Within the week of February 19, European electrical energy market costs fell in comparison with the earlier week, with the MIBEL market exhibiting the bottom costs. The rise in wind power manufacturing and the lower in fuel and CO2 costs favored this conduct. Portugal and France registered the very best wind power manufacturing for a February month, and Spain and Portugal broke once more the document for the very best photovoltaic power manufacturing for a February month, reached the earlier week.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind power manufacturing

In the course of the week of February 19, photo voltaic power manufacturing registered a rise in most main European electrical energy markets in comparison with the earlier week, sustaining the upward development for the second consecutive week. Will increase ranged from 9.3% in Portugal to 17% in Germany. Nevertheless, there have been exceptions within the Italian and French markets, the place photo voltaic power manufacturing decreased by 23% and 13%, respectively, reversing the earlier week’s upward development.

As within the earlier week, that of February 12, some markets registered a return of each day photovoltaic power manufacturing to ranges final seen within the fall, a development that may grow to be more and more widespread as spring approaches. On February 20, the Spanish and Portuguese markets set information for a February month once more, producing 118 GWh and 13 GWh, respectively, barely surpassing the highs reached throughout the earlier week. As well as, the German market set its highest photo voltaic photovoltaic power manufacturing since October, with 156 GWh generated on February 25.

For the week of February 26, in line with AleaSoft Vitality Forecasting’s photo voltaic power manufacturing forecasts, the development of the week of February 19 will proceed, with photo voltaic power manufacturing growing within the Spanish and German markets and lowering within the Italian market.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

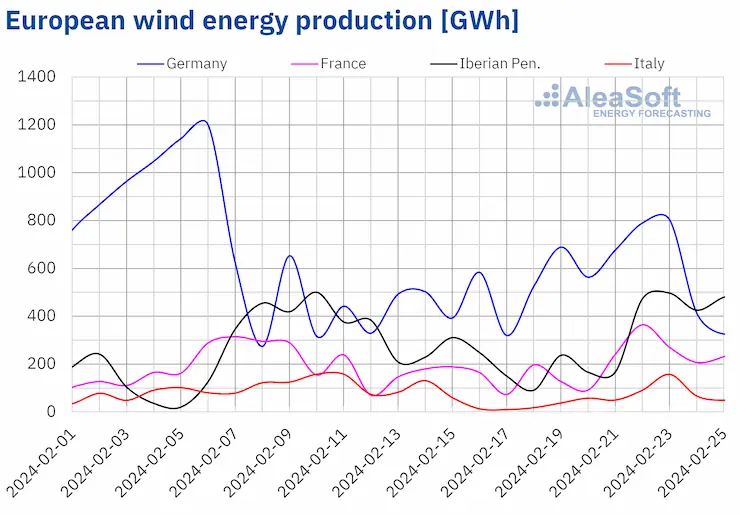

In the course of the week of February 19, wind power manufacturing registered per week?on?week improve in the principle European electrical energy markets, reversing the downward development registered the earlier week. Will increase ranged from 31% to 79% within the Italian and Portuguese markets, respectively.

As well as, the Portuguese and French markets registered the very best each day wind power manufacturing ever noticed in a February month. France reached this document on February 22, producing 365 GWh, a degree not registered for the reason that starting of the yr. However, Portugal reached its highest wind power manufacturing for a February month on February 25, producing 107 GWh utilizing this know-how. This worth additionally represents the very best registered since mid?October within the Portuguese market.

For the week of February 26, AleaSoft Vitality Forecasting’s wind power manufacturing forecasts point out that the upward development will proceed in Spain and Italy and it’ll reverse in Germany, France and Portugal.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

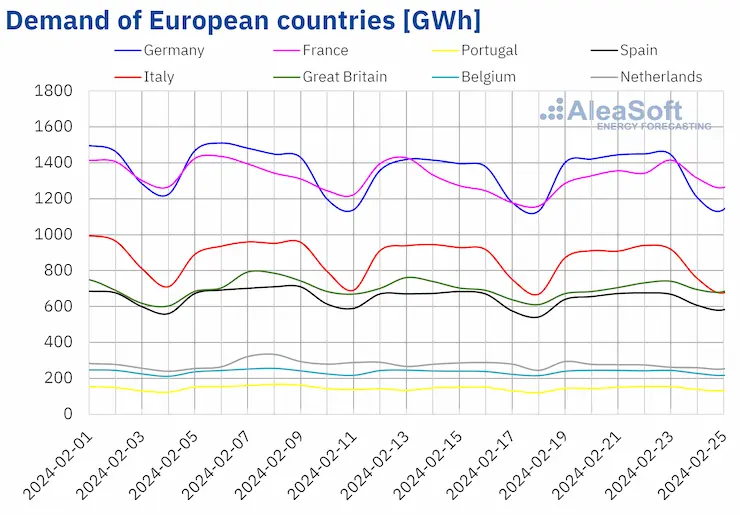

Electrical energy demand

In the course of the week of February 19, electrical energy demand elevated in most main European electrical energy markets, reversing the lower registered the earlier week. Within the analyzed markets, the Iberian Peninsula registered each the smallest and the biggest improve in demand. Within the case of Spain, it registered the smallest improve, 0.4%, whereas Portugal reached the biggest rise, 4.5%, attributable partly to the restoration of demand after the vacation of Tuesday of Carnival celebrated the earlier week on this market.

The Dutch and Italian markets exhibited a development opposite to the remainder of the analyzed markets. The Dutch market registered a drop of 1.9%, marking the second consecutive week of declines in demand on this market. As for Italy, the downward development continued for the fifth consecutive week, this time registering a drop of 1.3%.

Within the fourth week of February, most analyzed European markets registered a lower in common temperatures from the earlier week, falling from 2.5 °C in Belgium and Nice Britain to 1.0 °C in Germany. The exception was Italy, the place common temperatures elevated by 0.9 °C.

Within the week of February 25, in line with AleaSoft Vitality Forecasting’s demand forecasts, the upward development will proceed and demand will improve in all analyzed European markets.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

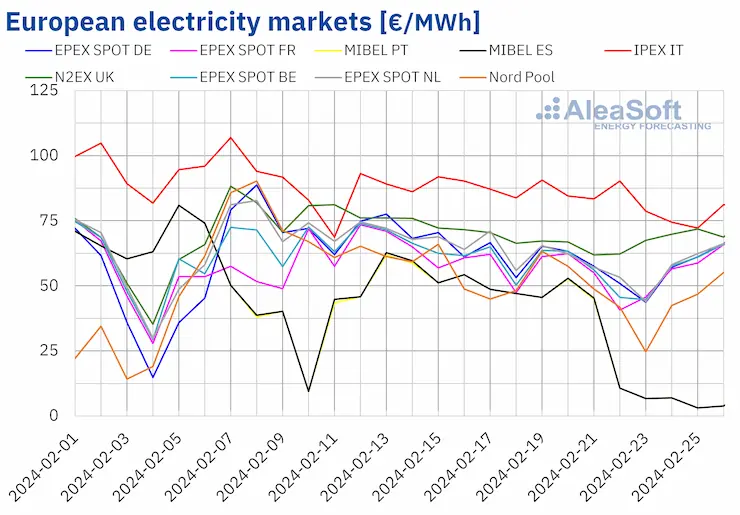

European electrical energy markets

Within the first days of the week of February 19, costs in the principle European electrical energy markets registered a downward development. Typically, costs began to get better within the final days of the week. Nevertheless, when considering the entire of the fourth week of February, weekly averages had been decrease than these of the earlier week in all markets analyzed at AleaSoft Vitality Forecasting. The MIBEL market of Spain and Portugal reached the biggest drop, which was 54%. In distinction, the IPEX market of Italy and the N2EX market of the UK registered the smallest declines, 7.6% and eight.2%, respectively. In the remainder of the analyzed markets, costs fell between 13% within the EPEX SPOT market of Belgium and France, and 17% within the Nord Pool market of the Nordic nations.

Within the fourth week of February, weekly averages had been under €60/MWh in most analyzed European electrical energy markets. The exceptions had been the British market, with a mean of €66.74/MWh, and the Italian market, with a mean of €82.03/MWh. In distinction, the Portuguese and Spanish markets registered the bottom weekly costs, €24.36/MWh and €24.45/MWh, respectively. In the remainder of the analyzed markets, costs ranged from €46.48/MWh within the Nordic market to €57.51/MWh within the Dutch market.

As for hourly costs, from February 23 to 26, the MIBEL market registered twenty?three hours with costs under €1/MWh. Of those, there have been eight hours with a value of €0/MWh.

In the course of the week of February 19, the lower within the common value of fuel and CO2 emission rights and the rise in wind power manufacturing led to decrease costs within the analyzed European electrical energy markets. The rise in photo voltaic power manufacturing additionally contributed to decrease costs within the German and Iberian markets. Within the case of the Italian market, demand fell, which additionally helped costs to lower.

AleaSoft Vitality Forecasting’s value forecasts point out that within the final week of February, costs may improve in most European electrical energy markets. The rise in demand and the drop in wind power manufacturing will result in this conduct. Nevertheless, costs within the Iberian and Italian markets may proceed to fall, influenced by the rise in wind power manufacturing in Spain and Italy, in addition to by the rise in Spanish photo voltaic power manufacturing.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from OMIE, EPEX SPOT, Nord Pool and GME.

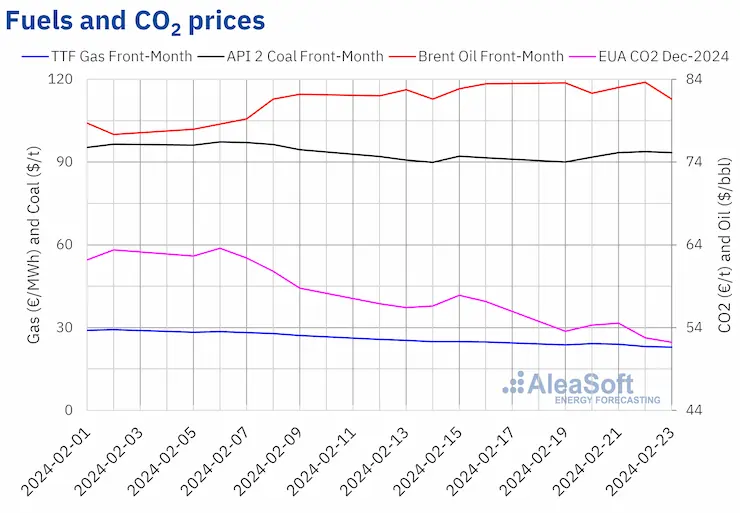

Brent, fuels and CO2

In most periods of the fourth week of February, settlement costs of Brent oil futures for the Entrance?Month within the ICE market elevated. Because of this, on Thursday, February 22, they registered their weekly most settlement value, $83.67/bbl. This value was 1.0% increased than the earlier Thursday and the very best for the reason that first half of November 2023. Nevertheless, after a 2.5% drop on Friday, February 23, these futures reached their weekly minimal settlement value, $81.62/bbl.

Elevated instability within the Center East, influenced by the US veto of a UN Safety Council decision for a humanitarian ceasefire in Gaza, contributed to the rise in costs within the fourth week of February. Nevertheless, considerations about demand evolution exerted their downward affect on Brent oil futures costs, resulting in their decline on the finish of the week. Expectations that rates of interest will stay excessive within the coming months in the US resulting from a pickup in inflation added to those considerations. As well as, US oil shares elevated, influenced by refinery outages.

As for settlement costs of TTF fuel futures within the ICE marketplace for the Entrance?Month, within the fourth week of February, they continued to register decreases. As a consequence of this downward development, on Friday, February 23, they registered their weekly minimal settlement value, €22.93/MWh. Based on the information analyzed at AleaSoft Vitality Forecasting, this value was 7.6% decrease than the earlier Friday and the bottom since Might 2021.

Seasonally low demand ranges, plentiful provides of liquefied pure fuel and excessive ranges of European reserves exerted a downward affect on TTF fuel futures costs within the fourth week of February.

As for settlement costs of CO2 emission rights futures within the EEX market for the reference contract of December 2024, throughout the fourth week of February, they had been under €55/t. The weekly most settlement value, registered on February 21, was €54.55/t. In distinction, these futures reached their weekly minimal settlement value, €52.21/t, on Friday, February 23. Based on knowledge analyzed at AleaSoft Vitality Forecasting, this settlement value was 8.7% decrease than the earlier Friday and the bottom since June 2021.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ICE and EEX.

AleaSoft Vitality Forecasting’s evaluation on the prospects for power markets in Europe and the financing and valuation of renewable power tasks

The subsequent webinar of AleaSoft Vitality Forecasting and AleaGreen will happen on March 14. This would be the third webinar of 2024, the yr of the 25th anniversary of the muse of AleaSoft Vitality Forecasting. On this event, specialists from EY will take part for the fourth time within the month-to-month webinar sequence. Along with the prospects for European power markets, the webinar will analyze regulation, financing of renewable power tasks, PPA, self?consumption, portfolio valuation, the inexperienced hydrogen public sale and the Innovation fund.