A brand new report from Wooden Mackenzie examines how the worldwide shift to increased rates of interest to fight inflation is squeezing the power transition.

From pv journal USA

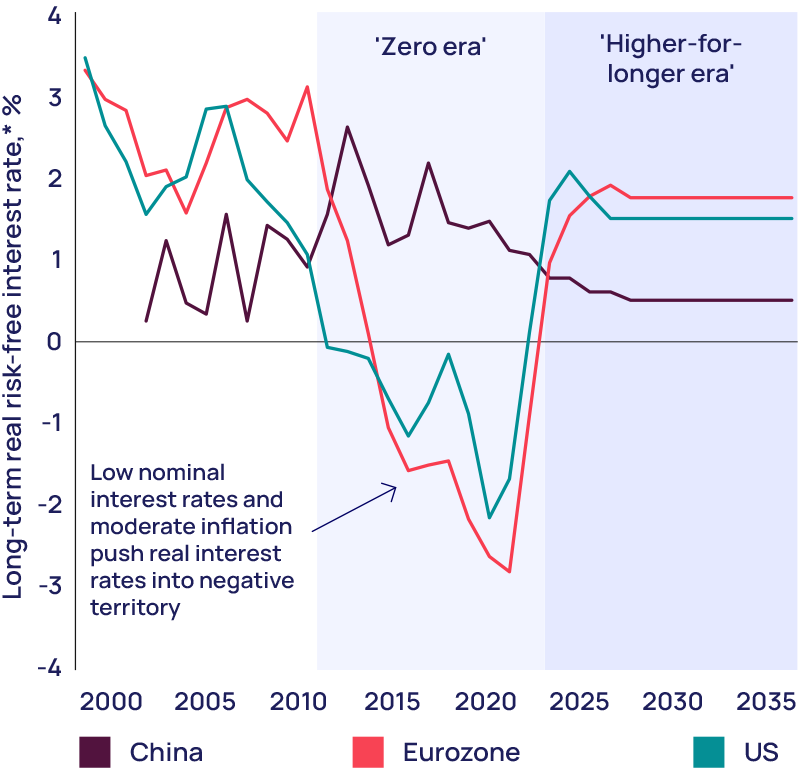

After a interval of traditionally low rates of interest from 2009 to 2022, central banks have sharply raised rates of interest to struggle inflation. The rising value of capital has “profound implications” for the power and pure useful resource industries, Wooden Mackenzie stated in a lately printed report.

The transition to a net-zero economic system may globally require $75 trillion of funding by 2050, stated the analysis agency. The upper value of capital challenges the transition to low-carbon applied sciences by way of value and tempo.

Wooden Mackenzie stated the economic system has departed from the post-Nice Recession “zero period” charges and certain will stay that method for “the following couple of a long time.”

US Federal Reserve members have echoed a “increased for longer” sentiment for rates of interest in latest months. Globally, structural inflationary developments like international commerce reshuffling, deglobalization, and an emphasis on nearshoring business and employment over uncooked macroeconomics might hold charges elevated for some time.

“Extremely capital intensive and sometimes reliant on subsidies, low-carbon power and nascent inexperienced applied sciences are most uncovered [to high rates],” stated the report. “Debt accounts for a better share of the capital construction for low-carbon power sectors.”

Wooden Mackenzie stated that the oil and gasoline business, whereas additionally extremely capital-intensive, has far much less publicity to the price of debt and is subsequently much less affected by the upper price surroundings. Gearing, or the ratio of debt to fairness, is often increased with renewables and nuclear power improvement than in mining, oils, and gasoline.

“Debt from bonds and undertaking finance, secured in opposition to long-term energy buying agreements, has been used to fund fast progress in renewables,” stated Wooden Mackenzie. “Whereas energy and renewables corporations have increased gearing, they do examine favorably with different peer teams on a cost-of-debt foundation.”

Renewable investments have larger value certainty than their oil and gasoline counterparts, making them a much less dangerous funding and enabling decrease borrowing prices. Plus, the levelized value of electrical energy (LCOE) for new-build photo voltaic is now 29% decrease than any fossil gas different, in response to Ernst and Younger. With photo voltaic module costs persevering with to plummet to report lows, this lower-cost, predictable electrical energy supply might function a strong long-term combatant to inflationary pressures.

Rates of interest have squeezed this LCOE benefit, stated Wooden Mackenzie. In its evaluation, rates of interest rising by 2 share factors result in an LCOE enhance of 20% for renewables, and 11% for a combined-cycle gasoline turbine plant. Regardless of this, Wooden Mackenzie stated renewables maintain a bonus in LCOE, even with none subsidies hooked up.

Whereas it’s tough to put a greenback worth on the price of damages from local weather change and what a transition to net-zero emissions would do to mitigate injury, a report from the Potsdam Institute in Berlin has assessed annual climate-related prices at $38 trillion per 12 months by 2050. Within the face of those prices, the $75 trillion international price ticket for transitioning the worldwide economic system to net-zero emissions appears extra palatable.

Whereas the oil and gasoline business is much less affected by the upper rates of interest, and oil giants have lowered their debt considerably from 2020 by 2023, Wooden Mackenzie stated the supply of finance may pose issues for the fossil gas business. Environmental, social, and governance considerations are contributing to an ever-shrinking record of lenders, it stated.

Wooden Mackenzie stated governments ought to proceed to subsidize the power transition to encourage funding, regardless of rising debt and debt servicing prices. It recommends a technique that focuses on environment friendly, non-discriminatory subsidization, a bolstering of worldwide carbon markets, and the mobilization of local weather finance.

“Policymakers have to act to offset the interest-rate headwinds. Eradicating obstacles equivalent to gradual allowing and undertaking approval and providing clear, constant and sustained incentives will assist nascent low-carbon applied sciences,” stated Wooden Makenzie. “Strengthening international carbon markets, maximizing subsidy effectivity and mobilizing inexperienced finance are additionally important. The next interest-rate surroundings is perhaps what it takes to get policymakers to spring into motion.”

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.