Monetary establishments searching for to deepen their sustainable finance experience in Singapore can now use a brand new business benchmark to facilitate recruitment within the rising house.

The sector’s nationwide accreditation and certification company will award people with a “abilities badge” to mirror the particular experience and proficiency stage they acquired from present process recognised sustainable finance programs.

To get a abilities badge, professionals might want to attend programs that the Institute of Banking and Finance (IBF) has mapped to the 12 sustainable finance technical abilities and competencies that it outlined along with the Financial Authority of Singapore (MAS) in 2022.

Talking on the launch occasion at Temasek’s Ecosperity convention, Alvin Tan, minister of state for commerce and business and a board member of the MAS, stated professionals may spotlight their proficiency in sustainable finance by posting their abilities badge on enterprise networking platform LinkedIn. Tan was beforehand head of LinkedIn’s public coverage and economics staff.

Checklist of sustainable finance technical abilities and competencies that may be mirrored on a abilities badge:

-

Taxonomy software

-

Carbon markets and decarbonisation methods administration

-

Pure capital administration

-

Local weather change administration

-

Impression indicators, measurement and reporting

-

Sustainability reporting

-

Sustainability threat administration

-

Sustainable lending devices structuring

-

Sustainable funding administration

-

Sustainability stewardship growth

-

Sustainable insurance coverage and re-insurance options and purposes

-

Non-financial business sustainability developments

Sources: Institute of Banking and Finance and Financial Authority of Singapore

“There lacks a constant benchmark that recognises sustainable finance abilities mastery throughout the business as a result of it is a new and evolving space. So the IBF’s new abilities badge will grow to be that frequent business benchmark,” stated Carolyn Neo, the company’s chief government officer.

When requested if the brand new benchmark addresses issues round “competence greenwash“, the place funding professionals exaggerate their inexperienced credentials in an effort to seize alternatives within the more and more profitable sector, IBF’s director and head of requirements Hee Siew Lie advised Eco-Enterprise that the abilities badge would “minimise that”.

“The consolation is there that the programme you might have gone by means of is in opposition to the business benchmark and that you’ve got acquired the abilities based mostly on what has been recognized by the business,” Hee stated.

Present choices of accredited sustainable finance programmes on IBF’s web site embrace e-learning programs that may be as quick as two hours.

A visible of the Institute of Banking and Finance’s abilities badge, which displays three ranges of abilities proficiency. Picture: IBF

Specialists conversant in the hiring scenario have cautioned in opposition to “reactive” recruiting for such roles and shoehorning finance professionals into environmental, social and governance (ESG) roles.

On Wednesday, MAS introduced that S$35 million (US$26 million) has been put aside to assist the enlargement of the city-state’s sustainable finance workforce over the following three years. This sum of cash will go into implementing the brand new business benchmark in addition to to introduce sustainable finance programs for undergraduates, postgraduates and executives with native institutes of upper studying.

As new sustainability laws kick in throughout Asia and demand for transition finance for high-emitting sectors grows, a KPMG examine initiatives that greater than half of the prevailing monetary sector workforce might want to decide up new sustainable finance-related job duties, comparable to in influence reporting, carbon markets and taxonomy software.

Singapore-listed firms shall be subjected to home necessary local weather reporting guidelines from subsequent 12 months, and people additionally listed in america or with important operations in Europe might also be subjected to their new disclosure guidelines within the subsequent few years.

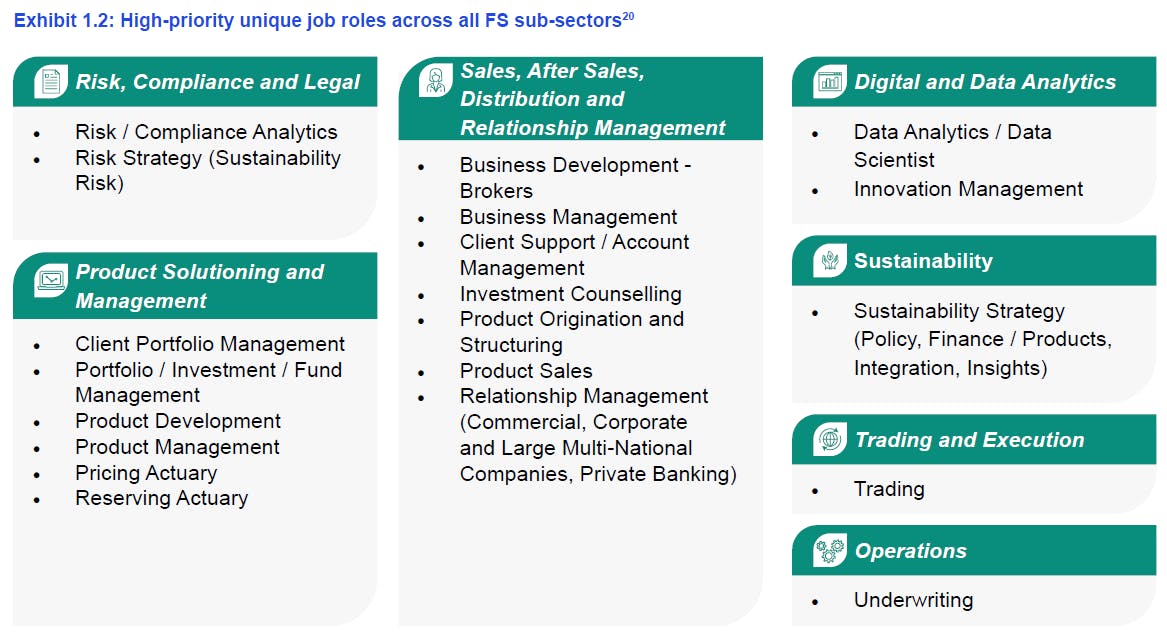

Roles that shall be extra considerably augmented embrace these in threat, compliance and authorized in addition to product options and administration profession tracks, stated Tan.

In the meantime, insurance coverage declare managers, for example, would possibly see much less change, as present protocols will seemingly nonetheless be relevant to claims from new sustainability-linked merchandise.

Earlier this 12 months, the brand new MAS managing director Chia Der Jiun earlier this 12 months shared that the preliminary examine findings confirmed that extremely specialised roles like sustainability threat analysts shall be in demand within the close to future.

The MAS-commissioned examine estimated that 4,000 to five,000 new job roles shall be created in areas like sustainability threat and sustainability technique and has recognized 20 distinctive roles to prioritise for upskilling, together with relationship managers in company banking in addition to portfolio managers.

The report said {that a} portfolio supervisor would possibly now be required to outline materials sustainability targets, metrics and outcomes for sustainability-related funding selections, which might require in-depth technical experience in sustainable funding administration, on prime of broad sustainability information.

20 job roles, the vast majority of which reside in gross sales and relationship administration groups, had been recognized to be prioritised for upskilling, as monetary establishments shift to seize sustainable finance alternatives. Supply: Sustainable Finance Jobs Transformation Map

Within the coming months, greater than 65 new government programs shall be launched in Singapore, including to the some 100 sustainable finance programs which were recognised by IBF. The company will even work with over 25 monetary establishments, together with HSBC, to accredit a few of the in-house coaching plans they have already got in place.

To encourage upskilling on this space, IBF will offset as much as 70 per cent of the charges for permitted programs and supply as much as 90 per cent of wage assist to reskill staff taking up augmented roles.