

Rebuilding the U.S. Enrichment Panorama

A serious concern expressed by lawmakers is that the U.S. home nuclear gas provide chain has “atrophied” over the previous decade—for numerous causes. The decline is pegged to vital disruptions within the nuclear gas market, initially spurred by the shutdowns of Japanese and German nuclear reactors following the 2011 Fukushima accident, coupled with comparable closures within the U.S. These occasions suppressed international demand for nuclear gas, affecting home uranium mining, conversion, and enrichment companies, and despatched market costs for uranium plummeting.

At this time,”whereas the U.S. maintains the biggest market globally for nuclear fuels, its present home enrichment capability can provide simply 30% of home gas necessities at current,” lawmakers famous.

Uranium enrichment entails “enriching” the U-235 isotope in a multi-step course of. Mined uranium consists of about 99.3% U-238 and 0.7% U-235, which is fissionable when enriched to past 3% (in addition to lower than 0.01% of U-234). At a conversion plant, uranium oxide is transformed from powder right into a UF6, a gasoline whose fluorine ingredient doesn’t contribute to the load distinction whereas separating U-235 from U-238. Honeywell final yr reopened Metropolis Works plant in Metropolis, Illinois—but it surely stays the U.S.’s sole uranium conversion facility. Throughout enrichment, in the meantime, the UF6 gasoline is separated into two streams, one with extra U-235 than earlier than and the opposite with much less. Centrus Power and Urenco at present host the nation’s solely enrichment capacities.

Home efforts to revive the front-end of the nuclear cycle kicked off in earnest in 2020, after the Trump administration discovered that uranium imports posed a risk to nationwide safety, and the U.S. convened a Nuclear Gas Working Group.

The group basically outlined a three-pronged technique to revive the uranium mining business, help conversion companies, and finish reliance on overseas uranium enrichment capabilities. A few of these efforts have borne fruit: Most U.S. uranium mines halted manufacturing after 2018, primarily owing to low costs., however following a pointy rise in costs and demand expectations, a number of U.S. mines restarted operations in 2022 and 2023, with extra re-openings deliberate.

However along with its home measures, the U.S. has lately moved to pursue worldwide collaborations to spice up its international nuclear provide chain. In December 2023, it joined with Canada, France, Japan, and the UK— to mobilize $4.2 billion to spice up enriched uranium manufacturing capability free from Russian materials and set up a resilient uranium provide market free from Russian affect.

On April 18, Dr. Kathryn Huff, assistant secretary of the Division of Power (DOE) Workplace of Nuclear Power, recommended the “Sapporo 5” has already made “unimaginable strides” to help enrichment actions, pointing to current bulletins from international business nuclear gas producers.

In July 2023, London-based Urenco stated it will add a number of new centrifuges at its UUSA facility in Eunice, New Mexico (which is operated by Louisiana Power Companies). “New commitments from U.S. prospects for non-Russian gas underpin this funding, which is able to present an extra capability of round 700 tonnes of SWU per yr, a 15% improve at UUSA, with the primary new cascades on-line in 2025,” it stated. Then in December 2023, Urenco pledged one other 15% capability improve (of round 750 tonnes of SWU per yr) for its Netherlands plant. It additionally stated it’s “re-fitting an present house with extra trendy centrifuge expertise” to reinforce the capability of its facility in Gronau, Germany.

In tandem, Urenco lately moved to amend a Nuclear Regulatory Fee (NRC) license to help allowable U-235 enrichment ranges to 10% to help business improvement and implementation of accident-tolerant gas (ATF). It has additionally supplied the NRC with a discover of intent to submit a license modification to help enrichment of as much as 20% to help the manufacturing of high-assay, low-enriched uranium (HALEU), a nuclear gas materials enriched to the next diploma (between 5% and 20%).

Within the U.S., the place the DOE posits greater than 40 metric tons of HALEU could also be wanted by 2030 to help superior reactor gas, Centrus Power in October 2023, kicked off enrichment operations at its American Centrifuge Plant cascade in Piketon, Ohio. As of April 19, the power had enriched greater than 100 kilograms (kg) of HALEU and was working towards an extra 900 kg, the DOE stated.

In the meantime, in October 2023, French nuclear gas big introduced plans to extend uranium enrichment capability at its Georges Besse 2 facility in France by practically a 3rd by 2028. “Future enhanced provide stays into consideration to help superior reactor fuels with enrichments as much as 6% for LEU+ [enriched uranium up to 10%] and as much as 19.75% for HALEU in numerous gas types,” Orano stated. Orano can also be reportedly mulling plans to construct a uranium enrichment facility.

“Moreover, Japan has dedicated to extend their enrichment from 75 tons per yr to 450 tSWU per yr by 2027, the UK introduced a £300 million funding to launch Europe’s first home HALEU program, and Canada continues to mine and convert uranium to help a protected and safe provide chain,” Huff famous in April.

Buoyed by Vital Investments

However, as POWER has reported, nuclear gas companies have underscored a must underwrite the numerous capital investments that shall be required to increase enrichment capability. The numerous investments require agency commitments by reactor builders or authorities entities, they’ve famous.

To help the Sapporo 5 aims, the U.S. lately made out there $2.7 billion as directed within the FY2024 spending invoice to construct out LEU and HALEU improvement. “This funding is contingent on a ban on Russian uranium imports that’s at present being thought of by Congress,” Huff famous.

France has in the meantime mobilized $1.8 billion, and the UK has pledged roughly $383 million. The mixed funding has notably already exceeded the Sapporo 5 pledge made late final yr, the DOE stated.

On the similar time, DOE efforts to handle the nuclear gas cycle seem to even be making headway. As of March 22, it had closed requests for proposals (RFPs) for the acquisition of enriched and deconverted high-assay low enriched-uranium (HALEU), essential elements of the superior nuclear gas provide chain.

The measure is furnished by $700 million allotted by the 2022 Inflation Discount Act (IRA) to help actions beneath the HALEU Availability Program (which Congress established within the Power Act of 2020). The DOE plans to award contracts enrichment and deconversion companies “later this summer season to assist spur demand for extra HALEU manufacturing and personal funding in our home nuclear gas provide infrastructure,” Huff famous.

Russian Uranium Ban Fuels Optimism

Nuclear stakeholders on Wednesday responded with optimism to the Senate’s passage of H.R 1042, heralding its potential to jumpstart the long-dormant gas cycle.

“This laws, which has now handed each chambers of Congress, not solely prohibits the importation of Russian uranium but in addition unlocks $2.72 billion that was appropriated within the Consolidated Appropriations Act of 2024 to bolster the U.S. home nuclear gas provide chain,” stated Judi Greenwald, govt director on the Nuclear Innovation Alliance (NIA). “This funding was contingent upon the enactment of a Russian uranium ban, underscoring the important position H.R. 1042 performs in advancing nuclear vitality innovation efforts,” she stated.

Greenwald, nevertheless, recommended substantial market challenges nonetheless lay forward. She pointed to a current NIA technical evaluation, which acknowledges that regardless of recognition of the necessity for a home HALEU market and pivotal actions by Congress, the DOE, and personal corporations, the business nonetheless grapples with a scarcity of detailed public dialogue and a transparent monetary technique to successfully encourage personal funding in HALEU manufacturing. The report notably offers a complete evaluation of HALEU manufacturing prices, detailing bills associated to uranium enrichment and deconversion. It additionally evaluates two authorities initiatives—a fabric off-take settlement program and a manufacturing companies settlement program—that would handle financial challenges.

Greenwald’s evaluation was echoed by the NEI, an business commerce group whose members embody U.S. energy plant operators and house owners, reactor designers, and gas suppliers and repair corporations. NEI President and CEO Maria Korsnick additionally heralded the ban’s position within the launch of the $2.72 billion in Congressional funding, which she stated will “revitalize a aggressive home enrichment and conversion functionality.” Nonetheless, she burdened: “It can take a few years to increase U.S. capability to produce the present fleet and the deployment of subsequent technology nuclear. The implementation of a significant program to help capability growth is important.

NEI and its members, Korsnick famous, have been working to create a “path to a dependable, safe home provide of gas for greater than two years, following Russia’s invasion of Ukraine.” The commerce group plans to maintain going, working with the DOE on the design and implementation “of an efficient program to spur growth of U.S. capabilities in addition to set up a predictable and environment friendly waiver course of,” she stated.

Suppose tank Third Means, in the meantime, lauded the invoice’s potential to supply extra certainty. “To problem the rising affect of authoritarian regimes, the united statesmust lead commercialization of recent nuclear applied sciences by 2035,” stated Josh Freed, senior vp for Third Means’s Local weather and Power Program. “This invoice will present the long-term market certainty wanted to help this mission and place the U.S. as a serious international vitality associate for many years to come back.”

Uranium Power Corp. (UEC), a diversified North American–centered uranium firm, in a press release, recommended the invoice demonstrates U.S. commitement to nuclear vitality. “This new regulation, together with the lately handed Nuclear Gas Safety Act, creates a agency basis for long-term progress of the U.S. uranium business to produce the gas that powers American households, knowledge facilities, and industrial base with clear baseload energy,” Amir Adnani, UEC president and CEO. “Because the quickest rising U.S. uranium firm, we’re delighted to have this thrilling backdrop together with constructive international uranium market fundamentals and advance the re-start of uranium manufacturing in Wyoming this August, adopted by the resumption of our South Texas operations subsequent yr.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).